Note: The following is the testimony of Dr. William McBride, Vice President of Federal Tax Policy & Stephen J. Entin Fellow in Economics at the Tax Foundation, prepared for a House Budget Committee hearing on June 22, 2023, titled, “Reigniting American Growth and Prosperity Series: Incentivizing Economic Excellence Through Tax Policy.”

TCJA, Biden’s TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Policies, and Potential Pro-Growth Reforms

Chairman Arrington, Ranking Member Boyle, and distinguished members of the House Budget Committee, thank you for the opportunity to provide testimony on “incentivizing economic excellence through tax policy.” I am William McBride, Vice President of Federal Tax Policy and Stephen J. Entin Fellow in Economics at the Tax Foundation, where I focus on how we can improve our federal tax code.

Today, my testimony will focus on three points. First, I will describe how the Tax Cuts and Jobs Act (TCJA) improved incentives and economic growth, contributing to record low unemployment and record high federal tax collections. Second, I will contrast TCJA with President Biden’s tax policies. Third, I will recommend ways to reform the federal tax code to reduce complexity, improve economic incentives, grow the economy, increase opportunity, and raise sufficient tax revenues at or above current levels.

TCJA Lowered Marginal Tax Rates and Raised Economic Growth

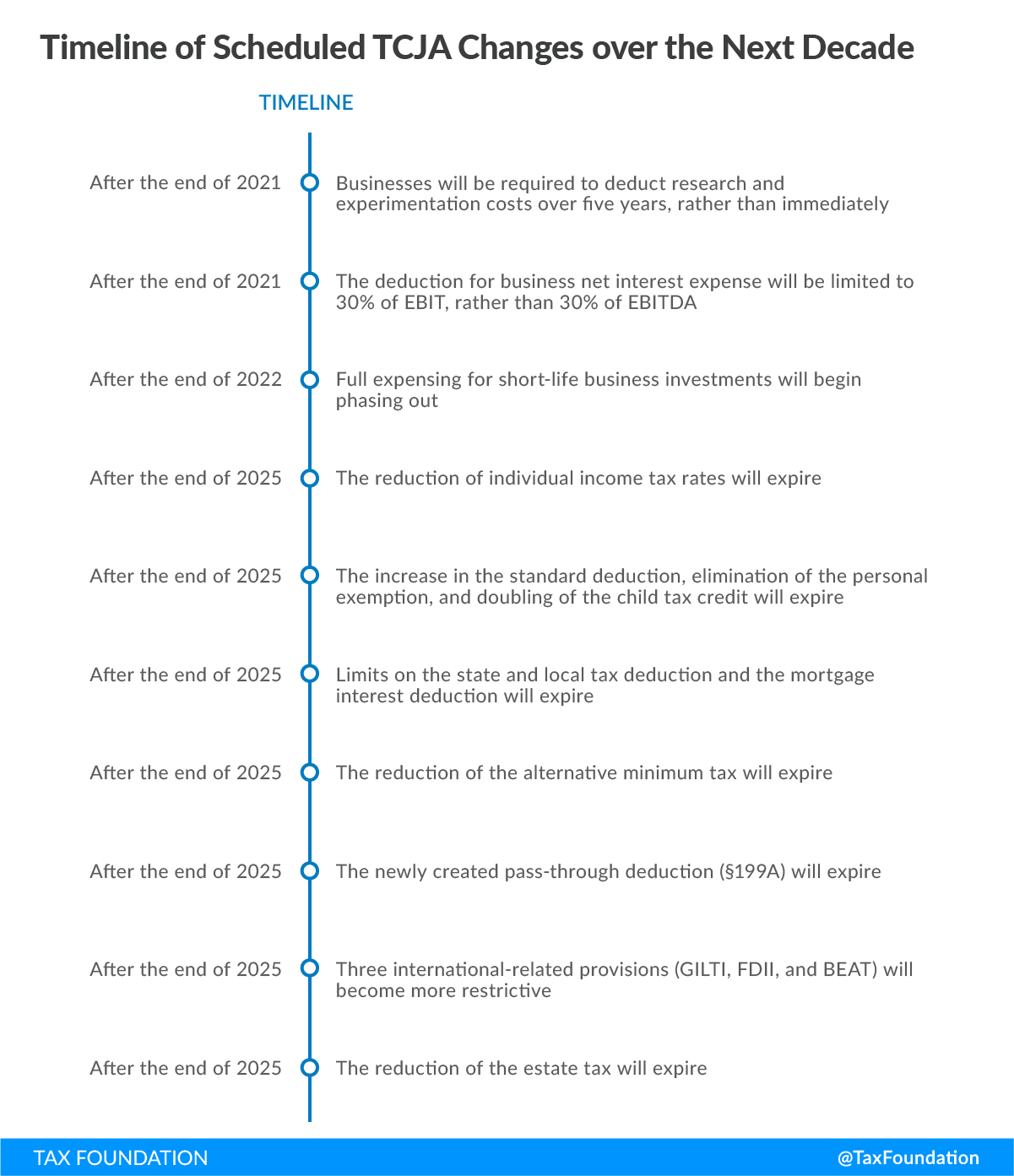

TCJA reduced income tax rates broadly for individuals and corporations: for individuals through a set of tax cuts that apply from 2018 to 2025, including lower statutory income tax rates on individual income, a larger standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. , and a larger child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. ; for corporations mainly through a permanent reduction in the statutory corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate from 35 percent to 21 percent as well as temporary 100 percent bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. (allowing companies to immediately deduct the full cost of investment in equipment) that applies from 2018 to 2022 and is phased out thereafter. These tax cuts were partially offset by curtailing deductions, among other things, including capping individual deductions for state and local taxes and mortgage interest and limiting business deductions for interest expense and R&D. Beginning in 2022, the limit on business interest expense became more stringent and businesses were required to amortize R&D expenses over five years (15 years for foreign R&D).[1]

Similar to analysis by the Congressional Budget Office (CBO), in 2018, the Tax Foundation analyzed the distributional impact of TCJA and found it would reduce taxes, and raise after-tax incomes, for all income groups throughout the period 2018 to 2025 in which the law’s individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. cuts apply.[2] For example, we found TCJA would raise real (inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. -adjusted) after-tax incomes for all quintiles of earners in 2022, by 0.9 percent for the bottom quintile, 1.6 percent for the middle quintile, and 2.4 percent for the top quintile, based on conventional (static) analysis that does not account for economic growth.

