- Overall Rankings

- Corporate Taxes

- Individual Income Taxes

- Sales Taxes

- Property Taxes

- Unemployment Insurance Taxes

Overall Rankings

The State Tax Competitiveness Index compares each state on more than 150 variables in the five major areas of taxation (corporate taxes, individual income taxes, sales and excise taxes, property and wealth taxes, and unemployment insurance taxes and then adds the results to yield a final, overall ranking. This approach rewards states on particularly strong aspects of their tax systems (or penalizes them on particularly weak aspects), while measuring the general competitiveness of their overall tax systems. The result is a score that can be compared to other states’ scores.

Corporate Taxes

This component measures the impact of each state’s principal tax on business activities and accounts for 21.3 percent of each state’s total score. It includes corporate income taxes and gross receipts taxes. It is well established that the extent of business taxation can affect a business’s level of economic activity within a state.

Individual Income Taxes

The individual income tax component, which accounts for 30.5 percent of each state’s total Index score, is important to both individuals and businesses because a significant number of businesses, including sole proprietorships, partnerships, and S corporations, report their income through the individual income tax code.

Sales Taxes

Sales tax makes up 22.8 percent of each state’s Index score. The type of sales tax familiar to taxpayers is a tax levied on the purchase price of a good at the point of sale. Due to the inclusion of some business inputs in most states’ sales tax bases, the rate and structure of the sales tax is an important consideration for many businesses. The sales tax can also hurt the business tax climate and tax competitiveness because as the sales tax rate climbs, customers make fewer purchases or seek low-tax alternatives. As a result, business is lost to lower-tax locations, causing lost profits, lost jobs, and lost tax revenue. The effect of differential sales tax rates among states or localities is apparent when a traveler crosses from a high-tax state to a neighboring low-tax state. Typically, a vast expanse of shopping malls springs up along the border in the low-tax jurisdiction.

Property Taxes

The property tax component, which includes taxes on real and personal property, net worth, and the transfer of assets, accounts for 14.9 percent of each state’s Index score. When properly structured, real property taxes exceed most other taxes in comporting with the benefit principle and can be fairly economically efficient. In the realm of public finance, they are often also prized for their comparative transparency among taxes, though that transparency may contribute to the public’s generally low view of property taxes.

Unemployment Insurance Taxes

Unemployment insurance (UI) is a social insurance program jointly operated by the federal and state governments. Taxes are paid by employers into the UI program to finance benefits for workers recently unemployed. Compared to the other major taxes assessed in the State Tax Competitiveness Index, UI taxes are much less well-known. Every state has one, and all 50 of them are complex, variable-rate systems that impose different rates on different industries and different bases depending upon such factors as the health of the state’s UI trust fund.

2025 State Tax Competitiveness Index Ranks and Component Tax Ranks

| State | Overall Rank | Corporate Tax Rank | Individual Income Tax Rank | Sales Tax Rank | Property Tax Rank | Unemployment Insurance Tax Rank |

