President Biden’s Fiscal Year 2024 Budget outlines several major tax increases that would bring U.S. taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates far out of step with international norms. Some of the proposals may be familiar, recycled from prior budgets and failed legislative attempts, but some are new, like the proposed tax hikes for Medicare funding.

In total, they would add up to almost $4.7 trillion in new taxes targeted at businesses and high-income individuals. The major changes include higher marginal tax rates on corporate, individual, and capital gains income; a complicated new minimum tax on high-net-worth individuals; and increases to Medicare taxes. The negative effects of higher tax rates on saving, investment, and entrepreneurship would have economy-wide repercussions, ultimately harming workers, international competitiveness, and domestic investment.

The Biden budget would also expand and create several tax credits, including a three-year extension of the American Rescue Plan Act Child Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. (CTC) through 2025 and a permanent expansion of CTC refundability. The tax credits would offset the $4.7 trillion in gross taxes by about $900 billion, resulting in $3.8 trillion of net tax increases. After about $1 trillion of additional new spending on top of expanded tax credits, the FY2024 Budget would reduce the deficit by $2.8 trillion over the next decade.

The Biden budget pays lip service to continuing at least some of the individual income tax cuts included in the 2017 Tax Cuts and Jobs Act (TCJA) that will expire after 2025, but offers no concrete proposal for doing so. As such, the cost of TCJA extensions is not factored into the budget. Nor is the cost of continuing the temporary expansion of the CTC. Together, such extensions would likely offset the projected deficit reductions.

| Proposed Tax Change | 10-Year Revenue in Billions of Dollars |

|---|---|

| Corporate and International Tax Proposals | |

| Increase the corporate income tax rate from 21 percent to 28 percent | $1,325.8 |

| Revise the global minimum tax regime and limit inversions, including: – Repeal BEAT and replace it with an undertaxed profits rule – Increase the GILTI tax rate from 10.5 percent to 21 percent and calculate the tax on a jurisdiction-by-jurisdiction basis – Repeal the deduction for foreign-derived intangible income (FDII) and provide other support to research and experimentation – Increase taxes on foreign fossil fuel income |

$1,160.6 |

| Quadruple the stock buyback tax implemented in the Inflation Reduction Act from 1 percent to 4 percent | $237.9 |

| Increase energy taxes, including repeal of expensing for intangible drilling costs, percentage depletion for oil and gas wells, and a new 30 percent tax on electricity used for digital asset mining | $36.5 |

| Misc. business tax proposals | $130.2 |

| Individual and Pass-Through Business Tax Proposals | |

| Raise the top statutory tax rate on individual income to 39.6 percent for single filers earning over $400,000 and joint filers earning over $450,000 | $235.3 |

| Create a 25 percent “billionaire minimum tax” to tax unrealized capital gains of high-net-worth taxpayers | $436.6 |

| Expand the base of the Net Investment Income Tax (NIIT) to apply to active pass-through business income above $400,000 and increase the NIIT and Health Insurance (HI) tax rates from 3.8 percent to 5 percent above $400,000 | $650.3 |

| Restrict contributions to IRAs for taxpayers with incomes above $400,000 | $22.7 |

| Make permanent the pass-through business loss limitation | $71.3 |

| Tax carried interest as ordinary income | $6.5 |

| Misc. individual tax proposals | $24.5 |

| Capital Gains, Estate, and Gift Tax, and IRS Proposals | |

| Repeal like-kind exchanges for deferred gain worth over $500,000 for single taxpayers and $1 million for joint taxpayers | $18.6 |

| Tax capital gains at ordinary income tax rates for taxpayers with income over $1 million | $213.9 |

| Change cryptocurrency tax rules | $31.6 |

| Modify estate and gift tax rules including for valuations and trusts | $77.5 |

| Increase tax compliance and enforcement | $13.7 |

| Subtotal (Tax Increases) | $4,693.6 |

| Expanded Tax Credits and Other Provisions | |

| Extend the ARPA Child Tax Credit expansion for three years, make the CTC fully refundable on a permanent basis, and create a monthly payment option | -$429.2 |

| Permanently extend the ARPA enhanced premium tax credits (PTCs) after they are scheduled to expire in 2026 | -$183.0 |

| Permanently expand the Earned Income Tax Credit for workers without qualifying children | -$156.0 |

| Expand the Low-Income Housing Tax Credit (LIHTC) and create a tax credit for rehabilitating homes in high-poverty neighborhoods | -$103.8 |

| Make the New Markets Tax Credit permanent and expand various tax provisions for work, education, and childcare | -$23.4 |

| Subtotal (Tax Credits) | -$895.4 |

| Net Revenue Increase | $3,798.2 |

|

Source: Tax Foundation compilation from the President’s FY 2024 budget, The White House, https://www.whitehouse.gov/omb/budget/. Note: Estimated revenue effects are from the Office of Management and Budget and the Department of the Treasury. |

|

The Biden budget would increase Internal Revenue Service (IRS) funding by 15 percent, or about $1.8 billion, to $14.1 billion in FY 2024. This includes $642 million for taxpayer services and $290 million for business systems modernization. The budget would also expand the drug pricing provisions enacted in the InflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. Reduction Act (IRA) by increasing the timeframe and number of drugs subject to government price setting. The budget proposes several major changes to the current international tax system that would move the U.S. closer to global minimum tax rules.

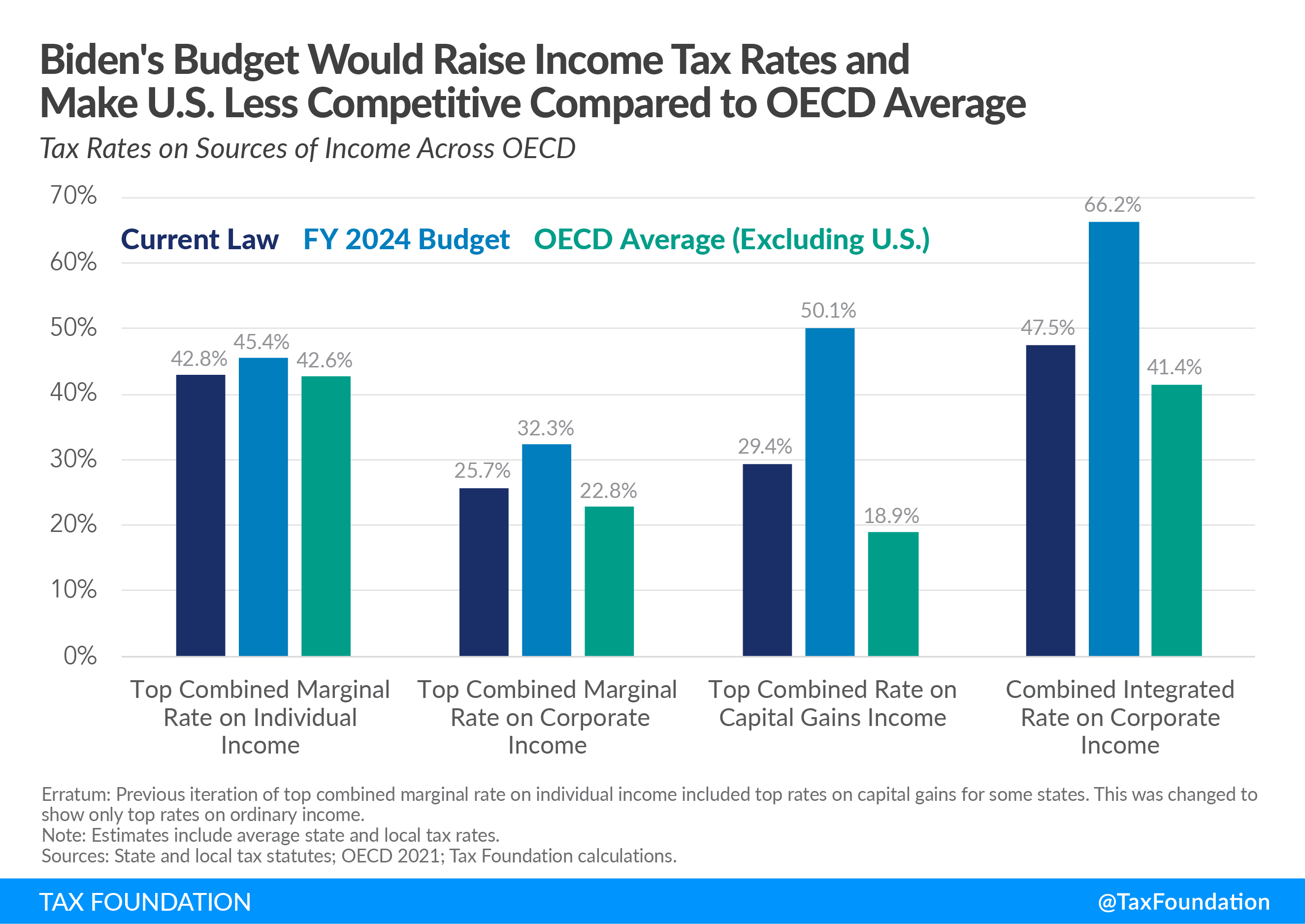

The Biden budget proposal would move top tax rates in the U.S. beyond international norms. The higher marginal tax rates on work, saving, and investment would reduce competitiveness and economic growth.

Under current law, the top combined marginal rate on individual income is 42.8 percent, consisting of the top federal rate (37 percent) and the average of state and local income tax rates. Biden’s proposal would raise it to 45.4 percent by increasing the top rate from 37 percent to 39.6 percent.

The top combined marginal rate on capital gains income under current law is 29.4 percent, consisting of the 20 percent capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. rate, the 3.8 percent Net Investment Income Tax (NIIT), and the average of state and local income tax rates on capital gains. Biden’s proposal would raise it to 50.1 percent by increasing the NIIT from 3.8 percent to 5 percent and taxing capital gains at ordinary income tax rates for taxpayers with more than $1 million in income. That would be the highest capital gains tax rate in the OECD (Organisation for Economic Co-operation and Development), currently levied by Denmark at 42 percent.

The top combined marginal rate on corporate income under current law is 25.7 percent, consisting of the federal corporate tax rate of 21 percent and the average percent state and local corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate. Biden’s proposal would increase it to 32.3 percent—the second highest corporate tax rate in the OECD (behind Colombia at 35 percent)—by raising the corporate tax rate to 28 percent.

The combined integrated rate on corporate income reflects the two layers of tax corporate income faces: first at the entity level and again at the shareholder level. Under current law, it is 47.3 percent. Under Biden’s proposals, it would rise to a jaw-dropping 66.2 percent.

| Current Law | FY 2024 Budget | OECD Average (Excluding U.S.) | |

|---|---|---|---|

| Top Combined Marginal Rate on Individual Income | 42.8% | 45.4% | 42.6% |

| Top Combined Marginal Rate on Corporate Income | 25.7% | 32.3% | 22.8% |

| Top Combined Marginal Rate on Capital Gains Income | 29.4% | 50.1% | 18.9% |

| Combined Integrated Rate on Corporate Income | 47.5% | 66.2% | 41.4% |

|

Note: Estimates include average state and local taxes. Sources: State and local tax statutes; OECD; Tax Foundation calculations. |