Also, similar to analysis by the CBO as well as several other researchers, we found that TCJA would improve incentives to work, save, and invest by lowering marginal income tax rates that apply to labor and capital income, resulting in more investment, more labor supply, and faster economic growth.[3] Lowering the corporate tax rate in particular improved the long-run health of the economy, reducing the tax burden on corporate investment, while bonus depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. reduced the economic harm of both the corporate tax and individual income taxes on pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. income, boosting business investment incentives broadly albeit on a temporary basis.

We found TCJA’s positive impacts on the economy would build over time and by 2025 would result in a 3.0 percent increase in GDP, a 6.4 percent increase in the capital stock, and a 1.7 percent increase in real wages. The improved economic growth would translate into larger incomes for all income groups. For example, accounting for the growth effects, we found TCJA would substantially raise real after-tax incomes for all quintiles of earners in 2025, by 3.9 percent for the bottom quintile, 4.1 percent for the middle quintile, and 4.9 percent for the top quintile. After 2025, as the individual tax cuts expire and business taxes increase, the economic benefits of TCJA diminish, but the law’s permanent features lead to a 1.7 percent increase in GDP in the long run.[4]

At least nine other research groups, including the CBO, the Joint Committee on Taxation (JCT), and the International Monetary Fund, came to similar conclusions, although they predicted somewhat different patterns and magnitudes of growth resulting from the law, reflecting differing assumptions used and considerable uncertainty in the law’s effects.[5]

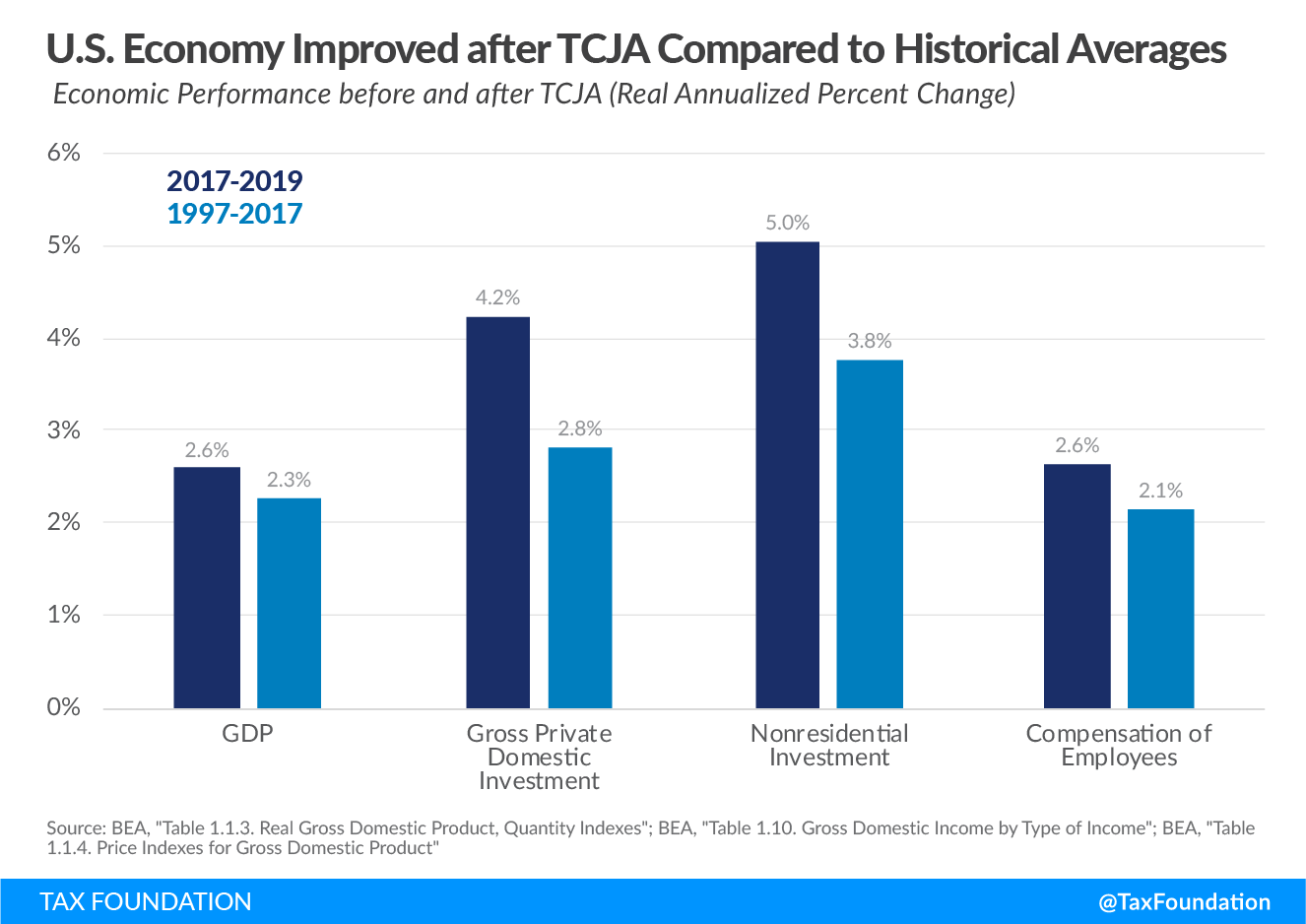

Comparison of the predicted effects to actual outcomes is extraordinarily difficult due to a series of confounding and unrelated events including higher tariffs and other policy developments, a pandemic, and the return of high inflation. However, at a high level, several measures point to a strengthening economy post-TCJA relative to expectations and to historic averages. For instance, actual business investment surged in 2018 by 6.5 percent, exceeding CBO’s forecast that factored in the effects of the law.[6] In 2019, unemployment hit a 50-year low of 3.5 percent.[7] Figure 2 and Table 1 show that economic performance, as measured by real GDP, investment, and labor compensation, improved in the two years after enactment of TCJA and before the pandemic relative to historic averages. Real GDP grew at an annual rate of 2.6 percent from 2017 to 2019, compared to 2.3 percent over the 20 years prior to TCJA. Real gross private domestic investment grew 4.2 percent and nonresidential business investment grew 5.0 percent from 2017 to 2019, compared to 2.8 percent and 3.8 percent growth respectively over the period 1997 to 2017. Real compensation of employees grew 2.6 percent from 2017 to 2019, compared to 2.1 percent over the 20 years prior to TCJA.

