Every year, millions of Americans pack up and move from one state to another, providing unique insights into what people value when deciding where to live, work, and raise a family. For many years, policymakers, journalists, and taxpayers have debated the role state taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policy plays in individuals’ and businesses’ location decisions. Annual data about who is moving—and where—provide clues about the factors contributing to these moves.

Taxes are one such factor. The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

Each year, the IRS releases migration data showing the movements of income taxpayers based on changes in their mailing address between filing one year’s income tax return and the next. The most recent data generally show location changes that occurred between when taxpayers filed their tax year 2019 returns in calendar year 2020 and when they filed their tax year 2020 returns in calendar year 2021. These data, therefore, capture many of the interstate moves made during the COVID-19 pandemic.

Non-governmental datasets, including from U-Haul and United Van Lines, have the advantage of being especially timely, shedding light on moves that occurred even more recently, but the IRS data are by default more comprehensive and provide important insights into the movement of adjusted gross income (AGI) among states.

Winners and Losers of Interstate Migration

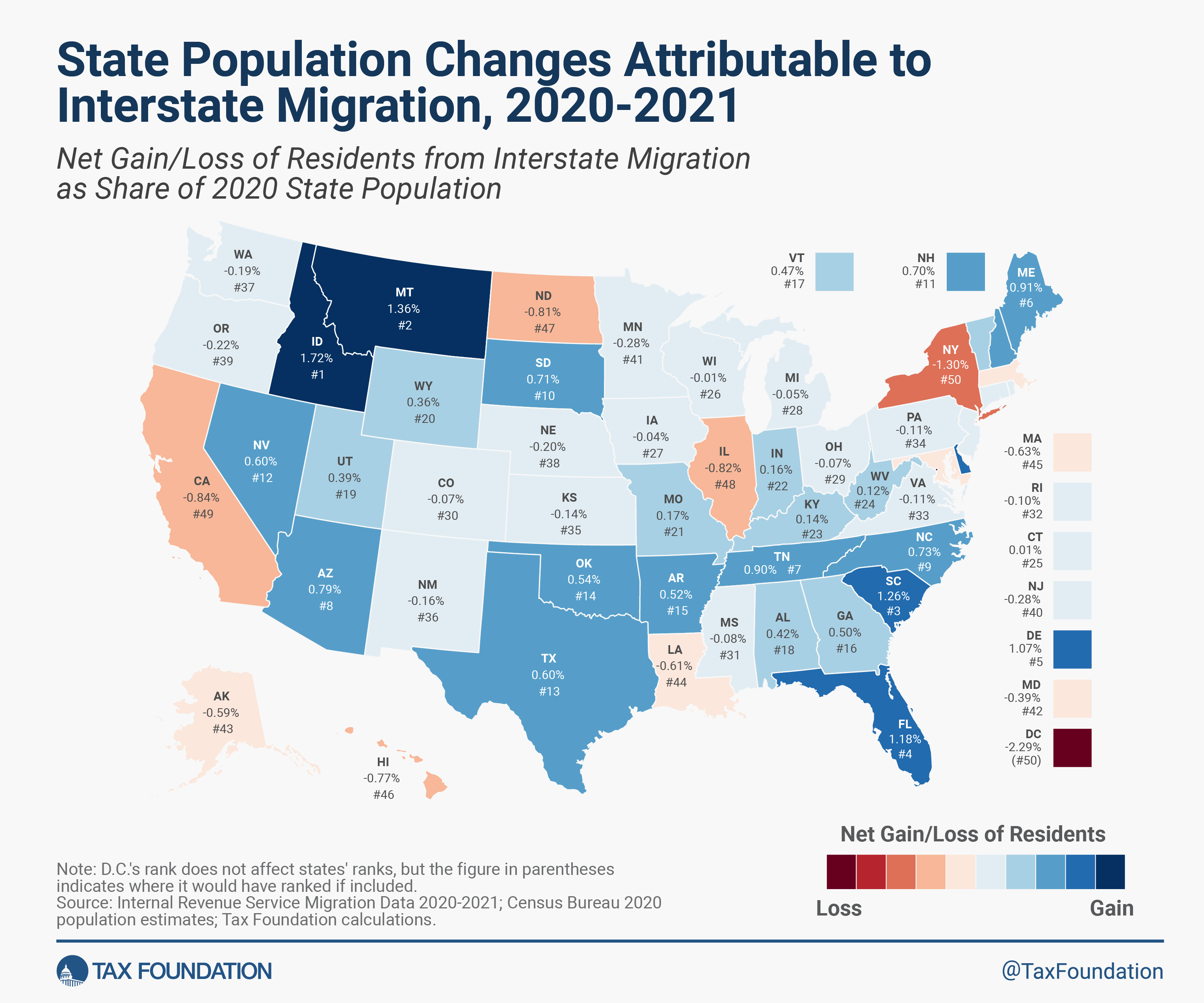

The IRS data show that between 2020 and 2021, 26 states experienced a net gain in income tax filers from interstate migration—led by Florida (+128,228), Texas (+82,842), North Carolina (+40,828), Arizona (+32,636), and Tennessee (+30,292)—while 24 states and the District of Columbia experienced a net loss—led by California (-158,220), New York (-142,109), Illinois (-53,910), Massachusetts (-25,029), and Louisiana (-14,113).

When all individuals associated with each tax return are accounted for, including spouses and dependents, 25 states experienced a net gain in individuals while 25 states and D.C. experienced a net loss. Only one state, Connecticut, saw a loss in tax returns attributable to interstate migration but a gain in individuals associated with the returns of those who moved in. Washington and Colorado, in contrast, saw a gain in tax returns but a loss in the total number of individuals on those returns.

States with the highest net AGI gains included Florida at $39.2 billion, Texas at $10.9 billion, and several states (North Carolina, Arizona, Tennessee, South Carolina, and Nevada) at around $4 billion each. States with the highest net AGI losses included California at -$29.1 billion, New York at -$24.5 billion, Illinois at -$10.8 billion, and Massachusetts at -$4.3 billion.

The map and table below show states’ gains and losses in resident population, income tax returns filed, and AGI attributable to interstate migration.

Many factors influence an individual’s or family’s decision to move from one state to another—employment or educational opportunities, proximity to family or friends, and geographic and lifestyle preferences like weather, natural landscape, and population density, to name a few. Cost-of-living considerations, including tax differentials, may not be the primary reason for an interstate move, but they are often one of several factors people consider when deciding whether—and where—to move.

More Americans Moved to States with Lower Taxes and Sound Tax Structures

Consistent with last year’s version of this publication, it is clear from the 2020-2021 IRS migration data that there is a strong positive relationship between state tax competitiveness and net migration. Overall, states with lower taxes and sound tax structures experienced stronger inbound migration than states with higher taxes and more burdensome tax structures.

Of the 10 states that experienced the largest gains in income taxpayers, four do not levy individual income taxes on wage or salary income at all. Additionally, eight of the top 10 states either forgo individual income taxes on wage and salary income, have a flat income tax, or are moving to a flat income tax.

Among the 26 states that experienced net inbound migration of income tax filers, only nine had a top marginal individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rate above the national median. Meanwhile, among the 24 states (and the District of Columbia) that experienced net outbound migration of income tax filers, 14 states and D.C. had top marginal rates above the median. In the aggregate, states with a top marginal rate at or below the 2020 median of 5.5 percent gained 300,329 net new residents from the states with rates above the median, including 46,812 net new residents with AGI of $200,000 or higher.

A robust positive relationship also exists between states with below-median state and local tax collections per capita and those experiencing strong inbound migration. Of the 26 states that saw a net gain in income tax filers due to interstate migration, 20 had below-median state and local tax collections per capita in fiscal year 2020, while 19 of 24 states that experienced net outbound migration had above-median collections per capita.

Furthermore, a strong positive relationship exists between states with well-structured tax codes and those that experience net inbound migration. Among the 25 best-ranking states on the 2021 State Business Tax Climate Index, which had a snapshot date of July 1, 2020, 19 states experienced net inbound migration between 2019 and 2020. Meanwhile, among the 25 worst-ranking states on the Index, 18 experienced a net loss of taxpayers to interstate migration.

Why Interstate Migration Matters

One reason policymakers should care about their state’s interstate migration patterns is the effect of interstate migration on tax revenue, economic output, and economic growth over time. Between 2020 and 2021, most states that experienced a net loss in income tax filers attributable to interstate migration also experienced a net loss in income associated with interstate migration, while most states that gained taxpayers also experienced corresponding gains in AGI.

Hawaii, Mississippi, Connecticut, New Mexico, and Rhode Island were among the states that lost residents on net and yet experienced a net gain in AGI, with new residents bringing in higher AGI per return than departing residents. Meanwhile, only three states—Indiana, Kentucky, and Missouri—saw a net gain in income tax filers but a net loss in AGI, with new residents earning less on average than the people who moved out. Some of this is due to cost-of-living adjustments that tend to occur when individuals leave employment in one state for employment in another. For example, even if their job duties are substantially similar, a registered nurse employed in a high-cost-of-living state is likely to have a higher salary than one employed in a lower-cost-of-living state due to cost-of-living considerations that affect market rate earnings in different parts of the country.

There is evidence, however, that in states like Hawaii, the loss of relatively lower-income residents is somewhat attributable to high taxes and high costs of living causing lower- and middle-income residents to seek more affordable destinations elsewhere. Notably, four of the top five states Hawaii residents moved to—Texas, Washington, Nevada, and Florida—forgo individual income taxes on wage income. Likewise, some of the gain of relatively lower-income residents in Indiana, Kentucky, and Missouri is likely due to the relatively low cost of living in those states compared to other locations. Crucially for economic growth, however, a low tax environment may encourage investment and entrepreneurial decision-making and attract highly mobile higher earners as well.

Higher-Income Residents Moved to Low-Tax States

The IRS data also show interstate migration broken down by AGI level. Among taxpayers with $200,000 or more in AGI, the top destinations for inbound interstate moves were Florida, Texas, North Carolina, Arizona, and South Carolina. Meanwhile, the states that saw the largest losses of taxpayers with $200,000 or more in AGI were California, New York, Illinois, Massachusetts, and New Jersey. Several of the states losing higher-income taxpayers, especially New York, California, and New Jersey, have highly progressive taxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden. codes under which tax liability rises steeply with income. States that structure their tax codes in this manner have consistently lost higher-income residents to lower-tax states, and not only the residents, but also any associated tax revenue and entrepreneurial activity that goes along with them. Interestingly, New York. with its top marginal income tax rate of 10.9 percent, had a net loss of 27,341 affluent residents, while Florida, one of the states with no income tax, had a net gain of roughly the same number of wealthy taxpayers, namely 27,567.

Sometimes taxpayers choose to move to a lower-tax state at least in part to reduce their own tax burden. But even those who do not consciously select for lower taxes may be doing so indirectly when they prioritize job opportunities and other factors related to the state’s economic competitiveness.

While taxes are just one factor influencing the location decisions of individuals and businesses, they are an important factor—and one within policymakers’ control. States that prioritize structurally sound tax policy improvements will reap the economic benefits that come with creating an attractive fiscal landscape in which all individuals and businesses have the opportunity to thrive.

How Do Taxes Affect Interstate Migration?

IRS Interstate Migration Data and State Tax Data and Rankings, 2020-2021

| State | Tax Returns Gain/Loss | Tax Returns Gain/Loss Rank | Individuals Gain/Loss | Individuals Gain/Loss Rank | AGI Gain/Loss | AGI Gain/Loss Rank | Gain/Loss of Returns with $200,000+ in AGI | Gain/Loss of Returns with $200,000+ in AGI Rank | Population Change | Population Change Rank | PIT Rate Below/Above Median | Rank on the 2021 Index | State and Local Tax Collections Per Capita | State and Local Tax Collections Rank |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Florida | 128,228 | 1 | 255,834 | 1 | $39,187,044,000.00 | 1 | 27,567 | 1 | 1.10% | 9 | No Tax | 4 | $4,047 | 46 |

| Texas | 82,842 | 2 | 174,866 | 2 | $10,901,303,000.00 | 2 | 9,008 | 2 | 1.12% | 7 | No Tax | 12 | $4,744 | 29 |

| North Carolina | 40,828 | 3 | 76,720 | 3 | $4,543,641,000.00 | 4 | 5,446 | 3 | 1.11% | 8 | Below | 10 | $4,209 | 40 |

| Arizona | 32,636 | 4 | 57,075 | 6 | $4,439,302,000.00 | 5 | 4,563 | 4 | 1.18% | 6 | Below | 23 | $4,136 | 42 |

| Tennessee | 30,292 | 5 | 62,015 | 5 | $4,145,718,000.00 | 7 | 3,917 | 6 | 0.62% | 17 | Interest and dividends income only | 27 | $3,719 | 50 |

| South Carolina | 29,981 | 6 | 64,724 | 4 | $4,193,460,000.00 | 6 | 4,510 | 5 | 1.20% | 5 | Above | 31 | $4,057 | 45 |

| Georgia | 25,535 | 7 | 53,845 | 7 | $1,267,644,000.00 | 12 | 873 | 14 | 0.54% | 18 | Above | 29 | $4,075 | 43 |

| Idaho | 14,081 | 8 | 31,821 | 8 | $2,153,211,000.00 | 8 | 2,315 | 8 | 2.98% | 1 | Above | 20 | $4,074 | 44 |

| Nevada | 12,026 | 9 | 18,728 | 11 | $4,617,504,000.00 | 3 | 2,785 | 7 | 0.99% | 11 | No Tax | 7 | $4,800 | 28 |

| Oklahoma | 9,232 | 10 | 21,332 | 10 | $505,137,000.00 | 19 | 254 | 25 | 0.66% | 14 | Below | 25 | $4,165 | 41 |

| Alabama | 8,468 | 11 | 21,376 | 9 | $738,143,000.00 | 15 | 749 | 16 | 0.37% | 21 | Below | 40 | $3,756 | 49 |

| Montana | 7,465 | 12 | 14,741 | 13 | $1,111,271,000.00 | 13 | 1,050 | 13 | 1.76% | 2 | Above | 5 | $4,471 | 32 |

| Maine | 7,391 | 13 | 12,344 | 15 | $922,591,000.00 | 14 | 1,089 | 12 | 1.00% | 10 | Above | 32 | $6,420 | 11 |

| Utah | 6,965 | 14 | 12,960 | 14 | $1,639,756,000.00 | 10 | 1,752 | 10 | 1.68% | 3 | Below | 8 | $4,467 | 33 |

| Arkansas | 6,627 | 15 | 15,643 | 12 | $537,621,000.00 | 17 | 491 | 18 | 0.46% | 19 | Above | 46 | $4,336 | 36 |

| Colorado | 5,868 | 16 | -4,213 | 33 | $2,123,323,000.00 | 9 | 2,052 | 9 | 0.46% | 20 | Below | 19 | $5,668 | 16 |

| Delaware | 5,643 | 17 | 10,638 | 17 | $537,052,000.00 | 18 | 797 | 15 | 1.28% | 4 | Above | 16 | $5,859 | 14 |

| New Hampshire | 5,528 | 18 | 9,661 | 19 | $1,464,718,000.00 | 11 | 1,332 | 11 | 0.65% | 15 | Interest and dividends income only | 6 | $5,131 | 25 |

| Washington | 3,718 | 19 | -14,407 | 42 | $177,669,000.00 | 23 | -111 | 34 | 0.22% | 28 | No Tax | 14 | $6,155 | 13 |

| Missouri | 3,636 | 20 | 10,627 | 18 | -$219,592,000.00 | 34 | -38 | 31 | 0.26% | 25 | Below | 11 | $3,967 | 48 |

| Indiana | 3,189 | 21 | 10,963 | 16 | -$167,170,000.00 | 32 | 8 | 29 | 0.36% | 22 | Below | 9 | $4,707 | 30 |

| South Dakota | 3,094 | 22 | 6,266 | 20 | $450,854,000.00 | 20 | 394 | 21 | 0.94% | 12 | No Tax | 2 | $4,466 | 34 |

| Kentucky | 2,443 | 23 | 6,149 | 21 | -$122,451,000.00 | 31 | 7 | 30 | -0.02% | 36 | Below | 17 | $4,329 | 37 |

| Vermont | 1,490 | 24 | 3,050 | 22 | $365,548,000.00 | 21 | 524 | 17 | 0.63% | 16 | Above | 43 | $6,450 | 10 |

| Wyoming | 1,067 | 25 | 2,101 | 23 | $548,300,000.00 | 16 | 366 | 22 | 0.33% | 23 | No Tax | 1 | $5,353 | 21 |

| West Virginia | 682 | 26 | 2,084 | 24 | $32,629,000.00 | 28 | -82 | 32 | -0.33% | 47 | Above | 22 | $4,278 | 38 |

| Rhode Island | -9 | 27 | -1,079 | 27 | $189,471,000.00 | 22 | 318 | 23 | 0.06% | 31 | Above | 39 | $5,732 | 15 |

| New Mexico | -432 | 28 | -3,420 | 30 | $95,132,000.00 | 25 | 119 | 27 | -0.08% | 38 | Below | 21 | $4,997 | 26 |

| Connecticut | -465 | 29 | 538 | 25 | $57,416,000.00 | 26 | 396 | 20 | 0.72% | 13 | Above | 47 | $8,448 | 2 |

| Iowa | -468 | 30 | -1,188 | 28 | -$259,644,000.00 | 38 | -187 | 38 | 0.22% | 27 | Above | 42 | $5,434 | 20 |

| Oregon | -829 | 31 | -9,461 | 39 | -$121,550,000.00 | 30 | 124 | 26 | 0.27% | 24 | Above | 15 | $5,202 | 24 |

| Wisconsin | -916 | 32 | -587 | 26 | -$61,455,000.00 | 29 | 278 | 24 | -0.27% | 42 | Above | 28 | $5,269 | 22 |

| Alaska | -1,741 | 33 | -4,333 | 34 | -$226,634,000.00 | 35 | -268 | 39 | 0.17% | 29 | No Tax | 3 | $4,523 | 31 |

| Mississippi | -1,916 | 34 | -2,399 | 29 | $49,283,000.00 | 27 | 111 | 28 | -0.29% | 44 | Below | 26 | $3,970 | 47 |

| Nebraska | -2,241 | 35 | -3,938 | 31 | -$206,495,000.00 | 33 | -172 | 37 | 0.05% | 32 | Above | 30 | $5,652 | 17 |

| Virginia | -2,634 | 36 | -9,293 | 38 | -$1,857,934,000.00 | 44 | -2,579 | 46 | 0.24% | 26 | Above | 24 | $5,597 | 18 |

| Kansas | -2,859 | 37 | -4,114 | 32 | -$234,270,000.00 | 36 | -135 | 36 | 0.00% | 35 | Above | 33 | $5,210 | 23 |

| North Dakota | -3,190 | 38 | -6,276 | 36 | -$248,535,000.00 | 37 | -122 | 35 | -0.20% | 40 | Below | 18 | $7,545 | 4 |

| Hawaii | -4,044 | 39 | -11,159 | 40 | $103,547,000.00 | 24 | 490 | 19 | -0.27% | 41 | Above | 38 | $7,480 | 5 |

| Michigan | -5,444 | 40 | -5,316 | 35 | -$1,068,754,000.00 | 40 | -99 | 33 | -0.32% | 46 | Below | 13 | $4,263 | 39 |

| Ohio | -6,285 | 41 | -7,991 | 37 | -$2,072,205,000.00 | 46 | -1,258 | 42 | -0.28% | 43 | Below | 37 | $4,857 | 27 |

| District of Columbia | -8,325 | 42 | -15,352 | 43 | -$1,599,797,000.00 | 42 | -2,009 | 44 | -0.31% | 45 | Above | 48 | $12,077 | 1 |

| Pennsylvania | -8,869 | 43 | -14,376 | 41 | -$1,858,853,000.00 | 45 | -1,022 | 41 | 0.14% | 30 | Below | 34 | $5,554 | 19 |

| Minnesota | -9,146 | 44 | -16,021 | 44 | -$1,562,517,000.00 | 41 | -1,453 | 43 | 0.03% | 33 | Above | 45 | $6,507 | 9 |

| New Jersey | -12,806 | 45 | -25,894 | 46 | -$3,794,238,000.00 | 47 | -2,617 | 47 | -0.04% | 37 | Above | 50 | $7,578 | 3 |

| Maryland | -12,955 | 46 | -24,041 | 45 | -$1,856,911,000.00 | 43 | -2,076 | 45 | 0.02% | 34 | Above | 44 | $6,810 | 8 |

| Louisiana | -14,113 | 47 | -28,502 | 47 | -$861,755,000.00 | 39 | -396 | 40 | -0.53% | 48 | Above | 41 | $4,410 | 35 |

| Massachusetts | -25,029 | 48 | -44,087 | 48 | -$4,275,158,000.00 | 48 | -3,118 | 48 | -0.09% | 39 | Below | 35 | $7,265 | 6 |

| Illinois | -53,910 | 49 | -105,109 | 49 | -$10,884,573,000.00 | 49 | -9,131 | 49 | -0.78% | 49 | Below | 36 | $6,400 | 12 |

| New York | -142,109 | 50 | -261,785 | 50 | -$24,466,836,000.00 | 50 | -19,795 | 50 | -1.25% | 51 | Above | 49 | $9,945 | 1 |

| California | -158,220 | 51 | -331,760 | 51 | -$29,070,964,000.00 | 51 | -27,341 | 51 | -0.91% | 50 | Above | 48 | $7,001 | 7 |

Source: Internal Revenue Service Migration Data 2020-2021; Census Bureau 2020 Population Estimates; Tax Foundation calculations.

Share this article