President Biden’s budget would raise the excise tax on stock buybacks introduced last year from 1 percent to 4 percent. The policy has two primary justifications: penalizing companies that are distributing profits instead of reinvesting them in their company’s operations and remedying a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. bias in favor of stock buybacks over dividends. Both problems could be solved with a better approach: replacing the corporate income tax with a distributed profits tax.

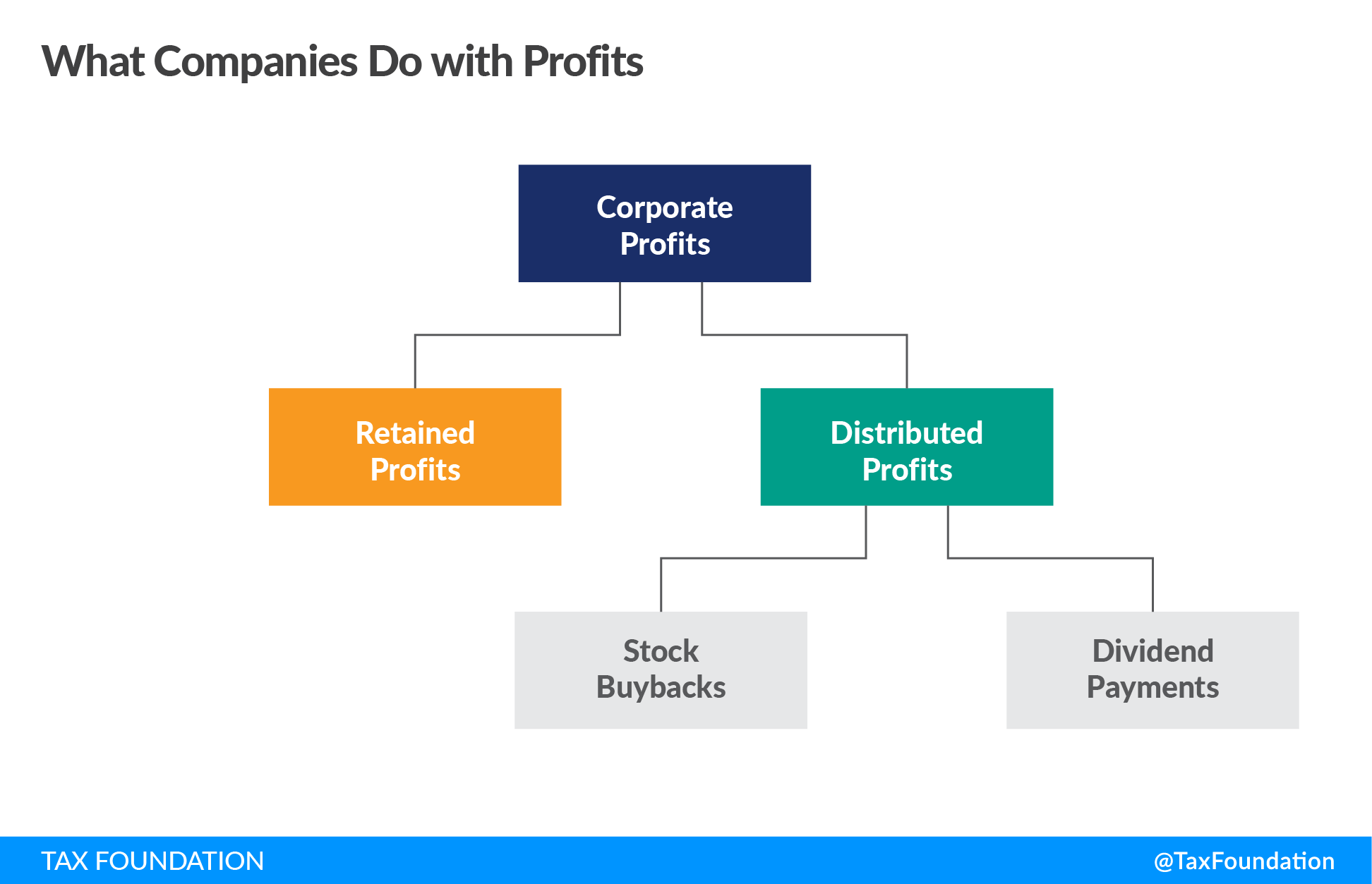

At an abstract level, companies can do two things with profits: 1) reinvest them in the business or 2) return them to shareholders by paying out dividends or buying back stock.

The debate over taxing stock buybacks concerns two perceived policy problems.

The first is an imbalance between retained profits and distributed profits. Critics of stock buybacks argue that companies are distributing too much of their profits back to shareholders (primarily through stock buybacks) and not retaining enough of their profits to reinvest and grow their businesses.

The second is an imbalance within distributed profits. Critics argue that stock buybacks are favored over dividends because dividend payments are directly (or currently) subject to tax while increases in value from stock buybacks are not directly taxed.

Regarding the first problem, buyback critics have a legitimate concern that the tax code disincentivizes reinvestment, but buybacks are a red herring. Companies usually engage in stock buybacks when they have exhausted their investment opportunities. Stock buybacks therefore play a valuable role in investment because shareholders do not just stash the distributed profits they receive under a mattress. They often reinvest a large portion of those profits in other firms around the economy—thus funding other investment opportunities.