| Post-TCJA | Pre-TCJA | |||

|---|---|---|---|---|

| 2019-22 | 2017-19 | 2015-17 | 1997-2017 | |

| GDP | 1.7% | 2.6% | 2.0% | 2.3% |

| Gross Private Domestic Investment | 2.4% | 4.2% | 1.5% | 2.8% |

| Nonresidential Investment | 1.6% | 5.0% | 2.5% | 3.8% |

| Compensation of Employees | 1.5% | 2.6% | 2.2% | 2.1% |

|

Source: BEA, “Table 1.1.3. Real Gross Domestic Product, Quantity Indexes”; BEA, “Table 1.10. Gross Domestic Income by Type of Income”; BEA, “Table 1.1.4. Price Indexes for Gross Domestic Product.” |

||||

Tax Revenues under TCJA Have Met or Exceeded Historic Levels

Regarding revenue estimates for TCJA, the law’s major changes, including a reduction in the corporate tax rate from 35 percent to 21 percent as well as the introduction of GILTI and other international provisions, resulted in considerable uncertainty about how the law might affect tax revenue, particularly due to effects on profit shiftingProfit shifting is when multinational companies reduce their tax burden by moving the location of their profits from high-tax countries to low-tax jurisdictions and tax havens. and economic growth. While the JCT estimated in December 2017 that TCJA would reduce tax revenue by $1.5 trillion over the period 2018 to 2027, the JCT also provided a macroeconomic analysis of the bill estimating that TCJA would increase the average level of GDP over the budget window by 0.7 percent, resulting in an offsetting increase in revenue of $451 billion over the budget window.[8]

Our modeling and analysis of TCJA largely agreed with JCT’s, though our estimates were somewhat different. We estimated TCJA would increase GDP by 2.9 percent over the budget window, reducing a static revenue loss of about $1.8 trillion to about an $800 billion loss after accounting for economic growth, with initial revenue losses switching to revenue gains by 2023.[9]

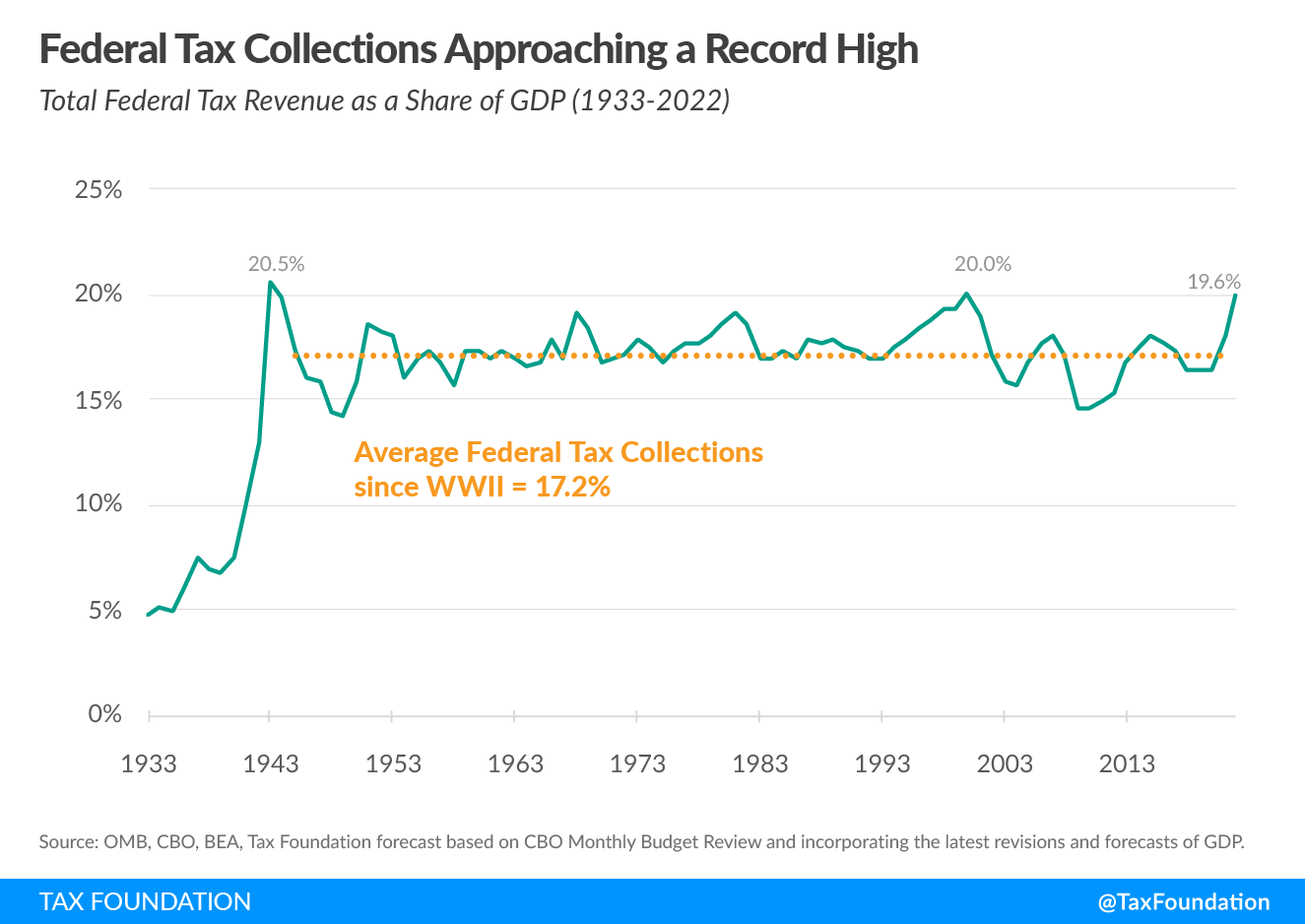

Actual revenue collections have generally matched or exceeded these forecasts, though noting again the influence of several non-tax factors. Federal tax collections dropped initially in fiscal years 2018 and 2019 to 16.4 percent of GDP, below the long-run average of 17.2 percent since World War II, and stayed at about that level in the pandemic year of 2020. Reflecting the rebounding economy and booming stock and housing markets, tax collections soared to 17.9 percent in 2021 and 19.6 percent in 2022, the highest level since the dot-com bubble in 2000 and nearly the highest level on record. Average federal tax collections in the five years since TCJA’s enactment are about 17.3 percent of GDP, higher than the 16.7 percent forecasted by the CBO following its passage, higher than most years leading up to TCJA, and higher than the long-run average of 17.2 percent.[10]

It remains to be seen where federal tax collections go from here. Through the first eight months of FY 2023, collections are down 11 percent relative to the same period last year, apparently due in part to reduced capital gains revenue as the stock and housing markets deflated in 2022.[11] However, this is relative to a record-breaking FY 2022. As such, depending on the path of GDP, federal tax collections as a share of GDP could come in near the historic average in FY 2023.