|---|---|---|---|---|---|---|

| Alabama | 38 | 14 | 34 | 49 | 14 | 18 |

| Alaska | 3 | 34 | 1 | 5 | 30 | 45 |

| Arizona | 15 | 13 | 8 | 45 | 13 | 2 |

| Arkansas | 36 | 15 | 39 | 44 | 19 | 11 |

| California | 48 | 41 | 49 | 46 | 23 | 25 |

| Colorado | 32 | 10 | 18 | 37 | 36 | 39 |

| Connecticut | 47 | 31 | 47 | 21 | 50 | 40 |

| Delaware | 18 | 50 | 42 | 2 | 1 | 1 |

| Florida | 4 | 16 | 1 | 14 | 21 | 10 |

| Georgia | 26 | 12 | 31 | 23 | 34 | 24 |

| Hawaii | 42 | 25 | 46 | 28 | 24 | 49 |

| Idaho | 11 | 21 | 11 | 9 | 3 | 35 |

| Illinois | 37 | 42 | 13 | 38 | 41 | 43 |

| Indiana | 10 | 8 | 16 | 17 | 5 | 13 |

| Iowa | 20 | 23 | 19 | 11 | 32 | 33 |

| Kansas | 25 | 27 | 27 | 30 | 29 | 4 |

| Kentucky | 22 | 18 | 23 | 18 | 27 | 34 |

| Louisiana | 40 | 29 | 33 | 48 | 16 | 9 |

| Maine | 29 | 40 | 22 | 8 | 48 | 19 |

| Maryland | 46 | 37 | 45 | 39 | 35 | 20 |

| Massachusetts | 41 | 33 | 41 | 20 | 46 | 47 |

| Michigan | 14 | 9 | 14 | 12 | 28 | 26 |

| Minnesota | 44 | 43 | 44 | 34 | 26 | 42 |

| Mississippi | 27 | 6 | 32 | 25 | 38 | 15 |

| Missouri | 13 | 4 | 20 | 24 | 11 | 5 |

| Montana | 5 | 19 | 10 | 3 | 18 | 21 |

| Nebraska | 24 | 20 | 26 | 13 | 45 | 3 |

| Nevada | 17 | 39 | 7 | 40 | 7 | 46 |

| New Hampshire | 6 | 32 | 12 | 1 | 39 | 27 |

| New Jersey | 49 | 44 | 48 | 35 | 43 | 50 |

| New Mexico | 31 | 22 | 37 | 41 | 2 | 16 |

| New York | 50 | 28 | 50 | 42 | 47 | 37 |

| North Carolina | 12 | 3 | 21 | 16 | 20 | 7 |

| North Dakota | 9 | 7 | 17 | 15 | 4 | 12 |

| Ohio | 35 | 45 | 25 | 43 | 6 | 14 |

| Oklahoma | 21 | 5 | 28 | 32 | 15 | 6 |

| Oregon | 30 | 49 | 40 | 4 | 31 | 41 |

| Pennsylvania | 34 | 38 | 38 | 22 | 9 | 36 |

| Rhode Island | 39 | 35 | 30 | 26 | 37 | 48 |

| South Carolina | 33 | 11 | 24 | 33 | 42 | 28 |

| South Dakota | 2 | 1 | 1 | 31 | 10 | 22 |

| Tennessee | 8 | 48 | 1 | 47 | 33 | 17 |

| Texas | 7 | 46 | 1 | 36 | 40 | 30 |

| Utah | 16 | 17 | 9 | 27 | 12 | 29 |

| Vermont | 43 | 36 | 43 | 29 | 49 | 8 |

| Virginia | 28 | 24 | 36 | 10 | 22 | 38 |

| Washington | 45 | 47 | 15 | 50 | 25 | 44 |

| West Virginia | 23 | 26 | 29 | 19 | 17 | 23 |

| Wisconsin | 19 | 30 | 35 | 6 | 8 | 32 |

| Wyoming | 1 | 1 | 1 | 7 | 44 | 31 |

| District of Columbia | 48 | 32 | 47 | 41 | 48 | 25 |

Notable Changes

-

Arkansas improved two places overall, from 38th to 36th, with the state reducing its top marginal corporate income tax rate from 5.1 percent to 4.3 percent and its top marginal individual income tax rate from 4.7 percent to 3.9 percent. Additionally, Arkansas consolidated its individual income tax brackets from three to two. This yielded a four-place improvement on the corporate component, from 19th to 15th, though the individual income tax rate reductions were not enough to secure an improvement in that component due to intense competition in other states.

-

California uncapped a 1.1 percent non-UI payroll tax, applying it to all income and functionally yielding a 14.4 percent top marginal rate on wage income. The state also re-suspended net operating loss carryforwards, making it once again the only state not to provide any ability to apply past losses to current or future year profits under the corporate income tax. These changes did not, however, budge the state’s overall rank of 48th, after only New York and New Jersey.

