Introduction

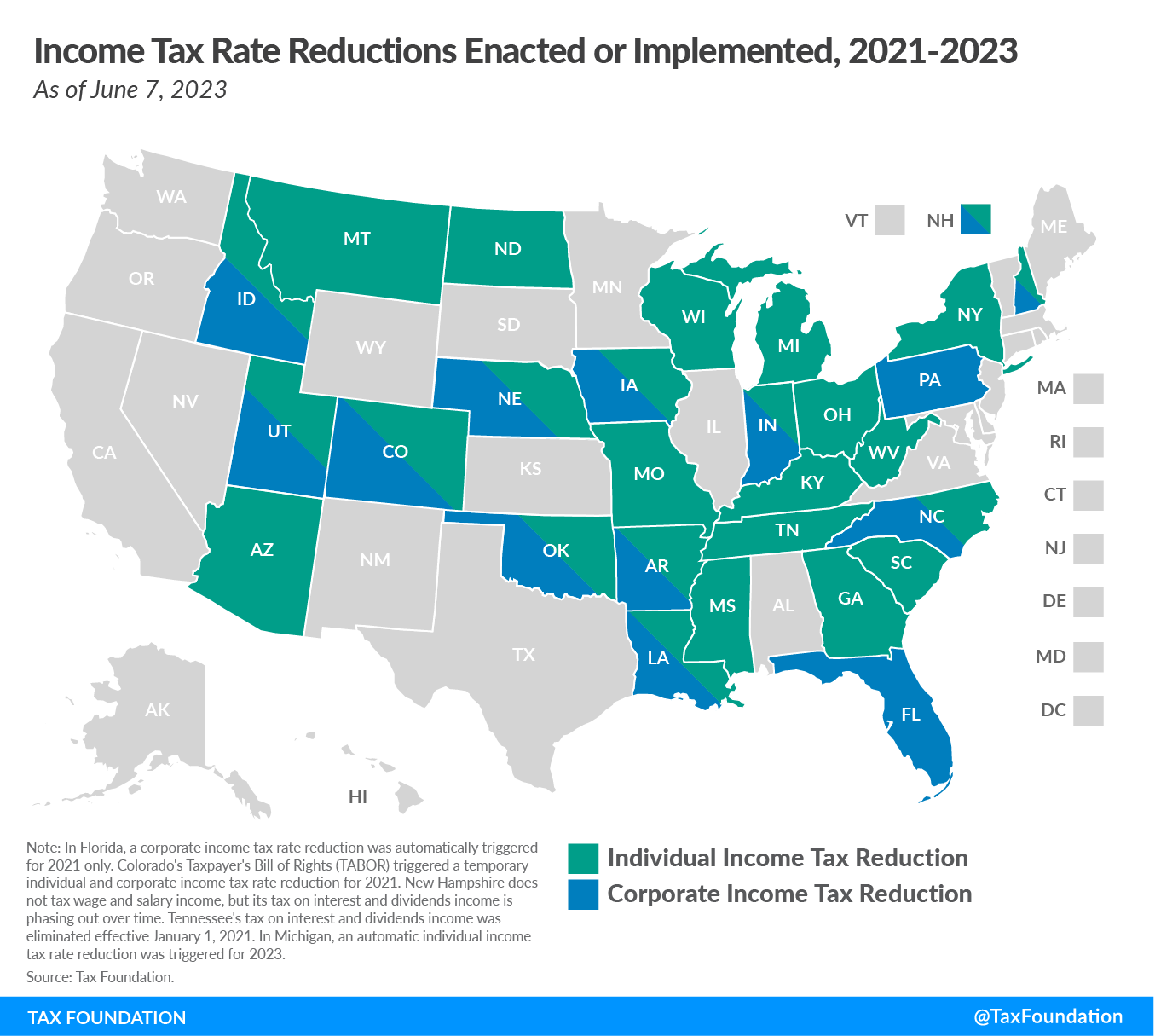

As legislative sessions wind down in many states, it is evident that 2023 marks a third consecutive year of substantial state taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. reform and relief. Since 2021, 25 states have cut individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rates (including 23 reductions to top marginal rates), 13 states have cut corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rates, two have cut sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. rates, and many more have made structural improvements like repealing capital stock taxes, adopting permanent full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. , raising nonresident filing and withholdingWithholding is the income an employer takes out of an employee’s paycheck and remits to the federal, state, and/or local government. It is calculated based on the amount of income earned, the taxpayer’s filing status, the number of allowances claimed, and any additional amount of the employee requests. thresholds, improving treatment of business tangible property, eliminating throwback and throwout rules, and more.

After the dramatic rate reductions and reforms in 2021 and 2022, many expected a lull in 2023. Those expectations have been shattered.

Eight states adopted individual income tax rate reductions: Arkansas, Indiana, Kentucky, Montana, Nebraska, North Dakota, Utah, and West Virginia. Additionally, Michigan triggered a potentially temporary rate reduction, while previously scheduled or triggered reductions also took effect in 2023 in Arizona, Idaho, Iowa, Mississippi, Missouri, New Hampshire (interest and dividend income tax), and North Carolina.

The table below shows where states’ top marginal income tax rates stood entering 2021—before any retroactive rate changes for that year—and what was implemented for 2022 and 2023. The table also shows anticipated 2024 rates, reflecting any rate changes already adopted by legislatures, and notes any further future rate reductions either scheduled in statute or subject to revenue triggers.

| Top Marginal Rates Entering 2021, for 2022-2024, and Subsequent Scheduled Reductions | ||||||

|---|---|---|---|---|---|---|

| State | Rate Cut? | Entering 2021 | 2022 | 2023 | 2024 | Future |

| Alabama | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | |

| Alaska | No tax | No tax | No tax | No tax | No tax | |

| Arizona | ✓ | 8.00%* | 2.98% | 2.50% | 2.50% | 2.50% |

| Arkansas | ✓ | 5.90% | 4.90% | 4.70% | 4.70% | 4.70% |

| California | 13.3% | 13.3% | 13.30% | 14.40% | 14.40% | |

| Colorado | ✓ | 4.55% | 4.40% | 4.40% | 4.40% | 4.40% |

| Connecticut | 6.99% | 6.99% | 6.99% | 6.99% | 6.99% | |

| Delaware | 6.60% | 6.60% | 6.60% | 6.60% | 6.60% | |

| Florida | No tax | No tax | No tax | No tax | No tax | |

| Georgia | ✓ | 5.75% | 5.75% | 5.75% | 5.49% | 4.99% |

| Hawaii | 11.00% | 11.00% | 11.00% | 11.00% | 11.00% | |

| Idaho | ✓ | 6.925% | 6.00% | 5.80% | 5.80% | 5.80% |

| Illinois | 4.95% | 4.95% | 4.95% | 4.95% | 4.95% | |

| Indiana | ✓ | 3.23% | 3.23% | 3.23% | 3.05% | 2.90% |

| Iowa | ✓ | 8.53% | 8.53% | 6.00% | 5.70% | 3.90% |

| Kansas | 5.70% | 5.70% | 5.70% | 5.70% | 5.70% | |

| Kentucky | ✓ | 5.00% | 5.00% | 4.50% | 4.00% | Indefinite |

| Louisiana | ✓ | 6.00% | 4.25% | 4.25% | 4.25% | 4.25% |

| Maine | 7.15% | 7.15% | 7.15% | 7.15% | 7.15% | |

| Maryland | 5.75% | 5.75% | 5.75% | 5.75% | 5.75% | |

| Massachusetts | 5% | 5% | 9.00% | 9.00% | 9.00% | |

| Michigan | ✓ | 4.25% | 4.25% | 4.05% | 4.25% | 4.25% |

| Minnesota | 9.85% | 9.85% | 9.85% | 9.85% | 9.85% | |

| Mississippi | ✓ | 5.00% | 5.00% | 5.00% | 4.70% | 4.00% |

| Missouri | ✓ | 5.40% | 5.30% | 4.95% | 4.95% | 4.50% |

| Montana | ✓ | 6.90% | 6.75% | 6.75% | 5.90% | 5.90% |

| Nebraska | ✓ | 6.84% | 6.84% | 6.64% | 5.84% | 3.99% |

| Nevada | No tax | No tax | No tax | No tax | No tax | |

| New Hampshire | ✓ | 5.00%† | 5.00%† | 4.00%† | 3.00%† | No tax |

| New Jersey | 10.75% | 10.75% | 10.75% | 10.75% | 10.75% | |

| New Mexico | 5.90% | 5.90% | 5.90% | 5.90% | 5.90% | |

| New York | 8.82% | 10.90% | 10.90% | 10.90% | 10.90% | |

| North Carolina | ✓ | 5.25% | 4.99% | 4.75% | 4.60% | 3.99% |

| North Dakota | ✓ | 2.90% | 2.90% | 2.90% | 2.50% | 2.50% |

| Ohio | ✓ | 4.797% | 3.99% | 3.99% | 3.99% | 3.99% |

| Oklahoma | ✓ | 5.00% | 4.75% | 4.75% | 4.65% | 4.65% |

| Oregon | 9.90% | 9.90% | 9.90% | 9.90% | 9.90% | |

| Pennsylvania | 3.07% | 3.07% | 3.07% | 3.07% | 3.07% | |

| Rhode Island | 5.99% | 5.99% | 5.99% | 5.99% | 5.99% | |

| South Carolina | ✓ | 7.00% | 6.50% | 6.50% | 6.50% | 6.00% |

| South Dakota | No tax | No tax | No tax | No tax | No tax | |

| Tennessee | No tax | No tax | No tax | No tax | No tax | |

| Texas | No tax | No tax | No tax | No tax | No tax | |

| Utah | ✓ | 4.95% | 4.85% | 4.65% | 4.65% | 4.65% |

| Vermont | 8.75% | 8.75% | 8.75% | 8.75% | 8.75% | |

| Virginia | 5.75% | 5.75% | 5.75% | 5.75% | 5.75% | |

| Washington | No tax | 7.00%§ | 7.00%§ | 7.00%§ | 7.00%§ | |

| West Virginia | ✓ | 6.50% | 6.50% | 5.12% | 5.12% | Indefinite |

| Wisconsin | 7.65% | 7.65% | 7.65% | 7.65% | 7.65% | |

| Wyoming | No tax | No tax | No tax | No tax | No tax | |

| District of Columbia | 8.95% | 10.75% | 10.75% | 10.75% | 10.75% | |

|

Notes: Rate reductions are displayed in bold and single-rate income taxes in italics. Kentucky and West Virginia have adopted revenue triggers that could theoretically see indefinite reductions in income tax rates, though Kentucky’s reductions must be affirmed by the legislature. Since 2021, New York and Wisconsin also cut middle-income rates but did not cut—and in New York’s case added—higher top marginal rates. * Arizona’s 8 percent top rate, approved by the voters in November 2020, was retroactively reversed by the legislature in 2021 and was never collected. Sources: Tax Foundation research; state statutes. |

||||||

Two states—Nebraska and Utah—adopted corporate income tax rate reductions in 2023. At the same time, Arkansas repealed its throwback rule; Mississippi made its expensing provision permanent; Montana adopted higher nonresident filing thresholds; Oklahoma repealed its capital stock tax; and Tennessee adopted full expensing and cuts to its excise (corporate income), franchise (capital stock), and business (gross receipts) taxes. Additional substantial business tax reforms are still pending in Louisiana.

These continued reforms are significant but should not be surprising. Many states continue to experience revenue growth and project further growth in coming years, and nearly all states anticipate revenues remaining well above pre-pandemic levels. And while state coffers are flush with cash, lawmakers are increasingly attuned to the value of tax competitiveness in an ever more mobile economy. With businesses and individuals alike better positioned than ever to take taxes into account in deciding where to live and work, lawmakers across the country are responding with pro-growth, pro-taxpayer reforms. The trends that kicked off in 2021 are still going strong, and the 2023 story is not over quite yet.

Pro-Growth State Tax Reforms Enacted in 2023

Arkansas

Building upon a series of reforms adopted in recent years, S.B. 549 and H.B. 1045 were enacted on April 10, reducing individual and corporate income tax rates and phasing out the throwback rule. In 2022, Arkansas’s top marginal individual income tax rate was reduced from 5.5 to 4.9 percent, retroactive to January 1, 2022, and the top marginal corporate income tax rate was reduced from 5.9 to 5.3 percent, effective January 1, 2023. The cuts enacted this year will reduce these rates even further, bringing the top marginal individual income tax rate to 4.7 percent and the top marginal corporate rate to 5.1 percent, retroactive to January 1, 2023. Meanwhile, H.B. 1045 will phase out the throwback rule in Arkansas’s corporate income tax code, eliminating it entirely by 2030.

Indiana

On May 4, 2023, Gov. Eric Holcomb (R) signed into law H.B. 1001, the state’s biennial budget bill for fiscal years 2024 and 2025. The most notable tax change included in the budget is a provision to accelerate previously enacted individual income tax rate reductions. Under legislation enacted in March 2022, Indiana’s flat individual income tax rate was reduced from 3.23 percent in 2022 to 3.15 percent for 2023 and 2024, and tax triggers were put in place to reduce the rate to as low as 2.9 percent by 2029. This year’s budget reduces the rate to 3.05 percent in 2024, and removes the previously existing tax triggers, instead prescribing rate reductions to bring the rate to 3 percent in 2025, 2.95 percent in 2026, and 2.9 percent in 2027 and beyond.

Another notable bill, S.B. 3, also enacted on May 4, establishes a “state and local tax review task force” to review the state’s short- and long-term financial outlook. The law directs the task force to examine several taxes, including the individual income tax, the corporate income tax, the sales tax, the property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. , and local option taxes, including local income taxes, food and beverage taxes, and occupancy taxes. Specifically, the law directs the task force to examine methods to “reduce or eliminate” the individual income tax, the tax on homestead properties, and the tax on business personal property. The law directs the task force to submit a report with its findings and recommendations no later than December 1, 2024.

Kentucky

In Kentucky, lawmakers wasted no time in passing H.B. 1, which was signed into law by Gov. Andy Beshear (D) on February 17, 2023. This law reduces Kentucky’s flat individual income tax rate from 4.5 percent in 2023 to 4 percent starting in 2024, codifying a reduction that was triggered under the conditions established by H.B. 8, enacted in 2022.

Under the 2022 law, an individual income tax rate reduction of 0.5 percentage points is triggered for years in which (1) actual general fund tax collections exceed appropriations by at least the amount necessary to reduce the rate by a full percentage point; (2) the Budget Reserve Trust Fund (rainy day fund) is funded to at least 10 percent of General Fund levels; and (3) the General Assembly proactively codifies the reduction. Clarifying changes to the trigger language were enacted with the passage of H.B. 360 in March 2023, but the substance of the trigger requirements remains unchanged. Kentucky’s recent rate reductions build upon reforms enacted in 2018 to improve the state’s tax structure and competitiveness. Additional structural reform recommendations are described in our tax reform options guide for Kentucky.

