This week’s state taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. map looks at throwback and throwout rules in states’ corporate tax codes. These rules may not be widely understood, but they have a notable impact on business location and investment decisions and reduce economic efficiency for the states that impose such rules. Over the long run, these rules reduce competitiveness while yielding very little—or no—increase in state collections.

For purposes of corporate taxation, states must apportion the income of multistate businesses. All apportionmentApportionment is the determination of the percentage of a business’ profits subject to a given jurisdiction’s corporate income or other business taxes. U.S. states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders. formulas use some combination of three factors: property, payroll, and sales. Many states use single sales factor, considering sales into the state to the exclusion of any other factor. Other states use all three factors, sometimes (but not always) weighted equally. The goal of apportionment is to prevent double taxation of corporate income, but there is wide variation among states in how apportionment formulas are designed, and when businesses are exposed to conflicting rules, they can still pay taxes more than once on the same income—or have some income exposed to no tax at all.

States can only tax corporations that have economic nexus with the state, which means that the corporation must have sufficient connection to the state to justify taxation. However, federal law constrains states in defining economic nexus. More specifically, Public Law 86-272 prohibits states from taxing income that arises from the sale of tangible property into the state by a company that has no other activity in that state other than soliciting sales.

When companies sell into a state where they do not have nexus, that destination state lacks jurisdiction to tax the company’s income. This results in what is known as “nowhere income”—income that cannot legally be taxed by the state where the income-producing sale occurs.

Under throwback rules, sales of tangible property that are not taxable in the destination state are “thrown back” into the state where the sale originated, even though that’s not where the income was earned. This means that if a company located in State A sells into State B, where the company lacks economic nexus, State A can require the company to “throw back” this income into its sales factor.

Even if it might be fairer for a company to pay taxes on this nowhere income (although it’s also unfair that they face double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. on other income), throwback rules are a case of the wrong tax, at the wrong rate, in the wrong state. They cause businesses to be taxed at potentially many multiples of the income they have in the state imposing the throwback rule, motivating these businesses—or at least certain aspects of their business—to locate elsewhere. This effect is so robust that studies find throwback rules actually decrease tax revenue over time, since they do more to drive out business activity than they do to tax the nowhere income from remaining businesses with exposure to the provision.

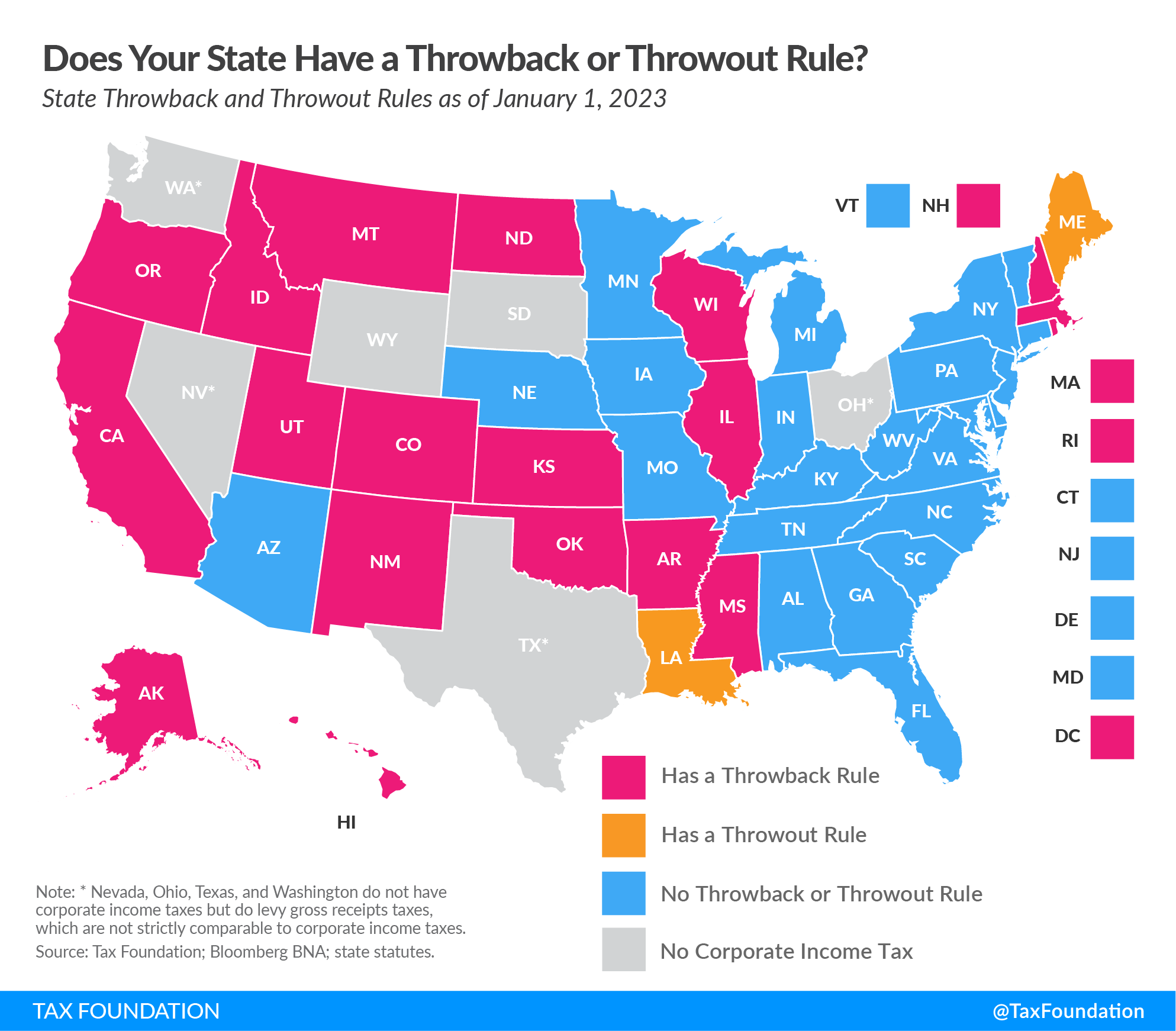

Nineteen states and the District of Columbia impose throwback rules for the sale of tangible personal property.

Although throwback rules are more common, two states adopt what are known as throwout rules. The difference between the two rules is in how the “nowhere income” is treated. In both cases, the state using the throwout or throwback rule is working with a fraction to calculate what portion of corporate income is taxable in that state. In the case of the sales factor (whether that’s the only factor or one of three), the fraction is the amount of sales associated with the state divided by the company’s total sales. Both throwback and throwout rules adjust this fraction to increase corporate tax liability. With a throwback rule, “nowhere income” is placed in the numerator (the amount apportioned to the state). With a throwout rule, the “nowhere income” is subtracted from the denominator (the amount of total sales). Both of these changes increase the value of the fraction, thus increasing a corporation’s in-state tax liability, though throwback rules do so more aggressively than throwout rules.

Whatever their aims, state throwback and throwout rules are nonneutral, often inequitable, uncompetitive, and ultimately counterproductive.

Share this article