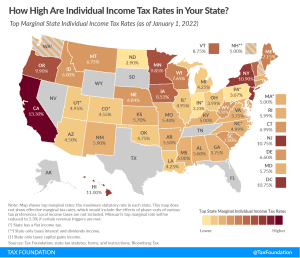

State Individual Income Tax Rates and Brackets, 2025

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min readProviding journalists, taxpayers and policymakers with basic data on taxes and spending is a cornerstone of the Tax Foundation’s educational mission. We’ve found that one of the best, most engaging ways to do that is by visualizing tax data in the form of maps.

How does your state collect revenue? Every week, we release a new tax map that illustrates one important measure of state tax rates, collections, burdens and more. If you enjoy our weekly tax maps, help us continue this work and more by making a small contribution here.

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

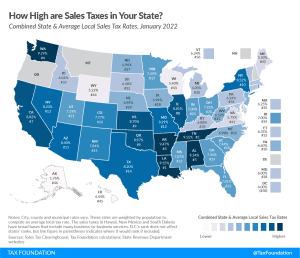

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 24 percent of combined state and local tax collections.

15 min read

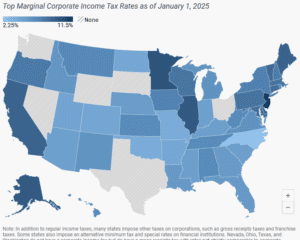

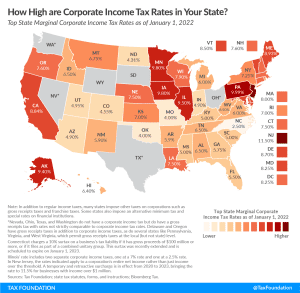

Forty-four states levy a corporate income tax, with top rates ranging from a 2.25 percent flat rate in North Carolina to a 11.5 percent top marginal rate in New Jersey.

7 min read

Property taxes are the primary tool for financing local governments. While no taxpayers in high-tax jurisdictions will be celebrating their yearly payments, property taxes are largely rooted in the benefit principle of taxation: the people paying the property tax bills are most often the ones benefiting from the services.

9 min read

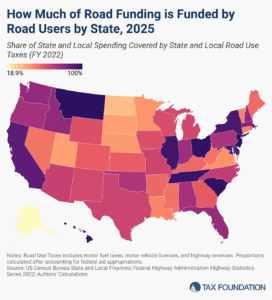

The amount of revenue states raise through roadway-related revenues varies significantly across the US. Only three states raise enough revenue to fully cover their highway spending.

5 min read

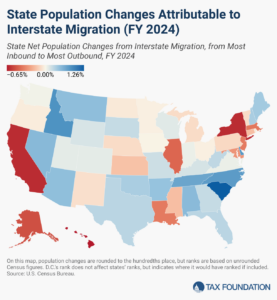

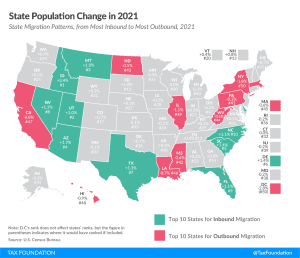

Americans were on the move in 2024, and many chose low-tax states over high-tax ones.

6 min read

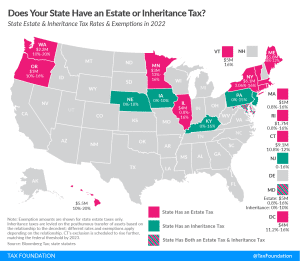

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

4 min read

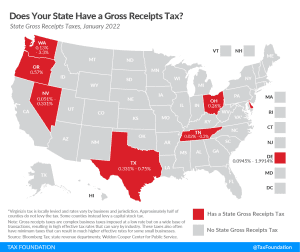

Eliminating state gross receipts taxes would be a pro-growth change to make the tax code better for businesses and consumers. How does your state compare?

4 min read

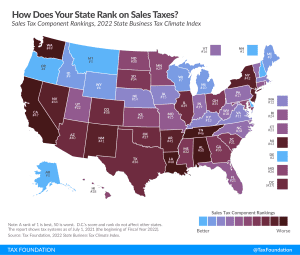

An ideal sales tax applies to a broad base of final consumer goods and services, with few exemptions, and is levied at a low rate.

3 min read

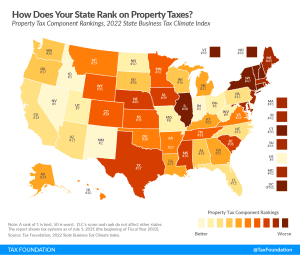

Which states have the highest property taxes in 2022? See how your state compares in property taxes across the United States

5 min read

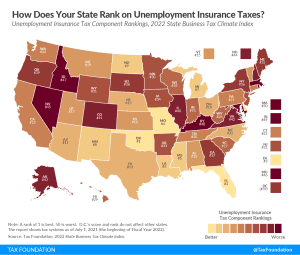

Ranking unemployment insurance tax codes on the 2022 State Business Tax Climate Index. Learn more about state unemployment insurance tax code and systems.

4 min read

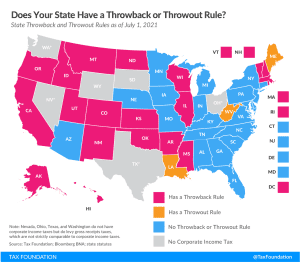

While throwback and throwout rules in states’ corporate tax codes may not be widely understood, they have a notable impact on business location and investment decisions and reduce economic efficiency.

3 min read

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

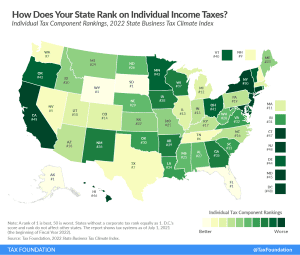

Unlike other studies that look solely at tax burdens, the State Business Tax Climate Index measures how well or poorly each state structures its tax system. It is concerned with the how, not the how much, of state revenue, because there are better and worse ways to levy taxes.

4 min read

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

28 min read

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts.

12 min read

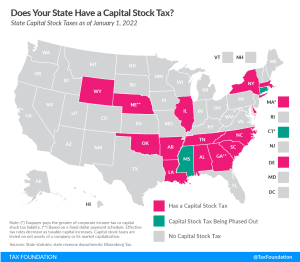

States can better position themselves for success by moving away from economically-damaging taxes like the capital stock tax.

3 min read

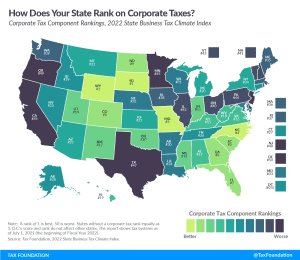

Forty-four states levy a corporate income tax. Rates range from 2.5 percent in North Carolina to 11.5 percent in New Jersey.

8 min read

The pandemic has accelerated changes in the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

6 min read

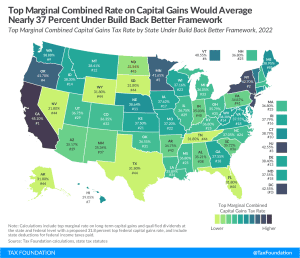

Under the Build Back Better framework, six states and D.C. would face combined top marginal capital gains tax rates of more than 40 percent, nearing the top rate among OECD countries.

3 min read

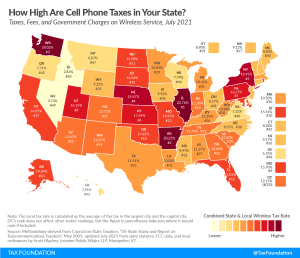

Taxes and fees on the typical American wireless consumer increased again this year, to a record 24.96 percent.

32 min read

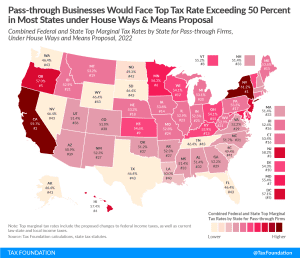

Under the House Democrats’ reconciliation plan, the top tax rate on pass-through business income would exceed 50 percent in most states. Pass-through businesses, such as sole proprietorships, S corporations, and partnerships, make up a majority of businesses and majority of private sector employment in the United States.

3 min read

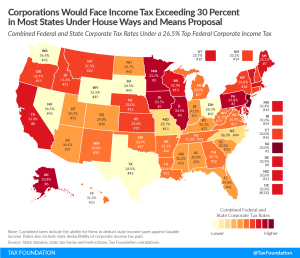

Under the House Democrats’ tax plan, companies in 21 states and D.C. would face a higher corporate tax rate than in any country in the OECD.

1 min read