-

Despite a continued trimming of state income tax rates from 4.4 to 4.25 percent, Colorado slid slightly in Index rankings as other states not only cut rates more deeply but also implemented other reforms.

-

Connecticut’s capital stock tax rate declined from 0.31 to 0.26 percent, not enough to change the state’s rankings, though the eventual phaseout of the tax will have a positive effect on the state’s Index ranks.

-

In 2024, Georgia transitioned from a graduated individual income tax with a top rate of 5.75 percent to a flat tax structure with a rate of 5.39 percent. The corporate income tax rate, per H.B. 1023, is now aligned with the individual income tax rate. Both rates are also scheduled to decrease to 4.99 percent by 2028. As a result of these structural reforms, Georgia moved up six places overall on the Index, including three places on the individual income tax component and two places on the corporate tax component.

-

Idaho’s individual and corporate income tax rates declined from 5.8 to 5.695 percent, though due to rate relief and structural reforms in other states, these rate reductions did not improve the state’s rankings.

-

Indiana’s individual income tax rate decreased from 3.15 percent in 2023 to 3.05 percent in 2024 due to H.B. 1001, enacted in May 2023. The rate is scheduled to drop to 2.9 percent by 2027. Indiana also implemented a filing and withholding threshold to protect nonresidents who spend up to 30 days in the state and removed the transactions threshold from its definition of economic nexus, providing additional protection for small remote retailers. As a result, the state now ranks 10th overall on the Index, an improvement of two places, and improved from 20th to 16th on the individual income tax component.

-

Iowa improved two places overall, to 20th, as the state continues to implement meaningful reforms. The corporate income tax phased down from 8.3 to 7.1 percent, resulting in an improvement of five places on the corporate component of the Index. A reduction of the top individual income tax rate from 6.0 to 5.7 percent, combined with a reduction in brackets from four to three, did not yield an improvement in the individual component rank since other states made larger changes. However, Iowa can expect continued gains as reforms continue to phase in, particularly once the state reaches its target of a 3.8 percent single-rate individual income tax. The state has improved its overall rank from 44th to 20th, its individual rank from 42nd to 19th, and its corporate rank from 45th to 23rd since 2020 thanks to a multi-year comprehensive reform package that continues to phase in. Beginning in 2025, Iowa will fully repeal its inheritance tax and implement a 3.8 percent flat individual income tax, both of which will substantially improve the state’s rankings.

-

Kansas improved one place on the individual component due to the passage of S.B. 1 in June 2024, which retroactively reduced the top marginal rate from 5.7 to 5.58 percent, consolidated three brackets into two, and increased the standard deduction, personal exemption, and dependent exemption, among other tax changes. The corporate income tax rate also declined from 7 to 6.5 percent, though this did not improve the state’s rank on the corporate component.

-

Kentucky’s individual income tax rate declined from 4.5 to 4.0 percent as part of a continued revenue-contingent phasedown of income tax rates, with each phased reduction subject to an affirmative vote of the legislature. These changes helped Kentucky improve by one Index rank overall.

-

The Louisiana legislature eliminated the state’s throwout rule, which taxes “nowhere income” in the state from which sales are made because the seller lacks sufficient nexus to be taxed in the destination state, leading to taxation in the wrong state at the wrong rate. This change improved the state’s corporate component ranking by two places, from 31st to 29th.

-

Minnesota is now the only state to tax long-term capital gains at a higher rate than ordinary income (excepting Washington, which taxes high earners’ capital gains income but not wage income), with the state sliding two places overall on the Index.

-

Mississippi improved two places on the Index, from 29th to 27th, as its capital stock (franchise) tax rate declined from 0.1 to 0.075 percent and its now-flat individual income tax rate phased down from 5 to 4.7 percent, on the way to an ultimate rate of 4 percent. The franchise tax is also scheduled for complete elimination.

-

A slight trimming of Missouri’s top individual income tax rate, from 4.95 to 4.8 percent, was enough to maintain the state’s overall rank of 13th, but not to improve it in a highly competitive tax environment.

-

In 2021, Montana lawmakers enacted legislation compressing the state’s seven individual income tax brackets into two and reducing the top marginal rate to 6.5 percent in 2024. Policymakers subsequently enhanced the rate reduction, bringing the top rate to 5.9 percent. Combined with high nonresident income tax filing and withholding thresholds and a well-structured income tax generally, these changes drove a dramatic improvement in the individual income tax component rank, from 22nd to 10th place.

-

Continued rate relief in Nebraska yielded a ranking improvement of four places overall, from 28th to 24th, as individual and corporate income tax rates both declined substantially to 5.84 percent. These rate reductions resulted in a seven-place improvement on the corporate component, from 27th to 20th, and an improvement of three places, from 29th to 26th, on the individual income tax component of the Index.

-

With the enactment of S.B. 189 in July 2023, New Hampshire decoupled from the federal limitation on the deductibility of business net interest expenses under IRC Section 163(j). As a result, as of January 1, 2024, businesses may now fully deduct their interest expenses in the year those expenses are incurred. This change, following on the heels of rate reductions to New Hampshire’s two business taxes, helped New Hampshire’s corporate component ranking improve by eight places, from 40th to 32nd. New Hampshire also continued to phase down its interest and dividends (I&D) tax this year, but given New Hampshire’s already highly competitive standing on this component, that change did not result in an improvement in rank on the individual tax component.

-

New Jersey largely removed GILTI from its tax base, a positive reform that was nonetheless not enough to budge the state from its unenviable position between New York and California, at 49th overall.

-

North Carolina’s flat-rate individual income tax rate was reduced from 4.75 to 4.5 percent, but due to reforms in other states, this failed to improve the state’s ranking, and the state actually slid from 11th to 12th overall as other states made meaningful structural reforms.

-

A cut to Ohio’s top individual income tax rate, from 3.75 to 3.5 percent, yielded a three-place improvement in the individual income tax component rank, from 28th to 25th. Ohio’s state-level income tax rate is now highly competitive, but the state remains burdened by high-rate local income taxes.

-

Oregon’s rank dropped primarily due to relatively minor changes in its property and unemployment insurance tax components. However, competition among the states in the middle of the Index, with many states cutting rates and improving their tax structures, was such that the state lost ground by standing still.

-

Pennsylvania reduced its high-rate corporate income tax from 9 to 8.49 percent, a positive development but one that failed to leapfrog other states given how much of an outlier the state’s corporate income tax rate remains. However, the rate is scheduled to continue declining to 4.99 percent in coming years, which will yield meaningful improvements on the Index. Similarly, legislation was recently adopted that will see the state’s anomalously stingy net operating loss provisions begin improving next year, which should also result in ranking improvements.

-

Tennessee slashed its gross receipts tax rate from 0.3 to 0.15 percent and made reforms to its state capital stock (franchise) tax to reduce burdens on business. Until these taxes are eliminated, however, Tennessee is unlikely to improve on its ranking of 8th overall.

-

Utah implemented another round of modest individual and corporate income tax rate reductions, trimming rates from 4.65 to 4.55 percent. However, Utah still slid from 15th to 16th overall due to significant improvements elsewhere across the country, including the advent of much lower top (or single) rate income taxes in some states.

-

Wisconsin’s property tax rank improved by five places as a result of AB 245, enacted in June 2023, which eliminated Wisconsin’s business personal property tax beginning with the January 1, 2024, property tax assessment. This caused Wisconsin to join the ranks of the states that no longer levy tangible personal property taxes and yielded a five-place improvement on the property tax component, from 13th to 8th, and an improvement of one place overall.

