Tax Competitiveness and Interstate Migration

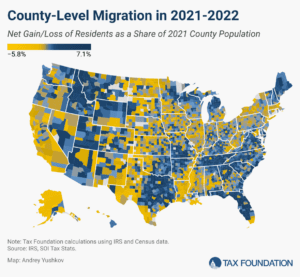

Recent data suggest that tax competitiveness plays a significant role in residents’ relocation decisions.

3 min read

Recent data suggest that tax competitiveness plays a significant role in residents’ relocation decisions.

3 min read

The Social Security trust funds face looming insolvency if policymakers don’t reform the program. One issue that garners a lot of attention in the debate over solutions is the payroll tax cap.

3 min read

Policymakers can and should address taxpayers’ legitimate grievances about out-of-control property tax bills, but they should do so without upending a system of taxation that is more efficient, fair, and pro-growth, and better suited to municipal finance, than any of the alternatives.

39 min read

We estimate Trump’s proposed tariffs and partial retaliation from all trading partners would together offset more than two-thirds of the long-run economic benefit of his proposed tax cuts.

12 min read

The gap between statutory rates and average effective tax rates for personal income tax in the European Union varies significantly, affecting the efficiency and simplicity of the tax system.

32 min read

The sales tax is the second-largest source of state tax revenue and an important source of local tax revenue, but decades of base erosion threaten the tax’s share of overall revenue and have prompted years of countervailing rate increases.

72 min read

World War II shaped many aspects of the modern world, including the US tax code. But the dramatic changes to our system that military mobilization required didn’t subside when the fighting finished; they’ve persisted to today.

4 min read

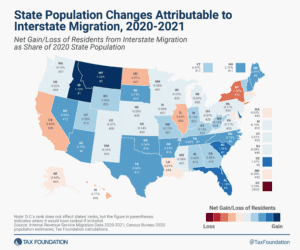

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

If lawmakers are convinced that new revenues must be part of any long-term effort to solve the budget crisis or offset the cost of extending the TCJA, they must choose the least harmful ways of raising new revenues or else risk undermining their efforts by slowing economic growth.

7 min read

The government provides various services at the federal, state, and local levels. How are they paid for? Taxes.

From President Biden calling the Tax Cuts and Jobs Act the “largest tax cut in American history,” to former President Trump claiming that Biden “wants to raise your taxes by four times,” the campaign rhetoric on taxes may be sparking some confusion.

5 min read

As members of Congress prepare to address the expiration of the TCJA, they should appreciate how revenues have evolved since 2017.

4 min read

While neither full expiration nor a deficit-financed full extension of the TCJA would be appropriate, lawmakers should consider the incentive effects of whichever tax reform they pursue. Because taxes affect the economy, they also affect the sustainability of debt reduction.

3 min read

When the tax code is stable and predictable, individuals, families, and businesses can set goals for the future and make plans to achieve them.

With state tax revenues receding from all-time highs, there’s been a great deal of handwringing about whether states can afford the tax cuts adopted over the past few years. Given that 27 states reduced the rate of a major tax between 2021 and 2023, is there reason for concern?

4 min read

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

3 min read

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

4 min read

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

Whether tax savings motivated his move or not, the implications for Washington are very real, and serve to illustrate just how dangerous it can be to design tax systems that rely so overwhelmingly on a very small number of taxpayers choosing to stay put.

3 min read