Louisiana

House Bill 171, which was signed into law on May 30, will simplify Louisiana’s remote sales tax collections laws by adjusting the safe harbor provision for marketplace facilitators, removing the 200 transactions threshold, as many other states have done, and converting the $100,000 sales threshold from one that applies to gross revenue from all sales to one that applies to gross revenue from retail sales only. Other tax reforms, including the repeal of the state’s franchise (capital stock) tax, are pending, and are discussed later.

Michigan

Michigan’s flat individual income tax rate has been reduced from 4.25 to 4.05 percent for 2023, the automatic result of a 2015 law that prescribed tax rate reductions for any year, beginning in 2023, in which general fund revenue growth exceeds the rate of inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. growth. In March 2023, Attorney General Dana Nessel issued a legal opinion stipulating that the rate will revert back to 4.25 percent for 2024 and beyond. This opinion has sparked debate among legislators and stakeholders as to the intent and letter of the 2025 law, which could lead to litigation. Click here for Tax Foundation analysis regarding this determination.

Mississippi

This legislative session, Mississippi lawmakers built upon recently enacted rate reductions by adopting important structural changes. House Bill 1733, enacted on March 27, substantially improves the income tax treatment of business investments in machinery and equipment by allowing permanent full expensing of these investments in the year such expenses are incurred. This is a substantial policy change for Mississippi, which did not previously offer any type of bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. allowance akin to IRC § 168(k). With the enactment of H.B. 1733, Mississippi has become the second state in the country to offer permanent full expensing, joining Oklahoma, which enacted a similar provision last year. Other states should consider enacting a permanent full expensing provision, including the many states that currently conform to the federal § 168(k) bonus depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. allowance, which is phasing down by 20 percent per year, such that only 80 percent bonus depreciation is available in 2023, 60 percent in 2024, 40 percent in 2025, 20 percent in 2026, and 0 percent in 2027.

Separately, H.B. 1733 codifies Mississippi’s practice of allowing first year expensing, up to certain limits, for § 179 property. Previously, Mississippi’s administrative code contained a § 179 expensing provision, but this law will ensure those protections are solidified in the underlying statute.

Montana

Montana was among the states to enact income tax cuts in 2021, reducing the top marginal rate from 6.9 percent in 2021 to 6.75 percent in 2022 and scheduling an additional future reduction to 6.5 percent beginning in 2024. However, on March 13, 2023, S.B. 121 was enacted, reducing the rate even further—to 5.9 percent—beginning in 2024. On that same day, H.B. 221 was also signed into law, reducing the income tax rates applying to net long-term capital gains income. Currently, a graduated-rate structure applies to long-term capital gains income, with rates of 4.7 and 6.5 percent, but effective January 1, 2024, the rates will be reduced to 3 and 4.1 percent, respectively. Also signed into law on May 13 was H.B. 212, a bill that increases the business equipment personal property tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service (IRS), preventing them from having to pay income tax. from $300,000 to $1 million.

Separately, H.B. 447 was enacted on May 18, creating an exclusion from individual income tax filing and payment obligations for nonresidents who work in Montana for 30 or fewer days in a tax year whose compensation for the prior year was not greater than $500,000. This change will significantly reduce compliance burdens for taxpayers, while also reducing the administrative costs to the state of processing low-dollar tax returns from nonresidents. The law does, however, specify that the safe harbor does not apply to certain individuals, including professional athletes and entertainers.

Nebraska

Nebraska has taken strides to improve its tax competitiveness in recent years and continued that work this session by accelerating previously enacted individual and corporate income tax rate reductions and reducing rates even further. Legislative Bill 754, which was signed into law on May 31, 2023, will gradually phase down Nebraska’s top marginal individual and corporate income tax rates to 3.99 percent in 2027, with initial reductions of both top marginal rates to 5.84 percent in 2024, reaching that target rate three years earlier than initially anticipated. Previously, LB 873, enacted in 2022, reduced both top marginal rates to 5.84 percent by 2027, building upon a law enacted in 2021 that trimmed the top marginal corporate income tax rate over two years.

This new law also converts Nebraska’s graduated-rate income tax into a single-rate tax, a reform recommended in our 2021 Nebraska tax reform options guide, and consolidates Nebraska’s four marginal individual income tax rates into three starting in 2026.

If fully implemented as planned by 2027, Nebraska will have cut its top marginal corporate income tax rate nearly in half over six years and will have cut its top marginal individual income tax rate by nearly 42 percent over five years.

North Dakota

After legislators considered several different proposals to reduce individual income tax rates, on April 28, Gov. Doug Burgum (R) signed into law H.B. 1158, a bill that contains several tax changes, the most notable of which is a reduction in North Dakota’s individual income tax rates. Specifically, H.B. 1158 converts the existing five-bracket individual income tax structure with a top rate of 2.9 percent into a more consolidated rate schedule with a top rate of 2.5 percent, a lower intermediate rate of 1.95 percent, and a sizeable zero bracket. These changes are retroactive to January 1, 2023.

Oklahoma

On May 26, two notable structural tax reforms in Oklahoma became law without the governor’s signature. House Bill 1039 repeals the state’s corporate franchise (capital stock) tax, effective July 1, 2023. House Bill 1040 removes the marriage penaltyA marriage penalty is when a household’s overall tax bill increases due to a couple marrying and filing taxes jointly. A marriage penalty typically occurs when two individuals with similar incomes marry; this is true for both high- and low-income couples. from Oklahoma’s individual income tax brackets by adjusting the bracket threshold at which the top marginal rate kicks in to $14,400, making it double the threshold at which the top marginal rate kicks in for single filers.

South Dakota

South Dakota, which does not have an individual or corporate income tax, enacted legislation this year to trim its sales tax rate, joining New Mexico, which did so in 2022. Enacted on March 21, H.B. 1137 reduces South Dakota’s state sales tax rate from 4.5 to 4.2 percent, effective July 1, 2023. Unusually, this rate reduction is temporary, effective for four years, and is scheduled to expire on June 30, 2027, though supporters clearly hope to make the provisions permanent by then.

Along with New Mexico and Hawaii, South Dakota has an overly broad sales tax base that captures many business inputs in addition to consumer goods and services. As such, this rate reduction will provide savings to consumers and businesses on all their taxable purchases.

While some in South Dakota, including Gov. Kristi Noem (R), wanted to create a sales tax exemption for groceries instead, legislators rejected this proposal, favoring a rate reduction that provides relief across all taxable purchases, a more neutral policy solution. The exemption of groceries from sales tax is likely to remain a topic of debate, however, as proponents of such a policy have begun collecting signatures to bring this issue to the ballot in November 2024 in the form of an initiated constitutional amendment and an initiated measure. To read about the economic and distributional arguments in favor of sales tax rate reductions over grocery exemptions, see our analysis here.

Tennessee

On May 11, Gov. Bill Lee (R) signed H.B. 323, a bill that includes several structural tax improvements. Specifically, effective as of January 1, 2023, the law conforms Tennessee to § 168(k), which offers bonus depreciation for firms making qualified machinery and equipment investments. From 2018-2022, the provision allowed 100 percent bonus depreciation, known as full expensing, but as of this year, the provision is phasing down by 20 percent per year until it sunsets in 2027. As such, in the future, Tennessee would do well to consider adopting a permanent full expensing provision separate from the federal government’s.

Additionally, the new law increases the amount of business income that is exempt from the corporate income tax, known in Tennessee as the excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. , to $50,000. For purposes of the excise (corporate income) tax and the franchise (capital stock) tax, the new law shifts to single sales factor apportionmentApportionment is the determination of the percentage of a business’ profits subject to a given jurisdiction’s corporate income or other business taxes. U.S. states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders. , moving away from a three-factor formula with a triple-weighted sales factor. The transition to single sales factor will be fully effective in 2025. Under Tennessee’s franchise tax, businesses are taxed on the greater of their net worth or the book value of their real or tangible personal property. Under the new law, when a business is taxed based on the book value of its real or tangible personal property, the first $500,000 in property value will be exempt.

