Individual income taxes are a major source of state government revenue, accounting for 33 percent of state tax collections in fiscal year 2023, the latest year for which data are available. Their significance in public policy is further enhanced by individuals being actively responsible for filing their income taxes, in contrast to the indirect payment of sales and excise taxes.

Forty-two states levy individual income taxes. Forty-one taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. wage and salary income. Washington only taxes capital gains income. Eight states, including New Hampshire, which repealed its interest and dividends tax in 2025, levy no individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. at all.

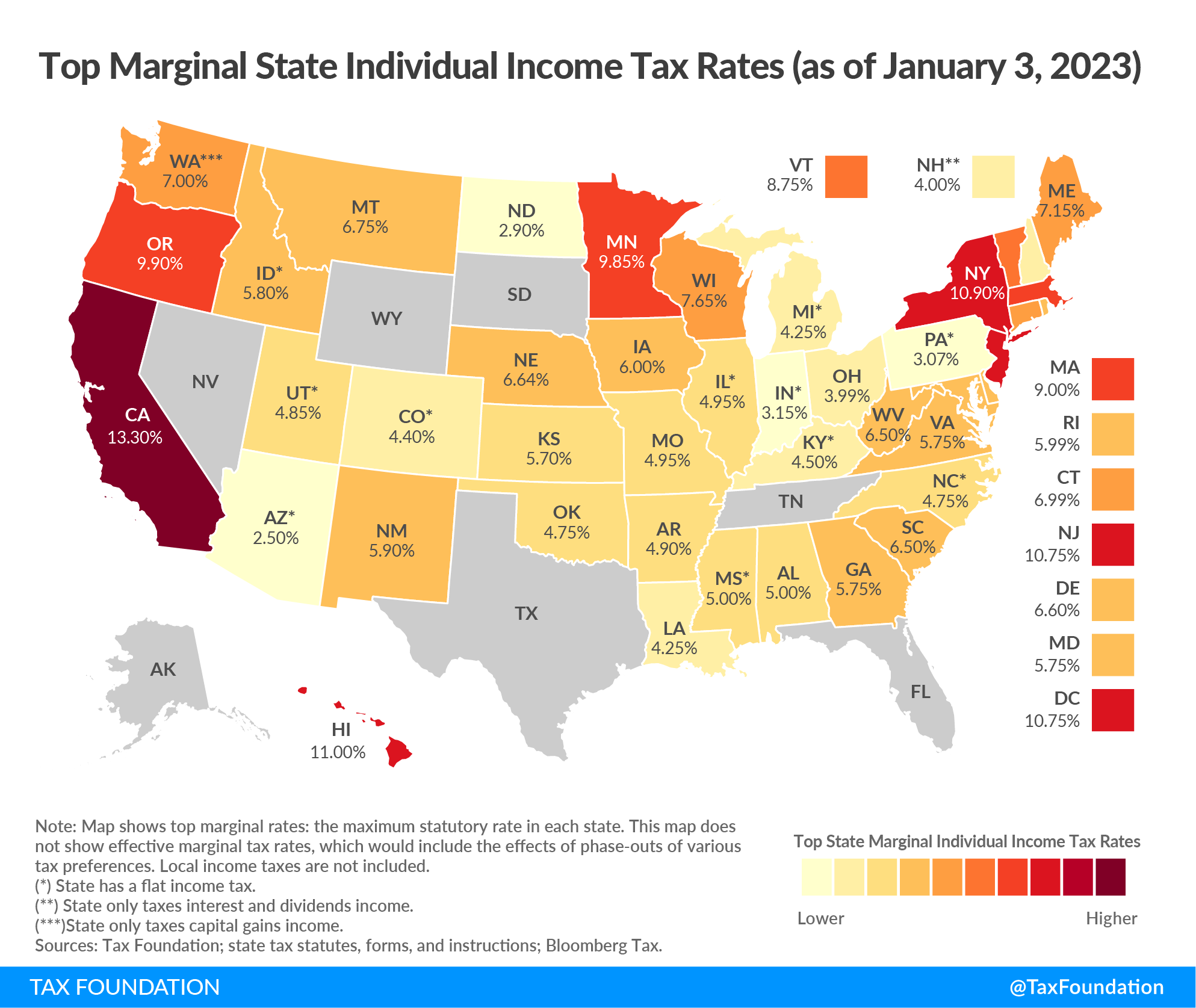

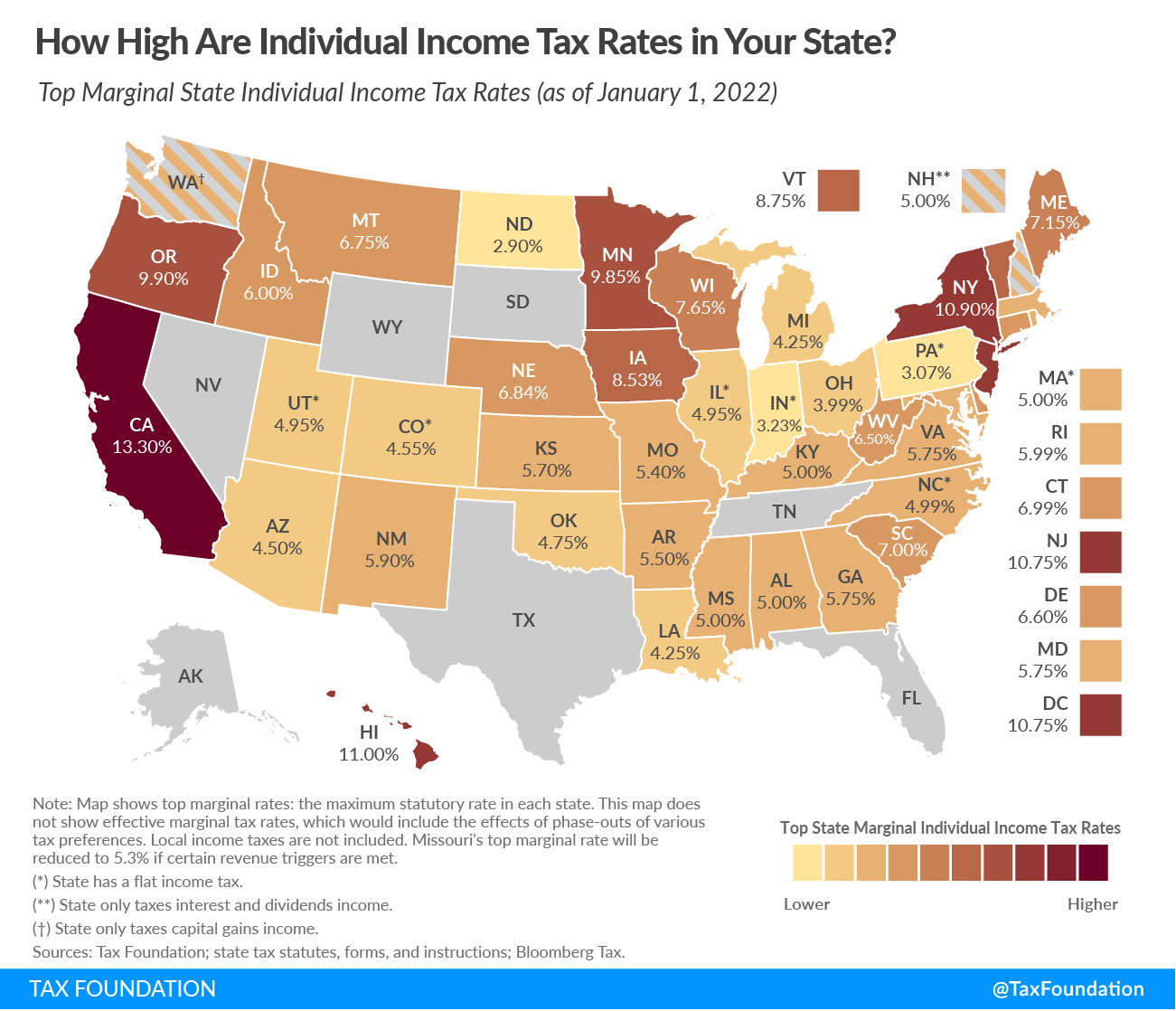

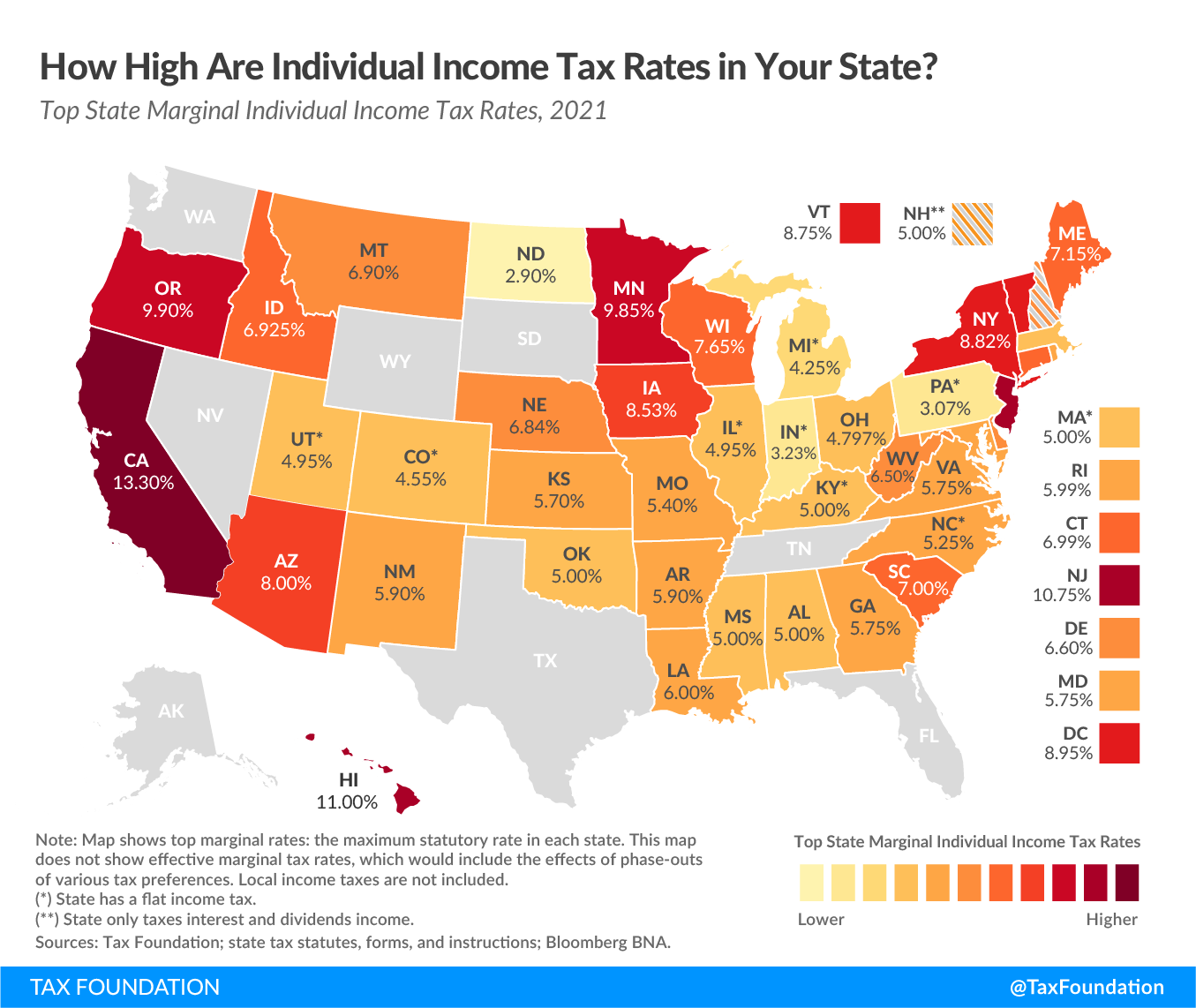

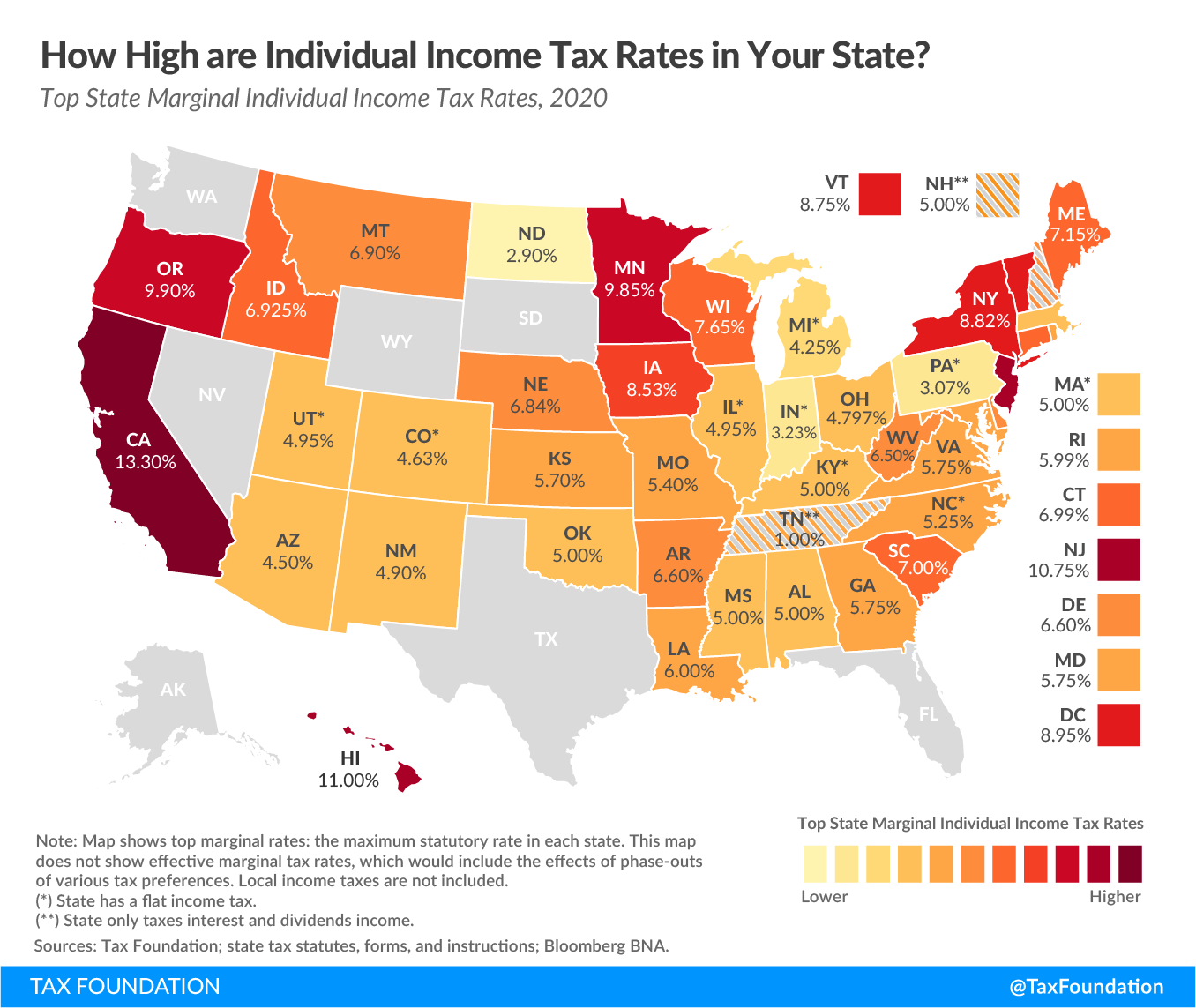

Of those states taxing wages, 14 have single-rate tax structures, with one rate applying to all taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. . Conversely, 27 states and the District of Columbia levy graduated-rate income taxes, with the number of brackets varying widely by state. Currently, six states—Arkansas, Kansas, Massachusetts, Montana, North Dakota, and Ohio—have a two-bracket income tax system. At the other end of the spectrum, Hawaii has 12 brackets. Top marginal rates span from 2.5 percent in Arizona and North Dakota to 13.3 percent in California. (California also imposes a 1.1 percent payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. on wage income, bringing the all-in top rate to 14.4 percent as of 2024.)

In some states, a large number of brackets are clustered within a narrow income band. For example, Virginia’s taxpayers reach the state’s fourth and highest bracket at $17,000 in taxable income. In other states, the top rate kicks in at a much higher level of marginal income. For example, the top rate kicks in at or above $1 million in California (when the “millionaire’s tax” surcharge is included), Massachusetts, New Jersey, New York, and the District of Columbia.

States’ approaches to income taxes vary in other details as well. Some states double their single-filer bracket widths for married filers to avoid imposing a “marriage penaltyA marriage penalty is when a household’s overall tax bill increases due to a couple marrying and filing taxes jointly. A marriage penalty typically occurs when two individuals with similar incomes marry; this is true for both high- and low-income couples. .” Some states index tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. , exemptions, and deductions for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. , while many others do not. Some states tie their standard deductions and personal exemptions to the federal tax code, while others set their own or offer none at all.

The federal Tax Cuts and Jobs Act of 2017 (TCJA) increased the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. Taxpayers who take the standard deduction cannot also itemize their deductions; it serves as an alternative. (set at $15,000 for single filers and $30,000 for joint filers in 2025) while suspending the personal exemption by reducing it to $0 through 2025. Most states use the federal tax code as the starting point for their own income taxes, but states vary in their approaches to bringing in the federal standard deduction and (currently suspended) personal exemption. Some states are conformed to out-of-date versions of the Internal Revenue Code (IRC), with California, which uses a 2015 (pre-TCJA) conformity date, as the most extreme case. Even with up-to-date conformity, however, some states conform to the federal standard deduction or personal exemption (either by using federal taxable income as a starting point or by expressly linking to the federal deduction and exemption levels), while others decouple from federal levels and maintain their own deduction and exemption amounts. Even absent conformity, some states chose to raise their own deductions and exemptions post-TCJA, which was particularly appropriate given the base-broadening nature of the federal law, some of which flowed through to state tax codes.

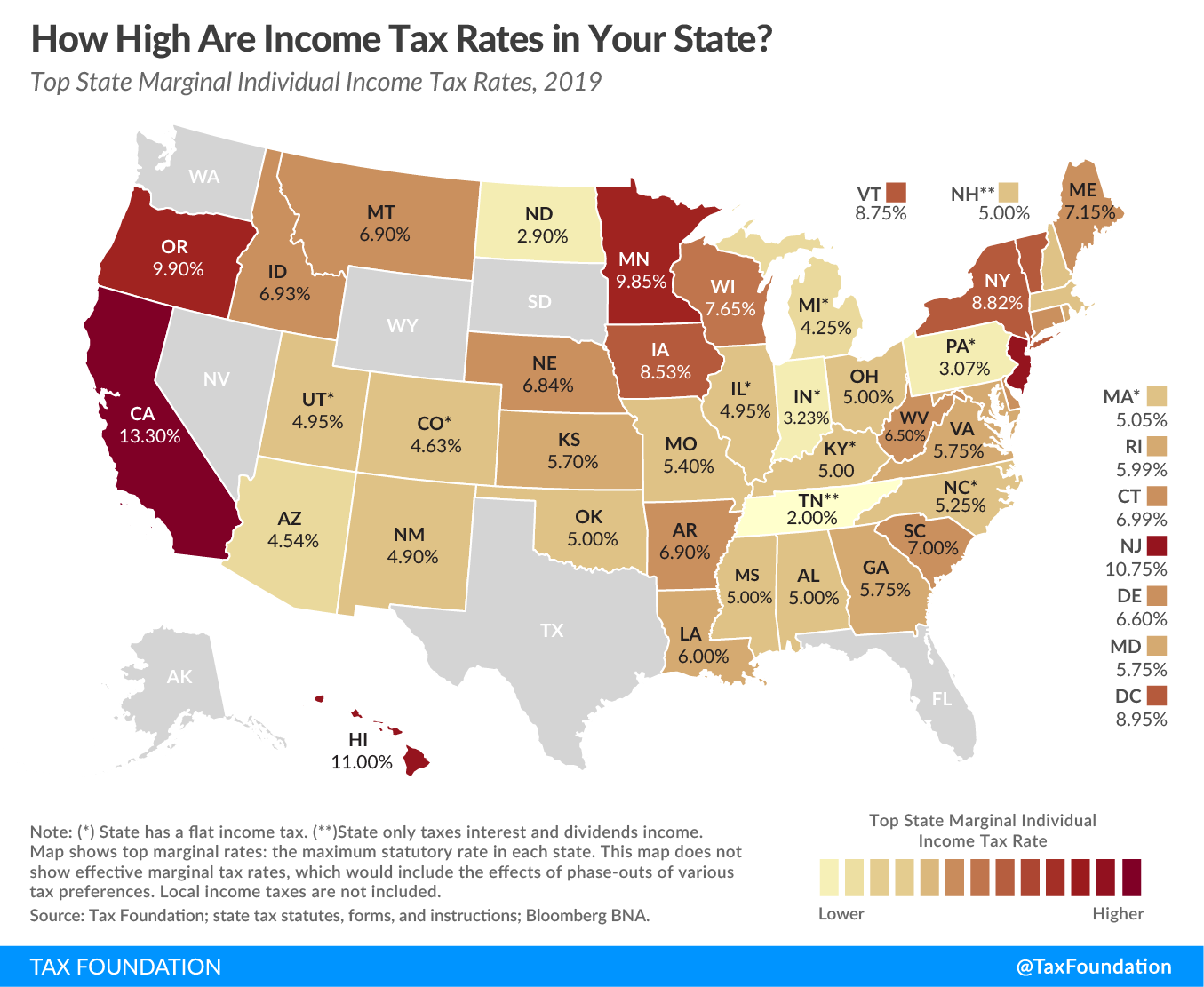

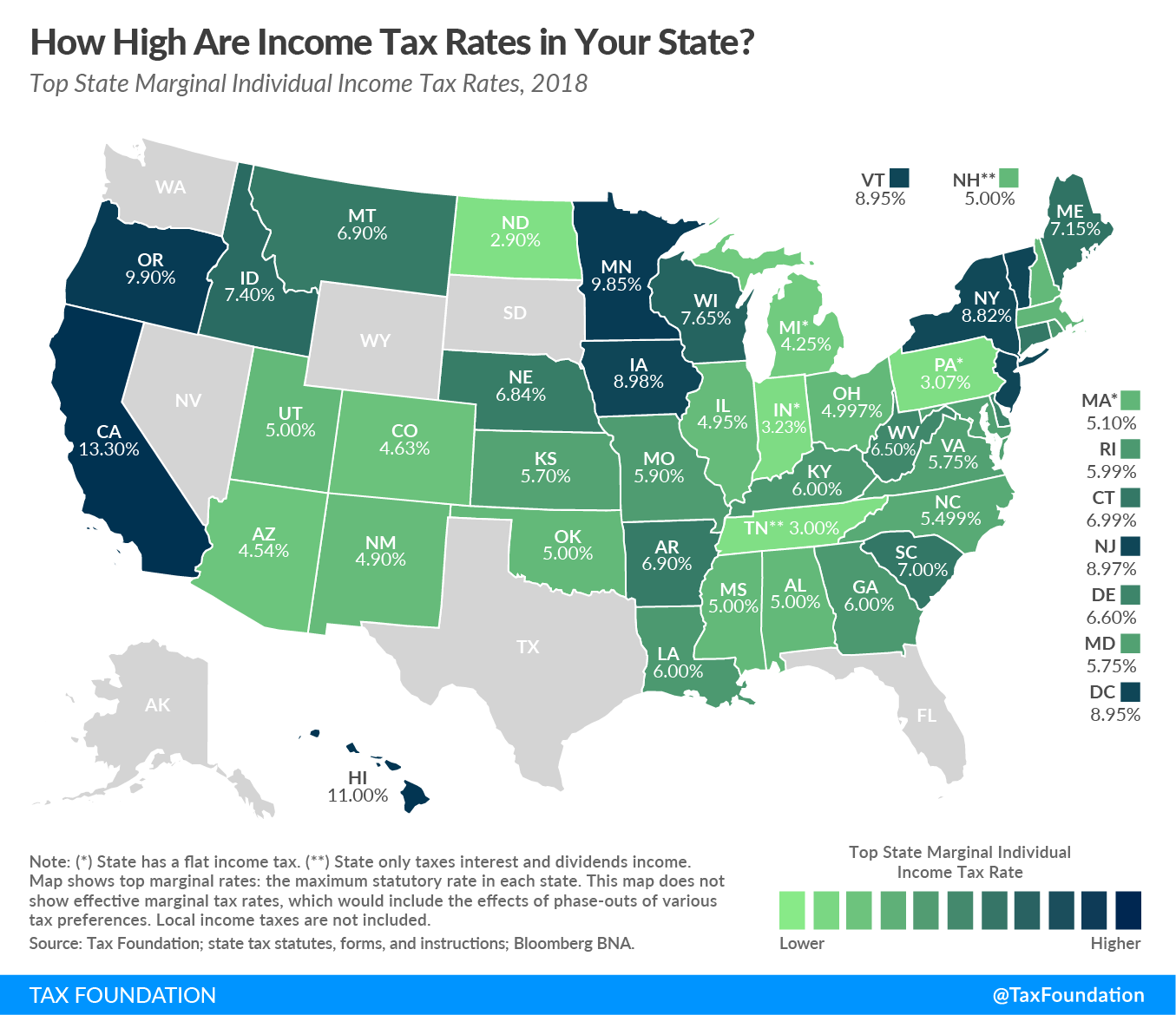

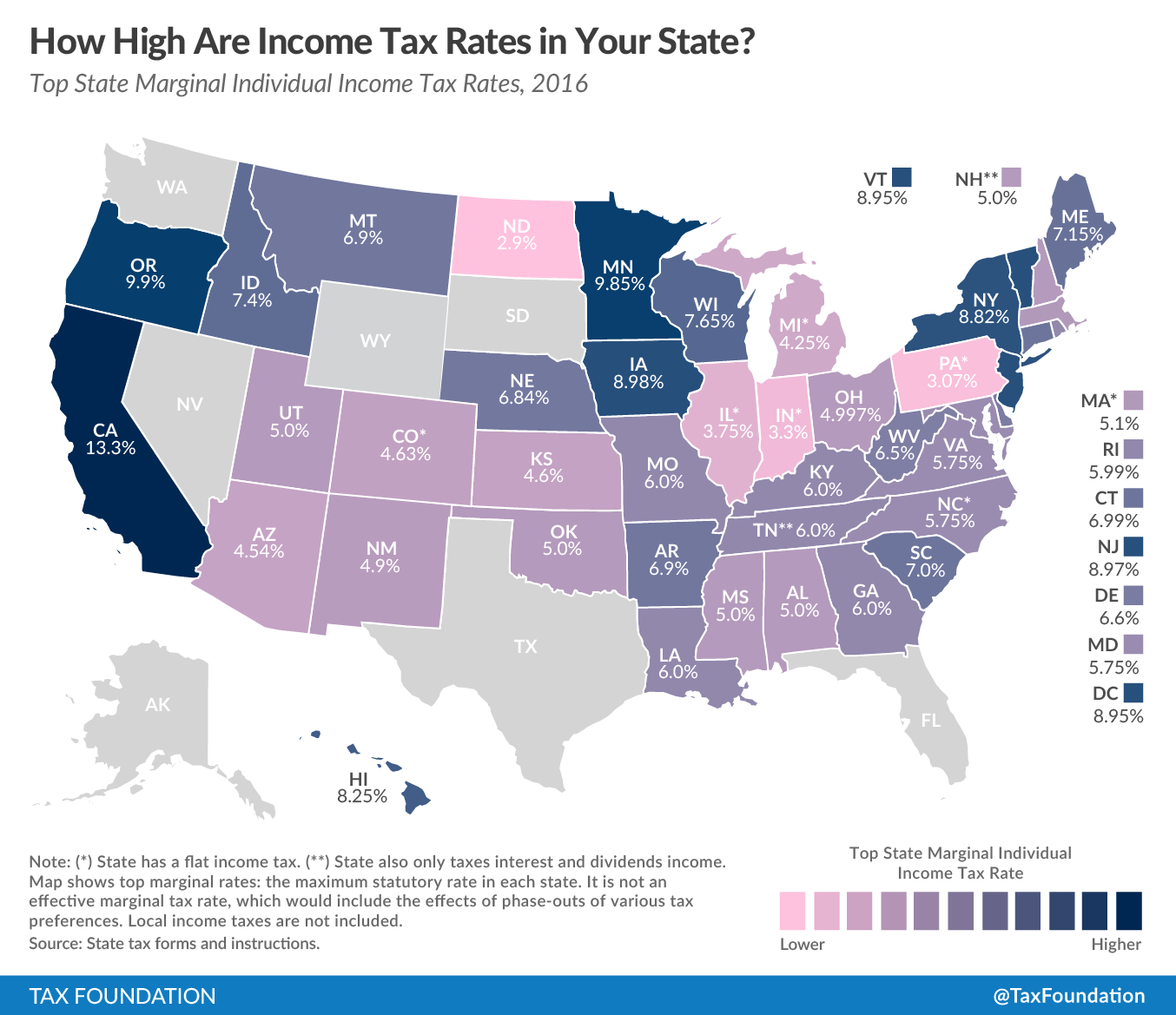

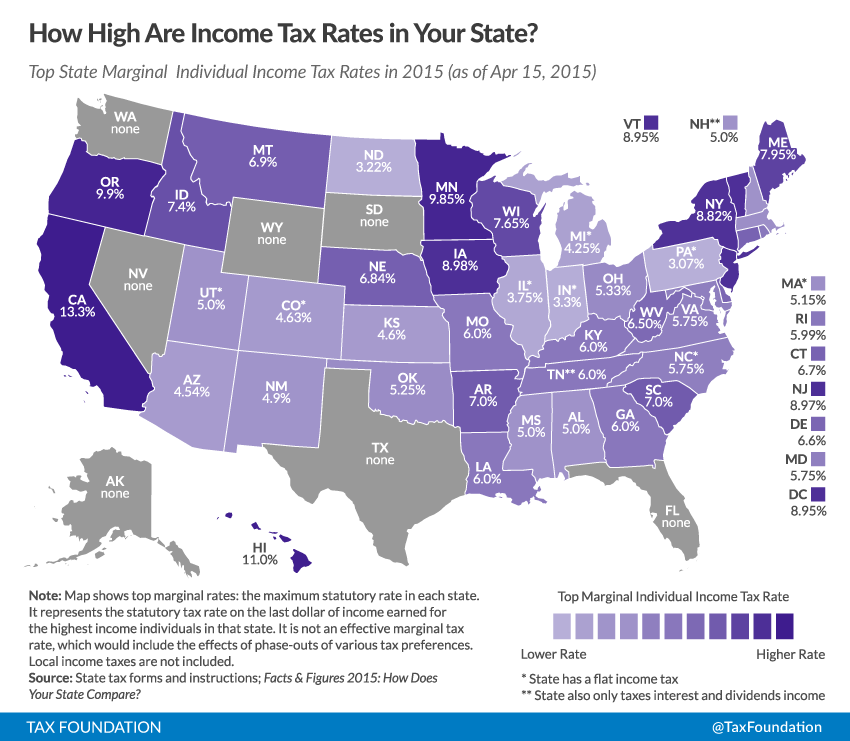

In the following tables, we have compiled the most up-to-date data available on state individual income tax rates, brackets, standard deductions, and personal exemptions for both single and joint filers. Following the tables, we document notable individual income tax changes implemented in 2025. The historic maps appear as they were originally published early in the applicable tax year; they have not been updated for changes enacted in those years that were retroactively applicable as of the beginning of those tax years. The historic tables, however, have been updated to account for retroactive changes.

Income Tax Structures by State

2025 State Individual Income Tax Structures

| States with No Income Tax | States with a Flat Income Tax | States with a Graduated-Rate Income Tax |

|---|---|---|

| Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming | Arizona, Colorado, Georgia, Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Michigan, Mississippi, North Carolina, Pennsylvania, Utah, Washington* | Alabama, Arkansas, California, Connecticut, Delaware, Hawaii, Kansas, Maine, Maryland, Massachusetts, Minnesota, Missouri, Montana, Nebraska, New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, Vermont, Virginia, West Virginia, Wisconsin, Washington DC |

Source: State tax statutes, forms, and instructions; Tax Foundation.

2025 State Income Tax Rates and Brackets

State Individual Income Tax Rates and Brackets, as of January 1, 2025

| State | Single Filer (Rates) | Single Filer (Brackets) | Married Filing Jointly (Rates) | Married Filing Jointly (Brackets) | Standard Deduction (Single) | Standard Deduction (Couple) | Personal Exemption (Single) | Personal Exemption (Couple) | Personal Exemption (Dependent) | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alabama (a, b, c) | 2.00% | > | $0 | 2.00% | > | $0 | $3,000 | $8,500 | $1,500 | $3,000 | $1,000 |

| — Alabama | 4.00% | > | $500 | 4.00% | > | $1,000 | |||||

| — Alabama | 5.00% | > | $3,000 | 5.00% | > | $6,000 | |||||

| Alaska | none | none | n.a. | n.a. | n.a. | n.a. | n.a. | ||||

| Arizona (e, f, u) | 2.50% | > | $0 | 2.50% | > | $0 | $15,000 | $30,000 | n.a. | n.a. | $100 credit |

| Arkansas (d, g, h, j, kk) | 2.00% | > | $0 | 2.00% | > | $0 | $2,410 | $4,820 | $29 credit | $58 credit | $29 credit |

| — Arkansas | 3.90% | > | $4,500 | 3.90% | > | $4,500 | |||||

| California (a, h, j, k, l, m, n, nn) | 1.00% | > | $0 | 1.00% | > | $0 | $5,540 | $11,080 | $149 credit | $298 credit | $461 credit |

| — California | 2.00% | > | $10,756 | 2.00% | > | $21,512 | |||||

| — California | 4.00% | > | $25,499 | 4.00% | > | $50,998 | |||||

| — California | 6.00% | > | $40,245 | 6.00% | > | $80,490 | |||||

| — California | 8.00% | > | $55,866 | 8.00% | > | $111,732 | |||||

| — California | 9.30% | > | $70,606 | 9.30% | > | $141,732 | |||||

| — California | 10.30% | > | $360,659 | 10.30% | > | $721,318 | |||||

| — California | 11.30% | > | $432,787 | 11.30% | > | $865,574 | |||||

| — California | 12.30% | > | $721,314 | 12.30% | > | $1,000,000 | |||||

| — California | 13.30% | > | $1,000,000 | 13.30% | > | $1,442,628 | |||||

| Colorado (a, o) | 4.40% | > | $0 | 4.40% | > | $0 | $15,000 | $30,000 | n.a. | n.a. | n.a. |

| Connecticut (i, p, q, r) | 2.00% | > | $0 | 2.00% | > | $0 | n.a. | n.a. | $15,000 | $24,000 | $0 |

| — Connecticut | 4.50% | > | $10,000 | 4.50% | > | $20,000 | |||||

| — Connecticut | 5.50% | > | $50,000 | 5.50% | > | $100,000 | |||||

| — Connecticut | 6.00% | > | $100,000 | 6.00% | > | $200,000 | |||||

| — Connecticut | 6.50% | > | $200,000 | 6.50% | > | $400,000 | |||||

| — Connecticut | 6.90% | > | $250,000 | 6.90% | > | $500,000 | |||||

| — Connecticut | 6.99% | > | $500,000 | 6.99% | > | $1,000,000 | |||||

| Delaware (a, h, m, s) | 2.20% | > | $2,000 | 2.20% | > | $2,000 | $3,250 | $6,500 | $110 credit | $220 credit | $110 credit |

| — Delaware | 3.90% | > | $5,000 | 3.90% | > | $5,000 | |||||

| — Delaware | 4.80% | > | $10,000 | 4.80% | > | $10,000 | |||||

| — Delaware | 5.20% | > | $20,000 | 5.20% | > | $20,000 | |||||

| — Delaware | 5.55% | > | $25,000 | 5.55% | > | $25,000 | |||||

| — Delaware | 6.60% | > | $60,000 | 6.60% | > | $60,000 | |||||

| Florida | none | none | n.a. | n.a. | n.a. | n.a. | n.a. | ||||

| Georgia | 5.39% | > | $0 | 5.39% | > | $0 | $12,000 | $24,000 | n.a. | n.a. | $4,000 |

| Hawaii (m, t) | 1.40% | > | $0 | 1.40% | > | $0 | $4,400 | $8,800 | $1,144 | $2,288 | $1,144 |

| — Hawaii | 3.20% | > | $9,600 | 3.20% | > | $19,200 | |||||

| — Hawaii | 5.50% | > | $14,400 | 5.50% | > | $28,800 | |||||

| — Hawaii | 6.40% | > | $19,200 | 6.40% | > | $38,400 | |||||

| — Hawaii | 6.80% | > | $24,000 | 6.80% | > | $48,000 | |||||

| — Hawaii | 7.20% | > | $36,000 | 7.20% | > | $72,000 | |||||

| — Hawaii | 7.60% | > | $48,000 | 7.60% | > | $96,000 | |||||

| — Hawaii | 7.90% | > | $125,000 | 7.90% | > | $250,000 | |||||

| — Hawaii | 8.25% | > | $175,000 | 8.25% | > | $350,000 | |||||

| — Hawaii | 9.00% | > | $225,000 | 9.00% | > | $450,000 | |||||

| — Hawaii | 10.00% | > | $275,000 | 10.00% | > | $550,000 | |||||

| — Hawaii | 11.00% | > | $325,000 | 11.00% | > | $650,000 | |||||

| Idaho (j, m, u) | 5.695% | > | $4,673 | 5.695% | > | $9,346 | $15,000 | $30,000 | n.a. | n.a. | n.a. |

| Illinois (d, m, v) | 4.95% | > | $0 | 4.95% | > | $0 | n.a. | n.a. | $2,850 | $5,700 | $2,850 |

| Indiana (a, m, w) | 3.00% | > | $0 | 3.00% | > | $0 | n.a. | n.a. | $1,000 | $2,000 | $1,000 |

| Iowa (a, h) | 3.80% | > | $0 | 3.80% | > | $0 | n.a. | n.a. | $40 credit | $80 credit | $40 credit |

| Kansas (a, m) | 5.20% | > | $0 | 5.20% | > | $0 | $3,605 | $8,240 | $9,160 | $18,320 | $2,320 |

| — Kansas | 5.58% | > | $23,000 | 5.58% | > | $46,000 | |||||

| Kentucky (a, d) | 4.00% | > | $0 | 4.00% | > | $0 | $3,270 | $6,540 | n.a. | n.a. | n.a. |

| Louisiana (x) | 3.00% | > | $0 | 3.00% | > | $0 | $12,500 | $25,000 | n.a. | n.a. | n.a. |

| Maine (u, y, bb) | 5.80% | > | $0 | 5.80% | > | $0 | $15,000 | $30,000 | $5,150 | $10,300 | $300 credit |

| — Maine | 6.75% | > | $26,800 | 6.75% | > | $53,600 | |||||

| — Maine | 7.15% | > | $63,450 | 7.15% | > | $126,900 | |||||

| Maryland (a, m, n, z, aa) | 2.00% | > | $0 | 2.00% | > | $0 | $2,700 | $5,450 | $3,200 | $6,400 | $3,200 |

| — Maryland | 3.00% | > | $1,000 | 3.00% | > | $1,000 | |||||

| — Maryland | 4.00% | > | $2,000 | 4.00% | > | $2,000 | |||||

| — Maryland | 4.75% | > | $3,000 | 4.75% | > | $3,000 | |||||

| — Maryland | 5.00% | > | $100,000 | 5.00% | > | $150,000 | |||||

| — Maryland | 5.25% | > | $125,000 | 5.25% | > | $175,000 | |||||

| — Maryland | 5.50% | > | $150,000 | 5.50% | > | $225,000 | |||||

| — Maryland | 5.75% | > | $250,000 | 5.75% | > | $300,000 | |||||

| Massachusetts (bb, rr) | 5.00% | > | $0 | 5.00% | > | $0 | n.a. | n.a. | $4,400 | $8,800 | $1,000 |

| — Massachusetts | 9.00% | > | $1,083,150 | 9.00% | > | $1,083,150 | |||||

| Michigan (a, d) | 4.25% | > | $0 | 4.25% | > | $0 | n.a. | n.a. | $5,800 | $11,600 | $5,800 |

| Minnesota (d, bb, cc, oo) | 5.35% | > | $0 | 5.35% | > | $0 | $14,950 | $29,900 | n.a. | n.a. | $5,200 |

| — Minnesota | 6.80% | > | $32,570 | 6.80% | > | $47,620 | |||||

| — Minnesota | 7.85% | > | $106,990 | 7.85% | > | $189,180 | |||||

| — Minnesota | 9.85% | > | $198,630 | 9.85% | > | $330,410 | |||||

| Mississippi | 4.40% | > | $10,000 | 4.40% | > | $10,000 | $2,300 | $4,600 | $6,000 | $12,000 | $1,500 |

| Missouri (a, b, m, u, bb) | 2.00% | > | $1,313 | 2.00% | > | $1,313 | $15,000 | $30,000 | n.a | n.a | n.a |

| — Missouri | 2.50% | > | $2,626 | 2.50% | > | $2,626 | |||||

| — Missouri | 3.00% | > | $3,939 | 3.00% | > | $3,939 | |||||

| — Missouri | 3.50% | > | $5,252 | 3.50% | > | $5,252 | |||||

| — Missouri | 4.00% | > | $6,565 | 4.00% | > | $6,565 | |||||

| — Missouri | 4.50% | > | $7,878 | 4.50% | > | $7,878 | |||||

| — Missouri | 4.70% | > | $9,191 | 4.70% | > | $9,191 | |||||

| Montana (o, u, bb) | 4.70% | > | $0 | 4.70% | > | $0 | $15,000 | $30,000 | n.a | n.a | n.a |

| — Montana | 5.90% | > | $21,100 | 5.90% | > | $42,200 | |||||

| Nebraska (d, h, m, bb) | 2.46% | > | $0 | 2.46% | > | $0 | $8,600 | $17,200 | $171 credit | $342 credit | $171 credit |

| — Nebraska | 3.51% | > | $4,030 | 3.51% | > | $8,040 | |||||

| — Nebraska | 5.01% | > | $24,120 | 5.01% | > | $48,250 | |||||

| — Nebraska | 5.20% | > | $38,870 | 5.20% | > | $77,730 | |||||

| Nevada | none | none | n.a. | n.a. | n.a. | n.a. | n.a. | ||||

| New Hampshire | none | none | n.a | n.a | n.a. | n.a. | n.a. | ||||

| New Jersey (a) | 1.400% | > | $0 | 1.400% | > | $0 | n.a. | n.a. | $1,000 | $2,000 | $1,500 |

| — New Jersey | 1.750% | > | $20,000 | 1.750% | > | $20,000 | |||||

| — New Jersey | 3.500% | > | $35,000 | 2.450% | > | $50,000 | |||||

| — New Jersey | 5.525% | > | $40,000 | 3.500% | > | $70,000 | |||||

| — New Jersey | 6.370% | > | $75,000 | 5.525% | > | $80,000 | |||||

| — New Jersey | 8.970% | > | $500,000 | 6.370% | > | $150,000 | |||||

| — New Jersey | 10.750% | > | $1,000,000 | 8.970% | > | $500,000 | |||||

| — New Jersey | 10.750% | > | $1,000,000 | ||||||||

| New Mexico (m, o, u, jj) | 1.50% | > | $0 | 1.50% | > | $0 | $15,000 | $30,000 | n.a. | n.a. | $4,000 |