|||

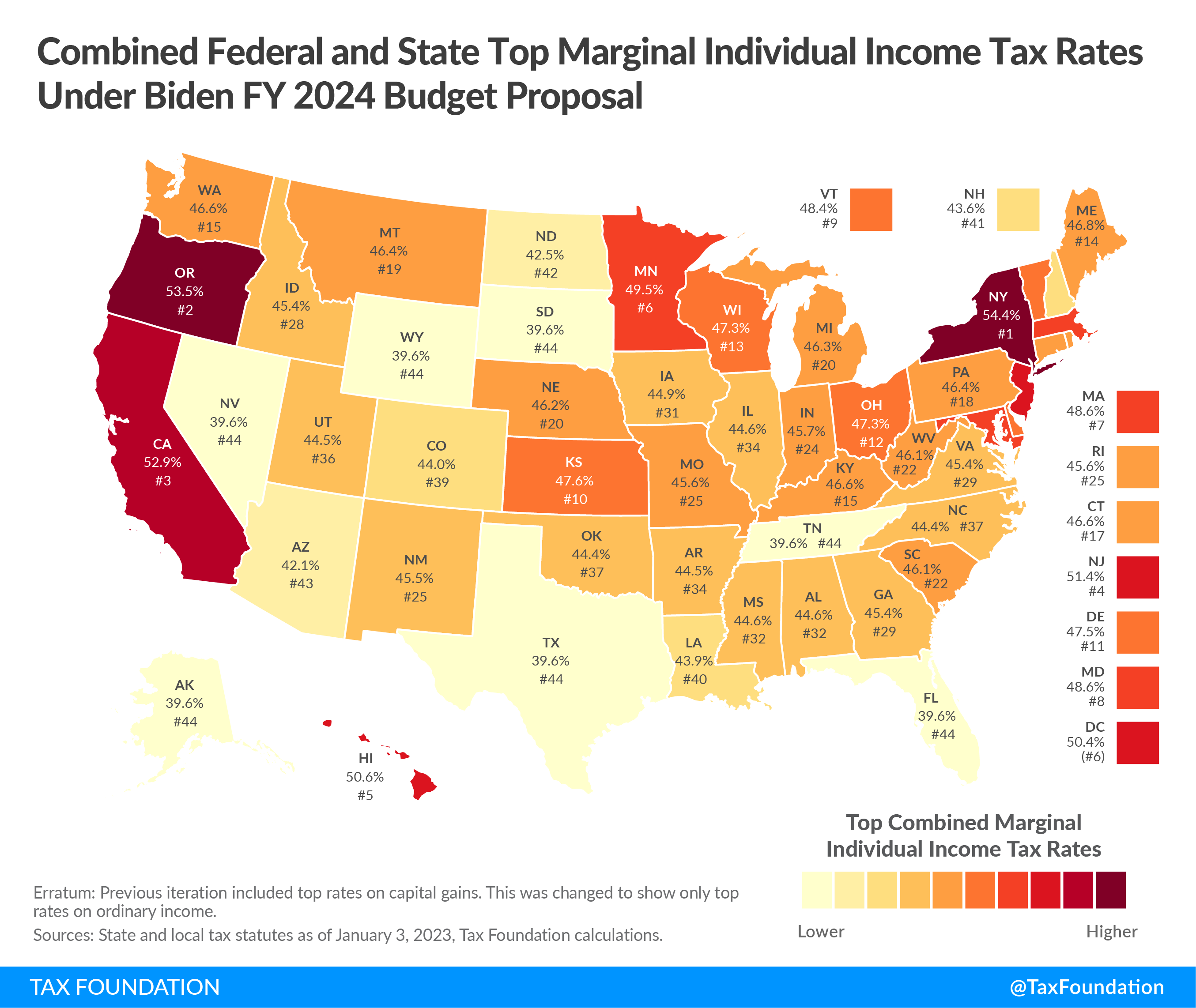

The proposed Biden budget tax increases would put upward pressure on combined top tax rates at the state and local levels. For example, Biden’s FY 2024 Budget would yield combined top marginal rates in excess of 50 percent in five states and D.C.: New York (54.4 percent), Oregon (53.5 percent), California (52.9 percent), New Jersey (51.4 percent), Hawaii (50.6 percent), and D.C. (50.4 percent). Marginal rates would also exceed 50 percent in New York City (54.4 percent).

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe