Alabama’s 2025 Legislative Session Advances Pro-Growth Tax Reforms

Alabama’s 2025 legislative session mostly demonstrates a commitment to pro-growth tax policies that enhance competitiveness and reduce compliance burdens.

4 min readAlabama‘s tax system ranks 38th overall on the 2025 State Tax Competitiveness Index. Alabama’s graduated-rate income tax is very nearly flat since its top rate kicks in at only $3,000 in taxable income for single filers and $6,000 for married couples, without an inflation adjustment. The standard deduction, which is similarly unadjusted for inflation, has also eroded in value over time. Notably, Alabama is among the states that permit local income taxes, which Alabama terms the Occupational Tax.

On the corporate tax front, Alabama levies a 6.5 percent corporate income tax with 15 years of net operating loss (NOL) carryforwards, which is less generous than the federal allowance. A longer carryforward period would allow the state to tax long-run profits without penalizing cyclical businesses. Alabama does benefit, however, by conforming to the federal bonus depreciation allowance under Section 168(k).

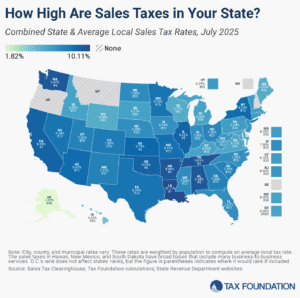

Alabama has a low 4 percent state sales tax rate, but its combined state and average local rate is among the nation’s highest, at 9.29 percent. It is one of only three states, with Colorado and Louisiana, that allows local governments to administer their own local sales taxes, creating significant additional complexity and imposing high compliance costs for businesses, particularly out-of-state retailers. Alabama has created an alternative system for remote sellers, but it remains far inferior to the centralized collection and administration of local sales taxes found in 35 of the 38 states with such taxes.

Alabama has among the lowest effective property tax rates in the country on owner-occupied housing value, but it does impose a nonneutral split roll system, with commercial property treated less favorably than residential property. While the state does not have an estate or inheritance tax, it does impose a real estate transfer tax. The state also features a capital stock tax, which falls on business net worth without regard for profitability.

| Category | Rank | Rank Change | Score |

|---|---|---|---|

| Overall | 38 | -1 | 4.77 |

| Corporate Taxes | 14 | 2 | 5.51 |

| Individual Income Taxes | 34 | 1 | 4.89 |

| Sales Taxes | 49 | 0 | 3.17 |

| Property Taxes | 14 | -1 | 5.47 |

| Unemployment Insurance Taxes | 18 | 2 | 5.38 |

Alabama’s 2025 legislative session mostly demonstrates a commitment to pro-growth tax policies that enhance competitiveness and reduce compliance burdens.

4 min read

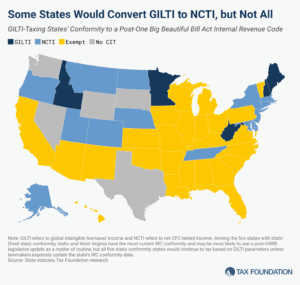

The One Big Beautiful Bill’s changes to the taxation of international income have surprising implications for state codes, yielding tax increases and a revised tax base that, through quirks of state incorporation, bears very little resemblance to the federal base and almost nothing of its purpose.

10 min read

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 24 percent of combined state and local tax collections.

17 min read