Budget Reconciliation: Tracking the 2025 Trump Tax Cuts

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

16 min read

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

16 min read

Lawmakers should consider maintaining QBAI and applying the several billion dollars from the Senate’s change toward other pro-growth international tax reforms instead.

6 min read

Congress is racing to pass the One Big Beautiful Tax Bill before the July 4 deadline. In this episode, Kyle Hulehan and Erica York break down what just happened over the weekend, what’s actually in the bill, and what comes next as the House and Senate try to reconcile their differences.

Expanding and updating the US tax treaty network—both by forging new agreements and modernizing existing ones—is vital to maintaining the country’s competitiveness in a rapidly evolving global tax landscape.

4 min read

The Senate draft overall makes more changes to international tax policy than the House draft. On net the changes are positive.

8 min read

If Illinois’ budget is enacted as-is, Illinois will newly tax 50 percent of Global Intangible Low-Taxed Income (GILTI) as of tax year 2025, retroactively increasing tax burdens for US businesses and further hindering Illinois’ business tax competitiveness.

7 min read

Tax Foundation Europe’s Sean Bray had the opportunity to interview Dr. Dominika Langenmayr, Professor of Economics at Catholic University of Eichstätt-Ingolstadt, about the future of the EU tax mix.

15 min read

Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

5 min read

As lawmakers consider options for budgetary offsets, they should prioritize competitiveness and economic growth, as a heavier corporate tax burden will undermine the core purpose and achievement of the TCJA.

24 min read

As Congress debates expensing and other policies impacting business investment, lawmakers should consider the importance of business investment in research and development (R&D) as a driver for economic growth. Recent studies suggest that the economic benefits of R&D spending are even greater than previously understood.

7 min read

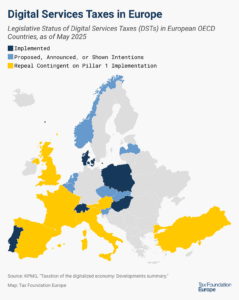

Currently, about half of all European OECD countries have either announced, proposed, or implemented a digital services tax. Because these taxes mainly impact US companies and are thus perceived as discriminatory, the US responded with retaliatory tariff threats.

5 min read

Do tariffs really level the playing field, or are they just bad economics? In this emergency episode, we fact-check the Trump administration’s claims that retaliatory tariffs make trade fairer.

What are the biggest tax stories shaping policy today—and what do they mean for you? In our 100th episode, we break down the five biggest tax stories, from the global tax deal to the looming expiration of the Tax Cuts and Jobs Act.

Policymakers should aim for neutral tax policies that support stable revenues like VATs and avoid inviting trade conflicts with discriminatory and economically harmful policies like DSTs.

6 min read

Maryland’s proposed budget has garnered headlines for many reasons, but another momentous change is flying under the radar: backdoor adoption of potentially mandatory worldwide combined reporting.

6 min read

President Donald Trump surprised many in the tax community by making the global tax deal a day one issue. His Jan. 20 memorandum gave his Treasury secretary 60 days to recommend interactions with tax treaties and possible protective measures to ensure the minimum tax rules have no force or effect in the US.

Tax legislation in 2025 may have good reason to address international corporate income taxes, because of scheduled changes slated to go into effect or because of international developments like the Pillar Two agreement.

63 min read

The agreement represents a major change for tax competition, and many countries will be rethinking their tax policies for multinationals. If there is no agreement on changes to Pillar Two or digital services taxes, retaliatory American tariffs could be on the horizon.

8 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

55 min read

As the third-largest economy in the world, with an influential voice within EU policymaking, and the United States among its most important trading partners, Germany’s next government will play a particularly important role in deciding the direction of European tax, trade, and transatlantic policy.

6 min read