Table of Contents

Key Findings

- As states close their books for fiscal year 2021, many have much more revenue on hand than they anticipated last year.

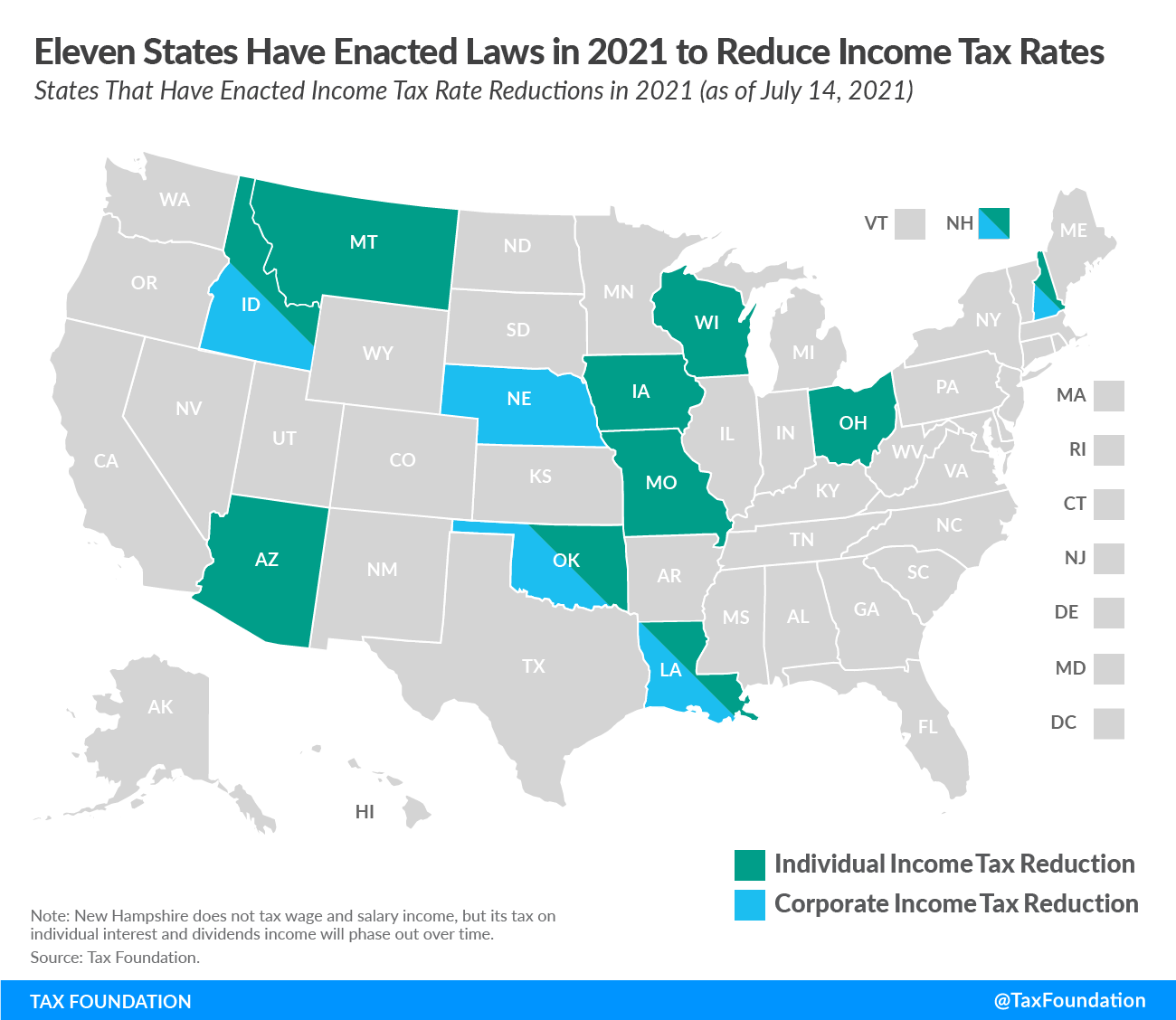

- In 2021, 11 states have enacted laws to reduce their income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates, with 10 reducing individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rates and five reducing corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rates.

- In many states, these rate reductions are paired with other pro-growth reforms.

- These income tax reforms have various effective dates. Some are retroactive to the beginning of 2021; some take effect in January 2022; and others take effect in 2023 or beyond or phase in over time.

- Five states–Arizona, Idaho, Iowa, Montana, and Ohio–enacted laws to reduce the number of brackets in their individual income tax, creating a more neutral structure.

- Five states–Arizona, Idaho, Louisiana, Ohio, and Oklahoma–enacted laws to reduce each of their marginal individual income tax rates.

- Of the 10 states that reduced their individual income tax rates, all but Wisconsin included reductions to the top marginal rate.

- Montana consolidated seven brackets into two, reducing the top rate and adopting a significantly higher standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. to provide targeted relief to those at the lower end of the income spectrum.

Introduction

It is not unusual for a theme to emerge from state legislative sessions, as each state responds to similar economic or national trends. From the perspective of a year ago, however, it is remarkable that the dominant tax policy trend in the states during their 2021 legislative sessions—concluded now, in many states—was income tax relief. With burgeoning revenues and the prospect of workplace flexibility greatly enhancing the salience of tax competition, 11 states have cut individual or corporate income taxes—or both—thus far in 2021, and there is every reason to believe that more states will follow, if not this year, then undoubtedly in 2022.

States concluded Fiscal Year 2021 with substantially more revenue than most thought possible in the early days of the COVID-19 pandemic. This is true even when looking exclusively at tax or other own-source revenue, and excluding all federal transfers under the CARES Act, the American Rescue Plan Act, or other federal legislation enacted in response to the pandemic. Taxable income grew over the past year, partly due to time-limited federal infusions, but largely because longer-term economic trends continued almost unabated. States emerging from the public health crisis not only with adequate revenue, but in many cases robust growth, recognized an opportunity for tax relief. Many policymakers, moreover, saw it not just as an opportunity but as a necessity, a way of demonstrating their state’s commitment to tax and overall economic competitiveness in an increasingly mobile world.

In early 2020, economic uncertainty reigned, and most state economists understandably prepared for the worst: revenues would plummet and might not recover quickly. States would need to make drastic spending cuts and then eventually raise taxes. State lawmakers responded to these dire economic forecasts by reducing spending, drawing from their rainy day funds, and, in some cases, even increasing taxes by making changes to their corporate income tax base, like California, or by increasing individual income tax rates, like New York.

But as vaccines have become widely accessible in the U.S. this year, many states have recovered quickly, and as states close out their books for fiscal year (FY) 2021, most are finding they are flush with extra cash, or, at the very least, are not experiencing anywhere near the scope of revenue declines they once anticipated.

While one-time federal aid has played a large role in helping states withstand the pandemic, many states’ economies continued growing of their own accord, with income and sales tax collections proving resilient despite the circumstances.

Now that a clearer fiscal picture is emerging, with many states projecting robust continued revenue growth over the next few years, policymakers have responded to their strong fiscal health through a combination of increased saving and increased spending, and, in many states, working to reinforce this competitive advantage by returning extra revenues to taxpayers in a manner that will make their tax code less economically harmful and more attractive in an increasingly competitive national landscape.

As shown in Table 1, each of the states that have enacted income tax rate reductions so far in 2021 have seen general fund tax revenue growth in FY 2021 compared to FY 2019, the last fiscal year before the pandemic.

| The eleven states which cut income tax rates in 2021 have seen significant general fund tax revenue growth between FY 2019 and FY 2021. | |

|---|---|

| Arizona | +21% |

| Idaho | +35% |

| Iowa | +13% |

| Louisiana | +6% |

| Missouri | +17% |

| Montana | +19% |

| Nebraska | +23% |

| New Hampshire | +11% |

| Ohio | +13% |

| Oklahoma | +5% |

| Wisconsin | +9% |

|

Sources: State revenue agencies. Several states only had data through May, not June (end of fiscal year); there, eleven-month figures were used for both fiscal years for comparability. |

|

So far in 2021, 11 states have enacted laws to reduce their income tax rates, with various effective dates. Specifically, 10 states have enacted individual income tax rate reductions and five have enacted corporate income tax rate reductions. In many states, these rate reductions are paired with other structural improvements to their income tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , such as consolidating brackets to create a more neutral structure, eliminating the state deduction for federal taxes paid, or conforming to the federal government’s more generous standard deduction.

One additional state, North Carolina, is also eyeing both individual and corporate income tax rate reductions this year. The Senate-passed budget, S.B. 105, would reduce the state’s flat individual income tax rate from 5.25 to 3.99 percent by 2026 and phase out the corporate income tax altogether by 2028. With a flat individual income tax rate of 3.99 percent, only North Dakota, Pennsylvania, and Indiana, would have a lower top rate. If North Carolina phases out its corporate income tax, it would be one of only three states—the others being South Dakota and Wyoming—to levy neither a corporate income tax nor a statewide gross receipts tax.

States that have not already acted to enhance their tax competitiveness should consider how they, too, can use their strong fiscal condition to make meaningful tax reforms that will help their state compete for business investment and attract and retain new residents, especially as remote work has become more common. And they should eschew the contrary policies of California, which ignored evidence of robust revenue growth to justify adopting structurally unsound measures to increase corporate tax revenues—the state would ultimately run a $76 billion surplus[2]—or of New York, which adopted $4.3 billion in individual and corporate income tax increases even after the much-feared revenue losses failed to materialize.[3]

The following pages provide an overview of the income tax reforms that have been enacted so far this year in 11 states. Policymakers in other states have a decision to make. Will they double down on uncompetitive taxes, like California and New York? Will they do nothing, content with their current tax codes? Or will they, like these states, embrace an opportunity to attract newly mobile employees and employers alike, and position their states for future growth?

Arizona Income Tax Reforms

On June 30, 2021, Gov. Doug Ducey (R) signed into law a budget for fiscal year (FY) 2022 that includes substantial reforms to the state’s individual income tax rates and brackets. These reforms are contained in Senate Bills 1827, 1828, and 1783.[4] These reforms will reduce tax collections by approximately $1.9 billion annually when fully phased in and help restore the state’s competitive standing—especially in contrast with California, from which it has attracted many individuals and businesses—in the wake of a recently enacted ballot measure raising taxes on high earners.[5]

Until these changes were enacted, Arizona had four general individual income tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. with rates ranging from 2.59 to 4.5 percent, with revenue dedicated to the general fund. In addition to those general rates, under Proposition 208, which was narrowly adopted by voters in November 2020, a 3.5 percentage-point surcharge is levied on taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. exceeding $250,000 (single filers) or $500,000 (married filing jointly), with revenue dedicated to education. Prop. 208 is currently being challenged before the Arizona Supreme Court. If it is upheld, the surcharge will be owed on income earned starting January 1, 2021, but the Arizona Department of Revenue thus far has not required employers to withhold the surcharge from affected taxpayers.[6]

Absent the reforms that were enacted in June, Arizona’s top marginal rate would have been 8 percent starting in tax year (TY) 2021. However, Senate Bill 1827 established a cap to prevent the combined top marginal rate from exceeding 4.5 percent when the general rates and the Prop. 208 surcharge are combined. As such, for taxpayers with taxable income exceeding the Prop. 208 threshold, 3.5 percent of that income will be sent to the education fund as required by Prop. 208, while the remaining 1 percent will be sent to the general fund.

Under Senate Bill 1828, the four general fund rates will be consolidated into one, and the rates will be reduced over time. Specifically, the 4.5 percent cap is effective retroactive to January 1, 2021, meaning Arizona’s rates for TY 2021 will match the rates that were in place before Prop. 208 was adopted, although some revenue from the 4.5 percent top marginal rate will go to education while some will go to the general fund.