Policymakers concerned about a lack of investment should instead look at the taxation of investment. Companies buy back shares when the expected after-tax return on new investment is not high enough to justify the cost or risk of pursuing the opportunity. If policymakers think companies are distributing too much profit through buybacks, then they should reduce taxes on investment so that more opportunities become viable, not raise taxes on buybacks. In other words, instead of quadrupling the buyback tax and hiking other corporate taxes as proposed in the budget, they should replace the existing corporate profits tax with a distributed profits taxA distributed profits tax is a business-level tax levied on companies when they distribute profits to shareholders, including through dividends and net share repurchases (stock buybacks). .

Consider two companies, each earning $100 in profits. For ease of illustration, we’ll assume the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate is 20 percent. Company A will retain and reinvest 25 percent of its profits and distribute the remaining 75 percent. Company B will retain and reinvest 75 percent of its profits and distribute the remaining 25 percent.

Before factoring in taxes on buybacks and dividends, Table 1 illustrates what their tax situations look like.

| Company A | Company B | |

|---|---|---|

| Pre-Tax Corporate Profits (A) | $100 | $100 |

| 20 Percent Corporate Income Tax (B) | $20 | $20 |

| After-Tax Profits (C = A – B) | $80 | $80 |

| Retained Profits (retained share of C) | $20 | $60 |

| Distributed Profits (distributed share of C) | $60 | $20 |

| Total Taxes Paid (B) | $20 | $20 |

|

Source: Author’s calculations. |

||

Even though Company B is investing at a much higher rate than Company A, they each pay the same amount of taxes. The picture changes significantly when shifting to a distributed profits tax, as illustrated in Table 2.

| Company A | Company B | |

|---|---|---|

| Pre-Tax Corporate Profits (A) | $100 | $100 |

| Retained Earnings (B = retained share of A) | $25 | $75 |

| Pre-Tax Distributed Profits (C = A – B) | $75 | $25 |

| 20 Percent Distributed Profits Tax (D = 20% * C) | $15 | $5 |

| Post-Tax Distributed Profits (C – D) | $60 | $20 |

| Total Taxes Paid (D) | $15 | $5 |

|

Source: Author’s calculations. |

||

Under a distributed profits tax, a firm that reinvests has a much lower tax burden than one that mostly returns its profits to shareholders. Solely taxing distributed profits is equivalent to allowing taxpayers to fully deduct new investments. On its face, it may seem like non-neutral tax treatment, but it is a way to eliminate biases against investment in the tax code.

The second argument for a stock buyback tax, that it addresses an imbalance in the tax treatment of different types of distributed profits, has more weight behind it, but not for the reasons often assumed. The typical argument, that stock buybacks have a tax advantage, usually assumes that stock buybacks cause shares to appreciate, and that appreciation can go untaxed. Stock buybacks, however, do not on their own cause share prices to rise. Thus, the reason the tax treatment of dividends and stock buybacks diverges is more complicated.

The shareholders who benefit the most from a gap in tax treatment between stock buybacks and dividends are foreign shareholders of U.S. stock. Foreign owners of U.S. stock face a withholding tax of 15 percent to 30 percent on dividends from the United States but face no U.S. capital gains taxes, and are instead subject to low or zero capital gains taxes in their countries of residence. As such, buybacks have a tax advantage in this case. For shares held in tax-exempt retirement accounts, however, both dividends and buybacks are not taxed.

Taxable brokerage accounts are more complex. Both dividends and capital gains arising from stock buybacks face tax, though specific cases vary. All dividends face a layer of tax, and when a firm buys back its stock, the individual shareholders who actually sell their shares back to the firm face tax immediately.

Shareholders who do not sell and who see appreciation in the value of their shares (which is determined by the prospects of a business operation and not by financial transactions like buybacks) will eventually face tax liability if they sell their shares—the ability to defer tax liability reduces effective capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. rates, resulting in a lighter tax burden than dividends face. Further, some shareholders may never sell their shares before their death, and because the basis for assets resets when ownership transfers to an heir, some domestic shareholders can avoid taxation on capital gains.

The Tax Policy Center recently estimated that the cumulative average gap between the taxation of dividends and stock buybacks is between 5 percent and 8 percent, with foreign shareholders accounting for 5 percentage points of the gap and domestic shareholders passing shares to heirs accounting for between 0 and 3 percentage points.

The simplest way to resolve the tax bias between stock buybacks and dividends is to move to a single layer of taxation on capital income. If the United States had a tax on distributed profits at the firm level and exempted both dividends and capital gains from the income tax, the tax treatment between stock buybacks and dividend payments would be equal. The stock buyback excise tax can be justified on the grounds of remedying the existing small bias between stock buybacks and dividends, but it is not a harmonized solution, and in some circumstances could produce a bias in favor of dividends over buybacks, such as when shares are held in tax-exempt accounts.

The distributed profits tax is a sounder approach to concerns about investment and stock buybacks than the existing policy approach.

Share this article