Spain’s Poorly Designed Tax Policy Hurts Its Competitiveness

Spain’s central government could learn some valuable lessons from its regional governments and other European countries about sound tax policy.

7 min read

Spain’s central government could learn some valuable lessons from its regional governments and other European countries about sound tax policy.

7 min read

Even though energy prices have declined from their recent peak, the United Kingdom is one of the few countries in Europe continuing to rely on windfall profits taxes to support households with the rising cost of living.

4 min read

The State Tax Competitiveness Index enables policymakers, taxpayers, and business leaders to gauge how their states’ tax systems compare. While there are many ways to show how much state governments collect in taxes, the Index evaluates how well states structure their tax systems and provides a road map for improvement.

115 min read

Rather than pursuing temporary policies, policymakers should implement long-term, pro-growth tax reforms that stimulate economic activity and incentivize energy diversification by supporting private investment through full expensing.

19 min read

If lawmakers are convinced that new revenues must be part of any long-term effort to solve the budget crisis or offset the cost of extending the TCJA, they must choose the least harmful ways of raising new revenues or else risk undermining their efforts by slowing economic growth.

7 min read

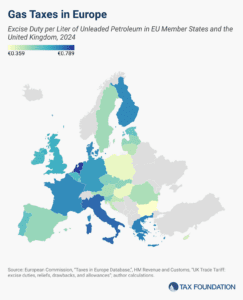

Gas and diesel taxes continue to be prominent policy issues throughout Europe. As the EU undergoes sweeping changes for its green transition, fuel taxes are likely to be a crucial aspect of policy discussions.

3 min read

By 2034, the gas tax and other car-related excise taxes are projected to raise less than half of the Highway Trust Fund’s outlays. While broader tax and spending reforms are necessary for overall deficit reduction, improving transportation funding would be a crucial step forward.

34 min read

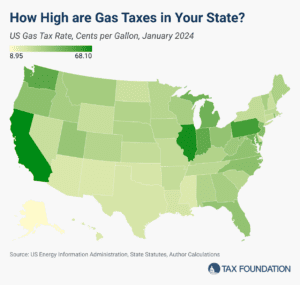

Though gas taxes are intended to serve as user fees and pollution deterrents, they vary widely across states. How does your state’s burden compare?

4 min read

Summer has arrived and states are beginning to implement policy changes that were enacted during the legislative session (or are being phased in over time).

13 min read

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the US in a distinctly uncompetitive international position and threaten the health of the US economy.

19 min read

Neutral tax codes don’t play favorites or try to influence personal or business decisions but stick to what they’re best at – raising sufficient revenue through low rates and a broad base.

Gas tax revenues have decoupled from road expenses and have been unable to support road funding in recent years. As such, states nationwide are exploring ways to supplement or replace gas tax revenues.

8 min read

Buckle up as we navigate the twists and turns of infrastructure and road funding. As electric vehicles gain traction, traditional gas taxes are running out of fuel to support our infrastructure budget.

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

At the beginning of 2024, a fee on certain methane emissions took effect. While insignificant on its own, it is the first U.S. federal-level effort to price greenhouse gas emissions to combat climate change.

3 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

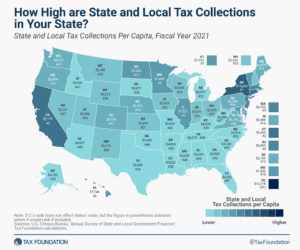

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

4 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

At the most recent Republican primary debate, former governor and United Nations ambassador Nikki Haley (R-SC) proposed eliminating the federal gas tax to lower fuel prices for consumers.

3 min read