The law also reduces reliance on the statewide gross receipts taxA gross receipts tax, also known as a turnover tax, is applied to a company’s gross sales, without deductions for a firm’s business expenses, like costs of goods sold and compensation. Unlike a sales tax, a gross receipts tax is assessed on businesses and apply to business-to-business transactions in addition to final consumer purchases, leading to tax pyramiding. , known as the business tax, by increasing the exemption threshold to $100,000, thus reducing the number of businesses to which it applies, and also reducing Tennessee’s top business tax rate from 0.3 to 0.1875 percent.

Utah

Utah is another state that reduced income tax rates in 2022 but has enacted legislation this session to reduce rates further. In February 2022, S.B. 59 was enacted, reducing Utah’s individual and corporate income tax rates from 4.95 to 4.85 percent, retroactive to January 1, 2022. This session, H.B. 54 was enacted on March 22, 2023, reducing both rates to 4.65 percent, retroactive to January 1, 2023.

West Virginia

After several years of deliberations between the House, Senate, and governor, and after decades of discussions on tax reform, H.B. 2526 was enacted on March 7th, implementing an across-the-board reduction to West Virginia’s five individual income tax rates, including reducing the top marginal rate from 6.5 to 5.12 percent. These rate reductions are retroactive to January 1, 2023, and mark the first time West Virginia has reduced individual income tax rates since 1987. The law also established a set of triggers that could reduce rates further in future years, starting in 2025, subject to revenue availability.

Notable State Tax Reforms Still Under Consideration

Louisiana

Senate Bill 1, which passed both chambers June 6th, would phase out Louisiana’s corporationAn S corporation is a business entity which elects to pass business income and losses through to its shareholders. The shareholders are then responsible for paying individual income taxes on this income. Unlike subchapter C corporations, an S corporation (S corp) is not subject to the corporate income tax (CIT). franchise tax, an economically distortive capital stock tax, over time, building upon a franchise tax reduction that was enacted in 2021. Specifically, beginning with the 2025 tax year, the tax would be reduced by 25 percent each year in which specified revenue targets are met. Further Tax Foundation analysis of this proposal is available here. The bill awaits action by the governor.

Separately, House Bill 631 would repeal Louisiana’s complex and economically harmful throwout rule, effective January 1, 2024. This legislation passed both chambers unanimously and is also on the governor’s desk. Finally, Senate Bill 2, which is still in the Senate, would phase out the distortionary inventory tax over five years, beginning in 2024.

Massachusetts

Governor Maura Healey’s (D) fiscal year 2024 budget proposal contains several structurally sound tax reforms that would help the state gain back some of the competitiveness it lost with the adoption of Question 1 in November 2022, which created a new top marginal individual income tax rate of 9 percent, among the highest in the nation. Specifically, the governor has proposed reducing the income tax rate on short-term capital gains income from 12 to 5 percent, matching the rate on long-term gains and the rate that applies to most ordinary income, as well as making the estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. less burdensome by increasing the exemption and creating a new estate tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. to reduce liability. Further analysis of these proposals is available here.

New Hampshire

Senate Bill 189, which has passed both chambers, would decouple the New Hampshire tax code from the federal net interest limitation in IRC § 163(j), thereby allowing businesses to fully deduct their interest expenses in the year those expenses are incurred. The federal limit on business interest deductibility was put in place as part of the 2017 tax reform law, not because Congress viewed the limitation as ideal tax policy, but because, as a revenue-raiser, it was a reasonable trade-off to help pay for the 100 percent bonus depreciation allowance that was created under § 168(k). Ideally, states should allow businesses to fully deduct all expenses in the year those expenses are incurred.

The state budget (H.B. 2), which is currently awaiting a full vote of the Senate, also contains an accelerated phaseout of New Hampshire’s tax on interest and dividend income, eliminating the tax by January 2025, rather than 2027.

