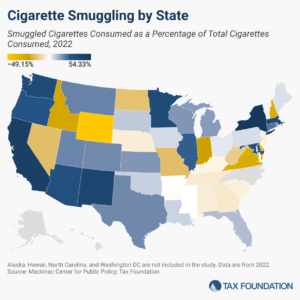

Cigarette Smuggling Cost States Nearly $5 Billion in Forgone Excise Tax Revenue Each Year

Tax avoidance is a natural consequence of tax policy. Policymakers should consider the unintended consequences, both to public health and public coffers, of the excise taxes and regulatory regimes for cigarettes and other nicotine products.

5 min read