Distilled spirits face the stiffest taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates of all alcoholic beverages. These high tax rates are a combination of greater alcohol content in spirits than wine or beer and higher tax rates applied on alcohol content with spirits. For example, a one-ounce shot of a spirit with 40 percent alcohol content (0.4 oz of alcohol) carries greater taxes than an identical 12-ounce beer with 4.8 percent alcohol content (0.4 oz of alcohol).

Data for this map comes from the Distilled Spirits Council of the United States (DISCUS). To allow for comparability across states, DISCUS uses a methodology for estimating tax rates that accounts for the various ways in which spirits are taxed and sold. These figures include case and bottle fees, special sales taxes on spirits (separate from, and in addition to, the excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. ), wholesale taxes, and retail and distributor license fees.

In 17 states, the government operates a monopoly of state-controlled liquor stores. In these control states, the state can artificially inflate prices in lieu of levying a formal tax. The data in the map represent the implied excise tax rates in those states with government monopoly sales.

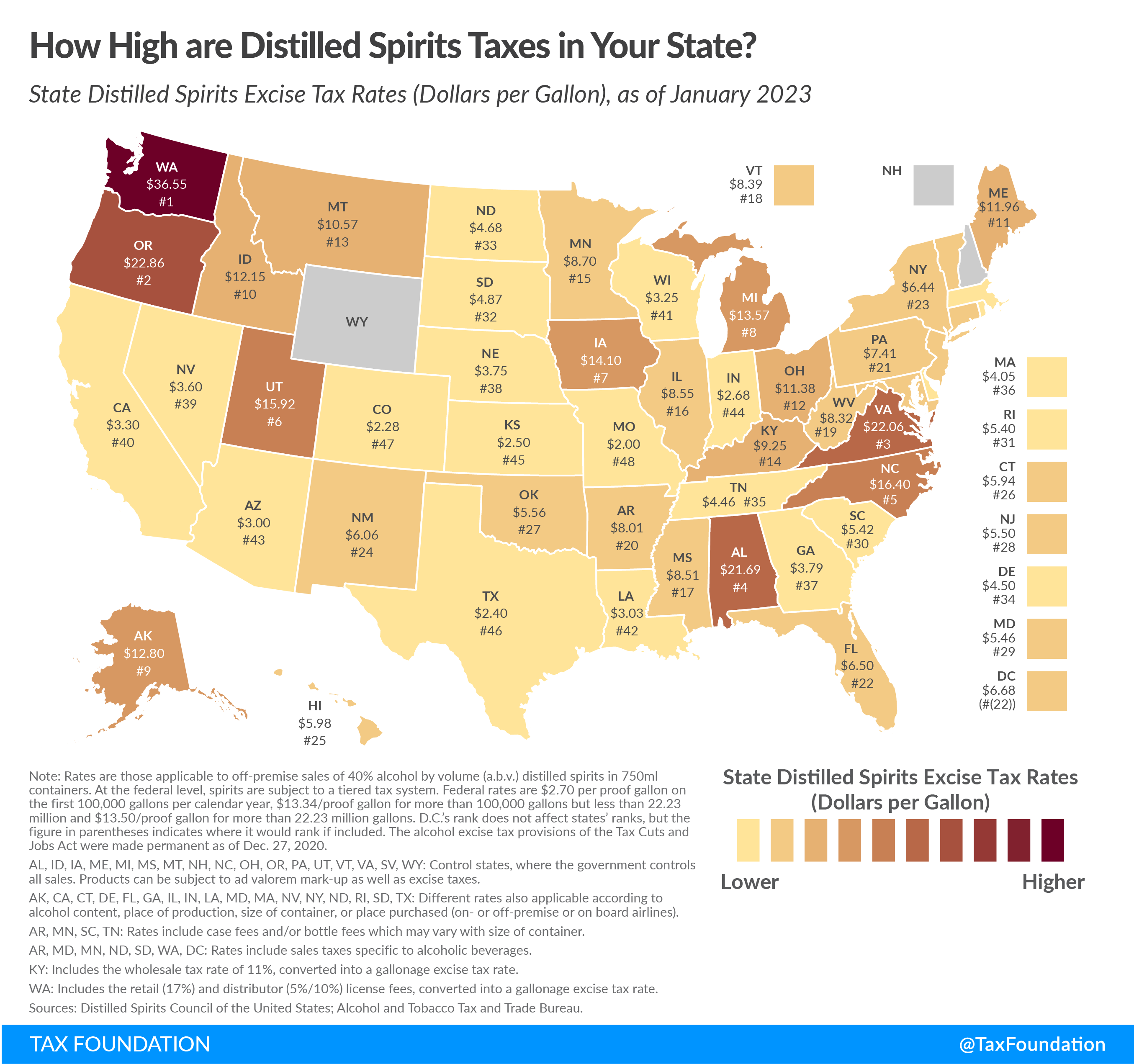

Across states, Washington levies the greatest excise tax rate on distilled spirits, at $36.55 per gallon. The Evergreen State is followed by Oregon ($22.86), Virginia ($22.06), Alabama ($21.69), and Utah ($15.92). Distilled spirits are taxed the least in Wyoming and New Hampshire. These two control states gain revenue directly from alcohol sales through government-run stores and have set prices low enough that they are comparable to buying spirits without taxes. Missouri taxes are the next lightest at $2.00 a gallon, followed by Colorado ($2.28), Texas ($2.40), and Kansas ($2.50).

Distilled spirits tax rates may also differ within states according to alcohol content, place of production, or place of purchase (such as on- or off-premises or onboard airlines).

| State Distilled Spirits Excise Tax Rates (Dollars per Gallon), as of January 2023 | ||

|---|---|---|

| State | Excise Tax Rate | Rank |

| Alabama | $21.69 | 4 |

| Alaska | $12.80 | 9 |

| Arizona | $3.00 | 43 |

| Arkansas | $8.01 | 20 |

| California | $3.30 | 40 |

| Colorado | $2.28 | 47 |

| Connecticut | $5.94 | 26 |

| Delaware | $4.50 | 34 |

| District of Columbia | $6.68 | (22) |

| Florida | $6.50 | 22 |

| Georgia | $3.79 | 37 |

| Hawaii | $5.98 | 25 |

| Idaho | $12.15 | 10 |

| Illinois | $8.55 | 16 |

| Indiana | $2.68 | 44 |

| Iowa | $14.10 | 7 |

| Kansas | $2.50 | 45 |

| Kentucky | $9.25 | 14 |

| Louisiana | $3.03 | 42 |

| Maine | $11.96 | 11 |

| Maryland | $5.46 | 29 |

| Massachusetts | $4.05 | 36 |

| Michigan | $13.57 | 8 |

| Minnesota | $8.70 | 15 |

| Mississippi | $8.51 | 17 |

| Missouri | $2.00 | 48 |

| Montana | $10.57 | 13 |

| Nebraska | $3.75 | 38 |

| Nevada | $3.60 | 39 |

| New Hampshire | — | |

| New Jersey | $5.50 | 28 |

| New Mexico | $6.06 | 24 |

| New York | $6.44 | 23 |

| North Carolina | $16.40 | 5 |

| North Dakota | $4.68 | 33 |

| Ohio | $11.38 | 12 |

| Oklahoma | $5.56 | 27 |

| Oregon | $22.86 | 2 |

| Pennsylvania | $7.41 | 21 |

| Rhode Island | $5.40 | 31 |

| South Carolina | $5.42 | 30 |

| South Dakota | $4.87 | 32 |

| Tennessee | $4.46 | 35 |

| Texas | $2.40 | 46 |

| Utah | $15.92 | 6 |

| Vermont | $8.39 | 18 |

| Virginia | $22.06 | 3 |

| Washington | $36.55 | 1 |

| West Virginia | $8.32 | 19 |

| Wisconsin | $3.25 | 41 |

| Wyoming | — | |

|

Note: Rates are those applicable to off-premise sales of 40% alcohol by volume (a.b.v.) distilled spirits in 750ml containers. At the federal level, spirits are subject to a tiered tax system. Federal rates are $2.70 per proof gallon on the first 100,000 gallons per calendar year, $13.34/proof gallon for more than 100,000 gallons but less than 22.23 million and $13.50/proof gallon for more than 22.23 million gallons. D.C.’s rank does not affect states’ ranks, but the figure in parentheses indicates where it would rank if included. The alcohol excise tax provisions of the Tax Cuts and Jobs Act were made permanent as of Dec. 27, 2020. AL, ID, IA, ME, MI, MS, MT, NH, NC, OH, OR, PA, UT, VT, VA, SV, WY: Control states, where the government controls all sales. Products can be subject to ad valorem mark-up as well as excise taxes. AK, CA, CT, DE, FL, GA, IL, IN, LA, MD, MA, NV, NY, ND, RI, SD, TX: Different rates also applicable according to alcohol content, place of production, size of container, or place purchased (on- or off-premise or on board airlines). AR, MN, SC, TN: Rates include case fees and/or bottle fees which may vary with size of container. AR, MD, MN, ND, SD, WA, DC: Rates include sales taxes specific to alcoholic beverages. KY: Includes the wholesale tax rate of 11%, converted into a gallonage excise tax rate. WA: Includes the retail (17%) and distributor (5%/10%) license fees, converted into a gallonage excise tax rate. Sources: Distilled Spirits Council of the United States (DISCUS); Alcohol and Tobacco Tax and Trade Bureau. |

||