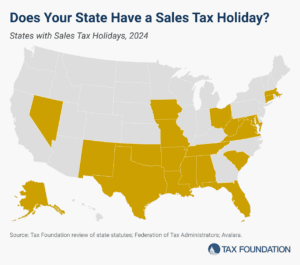

Sales Tax Holidays by State, 2024

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

11 min readSales tax holidays are periods when selected goods are exempted from state (and sometimes local) sales taxes. Such holidays have become an annual event in many states, with exemptions for such targeted items as back-to-school supplies, clothing, computers, hurricane preparedness supplies, products bearing the U.S. government’s Energy Star label, and even guns.

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

11 min read

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

4 min read

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

43 min read

Although state budgets may be in unusual places this year, sales tax holidays remain the same as they always have been—ineffective and inefficient.

4 min read

In the midst of the coronavirus crisis, some states are hoping that a sales tax holiday might help restart struggling industries by stimulating the economy. However, sales tax holidays can mislead consumers about savings and distract from genuine, permanent tax relief.

41 min read

If a state must offer a “holiday” from its tax system, it is an implicit recognition that the state’s tax system is uncompetitive.

44 min read

Sales tax holidays are not sound tax policy as they create complexities for all involved, while inserting the political process into consumer decisions.

45 min read

Sales tax holidays have enjoyed political success, but rather than providing a valuable tax cut or a boost to the economy, they impose serious costs on consumers and businesses without providing offsetting benefits.

43 min read