| — New Mexico | 3.20% | > | $5,500 | 3.20% | > | $8,000 | |||||

| — New Mexico | 4.30% | > | $16,500 | 4.30% | > | $25,000 | |||||

| — New Mexico | 4.70% | > | $33,500 | 4.70% | > | $50,000 | |||||

| — New Mexico | 4.90% | > | $66,500 | 4.90% | > | $100,000 | |||||

| — New Mexico | 5.90% | > | $210,000 | 5.90% | > | $315,000 | |||||

| New York (a, i) | 4.00% | > | $0 | 4.00% | > | $0 | $8,000 | $16,050 | n.a. | n.a. | $1,000 |

| — New York | 4.50% | > | $8,500 | 4.50% | > | $17,150 | |||||

| — New York | 5.25% | > | $11,700 | 5.25% | > | $23,600 | |||||

| — New York | 5.50% | > | $13,900 | 5.50% | > | $27,900 | |||||

| — New York | 6.00% | > | $80,650 | 6.00% | > | $161,550 | |||||

| — New York | 6.85% | > | $215,400 | 6.85% | > | $323,200 | |||||

| — New York | 9.65% | > | $1,077,550 | 9.65% | > | $2,155,350 | |||||

| — New York | 10.30% | > | $5,000,000 | 10.30% | > | $5,000,000 | |||||

| — New York | 10.90% | > | $25,000,000 | 10.90% | > | $25,000,000 | |||||

| North Carolina | 4.25% | > | $0 | 4.25% | > | $0 | $12,750 | $25,500 | n.a. | n.a. | n.a. |

| North Dakota (j, o, u) | 1.95% | > | $48,475 | 1.95% | > | $80,975 | $15,000 | $30,000 | n.a. | n.a. | n.a. |

| — North Dakota | 2.50% | > | $244,825 | 2.50% | > | $298,075 | |||||

| Ohio (a, j, dd, pp) | 2.750% | > | $26,050 | 2.750% | > | $26,050 | n.a. | n.a. | $2,400 | $4,800 | $2,400 |

| — Ohio | 3.500% | > | $100,000 | 3.500% | > | $100,000 | |||||

| Oklahoma (m) | 0.25% | > | $0 | 0.25% | > | $0 | $6,350 | $12,700 | $1,000 | $2,000 | $1,000 |

| — Oklahoma | 0.75% | > | $1,000 | 0.75% | > | $2,000 | |||||

| — Oklahoma | 1.75% | > | $2,500 | 1.75% | > | $5,000 | |||||

| — Oklahoma | 2.75% | > | $3,750 | 2.75% | > | $7,500 | |||||

| — Oklahoma | 3.75% | > | $4,900 | 3.75% | > | $9,800 | |||||

| — Oklahoma | 4.75% | > | $7,200 | 4.75% | > | $14,400 | |||||

| Oregon (a, b, d, h, m, bb, ee, nn) | 4.75% | > | $0 | 4.75% | > | $0 | $2,800 | $5,600 | $250 credit | $500 credit | $250 credit |

| — Oregon | 6.75% | > | $4,400 | 6.75% | > | $8,800 | |||||

| — Oregon | 8.75% | > | $11,050 | 8.75% | > | $22,100 | |||||

| — Oregon | 9.90% | > | $125,000 | 9.90% | > | $250,000 | |||||

| Pennsylvania (a) | 3.07% | > | $0 | 3.07% | > | $0 | n.a. | n.a. | n.a. | n.a. | n.a. |

| Rhode Island (d, bb, ff) | 3.75% | > | $0 | 3.75% | > | $0 | $10,900 | $21,800 | $5,100 | $10,200 | $5,100 |

| — Rhode Island | 4.75% | > | $79,900 | 4.75% | > | $79,900 | |||||

| — Rhode Island | 5.99% | > | $181,650 | 5.99% | > | $181,650 | |||||

| South Carolina (d, o, u, bb, ll, qq) | 0.00% | > | $0 | 0.00% | > | $0 | $15,000 | $30,000 | n.a. | n.a. | $4,790 |

| — South Carolina | 3.00% | > | $3,560 | 3.00% | > | $3,560 | |||||

| — South Carolina | 6.20% | > | $17,830 | 6.20% | > | $17,830 | |||||

| South Dakota | none | none | n.a. | n.a. | n.a. | n.a. | n.a. | ||||

| Tennessee | none | none | n.a. | n.a. | n.a. | n.a. | n.a. | ||||

| Texas | none | none | n.a. | n.a. | n.a. | n.a. | n.a. | ||||

| Utah (d, h, gg, ll) | 4.55% | > | $0 | 4.55% | > | $0 | $900 credit | $1,800 credit | n.a. | n.a. | $2,046 |

| Vermont (j, n, hh, mm) | 3.35% | > | $0 | 3.35% | > | $0 | $7,400 | $14,850 | $5,100 | $10,200 | $5,100 |

| — Vermont | 6.60% | > | $47,900 | 6.60% | > | $79,950 | |||||

| — Vermont | 7.60% | > | $116,000 | 7.60% | > | $193,300 | |||||

| — Vermont | 8.75% | > | $242,000 | 8.75% | > | $294,600 | |||||

| Virginia (m) | 2.00% | > | $0 | 2.00% | > | $0 | $8,500 | $17,000 | $930 | $1,860 | $930 |

| — Virginia | 3.00% | > | $3,000 | 3.00% | > | $3,000 | |||||

| — Virginia | 5.00% | > | $5,000 | 5.00% | > | $5,000 | |||||

| — Virginia | 5.75% | > | $17,000 | 5.75% | > | $17,000 | |||||

| Washington (n, ss) | 7.0% on capital gains income only | 7.0% on capital gains income only | $270,000 | $270,000 | n.a. | n.a. | n.a. | ||||

| West Virginia (a, m) | 2.22% | > | $0 | 2.22% | > | $0 | n.a. | n.a. | $2,000 | $4,000 | $2,000 |

| — West Virginia | 2.96% | > | $10,000 | 2.96% | > | $10,000 | |||||

| — West Virginia | 3.33% | > | $25,000 | 3.33% | > | $25,000 | |||||

| — West Virginia | 4.44% | > | $40,000 | 4.44% | > | $40,000 | |||||

| — West Virginia | 4.82% | > | $60,000 | 4.82% | > | $60,000 | |||||

| Wisconsin (d, m, bb, ii) | 3.50% | > | $0 | 3.50% | > | $0 | $13,560 | $25,110 | $700 | $1,400 | $700 |

| — Wisconsin | 4.40% | > | $14,680 | 4.40% | > | $19,580 | |||||

| — Wisconsin | 5.30% | > | $29,370 | 5.30% | > | $39,150 | |||||

| — Wisconsin | 7.65% | > | $323,290 | 7.65% | > | $431,060 | |||||

| Wyoming | none | none | n.a. | n.a. | n.a. | n.a. | n.a. | ||||

| Washington DC (u) | 4.00% | > | $0 | 4.00% | > | $0 | $15,000 | $30,000 | n.a. | n.a. | n.a. |

| — Washington DC | 6.00% | > | $10,000 | 6.00% | > | $10,000 | |||||

| — Washington DC | 6.50% | > | $40,000 | 6.50% | > | $40,000 | |||||

| — Washington DC | 8.50% | > | $60,000 | 8.50% | > | $60,000 | |||||

| — Washington DC | 9.25% | > | $250,000 | 9.25% | > | $250,000 | |||||

| — Washington DC | 9.75% | > | $500,000 | 9.75% | > | $500,000 | |||||

| — Washington DC | 10.75% | > | $1,000,000 | 10.75% | > | $1,000,000 |

(b) These states allow some or all of federal income tax paid to be deducted from state taxable income.

(c) For single taxpayers with AGI not exceeding $25,999, the standard deduction is $3,000. This standard deduction amount is reduced by $25 for every additional $500 of AGI, not to fall below $2,500. For Married Filing Joint (MFJ) taxpayers with AGI not exceeding $25,999, the standard deduction is $8,500. This standard deduction amount is reduced by $175 for every additional $500 of AGI, not to fall below $5,000. For all taxpayers with AGI of $50,000 or less and claiming a dependent, the dependent exemption is $1,000. This amount is reduced to $500 per dependent for taxpayers with AGI above $50,000 and equal to or less than $100,000. For taxpayers with more than $100,000 in AGI, the dependent exemption is $300 per dependent.

(d) Standard deduction and/or personal exemption is adjusted annually for inflation. Inflation-adjusted amounts for tax year 2025 are shown.

