TCJA Family Provisions Offer Template for Tax Reform in 2025

The Tax Cuts and Jobs Act’s changes to family tax policy serve as a reminder to avoid looking at tax reform provisions in a vacuum.

5 min read

The Tax Cuts and Jobs Act’s changes to family tax policy serve as a reminder to avoid looking at tax reform provisions in a vacuum.

5 min read

The Child Tax Credit (CTC) is a partially-refundable tax credit available to parents with qualifying dependents under the age of 17. Like other tax credits, the CTC reduces tax liability dollar-for-dollar of the value of the credit.

25 min read

We estimate the One Big Beautiful Bill Act would increase long-run GDP by 1.2 percent and reduce federal tax revenue by $5 trillion over the next decade on a conventional basis.

11 min read

Senate Republicans have advanced legislation to extend many provisions of the 2017 Tax Cuts and Jobs Act (TCJA) alongside dozens of new provisions, following broadly similar legislation put forward by House Republicans.

8 min read

Our preliminary analysis finds the tax provisions increase long-run GDP by 0.8 percent and reduce federal tax revenue by $4.0 trillion from 2025 through 2034 on a conventional basis before added interest costs.

9 min read

As lawmakers continue to debate the “One Big Beautiful Bill,” they should abandon temporary and complex policy in favor of simplicity and stability.

4 min read

Permanently extending the Tax Cuts and Jobs Act would boost long-run economic output by 1.1 percent, the capital stock by 0.7 percent, wages by 0.5 percent, and hours worked by 847,000 full-time equivalent jobs.

6 min read

As Republicans look for ways to offset the budgetary cost of extending the expiring provisions of the Tax Cuts and Jobs Act (TCJA) and potentially enacting other tax cuts, the latest estimates indicate several trillion dollars could be raised by reducing tax credits and other preferences in the tax code.

5 min read

Taxes and their broader impact are generally overlooked in American education. Taxes influence earnings, budgets, voting, and decisions on where to live, but do American taxpayers understand the US tax system?

25 min read

If Congress allows the Tax Cuts and Jobs Act (TCJA) to expire as scheduled, most aspects of the individual income tax would undergo substantial changes, resulting in more than 62 percent of tax filers experiencing tax increases in 2026.

3 min read

Explore the IRS inflation-adjusted 2025 tax brackets, for which taxpayers will file tax returns in early 2026.

4 min read

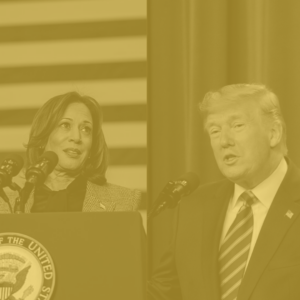

On tax policy, Harris carries forward much of President Biden’s FY 2025 budget, including higher taxes aimed at businesses and high earners. She would also further expand the child tax credit (CTC) and various other tax credits and incentives while exempting tips from income tax.

17 min read

We estimate Trump’s proposed tariffs and partial retaliation from all trading partners would together offset more than two-thirds of the long-run economic benefit of his proposed tax cuts.

12 min read

While federal tax collections—especially corporate taxes—have reached historically high levels, these gains have not kept pace with escalating spending, particularly on debt interest, leading to a substantial and concerning budget deficit in FY24.

6 min read

What do the contrasting tax proposals of Vice President Kamala Harris and former President Donald Trump mean for Americans as the 2024 election approaches?

The stakes for next year’s expiring tax provisions are quite high. If Congress does nothing, then 62 percent of households will see their taxes go up in January of 2026.

While tax policy was almost nonexistent in the first debate between Vice President Kamala Harris and former President Donald Trump, this episode will explore each candidate’s latest proposals in greater depth.

Dive into the highlights from the DNC as we break down Vice President Kamala Harris’s tax proposals and their potential impact on everyday families. What do higher taxes on businesses and the wealthy mean for working Americans?

Not every change in the Tax Cuts and Jobs Act simplified the tax code. However, the TCJA reduced compliance costs overall for individual filers, and allowing fundamental structural improvements to expire would make the tax code worse.

5 min read

Gov. Walz’s tax policy record is notable because of how much it contrasts with broader national trends. In recent years, most governors have championed tax cuts. Walz, rare among his peers, chose tax increases.

5 min read

While both President Biden and Vice President Harris aim their proposed tax hikes on businesses and high earners, key differences between their tax ideas in the past reveal where Harris may take her tax policy platform in the 2024 campaign.

6 min read

Both candidates should provide clear and honest answers about their plans (or lack thereof) to address the nation’s urgent tax policy issues.

8 min read