Note that tax collections as a share of GDP reflects both changes in nominal collections and changes in nominal GDP. TCJA boosted real and nominal GDP (according to our analysis and the JCT’s, for instance), so reaching and exceeding the historic average of tax collections as a share of GDP as TCJA has done understates the revenue performance of the law. Indeed, the available evidence over the last five years indicates the federal tax system under TCJA substantially boosted both the economy and federal tax collections, roughly in proportion.

President Biden’s Tax Proposals Would Stifle Economic Growth

In contrast to TCJA, President Biden’s tax proposals would raise marginal income tax rates, reducing incentives to work, save, and invest. While the proposals are ostensibly aimed at high-income earners and businesses, they would depress economic activity generally and reduce opportunities for workers at every level. Revenue raised with these tax hikes would in part be spent on tax credits and other subsidies for specific industries and taxpayers, further adding to the complexity of the tax code and expanding scope of the IRS.

The president’s most recent budget proposes nearly $4.8 trillion in new taxes through 2033 targeting businesses and high-income individuals, offset by about $833 billion in tax credits leading to a net tax increase of about $4 trillion.[12] The proposals include:

- Raising the top individual income tax rate to 39.6 percent, adding another 1.2 percent to the Medicare tax on wages, and expanding the base of the Net Investment Income Tax (NIIT) to include all pass-through business income while raising the rate to 5 percent, effectively resulting in a federal top income rate of about 44 percent (when combined with state income taxes, many taxpayers would face top rates over 50 percent).[13]

- Doubling the top capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. rate to 39.6 percent, which combined with the NIIT yields a top rate of 44.6 percent—the highest rate in several decades and the highest in the Organisation for Economic Co-operation and Development (OECD).[14]

- Taxing unrealized capital gains with a 25 percent minimum tax, an untried and impractical policy that taxes phantom income and has many potential downsides.[15]

- Raising the corporate income tax rate to 28 percent, resulting in a higher corporate tax rate than any of our major trading partners.[16]

- Hiking the GILTI tax and adding an Undertaxed Profits Rule (UTPR), further exposing U.S. companies to double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. on their foreign income.[17]

- Quadrupling the stock buyback tax to 4 percent, which can also subject multi-national companies to double taxation.[18]

- Raising taxes further on targeted industries, hitting pharmaceutical innovation and oil and gas production.[19]

Estimating the economic effects of many of these major tax hikes, we find they would reduce the size of the economy as measured by GDP by 1.3 percent over the long run, reduce wages by 1.0 percent and eliminate 335,000 jobs. This estimate likely understates the full economic harm from the president’s budget because it excludes the effects of the 25 percent minimum tax on unrealized capital gains and the UTPR, which together represent about a $1 trillion tax hike according to the administration’s estimates.[20]

The president’s budget is proposed in addition to the recently enacted Inflation Reduction Act (IRA), which includes several new, complicated, and burdensome tax hikes and tax credits that go into effect this year, including a book minimum tax, stock buyback tax, an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. to control drug prices, and about two dozen green energy tax credits.[21] The IRA was originally estimated to reduce deficits, according to analysis by the CBO and JCT, and was thus sold as a way to reduce inflation. However, JCT currently estimates the cost of the green energy credits has more than doubled to $663 billion while outside estimates put the cost at about $1 trillion over 10 years, indicating the IRA likely increases deficits.[22]

We find the IRA is a net drag on the economy, as it adds new penalties on business investment through the book minimum tax and stock buyback tax, ultimately shrinking the economy by 0.2 percent in the long run, lowering wages by 0.1 percent and eliminating 29,000 jobs.[23] However, these estimates do not capture what may be the most costly aspects of the law, which is the extraordinary complexity of many of its provisions and the associated distortionary effects of simultaneously penalizing and subsidizing specific activities and types of taxpayers, i.e., picking winners and losers on a grand scale.

The book minimum tax suffers from many flaws, including the fact that book incomeBook income is the amount of income corporations publicly report on their financial statements to shareholders. This measure is useful for assessing the financial health of a business but often does not reflect economic reality and can result in a firm appearing profitable while paying little or no income tax. is not a well-defined tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , and so it requires voluminous regulatory guidance and taxpayer comments to try and sort out how it could possibly work.[24] Meanwhile, the guidance continues to roll out even as the new tax liabilities are due, and many outstanding issues, such as how small partnerships are affected, will probably need to be settled in the courts.[25] Practitioners have noted that the book minimum tax contains so many unresolved, and possibly unresolvable, problems relating to fundamental differences in book and tax accounting rules, that the ensuing complexity and uncertainty for corporate taxpayers may exceed that created by all of the corporate tax changes in TCJA.[26]

The stock buyback tax is another new idea in taxation, but not a good one.[27] Ostensibly aimed at perceived problems in corporate finance, in practice it is also proving to be a way the administration can selectively punish certain types of firms and create additional compliance costs.[28]

While some might see the exploding budgetary cost of the green energy credits as a sign that they are working, because they target so specifically certain activities and technologies, they will primarily benefit a small minority of taxpayers, such as the 1 percent of relatively wealthy car owners who drive an electric vehicle;[29] automakers; solar panel and battery manufacturers; lithium miners; and financial, accounting, and consulting firms specializing in the complex rules relating to eligibility, credit transferability and monetization. Such a large subsidy targeting a limited number of suppliers will face substantial capacity constraints, especially in an overheated economy racked by labor shortages and inflation, potentially worsening price pressures for consumers.

Overall, the president’s tax policies signal a preference for expansive government intervention, control, and direction of the private economy, combined with a disregard for taxpayer concerns about complexity, compliance costs, and the economic cost of high marginal income tax rates.[30] At four million words and counting, the complexity of the federal tax code has reached absurd levels, far exceeding the ability of taxpayers to comprehend it and costing taxpayers more than $300 billion a year in compliance costs.[31] The economic cost of high marginal income tax rates have been well understood by economists for decades and have been documented and reaffirmed by dozens of studies.[32] The president and his advisors should weigh these costs when considering the potential benefits of new tax proposals.