New Jersey

Several pro-growth tax reforms are under consideration this session that would reduce business tax burdens in the Garden State. Two companion bills, S. 3737 and A. 5323, would, among other changes, reduce New Jersey’s taxation of Global Intangible Low-Taxed Income (GILTI) from 50 to 5 percent, as many other states have done. Separately, in his budget proposal, Gov. Phil Murphy (D) proposed allowing the state’s temporary 2.5 percent corporation business tax surcharge to expire at the end of 2023 as scheduled, but Senate President Nick Scutari (D) has signaled his desire to extend it.

North Carolina

The House and Senate have each passed budgets that include notable tax reforms. House Bill 259, which passed on April 6, 2023, would accelerate planned individual income tax rate reductions by reducing the rate to 4.5 percent, instead of 4.6 percent, on January 1, 2024. This bill would also increase the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. by $250 for single filers and by $500 for joint filers. At earlier stages, the budget bill also included reductions in the franchise (capital stock) tax and the repeal of the professional privilege tax. The Senate’s approach would accelerate already enacted reductions to bring the individual income tax rate to 2.49 percent, rather than 3.99 percent, by 2027. The appropriations measure is currently in conference to work out differences between the chambers.

Rhode Island

Legislation is advancing this session to make tangible personal property taxes less burdensome in the Ocean State. Senate Bill 928 would create a $100,000 exemption, whereby taxpayers with $100,000 or less in taxable tangible personal property would no longer have to file and pay these taxes, and whereby businesses with more than $100,000 in qualifying property would no longer be subject to property taxes on the first $100,000 of taxable tangible personal property value. If enacted, an estimated 85 percent of Rhode Island businesses would no longer have to file and pay taxes on tangible personal property.

Wisconsin

As lawmakers draft the budget for the upcoming biennium that begins July 1, Wisconsin is projected to end the current fiscal year biennium with a $6.9 billion budget surplus, the largest in state history. As such, tax cuts are expected to feature prominently in the budget, but the Republican-controlled legislature and Democratic Gov. Tony Evers have expressed differing priorities when it comes to how to cut taxes. Republican legislators have spent much of this session promoting various proposals to phase in a single-rate individual income tax structure, starting with reductions to each of the existing rates, while Gov. Evers has thrown cold water on the idea of a flat taxAn income tax is referred to as a “flat tax” when all taxable income is subject to the same tax rate, regardless of income level or assets. and has instead proposed adjusting various credits.

Additionally, after nearly doing so in 2021, policymakers on both sides of the aisle seem intent on repealing the state’s tangible personal property tax this session. Assembly Bill 245 passed on May 17, 2023, and awaits consideration in the Senate. This legislation would repeal all remaining tangible personal property taxes beginning with the January 1, 2024, property tax assessment.

Conclusion

The rate relief and reforms outlined here are by no means exhaustive. For instance, several states, including Iowa, adopted legislation to help rein in rising property taxes, and many states adopted exemptions, increased deductions, or implemented other policy changes that may provide tax relief. For states still in session, only a few pending proposals were highlighted, given uncertain prospects for many bills, including, for example, the acceleration of corporate net income tax rate reductions and the enhancement of net operating loss carryforwards in Pennsylvania. This survey of the legislative landscape does, however, cover the most significant reforms adopted this year, and the most viable reforms still pending.

The pace of tax reform will ebb and flow, and lawmakers’ ability to implement rate reductions will depend on future revenue and expenditure levels, but there will always be room for structural reforms. In an era characterized by remote work and greater workplace flexibility, more states should prioritize policies that attract investment, like permanent full expensing, and which reduce burdens for nonresidents, like higher filing and withholding thresholds. The work does not end—but thus far, the reforms of 2023 are clear evidence that lawmakers know the stakes, and that tax reform and tax relief continue to be high priorities.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe