State Individual Income Tax Rates and Brackets, 2025

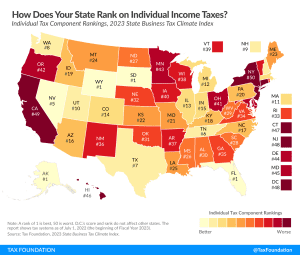

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min readProviding journalists, taxpayers and policymakers with basic data on taxes and spending is a cornerstone of the Tax Foundation’s educational mission. We’ve found that one of the best, most engaging ways to do that is by visualizing tax data in the form of maps.

How does your state collect revenue? Every week, we release a new tax map that illustrates one important measure of state tax rates, collections, burdens and more. If you enjoy our weekly tax maps, help us continue this work and more by making a small contribution here.

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

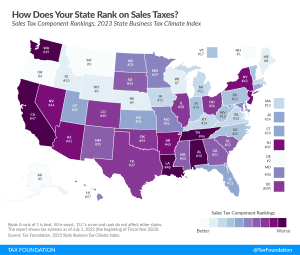

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 24 percent of combined state and local tax collections.

15 min read

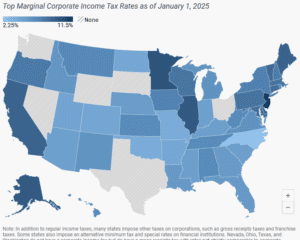

Forty-four states levy a corporate income tax, with top rates ranging from a 2.25 percent flat rate in North Carolina to a 11.5 percent top marginal rate in New Jersey.

7 min read

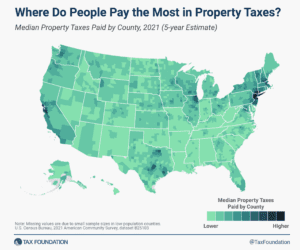

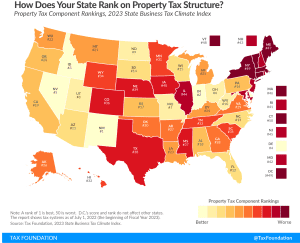

Property taxes are the primary tool for financing local governments. While no taxpayers in high-tax jurisdictions will be celebrating their yearly payments, property taxes are largely rooted in the benefit principle of taxation: the people paying the property tax bills are most often the ones benefiting from the services.

9 min read

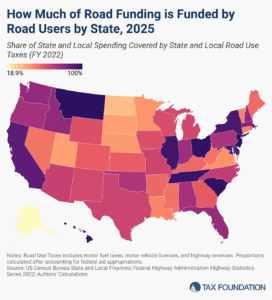

The amount of revenue states raise through roadway-related revenues varies significantly across the US. Only three states raise enough revenue to fully cover their highway spending.

5 min read

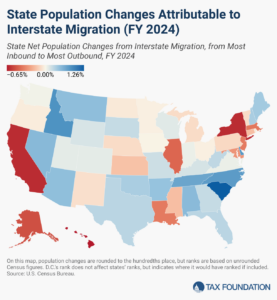

Americans were on the move in 2024, and many chose low-tax states over high-tax ones.

6 min read

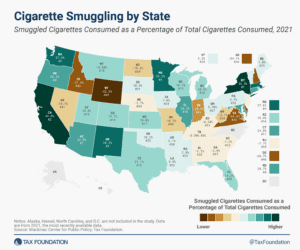

People respond to incentives. As tax rates increase or products are banned from sale, consumers and producers search for ways around these penalties and restrictions.

17 min read

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

5 min read

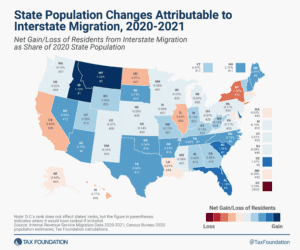

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

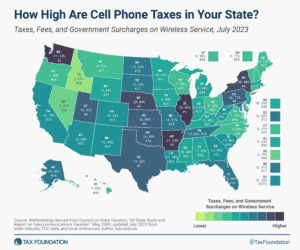

To alleviate the regressive impact on wireless consumers, states should examine their existing communications tax structures and consider policies that transition their tax systems away from narrowly based wireless taxes and toward broad-based tax sources.

18 min read

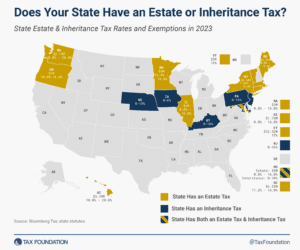

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

4 min read

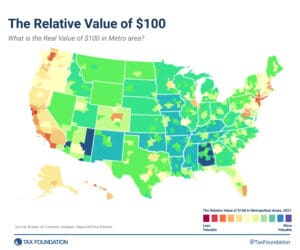

The differences in purchasing power can be large and they have significant implications for the relative impact of economic and tax policies across the United States.

3 min read

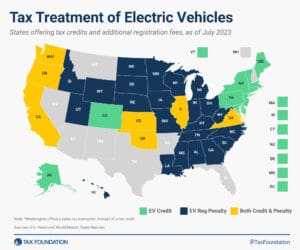

The state EV taxation landscape reflects the evolving transportation sector and the pressing need to address both fiscal gaps in road funding and environmental concerns.

4 min read

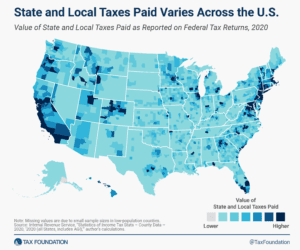

Any move to repeal the cap or enhance the deduction would disproportionately benefit higher earners, making the tax code more regressive.

5 min read

Property taxes are the primary tool for financing local governments and generate a significant share of state and local revenues.

6 min read

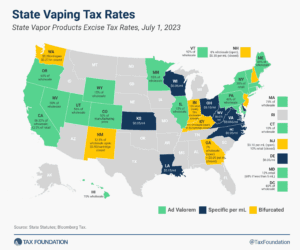

If the policy goal of taxing cigarettes is to encourage cessation, vapor taxation must be considered a part of that policy design.

3 min read

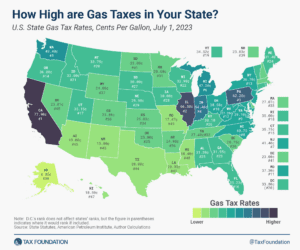

California pumps out the highest state gas tax rate of 77.9 cents per gallon (cpg), followed by Illinois (66.5 cpg) and Pennsylvania (62.2 cpg).

2 min read

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

4 min read

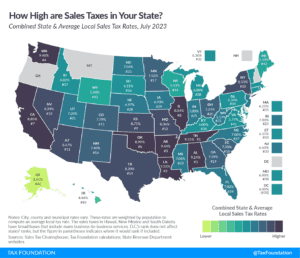

Compare the latest 2023 sales tax rates as of July 1st. Sales tax rate differentials can induce consumers to shop across borders or buy products online.

8 min read

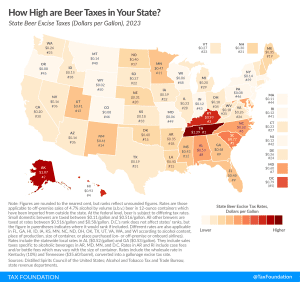

Taxes are the single most expensive ingredient in beer, costing more than the labor and raw materials combined.

3 min read

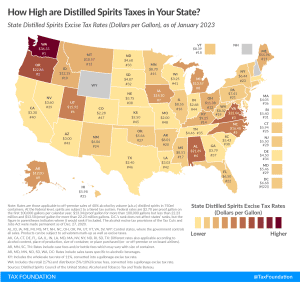

Of all alcoholic beverages subject to taxation, stiff drinks—and all distilled spirits—face the stiffest tax rates. Like many excise taxes, the treatment of distilled spirits varies widely across the states.

4 min read

States are in a better position to attract business investment when they maintain competitive real property tax rates and avoid harmful taxes on tangible personal property, intangible property, wealth, and asset transfers.

5 min read

Tobacco is the most highly taxed consumer product in the United States. The tools on this page allow you to explore state tax rates and the effects tax policy and tobacco regulations can have on state revenues, smuggling, and effective tax rates for different income groups.

2 min read

An ideal sales tax applies to a broad base of final consumer goods and services, with few exemptions, and is levied at a low rate.

5 min read

Individual income tax rates can influence location decision-making, especially in an era of enhanced mobility, where it is easier for individuals to move without jeopardizing their current job, or without limiting the scope of their search for a new one.

5 min read

Recreational marijuana taxation is one of the hottest policy issues in the U.S. Currently, 21 states have implemented legislation to legalize and tax recreational marijuana sales.

6 min read