Recommendations for Reform

Adam Smith’s advice on tax policy still applies, perhaps now more than ever:

“Little else is requisite to carry a state to the highest degree of opulence from the lowest barbarism, but peace, easy taxes, and a tolerable administration of justice; all the rest being brought about by the natural course of things. All governments which thwart this natural course, which force things into another channel, or which endeavour to arrest the progress of society at a particular point, are unnatural, and to support themselves are obliged to be oppressive and tyrannical.”[33]

Rather than easy taxes, we have a behemoth of a tax code that creates confusion and controversy while punishing success. Lawmakers should focus on simplifying the federal tax code, creating stability, and broadly improving economic incentives. There are incremental steps that can be made on the path to fundamental tax reform.

In the immediate term, lawmakers should seek solutions with bipartisan appeal. At the top of the list is returning to full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. for R&D on a permanent basis, a policy that had existed from the beginning of the tax code, until last year, when a TCJA provision began requiring amortization of R&D expenses over 5 years (15 years for foreign-located R&D).[34] This policy switch delays legitimate business deductions for R&D, triggering liquidity problems for small businesses and penalizing R&D investment, particularly in manufacturing, information technology, and other R&D-intensive sectors, due to inflation and the time value of money.

A related policy, 100 percent bonus depreciation, allows full expensing for equipment, but is phasing down to 80 percent this year and to zero over the next 4 years, meaning companies will have to wait up to 20 years to deduct the original cost of equipment purchases, according to complicated depreciation schedules.[35] If bonus depreciation were made permanent along with R&D expensing, we estimate it would boost GDP by 0.5 percent over the long run and add about 87,000 jobs. While these policies would have a dynamic budgetary cost of about $460 billion over the next decade, in the long run, revenues would be above baseline levels due to economic growth.[36] Temporary deficits could be covered by curtailing tax credits and other tax expenditures, such as by repealing or capping some of the green energy credits recently implemented as part of the IRA.

Going one step further and providing full expensing for all assets, including structures, on a permanent basis would greatly simplify business taxation while substantially growing the economy. We estimate full expensing would increase GDP by 2.3 percent in the long run, raise wages by 1.9 percent, and add 442,000 jobs.[37] While the revenue cost within the budget window would exceed $1 trillion, this too could be offset by a more thorough scrubbing of the tax code’s roughly 200 tax preferences that cost about $2 trillion annually.[38]

As 2025 approaches, when much of TCJA expires, lawmakers should consider fundamental tax reform to systematically address the tax code’s shortcomings. While there are many approaches to fundamental, pro-growth tax reform, we have recently detailed and analyzed a proposal that would substantially boost economic growth and opportunity.[39] It follows along the lines of the Estonian income tax system, which tops our annual ranking of most competitive tax systems.[40]

Simplicity and neutrality are the hallmarks of the Estonian income tax system.[41] Taxes are so simple in Estonia that they can typically be filed in five minutes, and the cost of compliance for businesses is among the lowest of any country.[42] Estonia’s tax system is also very pro-growth, increasing small business entrepreneurship, investment, labor productivity and, thereby, wages.[43] Estonia’s income tax system does all of this while generating substantial revenue comparable to other developed countries.[44]

The Estonian income tax is fully integrated, so it avoids double-taxing corporate income through taxes at both the entity and shareholder levels. Instead of a complicated corporate income tax and separate rules that apply to passthrough businesses, all businesses are subject to a simple 20 percent tax on distributed profits (including dividends and stock buybacks). At the individual level, a simple flat taxAn income tax is referred to as a “flat tax” when all taxable income is subject to the same tax rate, regardless of income level or assets. of 20 percent applies to all individual income except dividends, since they are already taxed by the distributed profits taxA distributed profits tax is a business-level tax levied on companies when they distribute profits to shareholders, including through dividends and net share repurchases (stock buybacks). . Capital gains are taxed as ordinary income at 20 percent. Rather than a complicated estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. like ours that taxes accumulated savings at death, bequeathed assets are simply taxed as capital gains when sold by the heir with deductible basis determined only by costs incurred by the heir.[45]

Our proposal consists of a revenue-neutral reform of the U.S. tax code along the lines of the Estonian income tax system, keeping only certain features of the current code that benefit low-income households (such as the Earned Income Tax Credit and Child Tax Credit) and support saving (such as 401ks).[46] By greatly simplifying the federal tax code, these reforms would substantially reduce compliance costs, potentially saving U.S. taxpayers more than $100 billion annually, comprised of more than $70 billion in reduced compliance costs for businesses and more than $30 billion in reduced compliance costs for individuals related to individual income and estate tax returns.

In addition to compliance cost savings, our modeling of the reform’s impacts on the U.S. economy indicates it would increase GDP by 2.3 percent in the long run, amounting to about $400 billion in additional annual output by 2032 and $1 trillion in the long run (both in 2023 dollars). These changes would increase the long-run capital stock by 3 percent, amounting to $2.1 trillion in 2023 dollars. Additionally, we estimate it would add 1.3 million full-time equivalent jobs and raise wages by 1.3 percent. By increasing GDP, the debt burden as measured by the debt-to-GDP ratio would fall by 5.9 percentage points over the long run.

Distributionally, we find the reform would increase after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. overall by 2.1 percent in the long run, accounting for improved economic growth, with a larger boost of 2.7 percent for the bottom quintile of earners, and 3.0 percent for the second quintile.

More generally, the U.S. could learn from the experience of other countries in the OECD, which rely more heavily on consumption taxes than the U.S. does.[47] Value added taxes (VATs) are a major source of revenue in virtually every developed country except the United States. VATs and other taxes on consumption are among the least economically harmful ways to raise revenue.[48]

OECD countries have also tended to abandon more complicated means of taxing high earners such as wealth taxes due to their administrative and economic challenges.[49] Rather than high capital gains taxes, or any attempt to tax unrealized capital gains, most OECD countries have lower capital gains tax rates than the U.S., and tax capital income overall at lower average tax rates.[50]

Consumption taxes can be designed to progressively tax the consumption of higher earners without the administrative complexity and compliance costs of our current progressive income tax system. For example, by splitting the VAT base in two, businesses would pay taxes on their cash flow (sales less purchases and compensation paid), while households would pay taxes on compensation received. Applying a progressive rate schedule at the household level, with the top rate matching the rate on business cash flow, is a relatively simple way to achieve progressivity within a consumption taxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or an income tax where all savings is tax-deductible. .[51] Under a more standard value-added tax, the most efficient way to increase progressivity would be to offer targeted relief to lower- and middle-income households.[52]

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] Tax Foundation, “Preliminary Details and Analysis of the Tax Cuts and Jobs Act,” Dec. 18, 2017, https://taxfoundation.org/final-tax-cuts-and-jobs-act-details-analysis/; Huaqun Li and Kyle Pomerleau, “The Distributional Impact of the Tax Cuts and Jobs Act over the Next Decade,” Tax Foundation, Jun. 28, 2018, https://taxfoundation.org/the-distributional-impact-of-the-tax-cuts-and-jobs-act-over-the-next-decade/.

[2] Huaqun Li and Kyle Pomerleau, “The Distributional Impact of the Tax Cuts and Jobs Act over the Next Decade,” Tax Foundation, Jun. 28, 2018, https://taxfoundation.org/the-distributional-impact-of-the-tax-cuts-and-jobs-act-over-the-next-decade/; Congressional Budget Office, “Distributional Analysis of the Tax Cuts and Jobs Act,” Nov. 27, 2017, https://www.cbo.gov/publication/53349; Garrett Watson, “Congressional Budget Office Shows 2017 Tax Law Reduced Tax Rates Across the Board in 2018,” Tax Foundation, Aug. 5, 2021, https://taxfoundation.org/congressional-budget-office-shows-2017-tax-law-reduced-tax-rates-across-board-2018/.

[3] John McClelland and Jeffrey Werling, “How the 2017 Tax Act Affects CBO’s Projections,” Congressional Budget Office, Apr. 20, 2018, https://www.cbo.gov/publication/53787; Congressional Budget Office, “The Effects of the 2017 Tax Act on CBO’s Economic and Budget Projections,” Appendix B of The Budget and Economic Outlook: 2018 to 2028, Apr. 9, 2018, https://www.cbo.gov/publication/53651; Tax Foundation, “Preliminary Details and Analysis of the Tax Cuts and Jobs Act,” Dec. 18, 2017, https://taxfoundation.org/final-tax-cuts-and-jobs-act-details-analysis/; Huaqun Li and Kyle Pomerleau, “The Distributional Impact of the Tax Cuts and Jobs Act over the Next Decade,” Tax Foundation, Jun. 28, 2018, https://taxfoundation.org/the-distributional-impact-of-the-tax-cuts-and-jobs-act-over-the-next-decade/.

[4] Tax Foundation, “Preliminary Details and Analysis of the Tax Cuts and Jobs Act,” Dec. 18, 2017, https://taxfoundation.org/final-tax-cuts-and-jobs-act-details-analysis/; Huaqun Li and Kyle Pomerleau, “The Distributional Impact of the Tax Cuts and Jobs Act over the Next Decade,” Tax Foundation, Jun. 28, 2018, https://taxfoundation.org/the-distributional-impact-of-the-tax-cuts-and-jobs-act-over-the-next-decade/.

[5] For a comparison of estimated effects, see: Congressional Budget Office, “The Effects of the 2017 Tax Act on CBO’s Economic and Budget Projections,” Appendix B of The Budget and Economic Outlook: 2018 to 2028, Apr. 9, 2018, https://www.cbo.gov/publication/53651.

[6] Congressional Budget Office, “The Effects of the 2017 Tax Act on CBO’s Economic and Budget Projections,” Appendix B of The Budget and Economic Outlook: 2018 to 2028, Apr. 9, 2018, https://www.cbo.gov/publication/53651; Bureau of Economic Analysis, “Table 5.3.6. Real Private Fixed Investment by Type, Chained Dollars,” last revised on May 25, 2023, https://www.bea.gov/itable/national-gdp-and-personal-income.

[7] Bureau of Labor Statistics, https://data.bls.gov/timeseries/LNS14000000.

[8] Joint Committee on Taxation, “Macroeconomic Analysis of the Conference Agreement for H.R. 1, The Tax Cuts and Jobs Act,” Dec. 22, 2017, JCX-69-17 | Joint Committee on Taxation (jct.gov).

[9] Tax Foundation, “Preliminary Details and Analysis of the Tax Cuts and Jobs Act,” Dec. 18, 2017, https://taxfoundation.org/final-tax-cuts-and-jobs-act-details-analysis/.

[10] William McBride, “Inflation Is Surging, So Are Federal Tax Collections,” Tax Foundation, Oct. 13, 2022, https://taxfoundation.org/federal-tax-collections-inflation-surging/.

[11] Congressional Budget Office, “Monthly Budget Review: May 2023,” Jun. 8, 2023, https://www.cbo.gov/publication/59134.

[12] Garrett Watson et al., “Details and Analysis of President Biden’s Fiscal Year 2024 Budget Proposal,” Tax Foundation, Mar. 23, 2023, https://taxfoundation.org/biden-budget-tax-proposals-analysis/.

[13] Erica York, Garrett Watson, and Alex Durante, “Biden’s FY 2024 Budget Would Result in More Than $4.5 Trillion in Gross Tax Increases,” Tax Foundation, Mar. 9, 2023, https://taxfoundation.org/biden-budget-taxes/.

[14] Alex Muresianu, Erica York, and Garrett Watson, “Biden’s Proposed Capital Gains Tax Rate Would be Highest for Many in a Century,” Tax Foundation, Apr. 26, 2021, https://taxfoundation.org/biden-capital-gains-tax-rate-historical/; Clifton Painter, “Biden’s Top Marginal Capital Gains Tax Rate Would Be Highest in OECD,” Tax Foundation, Jul. 6, 2021, https://taxfoundation.org/biden-capital-gains-tax-rate-oecd/.

[15] Garrett Watson and Erica York, “Proposed Minimum Tax on Billionaire Capital Gains Takes Tax Code in Wrong Direction,” Tax Foundation, Mar. 30, 2022, https://taxfoundation.org/biden-billionaire-tax-unrealized-capital-gains/.

[16] Christina Enache, “Corporate Tax Rates around the World, 2022,” Tax Foundation, Dec. 13, 2022, https://taxfoundation.org/publications/corporate-tax-rates-around-the-world/.

[17] Daniel Bunn, “U.S. Cross-border Tax Reform and the Cautionary Tale of GILTI,” Tax Foundation, Feb. 17, 2021, https://taxfoundation.org/gilti-us-cross-border-tax-reform/.

