Latest Work

Presidential Election in Poland: Tailoring Tax Policy to Poland’s Strategic Needs

Between Russia’s war in Ukraine, President Trump’s uncertain policies towards Europe, and Poland’s attempt to increase domestic defense capabilities, raising revenue has become one of the most critical topics in the campaign.

7 min read

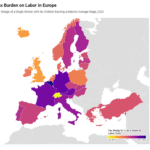

Fiscal Forum: Future of the EU Tax Mix with Dr. Jost Heckemeyer

Sean Bray interviewed Professor of Business Accounting and Taxation at the University of Kiel, Jost Heckemeyer, about the future of the EU tax mix. The interview shows that there is a trade-off between stability and flexibility in European tax policymaking. It also shows that there ought to be a balance between fairness and competitiveness when thinking about improving tax policy.

16 min read

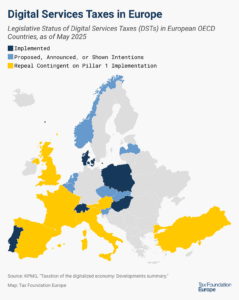

Digital Services Taxes in Europe, 2025

Currently, about half of all European OECD countries have either announced, proposed, or implemented a digital services tax. Because these taxes mainly impact US companies and are thus perceived as discriminatory, the US responded with retaliatory tariff threats.

5 min read

A Distributed Profits Tax in Poland

The Polish government is considering converting its traditional corporate income tax into a tax on distributed profits. We estimate that this reform would result in greater investment, a larger productive capital stock, and higher economic output in the long run.

29 min read

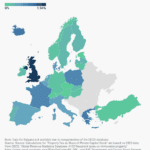

Businesses Pay and Remit 87 Percent of All Taxes Collected in Europe

Without businesses as their taxpayers and tax collectors, governments would not have the resources to provide even the most basic services.

5 min read

What Are the Goals of Retaliatory Tax Policies?

The US Ways and Means Committee’s “Big Beautiful Bill” includes a retaliatory provision called Section 899, along with an expansion of the base erosion and anti-abuse tax (BEAT).

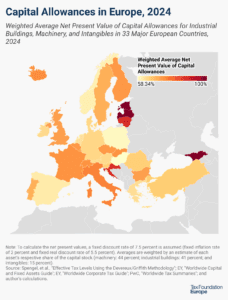

7 min read2024 European Tax Policy Scorecard

55 min readThe High Cost of Wealth Taxes

30 min readLatest Blog Posts

-

The EU Budget’s CORE Is Rotten

5 min read -

-

-

-

-

-

We are Europe’s leading nonpartisan tax policy nonprofit.

The mission of Tax Foundation Europe is to improve lives through tax policies that lead to greater economic growth and opportunity.

Our vision is a world where the tax code doesn’t stand in the way of success. Every day, in the European Union and throughout Europe, our team of trusted experts strives towards that vision by remaining principled, insightful, and engaged and by advancing the principles of sound tax policy: simplicity, neutrality, transparency, and stability.

-

We have the experts you need to understand how tax policy works.

-

Expert

ExpertSean Bray

Vice President of Global Projects at Tax Foundation and Policy Director of Tax Foundation Europe

TaxEDU Europe is designed to advance tax policy education, discussion, and understanding in classrooms, living rooms, and government chambers. It combines the best aspects of cutting-edge and traditional education to elevate the debate, enable deeper understanding, and achieve principled policy.

TaxEDU Europe gives teachers the tools to make students better citizens, taxpayers a vocabulary to see through the rhetoric, and videos and podcasts for anyone who wants to boost their tax knowledge on the go.

Glossary

Understand the terms of the European tax debate with our comprehensive glossary.

Educational Resources

Our primers are classroom-ready resources for understanding key concepts in tax policy.

Videos

Our animated explainer videos are designed for the classroom, social media, and anyone looking to boost their tax knowledge on the go.

Principles

Learn about the principles of sound tax policy—simplicity, transparency, neutrality, and stability—which should serve as touchstones for policymakers and taxpayers everywhere.