2025 State Tax Competitiveness Index (2020-2025)

| State | 2020 | 2021 | 2022 | 2023 | 2024 Rank | 2024 Score | 2025 Rank | 2025 Score | 2024-2025 Rank Change | 2024-2025 Score Change |

|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | 39 | 40 | 40 | 41 | 39 | 4.73 | 38 | 4.77 | -1 | 0.03 |

| Alaska | 3 | 3 | 3 | 3 | 3 | 7.17 | 3 | 7.05 | 0 | -0.12 |

| Arizona | 19 | 19 | 18 | 16 | 16 | 5.48 | 15 | 5.46 | -1 | -0.02 |

| Arkansas | 45 | 46 | 42 | 38 | 38 | 4.74 | 36 | 4.85 | -2 | 0.11 |

| California | 48 | 48 | 48 | 48 | 48 | 3.89 | 48 | 3.88 | 0 | -0.01 |

| Colorado | 22 | 22 | 25 | 27 | 31 | 5.06 | 32 | 5.02 | 1 | -0.04 |

| Connecticut | 47 | 47 | 47 | 47 | 47 | 4.15 | 47 | 4.13 | 0 | -0.02 |

| Delaware | 18 | 18 | 19 | 18 | 18 | 5.37 | 18 | 5.35 | 0 | -0.02 |

| Florida | 4 | 4 | 4 | 4 | 4 | 6.81 | 4 | 6.78 | 0 | -0.03 |

| Georgia | 30 | 29 | 28 | 29 | 32 | 5.03 | 26 | 5.10 | -6 | 0.07 |

| Hawaii | 38 | 41 | 43 | 43 | 44 | 4.49 | 42 | 4.52 | -2 | 0.03 |

| Idaho | 17 | 17 | 14 | 13 | 10 | 5.61 | 11 | 5.60 | 1 | -0.01 |

| Illinois | 33 | 34 | 35 | 34 | 36 | 4.82 | 37 | 4.77 | 1 | -0.05 |

| Indiana | 13 | 13 | 13 | 11 | 12 | 5.57 | 10 | 5.63 | -2 | 0.07 |

| Iowa | 44 | 39 | 38 | 37 | 22 | 5.19 | 20 | 5.30 | -2 | 0.11 |

| Kansas | 31 | 31 | 26 | 23 | 25 | 5.13 | 25 | 5.13 | 0 | 0.00 |

| Kentucky | 20 | 20 | 21 | 21 | 23 | 5.19 | 22 | 5.18 | -1 | -0.01 |

| Louisiana | 42 | 44 | 45 | 39 | 40 | 4.69 | 40 | 4.74 | 0 | 0.04 |

| Maine | 27 | 26 | 23 | 28 | 27 | 5.13 | 29 | 5.06 | 2 | -0.07 |

| Maryland | 41 | 43 | 46 | 46 | 46 | 4.33 | 46 | 4.35 | 0 | 0.02 |

| Massachusetts | 34 | 33 | 34 | 33 | 41 | 4.55 | 41 | 4.56 | 0 | 0.01 |

| Michigan | 12 | 11 | 12 | 12 | 14 | 5.55 | 14 | 5.49 | 0 | -0.06 |

| Minnesota | 46 | 45 | 44 | 44 | 42 | 4.54 | 44 | 4.48 | 2 | -0.06 |

| Mississippi | 29 | 30 | 30 | 31 | 29 | 5.09 | 27 | 5.09 | -2 | 0.00 |

| Missouri | 15 | 9 | 10 | 9 | 13 | 5.56 | 13 | 5.54 | 0 | -0.02 |

| Montana | 5 | 5 | 5 | 5 | 5 | 6.18 | 5 | 6.32 | 0 | 0.13 |

| Nebraska | 28 | 28 | 24 | 24 | 28 | 5.09 | 24 | 5.16 | -4 | 0.07 |

| Nevada | 16 | 15 | 17 | 17 | 17 | 5.42 | 17 | 5.37 | 0 | -0.05 |

| New Hampshire | 7 | 7 | 7 | 7 | 6 | 6.03 | 6 | 6.05 | 0 | 0.02 |

| New Jersey | 50 | 50 | 49 | 49 | 49 | 3.64 | 49 | 3.69 | 0 | 0.06 |

| New Mexico | 24 | 27 | 33 | 26 | 30 | 5.07 | 31 | 5.02 | 1 | -0.04 |