In TY 2022, the two highest brackets will be eliminated, and the two remaining rates will be reduced from 3.34 to 2.98 percent and from 2.59 to 2.55 percent, respectively. Then, after general fund revenues exceed a specified benchmark of nearly $12.8 billion, the 2.98 percent rate will be reduced to 2.75 percent, and the 2.55 percent rate will be reduced to 2.53 percent. Once revenues exceed a benchmark of nearly $13 billion, the 2.75 percent rate will be eliminated, and the one remaining general fund rate will be reduced from 2.53 to 2.5 percent. Absent the Prop. 208 surcharge, Arizona would—at that point—have a flat individual income tax at a low rate of 2.5 percent, but the 3.5 percent surcharge, subject to the 4.5 percent combined cap, results in a two-rate system, with taxable income below $250,000/$500,000 subject to a 2.5 percent rate and income above that threshold taxed at a rate of 4.5 percent.

A separate law, SB 1783, creates an entity-level tax election option for owners of pass-through businesses, allowing them to pay income taxes under a separate system rather than under the general individual income tax rate schedule if they so choose. Owners of businesses that elect to be taxed at the entity level, such as sole proprietorships, partnerships, limited liability companies (LLCs), and S corporations, would no longer be subject to the Prop. 208 surcharge. The law sets the entity-level tax rate at 3.5 percent for TY 2021, 3 percent for TY 2022, 2.8 percent for TYs 2023 and 2024, and 2.5 percent for TY 2025 and years thereafter.

While intended as a way to give businesses—many of which would otherwise be subject to the top individual income tax rate of 4.5 percent—the benefit of the low 2.5 percent rate that most individual taxpayers will pay under SB 1828, this law attempts to solve one nonneutrality (Prop. 208) with another, ultimately resulting in a system in which higher-income business owners can elect to be taxed at a lower rate than non-business owners making the same amount of income. (It bears noting, however, that businesses that elect to be taxed at the entity level would not be eligible to claim certain general deductions related to non-business activities.)

Table 2 shows Arizona’s individual income tax rates under prior law and under the reforms that were adopted in June.

| Arizona’s Individual Income Tax Rate Schedule, Prior Law and New Law | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Prior Law | New Law | ||||||||||||||||||

| Tax Year 2021 | Tax Year 2021 | Tax Year 2022 | Tax Year 2023* | Tax Year 2024* | |||||||||||||||

| Single | 2.59% | > | $0 | 2.59% | > | $0 | 2.55% | > | $0 | 2.53% | > | $0 | 2.50% | > | $0 | ||||

| 3.34% | > | $27,272 | 3.34% | > | $27,272 | 2.98% | > | $27,272 | 2.75% | > | $27,272 | 4.50% | > | $250,000 | |||||

| 4.17% | > | $54,544 | 4.17% | > | $54,544 | 4.50% | > | $250,000 | 4.50% | > | $250,000 | ||||||||

| 4.50% | > | $163,632 | 4.50% | > | $163,632 | ||||||||||||||

| 8.00% | > | $250,000 | |||||||||||||||||

| Married Filing Jointly | 2.59% | > | $0 | 2.59% | > | $0 | 2.55% | > | $0 | 2.53% | > | $0 | 2.50% | > | $0 | ||||

| 3.34% | > | $54,544 | 3.34% | > | $54,544 | 2.98% | > | $54,544 | 2.75% | > | $54,544 | 4.50% | > | $500,000 | |||||

| 4.17% | > | $109,088 | 4.17% | > | $109,088 | 4.50% | > | $500,000 | 4.50% | > | $500,000 | ||||||||

| 4.50% | > | $327,263 | 4.50% | > | $327,263 | ||||||||||||||

| 8.00% | > | $500,000 | |||||||||||||||||

|

Note: (*) The rate reductions shown for tax years 2023 and 2024 will take effect when revenue triggers are met. Income thresholds are adjusted annually for inflation, but tax year 2021 inflation adjustments were not available as of publication, so inflation-adjusted amounts for tax year 2020 are shown. Rates include the 3.5 percentage-point surcharge on marginal income above $250,000 (single filers) or $500,000 (joint filers). Unlike Arizona’s general income thresholds, the surcharge threshold ($250,000/$500,000) is not adjusted for inflation. The ballot measure that created the surcharge, Proposition 208, takes effect upon proclamation of the governor but is currently being challenged before the Arizona Supreme Court. Sources: Tax Foundation; state tax statutes, forms, and instructions; Bloomberg Tax. |

|||||||||||||||||||

Idaho Income Tax Reforms

On May 10, 2021, Governor Brad Little (R) signed House Bill 380, reducing the state’s flat corporate income tax rate and top marginal individual income tax rate from 6.925 to 6.5 percent while consolidating seven individual income tax brackets into five. These changes are retroactive to January 1, 2021, and will reduce income taxes by approximately $163 million.

Specifically, under H.B. 380, Idaho’s top marginal individual income tax rate and third-lowest rate were both eliminated. The remaining rates were each reduced by 0.125 percentage points, except for the second-lowest rate, which was reduced by 0.025 percentage points.

In addition to these permanent rate reductions, H.B. 380 provides $220 million in one-time income tax relief in the form of a rebate check to year-round residents who filed individual income taxes in 2020. Each eligible filer will receive a rebate check worth 9 percent of the taxpayer’s Idaho individual income taxes paid in 2019, with a minimum per-taxpayer rebate of $50. Table 3 shows Idaho’s individual income tax rates schedule under prior law and under H.B. 380. The corporate rate reduction is a straightforward decline from 6.925 to 6.5 percent

| Idaho’s Individual Income Tax Rate Schedule, Prior Law and H.B. 380 | |||||||

|---|---|---|---|---|---|---|---|

| Prior Law | New Law | ||||||

| Tax Year 2020 | Tax Year 2021 | ||||||

| Single | 1.125% | > | $0 | 1.0% | > | $0 | |

| 3.125% | > | $1,568 | 3.1% | > | $1,568 | ||

| 3.625% | > | $3,136 | 4.5% | > | $4,704 | ||

| 4.625% | > | $4,704 | 5.5% | > | $6,272 | ||

| 5.625% | > | $6,272 | 6.5% | > | $7,840 | ||

| 6.625% | > | $7,840 | |||||

| 6.925% | > | $11,760 | |||||

| Married Filing Jointly | 1.125% | > | $0 | 1.0% | > | $0 | |

| 3.125% | > | $3,136 | 3.1% | > | $3,136 | ||

| 3.625% | > | $6,272 | 4.5% | > | $9,408 | ||

| 4.625% | > | $9,408 | 5.5% | > | $12,544 | ||

| 5.625% | > | $12,544 | 6.5% | > | $15,680 | ||

| 6.625% | > | $15,680 | |||||

| 6.925% | > | $23,520 | |||||

|

Note: Bracket levels adjusted for inflation each year. Inflation-adjusted bracket widths for 2021 not available as of publication, so table reflects 2020 inflation-adjusted bracket widths. Source: Idaho State Tax Commission. |

|||||||

Iowa Income Tax Reforms

Governor Kim Reynolds (R) signed Senate File 619 on June 16, 2021, expediting individual income tax rate reductions that were initially adopted in 2018 by removing the revenue triggers from the previously enacted law. Under the 2018 law (SF 2417 of 2018), Iowa’s nine individual income tax brackets will be consolidated into four, and the top rate will be reduced from 8.53 to 6.5 percent. However, under that legislation, these changes would have taken effect only after both (1) general fund receipts for FY 2022 (or a future year) were at least $8.31 billion and (2) year-over-year general fund revenue growth was at least 4 percent.[7]

As of March 2021, the Iowa Revenue Estimating Conference (REC) estimated general fund receipts for FY 2022 would be nearly $8.39 billion—meeting the first condition—but that year-over-year revenue growth between FY 2021 and FY 2022 would be 3.8 percent, falling just shy of meeting the aggressive second condition necessary for the rate reduction and bracket consolidation to take effect in 2023.[8] Given the otherwise strong fiscal condition Iowa is in, SF 619 removed the revenue triggers to allow the reforms to take effect on January 1, 2023. This change will reduce TY 2023 individual income tax collections by approximately $298 million and deliver on the important tax reforms the state began a few years ago.

In addition to these individual income tax reforms, another important tax change included in SF 619 is the phasing out of the state’s inheritance tax by 20 percent per year starting in 2021, until it is completely phased out for property inherited from decedents dying after January 1, 2025.

Table 4 shows Iowa’s current and future individual income tax rates.

| Iowa’s Individual Income Tax Rate Schedule, Current and Future | |||||||

|---|---|---|---|---|---|---|---|

| Current Rates | Future Rates | ||||||

| Tax Year 2021 | Tax Year 2023 | ||||||

| Single | 0.33% | > | $0 | 4.40% | > | $0 | |

| 0.67% | > | $1,676 | 4.82% | > | $6,000 | ||

| 2.25% | > | $3,352 | 5.70% | > | $30,000 | ||

| 4.140% | > | $6,704 | 6.50% | > | $75,000 | ||

| 5.630% | > | $15,084 | |||||

| 5.960% | > | $25,140 | |||||

| 6.250% | > | $33,520 | |||||

| 7.440% | > | $50,280 | |||||

| 8.530% | > | $75,420 | |||||

| Married Filing Jointly | 0.33% | > | $0 | 4.40% | > | $0 | |

| 0.67% | > | $1,676 | 4.82% | > | $12,000 | ||

| 2.25% | > | $3,352 | 5.70% | > | $60,000 | ||

| 4.140% | > | $6,704 | 6.50% | $150,000 | |||

| 5.630% | > | $15,084 | |||||

| 5.960% | > | $25,140 | |||||

| 6.250% | > | $33,520 | |||||

| 7.440% | > | $50,280 | |||||

| 8.530% | > | $75,420 | |||||

|

Note: For the current rate schedule, inflation-adjusted bracket amounts for tax year 2021 are shown. Future bracket amounts will continue to be adjusted for inflation, but inflation-adjusted bracket widths for 2023 are not yet available. Source: SF 619 (2021). |

|||||||

Louisiana Income Tax Reforms

Louisiana legislators and Gov. Jon Bel Edwards (D) approved a series of bills this year that will result in a variety of pro-growth tax reforms if voters agree to the changes on the ballot this November. First, S.B. 159 would amend the state constitution to shift authority over the state income tax deduction for federal taxes paid (known as “federal deductibility”) to the legislature. Currently, changes to the deduction would require voter approval since the current deduction is written into the state constitution. S.B. 159 would also amend the constitution to cap the top individual income tax rate at 4.75 percent, which would be a reduction from the current top rate of 6 percent.

Separately, if authority over the deduction is given to the legislature, H.B. 278 would eliminate federal deductibility under the individual income tax. Louisiana’s deduction for federal taxes paid is an uncommon deduction that causes the state’s income tax rate to be significantly higher than it would be otherwise, and it makes the state tax code into a mirror of the federal tax code, penalizing activities that the federal code favors, and vice versa. For example, if a taxpayer can reduce his or her federal tax liability through child tax credits or business expense deductions, that taxpayer’s state tax liability increases automatically. House Bill 278 would then use that extra revenue to consolidate the state’s individual income tax brackets and reduce rates starting in TY 2022, as shown in Table 5. With the top marginal individual income tax rate reduced from 6 to 4.25 percent, Louisiana’s top rate would be lower than the rates in neighboring Arkansas and Mississippi.

| Louisiana’s Individual Income Tax Rate Schedule, Current Law and New Law (Subject to Voter Approval) | |||||||

|---|---|---|---|---|---|---|---|

| Current Law | New Law | ||||||

| Tax Year 2021 | Tax Year 2022 | ||||||

| Single | 2.00% | > | $0 | 1.85% | > | $0 | |

| 4.00% | > | $12,500 | 3.50% | > | $12,500 | ||

| 6.00% | > | $50,000 | 4.25% | > | $50,000 | ||

| Married Filing Jointly | 2.00% | > | $0 | 1.85% | > | $0 | |

| 4.00% | > | $25,000 | 3.50% | > | $25,000 | ||

| 6.00% | > | $100,000 | 4.25% | > | $100,000 | ||

|

Source: H.B. 278 (2021). |

|||||||

On the corporate income tax side, House Bill 292 would eliminate federal deductibility under the corporate income tax, consolidate five corporate income tax brackets into three, and reduce the top rate from 8 to 7.5 percent, also effective starting in 2022.

