As President Biden pointed out in his State of the Union address to raucous applause, “I think a lot of you at home agree with me that our present taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. system is simply unfair.” Two often overlooked aspects of unfairness in our tax code are complexity and double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. , which would be made substantially worse by Biden’s tax proposals laid out in this year’s budget.

The current federal tax code is already extremely complex. Totaling more than 6,000 pages and about 4 million words (plus about 15,000 pages of associated tax law interpretations), no taxpayer can reasonably be expected to fully comprehend it. And if the law cannot be understood, it cannot be fair.

Americans spend more than 6.5 billion hours a year trying to comply with the tax code at an estimated cost of about $313 billion, or 1.4 percent of GDP—a colossal waste of time and resources. The Internal Revenue Service (IRS) is overwhelmed with the challenge of administering the code, only answering about 10 percent of the millions of phone calls from taxpayers asking for help in recent years.

The Biden administration is now proposing to add dozens of new complicated provisions to the tax code, ostensibly explained by the 226-page “Green Book” that was just released. While many of the provisions are tax hikes aimed at high-income taxpayers and businesses, workers will pay the price. Reduced investment and innovation will lead to fewer jobs and lower wages.

The tax code’s complexity allows double taxation to run rampant, with little understanding among policymakers or taxpayers of how many times a dollar of income is taxed.

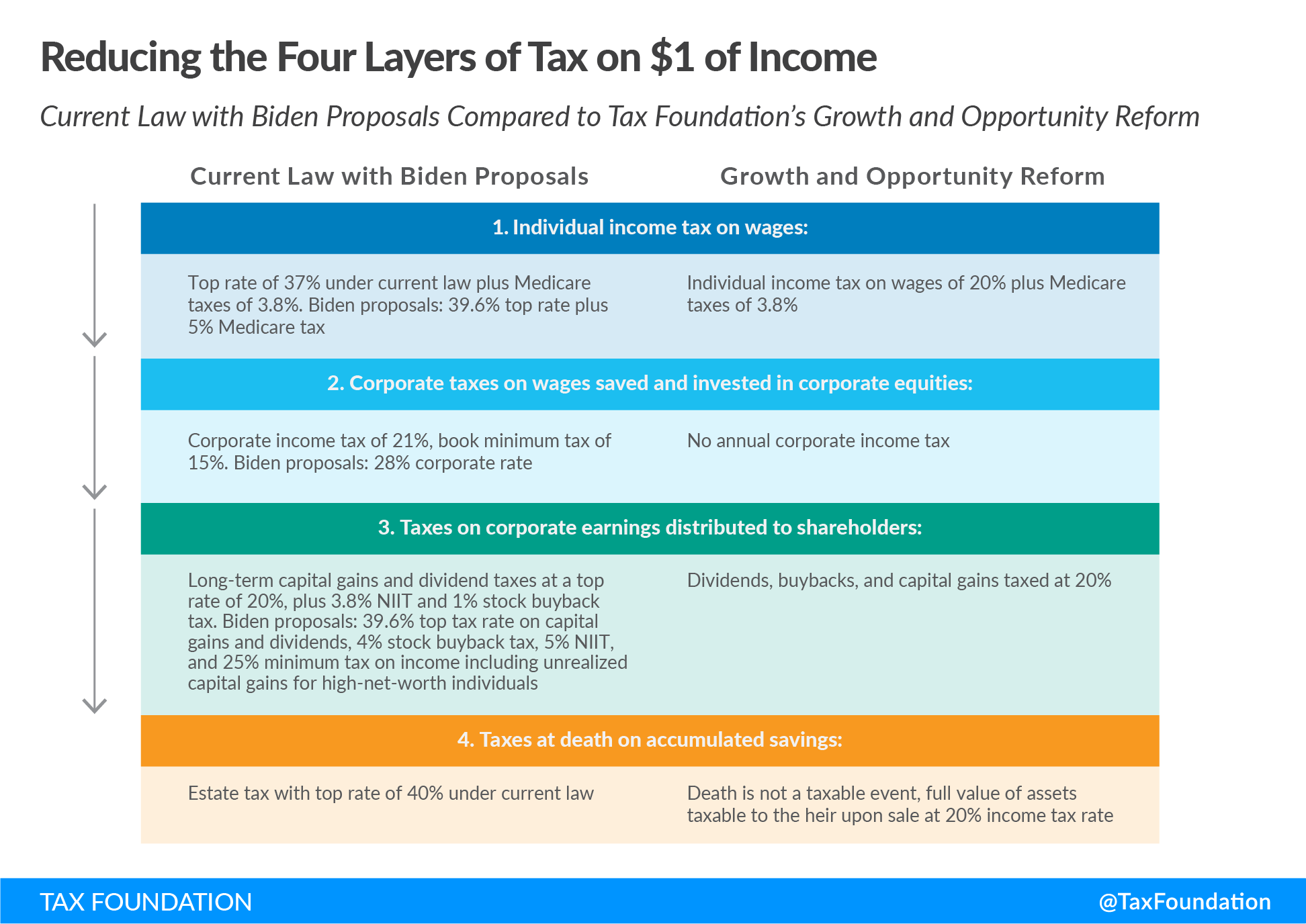

The tax code subjects saving and investment to several layers of tax:

- First, a worker’s wages face the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. at a top rate of 37 percent as well as Medicare taxes of 3.8 percent.

- If the worker saves their wages rather than immediately consuming, then the returns to saving likewise face the individual income tax. The two layers of tax create an incentive to consume now rather than save.

- If the worker invests their savings in corporate equities, then it faces additional layers of tax. At the entity level, that includes the 21 percent corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. , the new 15 percent book minimum tax, and the new 1 percent tax on stock buybacks. At the shareholder level, that includes taxes on capital gains and dividends at a top rate of 20 percent plus the 3.8 percent tax on net investment income (the NIIT).

- Finally, the estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. is the last layer of tax on accumulated savings (see example below).

The Biden administration is proposing several complicated and burdensome additions to the existing web of taxes that would worsen double taxation, many of them repurposed from past proposals, including:

- Raising the top individual income tax rate to 39.6 percent, adding another 1.2 percent to the Medicare tax on wages, and expanding the base of the NIIT to include all pass-through income while raising the rate to 5 percent, effectively resulting in a federal top income rate of about 44 percent (when combined with state income taxes, many taxpayers would face top rates over 50 percent)

- Doubling the top capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. rate to 39.6 percent, which combined with the NIIT yields a top rate of 44.6 percent—the highest rate in several decades and the highest in the OECD

- Taxing unrealized capital gains with a 25 percent minimum tax, an untried and impractical policy that taxes phantom income and has many potential downsides

- Raising the corporate income tax rate to 28 percent, resulting in a higher corporate tax rate than any of our major trading partners

- Hiking the GILTI tax, further exposing U.S. companies to double taxation on their foreign income

- Quadrupling the stock buyback tax to 4 percent, which can also subject multi-national companies to double taxation

- Raising taxes further on targeted industries, hitting pharmaceutical innovation and oil and gas production

If the President wants to improve fairness in the tax code, he should aim to simplify it and reduce double taxation. Doing so would also support economic growth and opportunity, as we demonstrate in our new Growth & Opportunity tax reform proposal.

Our proposal follows the successful example of Estonia, which tops our list of most competitive tax systems with its relatively simple, transparent, and neutral approach.

First, the individual income tax would be greatly simplified through a flat taxAn income tax is referred to as a “flat tax” when all taxable income is subject to the same tax rate, regardless of income level or assets. of 20 percent and the elimination of most tax preferences. The income tax would apply equally to wages, interest, and capital gains, while exempting dividend income. In Estonia, the system allows taxpayers to file their taxes in about 5 minutes. The reform would save U.S. taxpayers tens of billions of dollars in compliance costs and reduce marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. s on work, saving, and investment.

Second, the reform would replace our current complicated system of business taxes with a distributed profits taxA distributed profits tax is a business-level tax levied on companies when they distribute profits to shareholders, including through dividends and net share repurchases (stock buybacks). of 20 percent that applies to dividends and stock buybacks. To avoid double taxation, dividends received by shareholders are exempt from individual income tax. The distributed profits tax would apply equally to corporate and pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. profits, which under current law are subject to individual income tax. The reform benefits all businesses by exempting retained earnings and greatly reducing the double taxation, complexity, and uncertainty inherent in our current method of taxing business income.

Third, the plan would eliminate the estate tax, removing a tax at death that burdens families with billions of dollars of compliance costs, supports a cottage industry of tax planning, and collects relatively little tax revenue. Instead, inherited assets would be subject to the 20 percent capital gains tax when sold by the heirs, with the deductible basis determined only by the costs they incur.

The whole plan—including the distributed profits tax, flat individual income tax, and reforms to the estate tax—would save U.S. taxpayers more than $100 billion a year in compliance costs, grow long-run GDP by 2.3 percent, and add 1.3 million jobs. It is also revenue neutral, responsibly funding the government at current levels, but in a much more efficient way.

Tax reform should be about increasing fairness. And the way to get there is by reducing complexity and double taxation, not by doubling down on them. The country is facing a serious debt crisis that will be solved not by divisive tax policy proposals, but by common sense reforms that increase transparency, simplicity, and neutrality in the tax code.