| New York | 49 | 49 | 50 | 50 | 50 | 3.61 | 50 | 3.62 | 0 | 0.01 |

| North Carolina | 11 | 10 | 11 | 10 | 11 | 5.60 | 12 | 5.57 | 1 | -0.03 |

| North Dakota | 10 | 16 | 15 | 14 | 9 | 5.63 | 9 | 5.67 | 0 | 0.04 |

| Ohio | 36 | 37 | 37 | 36 | 35 | 4.84 | 35 | 4.87 | 0 | 0.04 |

| Oklahoma | 26 | 23 | 31 | 22 | 19 | 5.30 | 21 | 5.27 | 2 | -0.04 |

| Oregon | 9 | 12 | 29 | 30 | 26 | 5.13 | 30 | 5.05 | 4 | -0.08 |

| Pennsylvania | 37 | 36 | 36 | 35 | 34 | 4.91 | 34 | 4.93 | 0 | 0.02 |

| Rhode Island | 40 | 38 | 39 | 40 | 37 | 4.80 | 39 | 4.75 | 2 | -0.05 |

| South Carolina | 32 | 32 | 32 | 32 | 33 | 5.01 | 33 | 4.99 | 0 | -0.03 |

| South Dakota | 2 | 2 | 2 | 2 | 2 | 7.58 | 2 | 7.65 | 0 | 0.06 |

| Tennessee | 35 | 35 | 8 | 8 | 8 | 5.86 | 8 | 5.94 | 0 | 0.08 |

| Texas | 6 | 6 | 6 | 6 | 7 | 6.00 | 7 | 6.00 | 0 | -0.01 |

| Utah | 14 | 14 | 16 | 15 | 15 | 5.48 | 16 | 5.43 | 1 | -0.05 |

| Vermont | 43 | 42 | 41 | 42 | 43 | 4.54 | 43 | 4.50 | 0 | -0.03 |

| Virginia | 23 | 25 | 27 | 25 | 24 | 5.16 | 28 | 5.09 | 4 | -0.07 |

| Washington | 8 | 8 | 9 | 45 | 45 | 4.47 | 45 | 4.44 | 0 | -0.03 |

| West Virginia | 25 | 24 | 22 | 19 | 21 | 5.19 | 23 | 5.17 | 2 | -0.02 |

| Wisconsin | 21 | 21 | 20 | 20 | 20 | 5.28 | 19 | 5.32 | -1 | 0.04 |

| Wyoming | 1 | 1 | 1 | 1 | 1 | 7.73 | 1 | 7.65 | 0 | -0.08 |

| District of Columbia | 47 | 47 | 47 | 48 | 48 | 4.01 | 48 | 4.07 | 0 | 0.06 |

Meet the Authors

-

Jared Walczak is Vice President of State Projects at the Tax Foundation. He previously served as legislative director to a member of the Senate of Virginia and as political director for a statewide campaign, and consulted on research and policy development for a number of candidates and elected officials.

More State Tax Articles

Unpacking the State and Local Tax Toolkit: Sources of State and Local Tax Collections (FY 2020)

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

Arkansas’s Rate Reduction Acceleration

Arkansas recently became the 13th state to authorize an individual income tax rate reduction this year. This round of tax cuts accelerated reforms enacted eight months ago.

7 min read

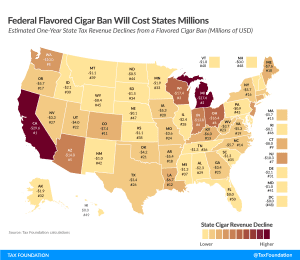

FDA Ban on Flavored Cigars Could Cost $836 Million in Annual Excise Tax Revenue

The FDA’s proposal to ban flavored cigars would carry significant revenue implications for many state governments.

7 min read