[18] Alex Durante, “Stock Buyback Tax Would Hurt Investment and Innovation,” Tax Foundation, Aug. 12, 2022, https://taxfoundation.org/inflation-reduction-act-stock-buybacks/.

[19] Erica York, “Lawmakers Revive Prescription Drug Pricing Policies and 1,900% Excise Tax,” Tax Foundation, Jul. 11, 2022, https://taxfoundation.org/prescription-drug-pricing-reform/; Alex Muresianu and William McBride, “A Guide to the Fossil Fuel Provisions of the Biden Budget,” Tax Foundation, Sep. 2, 2021, https://taxfoundation.org/biden-fossil-fuel-tax/.

[20] Garrett Watson et al., “Details and Analysis of President Biden’s Fiscal Year 2024 Budget Proposal,” Tax Foundation, Mar. 23, 2023, https://taxfoundation.org/biden-budget-tax-proposals-analysis/

[21] Alex Durante et al., “Details and Analysis of the Inflation Reduction Act Tax Provisions,” Tax Foundation, Aug. 12, 2022, https://taxfoundation.org/inflation-reduction-act/.

[22] William McBride and Daniel Bunn, “Repealing Inflation Reduction Act’s Energy Credits Would Raise $663 Billion, JCT Projects,” Tax Foundation, Jun. 7, 2023, https://taxfoundation.org/inflation-reduction-act-green-energy-tax-credits-analysis/.

[23] Alex Durante et al., “Details and Analysis of the Inflation Reduction Act Tax Provisions,” Tax Foundation, Aug. 12, 2022, https://taxfoundation.org/inflation-reduction-act/.

[24] Cody Kallen, William McBride, and Garrett Watson, “Minimum Book Tax: Flawed Revenue Source, Penalizes Pro-Growth Cost RecoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages. ,” Tax Foundation, Aug. 5, 2022, https://taxfoundation.org/inflation-reduction-act-accelerated-depreciation/; IRS, “Inflation Reduction Act of 2022: Latest Updates,” https://www.irs.gov/inflation-reduction-act-of-2022; Chandra Wallace, “Corporate AMT Comment Letters Rich in Detail – And Disagreement,” Tax Notes, Mar. 22, 2023, https://www.taxnotes.com/tax-notes-today-federal/corporate-alternative-minimum-tax/corporate-amt-comment-letters-rich-detail-and-disagreement/2023/03/22/7g804.

[25] Erin Slowey, “Partnerships Struggle With Impact of US Corporate Minimum Tax,” Oct. 4, 2022, https://news.bloombergtax.com/daily-tax-report/partnerships-struggle-with-impact-of-us-corporate-minimum-tax.

[26] Tax Policy Center, “Raising Revenue for Corporations,” May 16, 2023, https://www.taxpolicycenter.org/event/raising-revenue-corporations.

[27] Alex Durante, “Stock Buyback Tax Would Hurt Investment and Innovation,” Tax Foundation, Aug. 12, 2023, https://taxfoundation.org/inflation-reduction-act-stock-buybacks/.

[28] Alex Muresianu, “A Better Way to Tax Buybacks,” Tax Foundation, Apr. 25, 2023, https://taxfoundation.org/biden-stock-buybacks-tax/; Jennifer Williams-Alvarez, “U.S. Buyback Tax Could Hit More Foreign Firms Than First Expected,” The Wall Street Journal, Apr. 14, 2023, https://www.wsj.com/articles/u-s-buyback-tax-could-hit-more-foreign-firms-than-first-expected-e9dedec3.

[29] David Roberts, “Clean Energy Tax Credits Mostly Go to the Affluent. Is There a Better Way?,” Vox, Nov. 24 2015, https://www.vox.com/2015/11/24/9792474/energy-tax-credits-inequitable; U.S. Department of Energy, “Vehicle Registration Counts by State,” https://afdc.energy.gov/vehicle-registration.

[30] William McBride, “Testimony: The Costs and Complexity of the Federal Tax Code Demand Reform,” Tax Foundation, Apr. 18, 2023, https://taxfoundation.org/federal-tax-complexity-costs-reform/.

[31] Scott Hodge, “The Tax Compliance Costs of IRS Regulations,” Tax Foundation, Aug. 23, 2022, https://taxfoundation.org/tax-compliance-costs-irs-regulations/.

[32] N. Gregory Mankiw, Matthew Weinzierl, and Danny Yagan, “Optimal Taxation in Theory and Practice,” Journal of Economic Perspectives 23:4 (2009), https://eml.berkeley.edu/~yagan/OptimalTaxation.pdf; William McBride, “What Is the Evidence on Taxes and Growth,” Tax Foundation, Dec. 18, 2012, https://www.taxfoundation.org/what-evidence-taxes-and-growth/; Alex Durante, “Reviewing Recent Evidence of the Effect of Taxes on Economic Growth,” Tax Foundation, May 21, 2021, https://taxfoundation.org/reviewing-recent-evidence-effect-taxes-economic-growth/; Timothy Vermeer, “The Impact of Individual Income Tax Changes on Economic Growth,” Tax Foundation, June 14, 2022, https://taxfoundation.org/income-taxes-affect-economy/; Robert Carroll, “The Excess Burden of Taxes and the Economic Cost of High Tax Rates,” Tax Foundation, August 2009, https://files.taxfoundation.org/legacy/docs/sr170.pdf; Martin Feldstein, “Tax Avoidance and the Deadweight Loss of the Income Tax,” The Review of Economics and Statistics 81:4 (November 1999): 674-680, https://www.jstor.org/stable/2646716; Åsa Johansson, Christopher Heady, Jens Arnold, Bert Brys, Cyrille Schwellnus, & Laura Vartia, “Taxation and Economic Growth.”; Congressional Budget Office, “The Economics of Financing a Large and Permanent Increase in Government Spending: Working Paper 2021-03,” Mar. 22, 2021, https://www.cbo.gov/publication/57021; see also Garrett Watson, “Congressional Budget Office and Tax Foundation Modeling Show That Some Tax Hikes Are More Damaging Than Others,” Tax Foundation, Mar. 26, 2021, https://www.taxfoundation.org/tax-hikes-are-more-damaging-than-others-analysis/.

[33] Adam Smith, An Inquiry into the Nature and Causes of the Wealth of Nations (Cannan ed.), vol. 1, Methuen, 1776, https://oll.libertyfund.org/title/smith-an-inquiry-into-the-nature-and-causes-of-the-wealth-of-nations-cannan-ed-vol-1

[34] Alex Muresianu, “R&D Amortization Hurts Economic Growth, Growth Industries, and Small Businesses,” Tax Foundation, June 1, 2023, https://taxfoundation.org/rd-amortization-impact/

[35] Stephen J Entin, “Expensing of Machinery and Equipment Should Be Made Permanent,” Tax Foundation, May 30, 2023, https://taxfoundation.org/permanent-expensing-machinery-equipment/

[36] Garrett Watson, Erica York, Cody Kallen, and Alex Durante, “Details and Analysis of Canceling the Scheduled Business Tax Increases in Tax Cuts and Jobs Act,” Tax Foundation, Nov. 1, 2022, https://taxfoundation.org/tax-cuts-jobs-act-business-tax-increases/

[37] Tax Foundation, “Options for Reforming America’s Tax Code 2.0: Option 65,” Apr. 19, 2021, https://taxfoundation.org/tax-reform-options/?option=65

[38] The Joint Committee on Taxation, “Estimates of Federal Tax Expenditures for Fiscal Years 2022-2026,” Dec. 22, 2022, https://www.jct.gov/publications/2022/jcx-22-22/; Treasury Department, “Tax Expenditures,” https://home.treasury.gov/policy-issues/tax-policy/tax-expenditures.

[39] William McBride, Huaqun Li, Garrett Watson, Alex Durante, Erica York, and Alex Muresianu, “Details and Analysis of a Tax Reform Plan for Growth and Opportunity,” Tax Foundation, Feb. 14, 2023, https://taxfoundation.org/growth-opportunity-us-tax-reform-plan/

[40] Daniel Bunn and Lisa Hogreve, “International Tax Competitiveness Index, 2022,” Tax Foundation, Oct. 17, 2022, https://taxfoundation.org/2022-international-tax-competitiveness-index/.

[41] Estonia’s simple approach to taxing business and individual income has also been implemented in Latvia and Georgia. Daniel Bunn, “Better than the Rest,” Tax Foundation, Oct. 9, 2019, https://taxfoundation.org/estonia-tax-system-latvia-tax-system/; Gia Jandieri, “Tax Reform in Georgia 2004-2012,” Tax Foundation, Jul. 17, 2019, https://taxfoundation.org/tax-reforms-in-georgia-2004-2012/.

[42] Kyle Pomerleau, “The Best Part of the Estonian Tax Code Is Not 5 Minute Tax Filing,” Tax Foundation, Jul. 21, 2015, https://taxfoundation.org/best-part-estonian-tax-code-not-5-minute-tax-filing/; William McBride, Garrett Watson, Erica York, “Taxing Distributed Profits Makes Business Taxation Simple and Efficient,” Tax Foundation, Mar. 1, 2023, https://taxfoundation.org/distributed-profits-tax-us-businesses/.

[43] Jaan Maaso, Jaanika Meriküll, and Priit Vahter, “Gross Profit Taxation Versus Distributed Profit Taxation and Firm Performance: Effects of Estonia’s Corporate Income Tax Reform,” The University of Tartu Faculty of Economics and Business Administration Working Paper No. 81-2011, Mar. 23, 2011, https://ssrn.com/abstract=1793143 or http://dx.doi.org/10.2139/ssrn.1793143; Jaan Masso and Jaanika Merikull, “Macroeconomic Effects of Zero Corporate Income Tax on Retained Earnings,” Baltic Journal of Economics, 11:2 (2011): 81-99, https://www.tandfonline.com/doi/pdf/10.1080/1406099X.2011.10840502; Aaro Hazak, “Companies’ Financial Decisions Under the Distributed Profit Taxation Regime of Estonia,” Emerging Markets Finance & Trade 45:4 (2009): 4-12, https://www.jstor.org/stable/27750676; Eduardo Davila and Benjamin Hebert, “Optimal Corporate Taxation under Financial Frictions,” NBER Working Paper No. 25520, Oct. 2021, https://www.nber.org/papers/w25520.

[44] Over the last 10 years, Estonia’s central government tax collections from income and profit amount to about 7.4 percent of GDP, compared to 7.3 percent for the median OECD country and 8.4 percent averaged across OECD countries. See OECD Tax Revenue Statistics, https://stats.oecd.org/Index.aspx

[45] William McBride, “Biden’s New Tax Proposals are Complicated and Rife with Double Taxation,” Tax Foundation, Mar. 13, 2023, https://taxfoundation.org/biden-tax-fairness/.

[46] William McBride, Huaqun Li, Garrett Watson, Alex Durante, Erica York, and Alex Muresianu, “Details and Analysis of a Tax Reform Plan for Growth and Opportunity,” Tax Foundation, Feb. 14, 2023, https://taxfoundation.org/growth-opportunity-us-tax-reform-plan/

[47]Daniel Bunn and Cecilia Perez Weigel, “Sources of Government Revenue in the OECD,” Tax Foundation, Feb. 23, 2023, https://taxfoundation.org/oecd-tax-revenue-by-country-2023/.

[48] William McBride, “What Is the Evidence on Taxes and Growth,” Tax Foundation, Dec. 18, 2012, https://www.taxfoundation.org/what-evidence-taxes-and-growth/.

[49] Daniel Bunn, “What the U.S. Can Learn from the Adoption (and Repeal) of Wealth Taxes in the OECD,” Tax Foundation, Jan. 18, 2022, https://taxfoundation.org/wealth-taxes-in-the-oecd/.

[50] Daniel Bunn and Elke Asen, “Savings and Investment: The Tax Treatment of Stock and Retirement Accounts in the OECD,” Tax Foundation, May 26, 2021, https://taxfoundation.org/savings-and-investment-oecd/#Capital; Jacob Lundberg and Johannes Nathell, “Taxing Capital—An International Comparison,” Tax Foundation, May 11, 2021, https://taxfoundation.org/tax-burden-on-capital-income/.

[51] This design is known as the “X Tax,” developed by the late economist David Bradford. See Robert Carroll and Alan D. Viard, Progressive Consumption Taxation: The X Tax, (Washington, D.C: The Rowman & Littlefield Publishing Group, 2012).

[52] See Rita de la Feria and Michael Walpole, “The Impact of Public Perceptions on General Consumption Taxes,” British Tax Review 67:5 (Dec. 4, 2020), 637-669, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3723750 for a discussion on how other approaches, such as exemptions or reduced rates can, counterintuitively, increase regressivity by providing more benefits to higher-income households.

Share