Sources of US Tax Revenue by Tax Type, 2025

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

Developed countries raise tax revenue through individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes—the combination of which determines how distortionary or neutral a tax system is.

4 min read

According to the latest economic data from the US Census Bureau, the average per capita state and local tax burden is $7,109. However, collections vary widely by state, reflecting differences in tax rates and bases, natural resource endowments, the scale and scope of taxable economic activity in each state, and residents’ political preferences.

5 min read

Given the poor state of the budget process and worsening debt trajectory, lawmakers should move boldly and quickly to address the issue, including via a fiscal commission process. Issues to consider should include reforms to both spending and taxes.

42 min read

How does tax policy shape a nation’s competitiveness? Today, we’re diving into the showdown between the US and China, exploring how China’s enticing tax incentives pose a formidable challenge to America’s economic supremacy.

While federal tax collections—especially corporate taxes—have reached historically high levels, these gains have not kept pace with escalating spending, particularly on debt interest, leading to a substantial and concerning budget deficit in FY24.

6 min read

Restoring expensing for R&D, machinery, and equipment; extending better cost recovery to structures investment; and avoiding raising the corporate tax rate would create a stronger, pro-investment policy environment for the US economy.

44 min read

World War II shaped many aspects of the modern world, including the US tax code. But the dramatic changes to our system that military mobilization required didn’t subside when the fighting finished; they’ve persisted to today.

4 min read

The government provides various services at the federal, state, and local levels. How are they paid for? Taxes.

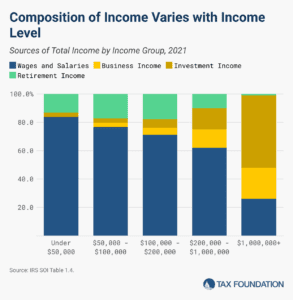

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

9 min read

For over a century, lawmakers have exempted politically favored organizations and industries from the tax code. As a result, the tax-exempt nonprofit economy now comprises 15 percent of GDP, roughly equal to the fifth-largest economy in the world.

41 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

3 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

3 min read

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

5 min read

Lawmakers should simplify the tax code so that taxpayers can understand the laws and the IRS can administer them with minimum cost and frustration.

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

10 min read

Lawmakers should focus on simplifying the federal tax code, creating stability, and broadly improving economic incentives. There are incremental steps that can be made on the path to fundamental tax reform.

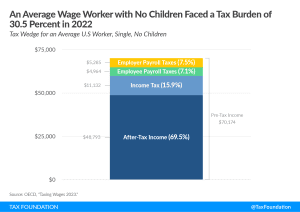

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay more than 30 percent of their wages in taxes.

4 min read

Our recent policy conference brought together academics and political leaders to present research on some of the most pressing issues in global tax policy and to discuss solutions that can unlock genuine global growth.

9 min read

Scandinavian countries are well known for their broad social safety net and their public funding of services such as universal health care, higher education, parental leave, and child and elderly care. So how do Scandinavian countries raise their tax revenues?

7 min read