| Louisiana’s Corporate Income Tax Rate Schedule, Current Law and New Law (Subject to Voter Approval) | ||||||

|---|---|---|---|---|---|---|

| Current Law | New Law | |||||

| Tax Year 2021 | Tax Year 2022 | |||||

| 4.00% | > | $0 | 3.50% | > | $0 | |

| 5.00% | > | $25,000 | 5.50% | > | $50,000 | |

| 6.00% | > | $50,000 | 7.50% | > | $150,000 | |

| 7.000% | > | $100,000 | ||||

| 8.000% | > | $200,000 | ||||

|

Source: H.B. 292 (2021). |

||||||

Both the individual and corporate income tax reforms are approximately revenue neutral. These bills also set forth further rate reductions that would take effect in future years subject to tax triggers. Specifically, if the state reaches specified goals for revenue growth, and if the Budget Stabilization Fund balance equals more than 2.5 percent of the previous year’s revenue receipts, further rate reductions will be triggered. The amount by which rates would be reduced would be determined by the amount of growth the state sees. The growth factor that would be used is already part of the state constitution; it is based on personal income growth over a trailing three-year period and is currently roughly 4 percent. These policies, along with a separate effort to centralize administration of local sales taxes, would represent a substantial modernization of Louisiana’s antiquated tax code.

Missouri Income Tax Reforms

When S.B. 153 was signed into law on June 30, 2021, Missouri became the final state with a sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. to adopt an economic nexus law for remote sales tax collections, requiring remote sellers and marketplace facilitators with more than $100,000 in annual sales into Missouri to collect Missouri’s state and local sales taxes starting January 1, 2023. This new law will result in increased sales tax collections in the future, so instead of pocketing the extra revenue, policymakers decided to use their windfall to reduce individual income taxes.

Under S.B. 509, adopted in 2014, tax triggers are currently in place to reduce the top individual income tax rate by one-tenth of 1 percent per year, subject to revenue availability, for a total of five reductions. S.B. 153 builds upon these reforms by allowing two additional reductions, also subject to revenue triggers. While S.B. 509 specified that no reduction would occur in 2024, the new law provides that the top rate will be reduced by 0.1 percent, with no triggers necessary.

If revenue triggers are met each year, Missouri’s individual income tax rates would be reduced as shown in Table 7. While Missouri was late to adopt a sales tax nexus law, policymakers were prudent to take the step—largely disregarded in other states—of using the revenue to reduce taxes elsewhere.

| Missouri’s Projected Top Rate under S.B. 509 (2014) and S.B. 153 (2021) (Subject to Revenue Triggers) | |

|---|---|

| Tax Year | Top Rate |

| 2021 | 5.4% |

| 2022 | 5.3% |

| 2023 | 5.3% |

| 2024 | 5.2% |

| 2025 | 5.1% |

| 2026 | 5.0% |

| 2027 | 4.9% |

| 2028 | 4.8% |

|

Note: Assumes years revenue triggers will be met in line with state projections. Inflation-adjusted bracket widths for 2021 were not available as of publication, so table reflects 2020 inflation-adjusted bracket widths. Source: Missouri Committee on Legislative Research Oversight Division. |

|

Montana Income Tax Reforms

Montana adopted structural reforms to both its individual and corporate income taxes this year, but the individual income tax rate will be reduced while the corporate rate will not. Under S.B. 159, enacted on May 6, 2021, Montana’s top marginal individual income tax rate will be reduced from 6.9 to 6.75 percent on January 1, 2022. This law expires after 2024, but the sunset provision was contingent upon the enactment of S.B. 399, also adopted, which consolidates brackets while reducing the top rate even further to 6.5 percent.

Specifically, S.B. 399, enacted the same day, consolidated seven individual income tax brackets into two, with rates of 4.7 and 6.5 percent, while adopting federal taxable income as the income tax starting point, thereby bringing in the federal standard deduction. Although the lowest rate will rise to 4.7 percent in 2024, conforming to the federal standard deduction in 2025 will yield tax savings for lower-income taxpayers. Importantly, S.B. 399 doubles the bracket widths for married filers, thereby removing the marriage penalty that currently exists in the state’s income tax code.

Under current law, a married couple has income in all seven brackets by $18,700 in taxable income, so increasing the standard deduction from $4,790/$9,580 to federal levels (currently $12,550/$25,100) provides a substantial benefit that more than offsets the elimination of the narrow low-rate brackets in current law even before the elimination of the marriage penaltyA marriage penalty is when a household’s overall tax bill increases due to a couple marrying and filing taxes jointly. A marriage penalty typically occurs when two individuals with similar incomes marry; this is true for both high- and low-income couples. .

| Montana’s Individual Income Tax Rate Schedule, Current Law and New Law | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Current Law | New Law | ||||||||||

| Tax Year 2021 | Tax Years 2022-23 | Tax Year 2024 | |||||||||

| Single | 1.00% | > | $0 | 1.00% | > | $0 | 4.70% | > | $0 | ||

| 2.00% | > | $3,100 | 2.00% | > | $3,100 | 6.50% | > | $20,500 | |||

| 3.00% | > | $5,000 | 3.00% | > | $5,000 | ||||||

| 4.00% | > | $8,400 | 4.00% | > | $8,400 | ||||||

| 5.00% | > | $11,300 | 5.00% | > | $11,300 | ||||||

| 6.00% | > | $14,500 | 6.00% | > | $14,500 | ||||||

| 6.90% | > | $18,700 | 6.75% | > | $18,700 | ||||||

| Married Filing Jointly | 1.00% | > | $0 | 1.00% | > | $0 | 4.70% | > | $0 | ||

| 2.00% | > | $3,100 | 2.00% | > | $3,100 | 6.50% | > | $41,000 | |||

| 3.00% | > | $5,000 | 3.00% | > | $5,000 | ||||||

| 4.00% | > | $8,400 | 4.00% | > | $8,400 | ||||||

| 5.00% | > | $11,300 | 5.00% | > | $11,300 | ||||||

| 6.00% | > | $14,500 | 6.00% | > | $14,500 | ||||||

| 6.90% | > | $18,700 | 6.75% | > | $18,700 | ||||||

|

Bracket levels adjusted for inflation each year. Inflation-adjusted bracket widths for 2021 were not available as of publication, so table reflects 2020 inflation-adjusted bracket widths. Sources: S.B. 159 and S.B. 399 (2021); Bloomberg Tax; Maxwell James and Jared Walczak, “Montana Adopts Individual and Corporate Income Tax Reform.” |

|||||||||||

Nebraska Income Tax Reforms

Gov. Pete Ricketts (R) signed Legislative Bill 432 on May 26, 2021, reducing the higher of the state’s two marginal corporate income tax rates. Specifically, the top marginal rate will drop from 7.81 to 7.5 percent on January 1, 2022, and to 7.25 percent in January 2023.

The law also expresses the intent of the Unicameral legislature to pass additional legislation reducing the rate to 7 percent for TY 2024 and to 6.84 percent for TY 2025, though these reductions are not guaranteed without future legislative action. A fiscal note estimates the enacted rate reductions will reduce general fund revenues by $1.9 million in FY 2022 and $9.1 million in FY 2023.[9] If the reductions to 7 and 6.84 percent are enacted as planned, these changes would reduce revenues by $19.8 million in FY 2024 and $26 million in FY 2025.

Legislative Bill 432 does not change the state’s lower marginal corporate income tax rate of 5.58 percent, which applies to the first $100,000 of taxable corporate income. Progressivity has little meaning in corporate income taxation, because the size of a company has little bearing on the wealth of its owners or investors, which is why many states—but not Nebraska—have single-rate corporate income taxes even if they impose graduated rate individual income taxes.

| Nebraska’s Corporate Income Tax Rate Schedule, Current Law, New Law, and Proposed | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Current Law | New Law | Proposed Future Reductions | ||||||||||||||||

| Tax Year 2021 | Tax Year 2022 | Tax Year 2023 | Tax Year 2024 (Proposed) | Tax Year 2025 (Proposed) | ||||||||||||||

| 5.58% | > | $0 | 5.58% | > | $0 | 5.58% | > | $0 | 5.58% | > | $0 | 5.58% | > | $0 | ||||

| 7.81% | > | $100,000 | 7.50% | > | $100,000 | 7.25% | > | $100,000 | 7.00% | > | $100,000 | 6.84% | > | $100,000 | ||||

|

Source: Nebraska Department of Revenue; LB432 (2021). |

||||||||||||||||||

New Hampshire Income Tax Reforms

Governor Chris Sununu (R) signed H.B. 1 and H.B. 2 on June 25, 2021, making significant changes to the tax code as part of the biennial budget. Most notably, the state will phase out its tax on interest and dividends income by 1 percentage point per year, starting in TY 2023, until it is fully repealed by 2027.[10] This will make New Hampshire the ninth state in the U.S. to completely forgo an individual income tax. Currently, New Hampshire does not impose a tax on wage or salary income but does levy an income tax on individuals’ investment income of 5 percent, which is levied when a taxpayer has adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” from interest and dividends exceeding $2,400 (single filers) or $4,800 (joint filers).

In addition to this individual income tax phaseout, New Hampshire will reduce its major business taxes, including both the Business Profits Tax (BPT) and the Business Enterprise Tax (BET). The BPT, which is New Hampshire’s corporate income tax, will see its rate reduced from 7.7 to 7.6 percent starting in TY 2022. The BET, which is similar to a value-added tax (VAT), will see its rate reduced from 0.6 to 0.55 percent in 2022, with the filing threshold increased such that the tax will apply only when businesses have gross receipts exceeding $250,000, up from $200,000.

Under current law, revenue triggers are in place that would reduce the BPT and BET rates if certain conditions are met, but the trigger design makes it unlikely that rate reductions would occur without significant revenue growth. Under previous law, if the amount of combined unrestricted general and education trust fund revenue is 6 percent or more below official revenue estimates, the BPT rate increases to 7.9 percent and the BET rate increases to 0.675 percent. If that same revenue is 6 percent or more above estimates, the BPT and BET rates decrease to 7.5 and 0.5 percent, respectively. The same provision was in place for TY 2021 but was not triggered in either direction. HB 2 removes these triggers and adopts lower, fixed rates.

Table 10 shows how New Hampshire’s interest and dividends tax will phase out by 2027.

| New Hampshire’s Interest and Dividends Tax Rates Under New Law | |

|---|---|

| Year | Rate |

| 2021-2022 | 5% |

| 2023 | 4% |

| 2024 | 3% |

| 2025 | 2% |

| 2026 | 1% |

| 2027 | No tax |

|

Source: H.B. 2 (2021); Bloomberg Tax. |

|

Ohio Income Tax Reforms

On July 1, 2021, Governor Mike DeWine (R) signed H.B. 110, the budget for the FY 2022-23 biennium. The law provides substantial tax relief for Ohioans by consolidating five individual income tax brackets into four and reducing each of the rates retroactive to January 1, 2021.[11] Specifically, the law reduces the top marginal rate from 4.797 to 3.99 percent, and the other rates are reduced by 3 percent across the board. The income level at which the first tax rate kicks in is also increased from $22,150 to $25,000, providing targeted tax relief at the lower end of the income spectrum.[12]

Also included in the budget is an option for Ohioans to receive a refund for municipal income taxes withheld in 2021 to jurisdictions to which they did not commute during the pandemic. This provision was included in the budget as a partial reversal of H.B. 197, enacted in March 2020, which established that for municipal income tax purposes, work performed at a temporary worksite due to the COVID-19 pandemic would be treated as if it had been performed at the normal worksite.[13] As such, those who typically commuted into a downtown office before the pandemic were subject to that municipality’s income taxes throughout 2020 even if they worked remotely from their home outside that municipality throughout the pandemic. The law as enacted in 2020 stands on legally precarious ground, as the Ohio Constitution prohibits municipalities from taxing the income of individuals who neither live nor work in the taxing jurisdiction and has been the subject of litigation.

