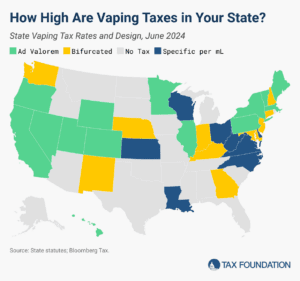

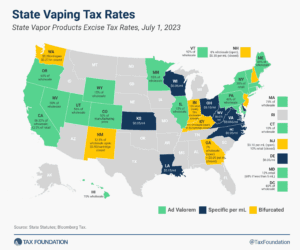

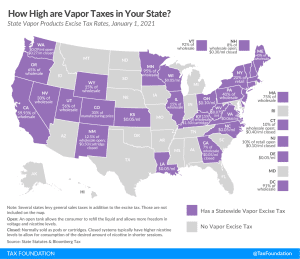

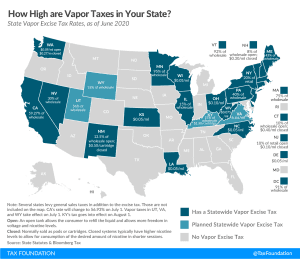

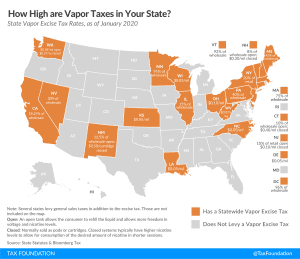

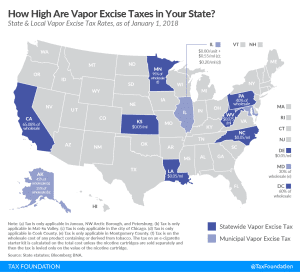

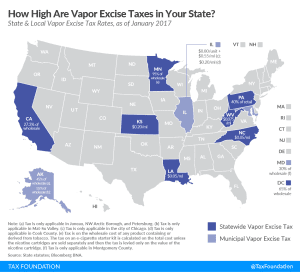

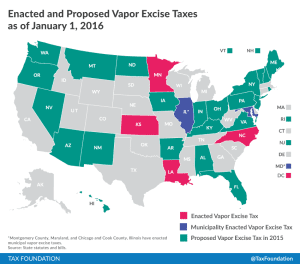

Vaping Taxes by State, 2024

The vaping industry has grown rapidly in recent decades, becoming a well-established product category and a viable alternative to cigarettes for those trying to quit smoking. US states levy a variety of tax structures on vaping products.

4 min read