(e) Arizona's standard deduction can be adjusted upward by an amount equal to 33 percent (as of TY 2024) of the amount the taxpayer would have claimed in charitable deductions if the taxpayer had claimed itemized deductions.

(f) In lieu of a dependent exemption, Arizona offers a dependent tax credit of $100 per dependent under the age of 17 and $25 per dependent age 17 and older. The credit begins to phase out for taxpayers with federal adjusted gross income (FAGI) above $200,000 (single filers) or $400,000 (MFJ).

(g) Rates apply to individuals earning more than $89,600. A separate tax tables exist for individuals earning $89,600 or less, with rates of 2 percent on income greater than or equal to $5,300; 3 percent on income greater than or equal to $10,600; 3.4 percent on income greater than or equal to $15,100; and 3.9 percent on income greater than $25,000 but less than or equal to $89,600.

(h) Standard deduction or personal exemption is structured as a tax credit.

(i) Connecticut and New York have "tax benefit recapture," by which many high-income taxpayers pay their top tax rate on all income, not just on amounts above the benefit threshold.

(j) Bracket levels adjusted for inflation each year. Inflation-adjusted bracket widths for 2025 were not available as of publication, so table reflects 2024 inflation-adjusted bracket widths.

(k) Exemption credits phase out for single taxpayers by $6 for each $2,500 of federal AGI above $237,035 and for MFJ filers by $12 for each $2,500 of federal AGI above $474,075. The credit cannot be reduced to below zero.

(l) Rates include the additional mental health services tax at the rate of 1 percent on taxable income in excess of $1 million. Rates exclude a payroll tax of 1.1 percent to fund the state’s disability insurance program. Effecting as of TY 2024, there is no wage ceiling for this payroll tax, which means that the state’s top individual income tax rate on wage income becomes 14.4 percent.

(m) State provides a state-defined personal exemption amount for each exemption available and/or deductible under the Internal Revenue Code. Under the Tax Cuts and Jobs Act, the personal exemption is set at $0 until 2026 but not eliminated. Because it is still available, these state-defined personal exemptions remain available in some states but are set to $0 in other states.

(n) Standard deduction and/or personal exemption adjusted annually for inflation, but the 2025 inflation adjustment was not available at time of publication, so table reflects actual 2024 amount(s).

(o) Colorado, Montana, New Mexico, North Dakota, and South Carolina include the federal standard deduction in their income starting point.

(p) Connecticut has a complex set of phaseout provisions. For each single taxpayer whose Connecticut AGI exceeds $56,500, the amount of the taxpayer's Connecticut taxable income to which the 2 percent tax rate applies shall be reduced by $1,000 for each $5,000, or fraction thereof, by which the taxpayer's Connecticut AGI exceeds said amount. Any such amount will have a tax rate of 4.5 percent instead of 2 percent. Each single taxpayer whose Connecticut AGI exceeds $105,000 shall pay an amount equal to $25 for each $5,000, or fraction thereof, by which the taxpayer's Connecticut AGI exceeds $105,000, up to a maximum payment of $250. Additionally, each single taxpayer whose Connecticut AGI exceeds $200,000 shall pay an amount equal to $90 for each $5,000, or fraction thereof, by which the taxpayer's Connecticut AGI exceeds $200,000 but is less than $500,000, and by an additional $50 for each $5,000, or fraction thereof, by which the taxpayer’s AGI exceeds $500,000, up to a maximum payment of $3,150. For each MFJ taxpayer whose Connecticut AGI exceeds $100,500, the amount of the taxpayer's Connecticut taxable income to which the 2 percent tax rate applies shall be reduced by $2,000 for each $5,000, or fraction thereof, by which the taxpayer's Connecticut AGI exceeds said amount. Any such amount of Connecticut taxable income to which, as provided in the preceding sentence, the 2 percent tax rate does not apply shall be an amount to which the 4.5 percent tax rate shall apply. Each MFJ filer whose Connecticut AGI exceeds $210,000 shall pay an amount equal to $50 for each $10,000, or fraction thereof, by which the taxpayer's Connecticut AGI exceeds $210,000, up to a maximum payment of $500. Additionally, each MFJ taxpayer whose Connecticut AGI exceeds $400,000 shall pay, in addition to the amount above, an amount equal to $180 for each $10,000, or fraction thereof, by which the taxpayer's Connecticut AGI exceeds $400,000, up to a maximum of $5,400, and a further $100 for each $10,000, or fraction thereof, by which Connecticut AGI exceeds $1 million, up to a combined maximum payment of $6,300.

(q) Connecticut taxpayers are also given personal tax credits (1-75%) based upon adjusted gross income.

(r) Connecticut's personal exemption phases out by $1,000 for each $1,000, or fraction thereof, by which a single filer's Connecticut AGI exceeds $30,000 and a MFJ filer's Connecticut AGI exceeds $48,000.

(s) In addition to the individual income tax rates, Delaware imposes a tax on lump-sum distributions.

(t) Additionally, Hawaii allows any taxpayer, other than a corporation, acting as a business entity in more than one state and required by law to file a return, to report and pay a tax of 0.5 percent of its annual gross sales (1) where the taxpayer's only activities in Hawaii consist of sales, (2) when the taxpayer does not own or rent real estate or tangible personal property, and (3) when the taxpayer’s annual gross sales in or into Hawaii do not exceed $100,000. Haw. Rev. Stat. § 235-51 (2015).

(u) Deduction and/or exemption tied to federal tax system. Federal deductions and exemptions are indexed for inflation, and where applicable, the tax year 2025 inflation-adjusted amounts are shown.

(v) As of June 1, 2017, taxpayers cannot claim the personal exemption if their adjusted gross income exceeds $250,000 (single filers) or $500,000 (MFJ).

(w) $1,000 is a base exemption. If dependents meet certain conditions, filers can take an additional $1,500 exemption for each. If a taxpayer is claiming a child as a dependent for the first taxable year in which the exemption is allowed, the taxpayer is now permitted to claim an amount of $3,000, instead of $1,500.

(x) Standard deduction will be adjusted for inflation beginning in 2026.

(y) Maine's personal exemption begins to phase out for taxpayers with income exceeding $323,900 (single filers) or $388,650 (MFJ). These phaseout thresholds are adjusted annually for inflation, but 2025 inflation adjustments were not available at the time of publication. The standard deduction amounts for 2025 are phased out for taxpayers with Maine income over $100,000 (single filers) or $200,050 (MFJ). The dependent personal exemption is structured as a tax credit and begins to phase out for taxpayers with income exceeding $200,000 (head of household) or $400,000 (married filing jointly).

(z) The standard deduction is 15 percent of income with a minimum of $1,800 and a cap of $2,700 for single filers and married filing separately filers. The standard deduction is a minimum of $3,650 and capped at $5,450 for MFJ filers, head of household filers, and qualifying surviving spouses. The minimum and maximum standard deduction amounts are adjusted annually for inflation. 2025 inflation-adjusted amounts were not announced as of publication, so 2024 inflation-adjusted amounts are shown.

(aa) The exemption amount has the following phaseout schedule: If AGI is above $100,000 for single filers and above $150,000 for married filers, the $3,200 exemption begins to be phased out. If AGI is above $150,000 for single filers and above $200,000 for married filers, the exemption is phased out entirely.

(bb) Bracket levels adjusted for inflation each year. Inflation-adjusted bracket levels for 2025 are shown.

(cc) For taxpayers whose AGI exceeds $119,475 (married filing separately) or $238,950 (all other filers), Minnesota’s standard deduction is reduced by 3 percent of the excess of the taxpayer’s federal AGI over the applicable amount but not over $165,150 (married filing separately) or $330,300 (all other filers), plus 10 percent of the taxpayer's federal adjusted gross income over the second threshold, or 80 percent of the standard deduction otherwise allowable, whichever is less.

(dd) Ohio's personal exemption is $2,400 for an AGI of $40,000 or less, $2,150 if AGI is more than $40,000 but less than or equal to $80,000, and $1,900 if AGI is greater than $80,000.

(ee) The personal exemption credit is not allowed if federal AGI exceeds $100,000 for single filers or $200,000 for MFJ.

(ff) The phaseout range for the standard deduction, personal exemption, and dependency exemption is $254,250 to $283,250. For taxpayers with modified Federal AGI exceeding $283,250, no standard deduction, personal exemption, or dependency exemption is available.

(gg) The standard deduction is taken in the form of a nonrefundable credit of 6 percent of the federal standard or itemized deduction amount, excluding the deduction for state or local income tax. This credit phases out at 1.3 cents per dollar of AGI above $17,652 ($35,304 for MFJ) as of 2024.

(hh) For taxpayers with federal AGI that exceeds $150,000, the taxpayer will pay the greater of state income tax or 3 percent of federal AGI.

