The Biden administration is proposing to taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. long-term capital gains at ordinary income rates for high earners, which will bring the top federal rate to highs not seen since the 1920s. Taxing capital gains at a lower tax rate than ordinary income is partly a feature of savings-consumption neutral taxation.

The highest capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. rates in history date to the 1920s, when capital gains income was subject to a maximum rate of 77 percent. Those high rates were reduced starting in 1922 due to concerns about decreasing capital gains tax revenues, and going forward, long-term capital gains have mostly been taxed at lower rates than ordinary income.

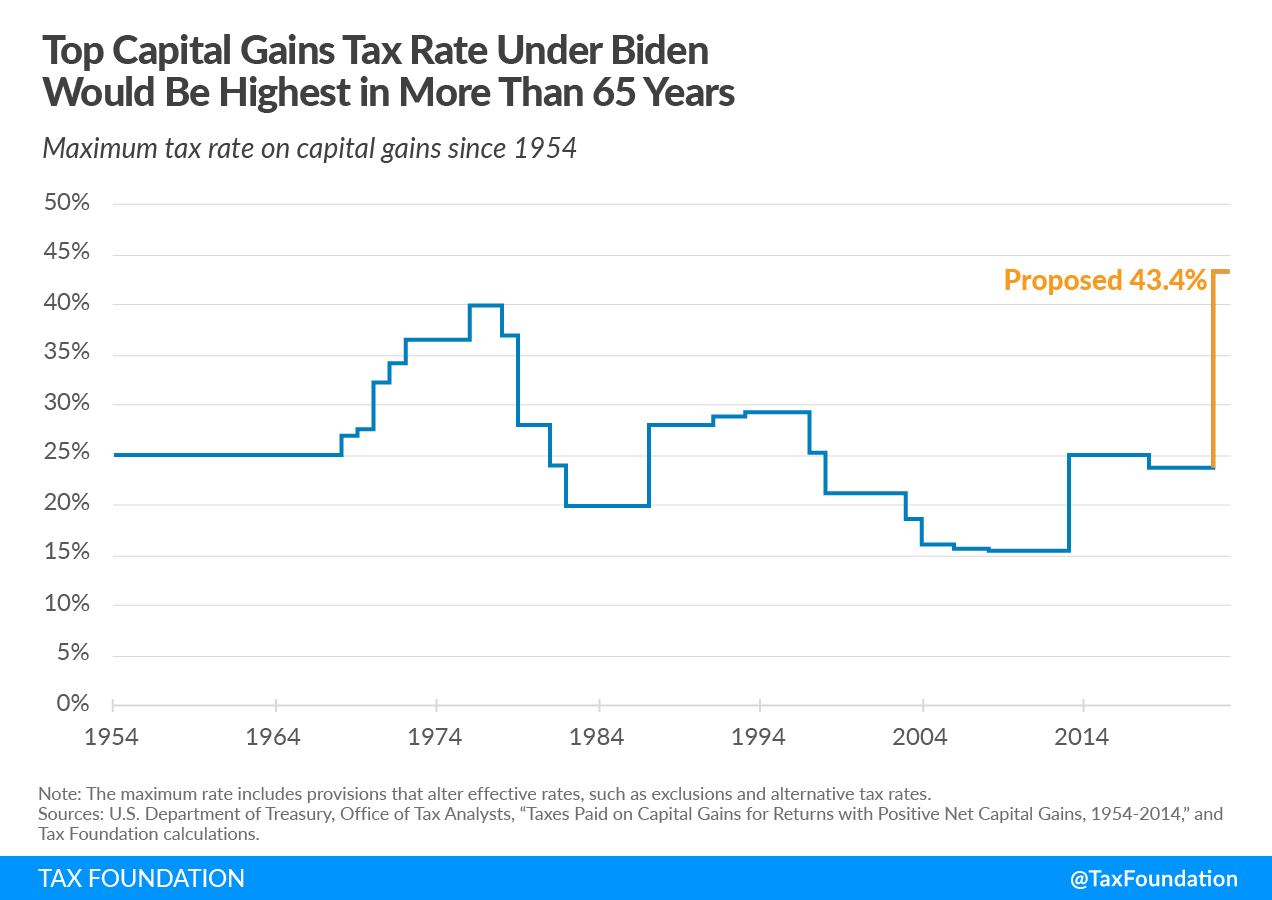

Biden’s proposal would reverse that—raising the top rate on capital gains up to 43.4 percent when including the 3.8 percent Net Investment Income Tax (NIIT). While not as high as the rates seen in the 1910s and 1920s, a 43.4 percent top rate would be the highest in modern times. (Of note, some taxpayers experienced a top rate of 49.875 percent in 1978 due to other tax interactions.)

Since 1954, the capital gains tax rate has almost always been lower than the top ordinary income tax rate. The exception to the rule was in the years following the 1986 Tax Reform Act, which taxed both ordinary income and capital gains at a 28 percent rate (by lowering the top ordinary income tax and raising the capital gains tax). However, this policy change drove a sharp decline in capital gains realizations (the selling of stock).

A top capital gains rate of 43.4 percent would match the top ordinary income tax rate of 39.6 percent plus the 0.9 percent additional Medicare tax and the 2.9 percent health insurance (HI) tax on labor income. However, the 43.4 percent capital gains rate would be higher than taxes paid on labor income when one includes the payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. in a taxpayer’s total income. (In other words, measuring the tax-inclusive rate.) Using the tax-inclusive measure, Biden’s proposed capital gains rate would exceed the ordinary income tax rate, 42.8 percent to 43.4 percent.

Under a tax code neutral between savings and consumption, the returns to saving, like capital gains, would not face a tax. But, according to a Haig-Simons approach to taxation, capital gains should be taxed like any other form of income. Taxing capital gains, but at a lower rate than ordinary income, represents a middle ground between these two philosophies.

Biden’s proposal to increase the capital gains tax rate would lead to a tax rate not seen in decades, and it would increase the tax burden on saving.

Launch Resource Center: President Biden’s Tax Proposals

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe