New York‘s tax system ranks 50th overall on the 2025 State Tax Competitiveness Index. New York ranks last on the Index, with high rates and a burdensome and nonneutral tax structure. To a significant degree, the draw of New York, and particularly New York City, has been enough to attract and retain individuals despite a high-rate, poorly structured tax code, just as many people choose to live in the city despite its high cost of living generally. At the margin, however, taxes matter—and in an era of enhanced migration, they now matter more than ever.

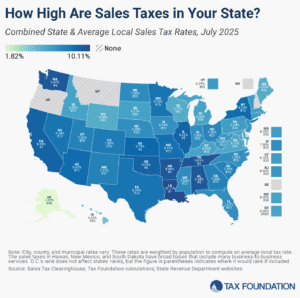

New York has a high top individual income tax rate of 10.9 percent and is one of only two states with a “tax benefit recapture” provision, where the benefit of lower rates is phased out and a taxpayer’s top rate is ultimately applied to all income, not just marginal income above a certain level. In addition, some jurisdictions collect local income taxes, including New York City, which imposes a progressive income tax with a top rate of 3.876 percent. New York also has a graduated corporate income tax, with rates ranging from 6.5 percent to 7.25 percent. The state maintains a capital stock base within its corporate income tax, which was scheduled to phase out but has yet to be eliminated. While the state sales tax rate is reasonable at 4 percent, the average combined state and local sales tax rate is much higher, at 8.53 percent, and the base is especially narrow with both groceries and clothing exempt.

New York is an outlier in imposing a “convenience of the employer” rule on taxpayers, requiring nonresident individuals to pay New York income taxes if they are employed by a business located in the state, even if they have minimal contacts with New York otherwise. This creates double taxation for remote employees of firms headquartered in New York, unless an allowance is provided by the other state. This also adds to compliance costs for tax filers.

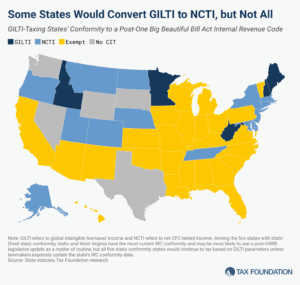

Additionally, New York does not conform to the federal government’s bonus depreciation allowance under Section 168(k), discouraging investment. While levy limits have constrained the continued growth of property taxes, effective rates remain high, and a disproportionate split roll system shifts property tax costs to businesses and renters. New York also has both an estate tax and a real estate transfer tax. New York does, however, do better than some of its regional rivals in largely exempting global intangible low-taxed income (GILTI) from its corporate tax base.