Table 11 shows the income tax changes adopted in H.B. 110.

| Ohio’s Individual Income tax Rates and Brackets, Prior Law and New Law | |||||||

|---|---|---|---|---|---|---|---|

| Prior Law | New Law | ||||||

| Tax Year 2021 | Tax Year 2021 | ||||||

| Single | 0.000% | > | $0 | 0.000% | > | $0 | |

| 2.850% | > | $22,151 | 2.765% | > | $25,000 | ||

| 3.326% | > | $44,251 | 3.226% | > | $44,251 | ||

| 3.802% | > | $88,451 | 3.688% | > | $88,451 | ||

| 4.413% | > | $110,651 | 3.990% | > | $110,651 | ||

| 4.797% | > | $221,301 | |||||

| Married Filing Jointly | 0.000% | > | $0 | 0.000% | > | $0 | |

| 2.850% | > | $22,151 | 2.765% | > | $25,000 | ||

| 3.326% | > | $44,251 | 3.226% | > | $44,251 | ||

| 3.802% | > | $88,451 | 3.688% | > | $88,451 | ||

| 4.413% | > | $110,651 | 3.990% | > | $110,651 | ||

| 4.797% | > | $221,301 | |||||

|

Note: Bracket levels typically adjusted for inflation every year, but updated bracket amounts for 2021 were not available as of publication, so bracket widths for tax year 2020 are shown (prior law rate schedule). H.B. 110 suspends inflation indexing for tax year 2021. Sources: Ulrik Boesen, “Ohio Lawmakers Agree on Income Tax Cuts and Remote Work Tax Relief;” H.B. 110 (2021). |

|||||||

Oklahoma Tax Reforms

House Bills 2960, 2962, and 2963 were signed into law on May 21, 2021, reducing individual and corporate income tax rates in the Sooner State starting January 1, 2022.[14] H.B. 2962 will reduce the state’s individual income tax rates by 0.25 percentage points across the board. The top rate will therefore be reduced from 5 to 4.75 percent, putting it on track to be the seventh lowest top marginal rate in TY 2022 among states that levy an individual income tax. H.B. 2962 also restores the refundability of the state’s earned income tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. (EITC), which was made nonrefundable in 2016.[15] These individual income tax changes are expected to reduce income tax collections by $237 million in FY 2023.[16]

Lawmakers also approved H.B. 2960, which will reduce the corporate income tax rate from 6 to 4 percent. This will result in Oklahoma tying Missouri for the second-lowest corporate income tax rate in the nation, after North Carolina (2.5 percent), when the rates become effective on January 1, 2022. This new rate will also be applied to pass-through businesses as a result of H.B. 2963. This rate reduction is expected to reduce tax collections by $110 million in FY 2023. The following table shows individual income tax rate reductions; the corporate rate reduction simply involves a change in the flat rate.

| Oklahoma’s Individual Income Tax Rates, Prior Law and New Law | |||||||

|---|---|---|---|---|---|---|---|

| Current Law | New Law | ||||||

| Tax Year 2021 | Tax Year 2022 | ||||||

| Single | 0.50% | > | $0 | 0.25% | > | $0 | |

| 1.00% | > | $1,000 | 0.75% | > | $1,000 | ||

| 2.00% | > | $2,500 | 1.75% | > | $2,500 | ||

| 3.00% | > | $3,750 | 2.75% | > | $3,750 | ||

| 4.00% | > | $4,900 | 3.75% | > | $4,900 | ||

| 5.00% | > | $7,200 | 4.75% | > | $7,200 | ||

| Married Filing Jointly | 0.50% | > | $0 | 0.25% | > | $0 | |

| 1.00% | > | $2,000 | 0.75% | > | $2,000 | ||

| 2.00% | > | $5,000 | 1.75% | > | $5,000 | ||

| 3.00% | > | $7,500 | 2.75% | > | $7,500 | ||

| 4.00% | > | $9,800 | 3.75% | > | $9,800 | ||

| 5.00% | > | $12,200 | 4.75% | > | $12,200 | ||

|

Source: H.B. 2962 (2021); Bloomberg Tax. |

|||||||

Wisconsin Tax Reforms

On July 8, 2021, Gov. Tony Evers (D) approved the biennial budget for FYs 2022-23 (A.B. 68) with partial vetoes. One of the approved provisions in the budget is a reduction of the second-highest individual income tax rate from 6.27 to 5.3 percent, retroactive to January 1, 2021. At 6.27 percent, Wisconsin’s penultimate individual income tax rate was higher than the top marginal rates in 23 states that levy an individual income tax. Kicking in at just over $24,000 in taxable income for single filers and $32,000 for married couples, Wisconsin’s second-highest rate affects the vast majority of the state’s taxpayers, with most paying more in income taxes to Wisconsin than they would with the same amount of income in most other states.