(ii) The standard deduction begins to phase out at $19,549 in income for single filers and $28,209 in income for joint filers. The standard deduction phases out to zero at $132,549 for single filers and $155,169 for joint filers.

(jj) In lieu of the suspended personal exemption, New Mexico offers a deduction of $4,000 for all but one of a taxpayer’s dependents.

(kk) Taxpayers with net income greater than or equal to $89,600 but not greater than $92,700 shall reduce the amount of tax due by deducting a bracket adjustment amount.

(ll) The dependent deduction/exemption is adjusted annually for inflation, but the 2025 amount was not available at the time of publication, so the 2024 amount is shown.

(mm) Taxpayers also receive an additional deduction of $1,200 for each standard deduction box checked on federal Form 1040.

(nn) California and Oregon do not fully index their top brackets.

(oo) Minnesota has a surtax on individuals, estates, and trusts equal to 1% of net investment income over $1 million.

(pp) Ohio's personal exemption is adjusted periodically based on changes in the GDP deflator.

(qq) South Carolina's withholding tables for 2025 assume a top marginal rate of 6.2 percent.

(rr) In Massachusetts, rates exclude the paid family and medical leave payroll tax. Employers must withhold 0.46 percent of employees' eligible wages. Additionally, employers with 25 or more employees contribute an extra 0.42 percent of eligible wages.

(ss) In Washington, the rate excludes the 0.58 percent payroll tax that funds the long-term care insurance program (WA Cares). Employers withhold this tax from employees' gross wages.

Data compiled by Andrey Yushkov, Katherine Loughead

Notable 2025 State Individual Income Tax Changes

Last year continued the historic pace of income tax rate reductions. In total, 28 states enacted and/or implemented individual income tax rate reductions since 2021. Only Massachusetts and the District of Columbia increased their top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. in those years. Several changes implemented in 2024 were retroactively effective as of January 1, 2024. However, several notable changes took effect on January 1, 2025, or are set to occur on specific future dates, with rates phasing down incrementally over time. Some of the scheduled future rate reductions rely on tax triggers, where specific changes to tax rates will occur once certain revenue benchmarks are met. Notable changes to major individual income tax provisions already certified for 2025 include the following:

Arkansas

Under S.B. 8, enacted in September 2023, the top individual income tax rate in Arkansas was reduced from 4.7 percent to 4.4 percent for tax years beginning on or after January 1, 2024. In June 2024, H.B. 1001 was adopted, further reducing the top marginal rate to 3.9 percent, retroactively effective as of January 1, 2024.

Colorado

Colorado’s individual and corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rates were temporarily and retroactively reduced to 4.25 percent for tax year 2024 but reverted to the normal statutory rate of 4.4 percent as of January 2025. The temporary reduction for 2024 was the result of the state’s Taxpayer’s Bill of Rights (TABOR) law, which prescribes various forms of tax relief, including income tax rate reductions, when revenues exceed the TABOR spending limit. Colorado’s sizeable surplus in FY 2023-24 triggered the retroactive tax cut for tax year 2024.

Georgia

Per H.B. 1015, enacted in April 2024, the flat individual income tax rate for 2024 decreased from 5.49 percent to 5.39 percent. Although the bill allowed for an accelerated schedule of future individual income tax rate reductions, the revenue conditions were not met for 2025, so the rate remains at 5.39 percent this year.

Hawaii

Hawaii significantly revised its individual income tax brackets under H.B. 2404, enacted in June 2024. Starting January 1, 2025, the lowest rate of 1.4 percent will apply to single-filer income below $9,600 (up from $2,400 in 2024), while the highest rate of 11 percent will apply to income exceeding $325,000 (up from $200,000). Additionally, the bill doubled the standard deduction from $2,200 to $4,400 for single filers for tax years 2024 and 2025. Despite these changes, Hawaii still has one of the most complex bracket structures in the nation, with 12 brackets. Brackets will be further widened in 2027, with additional increases to the standard deduction phased in over several years.

Idaho

In March 2024, H. 521 was enacted, retroactively reducing Idaho’s individual and corporate income tax rates from 5.8 to 5.695 percent as of January 1, 2024.

Indiana

Under H.B. 1001, enacted in May 2023, Indiana accelerated its previously enacted tax rate reductions, lowering the individual income tax rate from 3.05 in 2024 to 3.00 percent in 2025. The law also repealed previously enacted tax triggers, instead prescribing a rate reduction to 2.95 percent in 2026, and 2.9 percent in 2027 and beyond.

Iowa

As part of its comprehensive tax reform, effective January 1, 2025, Iowa consolidated its three tax brackets into a single bracket with a rate of 3.8 percent, joining the group of states with flat individual income taxes.

Kansas

Numerous tax changes took effect in Kansas as a result of Senate Bill 1, enacted in June 2024. Many of this law’s provisions were retroactively effective as of January 1, 2024, including individual income tax changes that consolidated three brackets into two, reduced the top marginal rate from 5.7 to 5.58 percent and the lower rate from 5.25 to 5.2 percent, eliminated the lowest marginal bracket, and substantially increased the amount of income exempt from taxation. Specifically, this law increased the personal exemption from $2,250 to $9,160 for single filers and from $4,500 to $18,320 for married couples filing jointly, increased the dependent exemption from $2,250 to $2,320, and increased the standard deduction from $3,500 to $3,605 for single filers and from $8,000 to $8,240 for married couples filing jointly.

Louisiana

In December 2024, Louisiana policymakers enacted a comprehensive tax reform law, which included individual income tax reforms that took effect January 1, 2025. These reforms included converting three individual income tax brackets into one and moving from a top marginal rate of 4.25 percent to a single rate of 3 percent. Additionally, the combined standard deduction and personal exemption—previously $4,500 for single filers, $9,000 for married couples filing jointly, and $1,000 for dependents—was replaced with a standard deduction of $12,500 for single filers and $25,000 for married couples filing jointly. The standard deduction will be adjusted annually for inflation beginning in 2026.

Mississippi

Under H.B. 531, enacted in April 2022, Mississippi continues reducing its flat individual income tax rate. Effective January 1, 2025, the tax rate goes down from 4.7 percent to 4.4 percent (applied on taxable income exceeding $10,000).

Missouri

Per S.B. 3, enacted in October 2022, Missouri’s Department of Revenue, effective January 1, 2025, reduced its top individual income tax rate from 4.8 percent to 4.7 percent as the respective revenue triggers were met in the previous fiscal year.

Nebraska

L.B. 754, enacted in May 2023, reduced the top individual income tax rate from 5.84 percent in 2024 to 5.20 percent in 2025 and outlined the gradual reduction of the state’s top rate to 3.99 percent by 2027.

New Hampshire

As of January 1, 2025, New Hampshire repealed its interest and dividends tax, joining the group of seven other states with no individual income tax.

New Mexico

Under H.B. 252, enacted in March 2024, New Mexico made notable changes to its tax bracket structure, primarily affecting low- and middle-income households. Specifically, the state introduced a new 4.3 percent bracket for taxable income between $16,500 and $33,500 for single filers and between $25,000 and $50,000 for married couples filing jointly and increased income thresholds for its 4.7 and 4.9 percent tax brackets. The top 5.9 percent bracket remains unaffected by H.B. 252.

North Carolina

Under H.B. 259, enacted in September 2023, North Carolina accelerated the reduction of its flat individual income tax rate. Effective January 1, 2025, the tax rate dropped from 4.5 percent to 4.25 percent. The rate is scheduled to decline to 3.99 percent by 2026.

South Carolina

South Carolina’s top marginal individual income tax rate was retroactively reduced from 6.4 to 6.2 percent for tax year 2024. This is the result of (1) tax triggers implemented under S.B. 1087, enacted in 2022, which permanently reduced the rate by 0.1 percent to 6.3 percent, as well as (2) the FY 2024-25 budget, enacted in June 2024, which temporarily reduced the rate by an additional 0.1 percent, to 6.2 percent, for tax year 2024 only. As such, the rate reverted to 6.3 percent for tax year 2025, but, as of this writing, a triggered reduction to 6.2 percent is all but finalized for tax year 2025.

Governor McMaster’s executive budget for FY 2025-26 assumes a triggered reduction to 6.2 percent will occur for 2025 based on November 2024 revenue projections, and an official announcement is expected before the end of February. Furthermore, South Carolina’s withholdingWithholding is the income an employer takes out of an employee’s paycheck and remits to the federal, state, and/or local government. It is calculated based on the amount of income earned, the taxpayer’s filing status, the number of allowances claimed, and any additional amount the employee requests. tables for tax year 2025 assume a top marginal rate of 6.2 percent. Under current law, tax triggers are in place to reduce the top marginal rate to 6 percent once specific revenue conditions are met.

Utah

In March 2024, legislation was enacted reducing Utah’s individual and corporate income tax rates from 4.65 to 4.55 percent, retroactively effective as of January 1, 2024.

Historical State Individual Income Tax Rates

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe