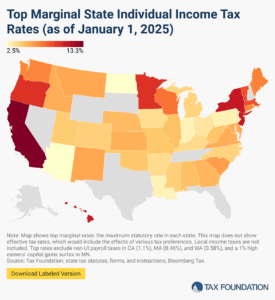

State Individual Income Tax Rates and Brackets, 2025

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min readProviding journalists, taxpayers and policymakers with basic data on taxes and spending is a cornerstone of the Tax Foundation’s educational mission. We’ve found that one of the best, most engaging ways to do that is by visualizing tax data in the form of maps.

How does your state collect revenue? Every week, we release a new tax map that illustrates one important measure of state tax rates, collections, burdens and more. If you enjoy our weekly tax maps, help us continue this work and more by making a small contribution here.

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

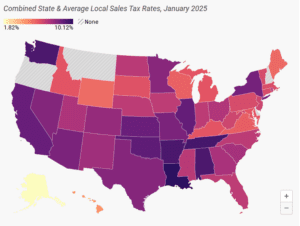

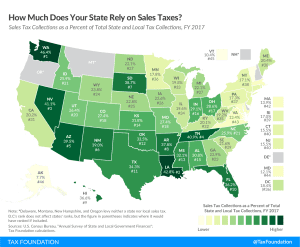

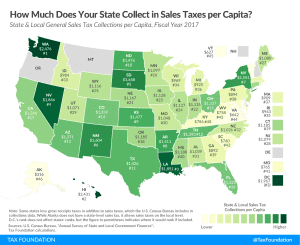

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 24 percent of combined state and local tax collections.

15 min read

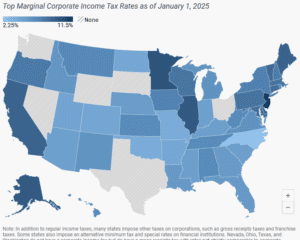

Forty-four states levy a corporate income tax, with top rates ranging from a 2.25 percent flat rate in North Carolina to a 11.5 percent top marginal rate in New Jersey.

7 min read

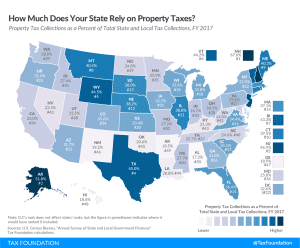

Property taxes are the primary tool for financing local governments. While no taxpayers in high-tax jurisdictions will be celebrating their yearly payments, property taxes are largely rooted in the benefit principle of taxation: the people paying the property tax bills are most often the ones benefiting from the services.

9 min read

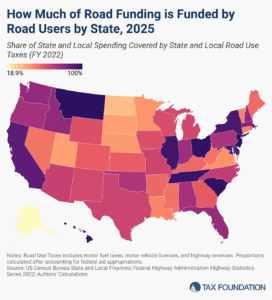

The amount of revenue states raise through roadway-related revenues varies significantly across the US. Only three states raise enough revenue to fully cover their highway spending.

5 min read

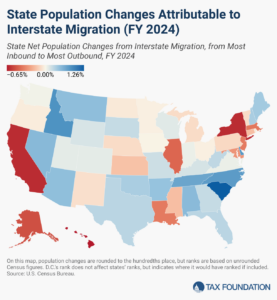

Americans were on the move in 2024, and many chose low-tax states over high-tax ones.

6 min read

Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy.

12 min read

We estimate that moving to permanent full expensing and neutral cost recovery for structures would add more than 1 million full-time equivalent jobs to the long-run economy and boost the long-run capital stock by $4.8 trillion.

4 min read

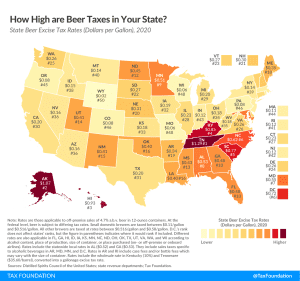

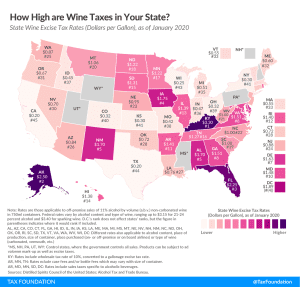

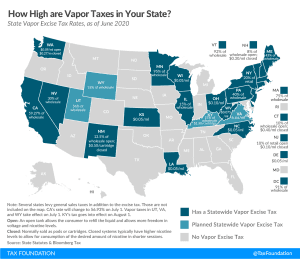

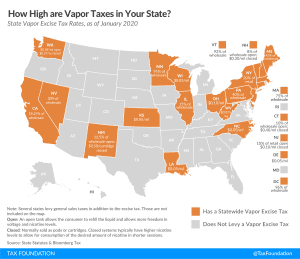

Many states may be looking toward vapor and other excise taxes to fill budget holes caused by the coronavirus crisis. While those areas may represent untapped revenue sources for many states, taxing those activities is unlikely to raise much revenue in the short term.

3 min read

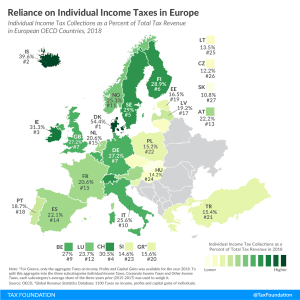

Consumption taxes, like sales taxes, are more economically neutral than taxes on capital and income because they target only current consumption.

3 min read

While the current crisis has caused consumption to drop dramatically, it is generally true that income taxes are more volatile than consumption taxes in an economic downturn and income taxes tend to be more harmful to economic growth than consumption taxes and property taxes.

3 min read

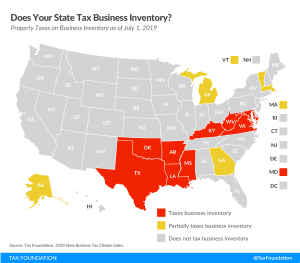

Inventory taxes are levied regardless of whether a business makes a profit, adding to the burden of businesses already struggling to stay afloat.

2 min read

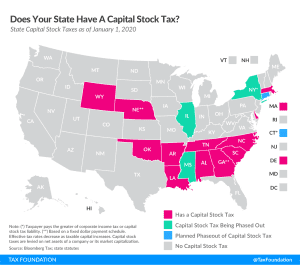

As many businesses may need time to return to profitability after this crisis, states should prioritize reducing reliance on capital stock taxes, and shift toward more neutral forms of business taxation.

4 min read

While it’s unclear how soon state economies may be able to fully open again, it’s not too early for states to consider how they can remove barriers to businesses & consumers resuming activity.

3 min read

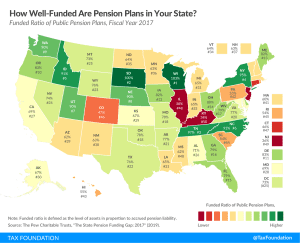

The current crisis highlights the cost of underfunding pensions in years of economic growth. Twenty states have pension plans that were less than two-thirds funded, and five states had pension plans that were less than 50 percent funded.

3 min read

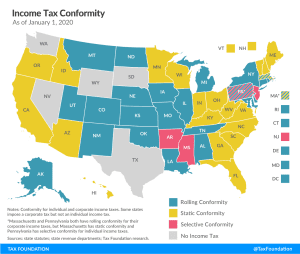

If states fail to update their income tax conformity, they will wind up taxing the federal lifeline to small businesses in the CARES Act: the Paycheck Protection Program (PPP) loans.

3 min read

Six states, which collectively account for over one-third of the U.S. population, are currently in a position to pay out fewer than 10 weeks of the unemployment compensation claims that have already come in since the start of the COVID-19 pandemic.

3 min read

Another 1.4 million Americans filed initial regular unemployment benefit claims, the eleventh week of a decline in the rate of new claims, but still among the highest levels in U.S. history. The total number of new and continued claims now stands at 19.3 million, a marked decline from the peak of 24.9 million a month ago.

7 min read

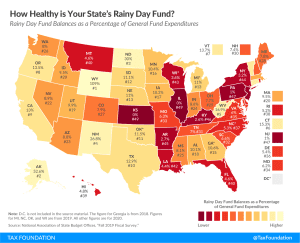

Rainy day funds have increasingly emerged as a standard component of states’ budgeting toolkits. Economic cycles can have significant impacts on state revenue, but states can prepare for the inevitable downturns during good times by putting away money in a revenue stabilization fund.

2 min read

While lawmakers are working through the design of vapor tax proposals, they must thread the needle between protecting adult smokers’ ability to switch and barring minors’ access to nicotine products. A good first step is creating appropriate definitions for the new nicotine products to avoid unintended disproportionate taxation based on design differences or bundling.

7 min read