Cigarette Taxes and Cigarette Smuggling by State, 2022

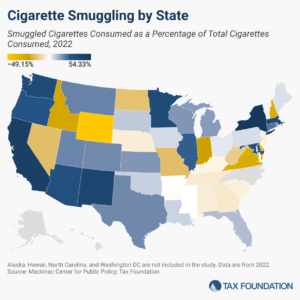

Growing cigarette tax levels and differentials have made cigarette smuggling both a national problem and a lucrative criminal enterprise.

16 min read

Growing cigarette tax levels and differentials have made cigarette smuggling both a national problem and a lucrative criminal enterprise.

16 min read

People respond to incentives. As tax rates increase or products are banned from sale, consumers and producers search for ways around these penalties and restrictions.

17 min read

People respond to incentives. As tax rates increase or products are banned from sale, consumers and producers search for ways around these penalties and restrictions.

19 min read

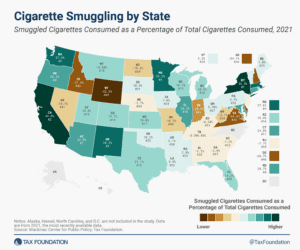

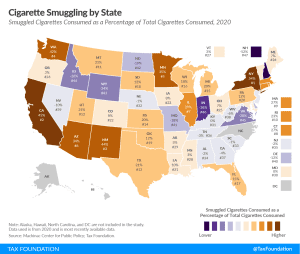

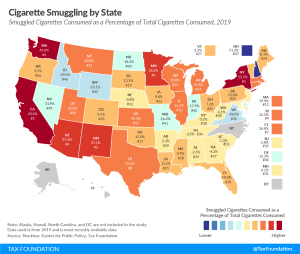

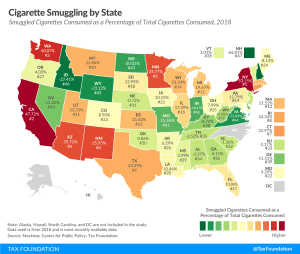

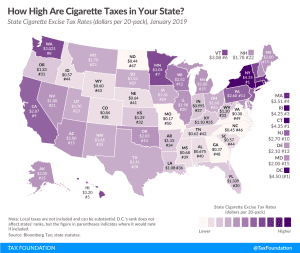

Excessive tax rates on cigarettes in some states induce substantial black and gray market movement of tobacco products into high-tax states from low-tax states or foreign sources. New York has the highest inbound smuggling activity, with an estimated 53.2 percent of cigarettes consumed in the state deriving from smuggled sources.

13 min read

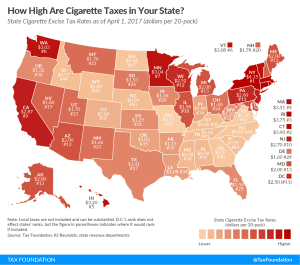

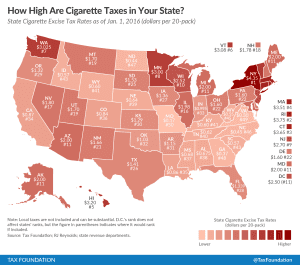

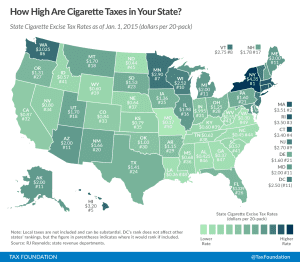

Cigarette taxes around the country are levied on top of the federal rate of $1.0066 per 20-pack of cigarettes. As of 2016, taxes accounted for almost half of the retail cost of a pack of cigarettes.

2 min read

Excessive tax rates on cigarettes approach de facto prohibition in some states, inducing black and gray market movement of tobacco products into high-tax states from low-tax states or foreign sources.

7 min read