Summary of the Latest Federal Income Tax Data, 2023 Update

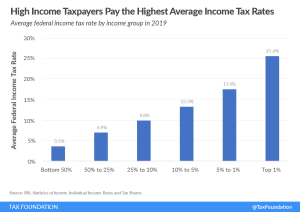

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

When we discuss tax policy, the conversation inevitably turns to who pays, who should pay, and how much they should pay. Unfortunately, the tax burdens debate is often missing a key point: how income transfer programs—like Social Security or Medicaid—affect households’ tax burdens.

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

We estimate the One Big Beautiful Bill Act would increase long-run GDP by 1.2 percent and reduce federal tax revenue by $5 trillion over the next decade on a conventional basis.

11 min read

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

16 min read

With reports that Republican legislative leaders and Wisconsin Gov. Evers (D) have reached a budget deal for FY 2026 and 2027, it is worth examining two significant tax relief proposals included in the plan.

7 min read

Senate Republicans have advanced legislation to extend many provisions of the 2017 Tax Cuts and Jobs Act (TCJA) alongside dozens of new provisions, following broadly similar legislation put forward by House Republicans.

8 min read

Tax Foundation Europe’s Sean Bray interviews Dr. Monika Köppl-Turyna, director of the EcoAustria Institute for Economic Research, about the future of the EU tax mix.

14 min read

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read

If Michiganders are interested in increasing the state’s spending on education or other priorities—and believe that current revenues are insufficient to support such an increase—there are several ways to do so without significantly affecting residents’ incentives to live and work in Michigan.

4 min read

Rhode Island lawmakers are debating raising the state’s top income tax rate. Though billed as a tax hike on high earners, the consequences would manifest across the state’s entire economy—creating a risk that Rhode Island will tax its way into uncompetitiveness.

Our preliminary analysis finds the tax provisions increase long-run GDP by 0.8 percent and reduce federal tax revenue by $4.0 trillion from 2025 through 2034 on a conventional basis before added interest costs.

9 min read

For owners of pass-through businesses, the reconciliation package (1) raises the state and local tax (SALT) deduction cap, (2) denies the benefit of pass-through entity-level taxes that had previously worked around the SALT cap for such pass-through businesses, and (3) increases the Section 199A deduction for qualifying pass-through entities.

4 min read

Letting the SALT cap slip further upwards would undercut the TCJA’s long-term legacy, worsening the fiscal outlook of the tax package and providing an unneeded benefit to higher earners.

4 min read

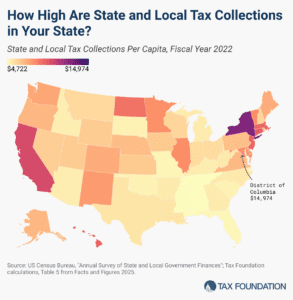

According to the latest economic data from the US Census Bureau, the average per capita state and local tax burden is $7,109. However, collections vary widely by state, reflecting differences in tax rates and bases, natural resource endowments, the scale and scope of taxable economic activity in each state, and residents’ political preferences.

5 min read

The economic literature overwhelmingly suggests that an income tax increase of this magnitude would negatively affect economic growth and opportunity in Rhode Island.

The Institute for Policy Studies (IPS) only succeeds in demonstrating that America has more millionaires than it used to, not that high-tax states are doing well in attracting or retaining them.

7 min read

Raising the top income tax rate would raise several hundred billion dollars but would offset most of the pro-growth effects of making the TCJA’s individual tax provisions permanent by reducing incentives to work and invest.

5 min read

By implementing a more sophisticated and nuanced trigger system for its tax reduction goals, North Carolina can sustain its trajectory toward lower tax rates, reinforce its reputation as a business-friendly state, and ensure long-term fiscal stability in an ever-changing economic landscape.

4 min read

Without aligning fiscal discipline with pro-growth tax policies, Germany and the EU risk high deficits, mounting debt, and sustained inflation.

5 min read

If adopted, these reforms would make Kansas’ tax code substantially more competitive while returning revenue growth to taxpayers in a fiscally responsible manner.

5 min read

Lawmakers are right to enact a single-rate individual income tax. However, lawmakers should consider the full effects of the reform, ensuring that relief is not financed by shifting the tax burden to lower-income individuals and families.

4 min read

Surtaxes such as Germany’s solidarity surtax run counter to the principles of simplicity and transparency of the tax system because they impose an additional layer of tax on taxpayers and create a more complex tax structure that often obscures the actual tax burden.

4 min read