As we continue to look at taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. types that can harm states’ post-coronavirus recovery, it’s worth highlighting taxes on business inventory.

Inventory taxes fall under the umbrella of the property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. , which is the largest tax paid by businesses at the state and local levels. In addition to taxes on the value of buildings and land, businesses can also pay property taxes on their machinery and equipment, known as business tangible personal property (TPP) taxes. A number of states include inventory as part of their tangible personal property tax.

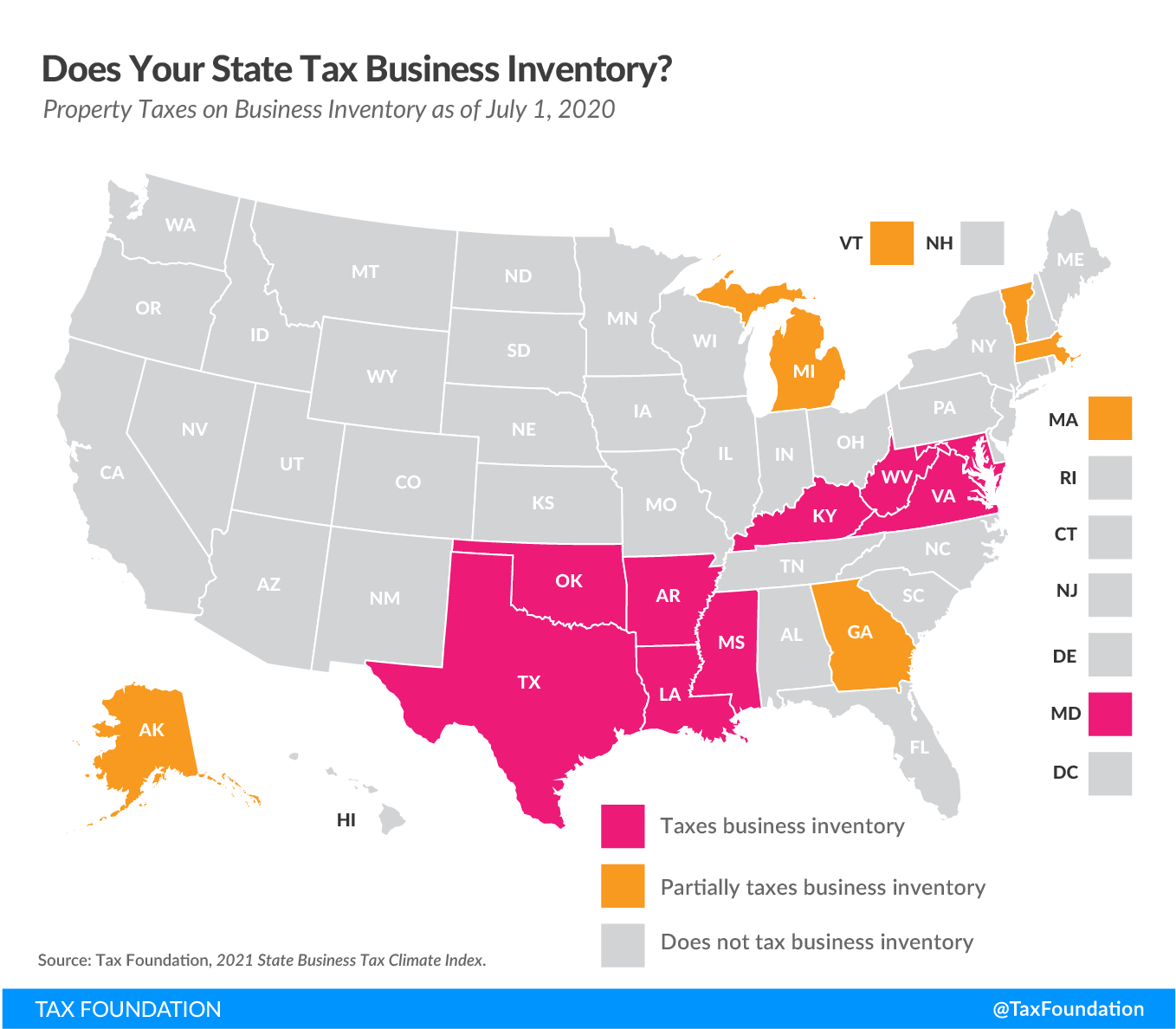

As shown in the map, nine states (Arkansas, Kentucky, Louisiana, Maryland, Mississippi, Oklahoma, Texas, Virginia, and West Virginia) fully tax business inventory, with five additional states (Alaska, Georgia, Massachusetts, Michigan, and Vermont) levying partial taxes on business inventory.

Inventory taxes are levied regardless of whether a business makes a profit, adding to the burden of businesses already struggling to stay afloat. Inventory taxes are also nonneutral, as businesses with larger inventories, like retailers and manufacturers, end up paying more in inventory taxes than other firms do. The inventory tax is also not as transparent as other taxes; those extra fees get passed on to consumers in the form of higher prices.

Inventory taxes, and other tangible personal property taxes, are also “taxpayer active,” meaning taxpayers must determine their tax liability themselves. This increases the cost of complying with tangible personal property taxes.

Because inventory taxes are a type of property tax, local governments receive the majority of revenue from such taxes. This adds a layer of complexity to any plans of limiting or repealing such taxes, as an immediate repeal could strain local government finances.

Louisiana sought to limit the burden of inventory taxes by creating a state credit for inventory taxes paid. While this does take the weight off businesses, it turns the system into what is essentially a backdoor state-to-local revenue transfer. This credit increases the complexity of the state’s tax code, takes away any incentive to keep the tax rate low, and leads to the possibility of gaming the system.

When possible, state and local governments should look to shift from inventory taxes toward revenue sources with broader, more neutral bases. While this shifting cannot and will not be an immediate solution to the economic crisis still facing the country, a responsible shift would help businesses adjust in a post-coronavirus world and protect businesses both small and large in case of future crises.

Note: This blog post is part of a series that looks at tax policy barriers to states’ post-coronavirus recovery.