While the rate reduction is retroactive to January 1, 2021, the governor vetoed a technical provision of the budget that would have directed the Wisconsin Department of Revenue to update the state’s individual income tax withholdingWithholding is the income an employer takes out of an employee’s paycheck and remits to the federal, state, and/or local government. It is calculated based on the amount of income earned, the taxpayer’s filing status, the number of allowances claimed, and any additional amount of the employee requests. tables to reflect the change beginning January 1, 2022.[17] Until the Department updates the state’s income tax withholding tables, taxes will continue to be withheld from taxpayers’ paychecks using the 6.27 percent rate, a highly unusual move that will result in taxpayers providing what is essentially an interest-free loan to the government of approximately $700 million each year of the biennium. While taxpayers will see the tax relief in the form of a refund when they file their tax returns each spring, they will pay more than they legally owe throughout each year until the Department updates the withholding tables to reflect the change.

| Wisconsin’s Individual Income Tax Rates, Prior Law and New Law | |||||||

|---|---|---|---|---|---|---|---|

| Prior Law | New Law | ||||||

| Tax Year 2021 | Tax Year 2021 | ||||||

| Single | 3.54% | > | $0 | 3.54% | > | $0 | |

| 4.65% | > | $12,120 | 4.65% | > | $12,120 | ||

| 6.27% | > | $24,250 | 5.30% | > | $24,250 | ||

| 7.65% | > | $266,930 | 7.65% | > | $266,930 | ||

| Married Filing Jointly | 3.54% | > | $0 | 3.54% | > | $0 | |

| 4.65% | > | $16,160 | 4.65% | > | $16,160 | ||

| 6.27% | > | $32,330 | 5.30% | > | $32,330 | ||

| 7.65% | > | $355,910 | 7.65% | > | $355,910 | ||

|

Note: Income tax brackets adjusted annually for inflation. Inflation-adjusted amounts for tax year 2021 are shown. Sources: AB 68 (2021 Wisconsin Act 58); Wisconsin Department of Revenue, “Worksheet for Employee Witholding Agreement.” |

|||||||

Conclusion

As final state revenue figures come in for FY 2021, many states are finding they are in a much healthier position than they ever would have anticipated this time last year. Eleven states have responded by reducing income tax rates and making related structural reforms as they strive to solidify a competitive advantage in an increasingly competitive national landscape. Other states finding they are in a strong fiscal position ought to consider how they, too, can return extra revenue to taxpayers in a manner that simultaneously improves their tax structure to make it more competitive for years, and even decades, to come.

[1] The authors would like to thank Jeremiah Nguyen for his valuable research contributions.

[2] Kevin Yamamura, “California has a staggering $75.7B budget surplus,” Politico, May 10, 2021, https://www.politico.com/states/california/story/2021/05/10/california-has-a-staggering-757b-budget-surplus-1381195.

[3] Jared Walczak, “14.8% Individual Income Tax and 16.1% Corporate Income Tax Coming To New York City?” Tax Foundation, Apr. 6, 2021, https://www.taxfoundation.org/new-york-city-tax-budget/.

[4] Katherine Loughead, “What’s in Arizona’s Tax Reform Package?” Tax Foundation, July 1, 2021, https://www.taxfoundation.org/arizona-tax-reform/.

[5] Office of the Governor Doug Ducey, “Primer: Governor Ducey, Legislature Advance Reform Agenda,” July 12, 2021, https://www.azgovernor.gov/governor/news/2021/07/primer-governor-ducey-legislature-advance-reform-agenda.

[6] EY, “Employers Not Required to Withhold New Surcharge from High Income Individuals; Arizona Releases State Withholding Form A-4,” Jan. 21, 2021, https://taxnews.ey.com/news/2021-0146-employers-not-required-to-withhold-new-surcharge-from-high-income-individuals-arihttps://taxnews.ey.com/news/2021-0146-employers-not-required-to-withhold-new-surcharge-from-high-income-individuals-arizona-releases-state-withholding-form-a-4zona-releases-state-withholding-form-a-4.

[7] Jared Walczak, “What’s in Iowa’s Tax Reform Package,” Tax Foundation, May 9, 2018, https://www.taxfoundation.org/whats-iowa-tax-reform-package/.

[8] Iowa Legislative Services Agency, “Fiscal Note: SF 619 – Taxation and Other Provisions,” June 28, 2021, https://www.legis.iowa.gov/legislation/BillBook?ga=89&ba=sf619.

[9] Austin Ligenza, “LB 432 Fiscal Note,” Nebraska Legislative Fiscal Office, May 17, 2021, https://www.nebraskalegislature.gov/FloorDocs/107/PDF/FN/LB432_20210518-113236.pdf.

[10] Janelle Cammenga, “New Hampshire Closes in on Tax Cuts to Enhance State’s Competitive Advantage,” Tax Foundation, June 23, 2021, https://www.taxfoundation.org/new-hampshire-no-income-tax/.

[11] Ulrik Boesen, “Ohio Lawmakers Agree on Income Tax Cuts and Remote Work Tax Relief,” Tax Foundation, June 30, 2021, https://www.taxfoundation.org/ohio-budget-tax-cuts/.

[12] Paul Williams, “Ohio Enacts Budget With $1.6B Tax Cuts, Teleworker Refunds,” Law360, July 1, 2021, https://www.law360.com/tax-authority/articles/1399539/ohio-enacts-budget-with-1-6b-tax-cuts-teleworker-refunds-.

[13] Ulrik Boesen, “Non-Profit Files Lawsuit over Withholding Requirements in Ohio,” Tax Foundation, July 10, 2020, https://www.taxfoundation.org/non-profit-files-lawsuit-over-withholding-requirements-in-ohio/.

[14] Janelle Cammenga, “Oklahoma Passed Corporate and Individual Income Tax Reductions,” Tax Foundation, May 25, 2021, https://www.taxfoundation.org/oklahoma-tax-bill-budget/.

[15] Carolina Vargas, “State to Reduce Corporate, Individual Income Tax Rates,” Tax Notes, May 31, 2021, https://www.taxnotes.com/tax-notes-state/legislation-and-lawmaking/state-reduce-corporate-individual-income-tax-rates/2021/05/31/67z5d.

[16] Emily McPherson, “Bill Summary: HB 2962,” Oklahoma House of Representatives, May 17, 2021, http://webserver1.lsb.state.ok.us/cf_pdf/2021-22%20SUPPORT%20DOCUMENTS/BILLSUM/House/HB2962%20FULLPCS1%20BILLSUM.PDF.

[17] Office of Gov. Tony Evers, “Gov. Evers 2021-23 Veto Message,” July 8, 2021, 15, https://docs.legis.wisconsin.gov/2021/related/veto_messages/2021_wisconsin_act_58.pdf.

Share this article