A hot summer travel season makes fuel taxes salient to many Americans. Today’s map shows state gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. rates as of July 2023.

States taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. fuel in several ways, including sales taxes, per-gallon excise taxes collected at the pump, taxes imposed on wholesalers (which are passed along to consumers in the form of higher prices), and a variety of operational taxes, such as underground storage tank fees, that are often charged to the retailer.

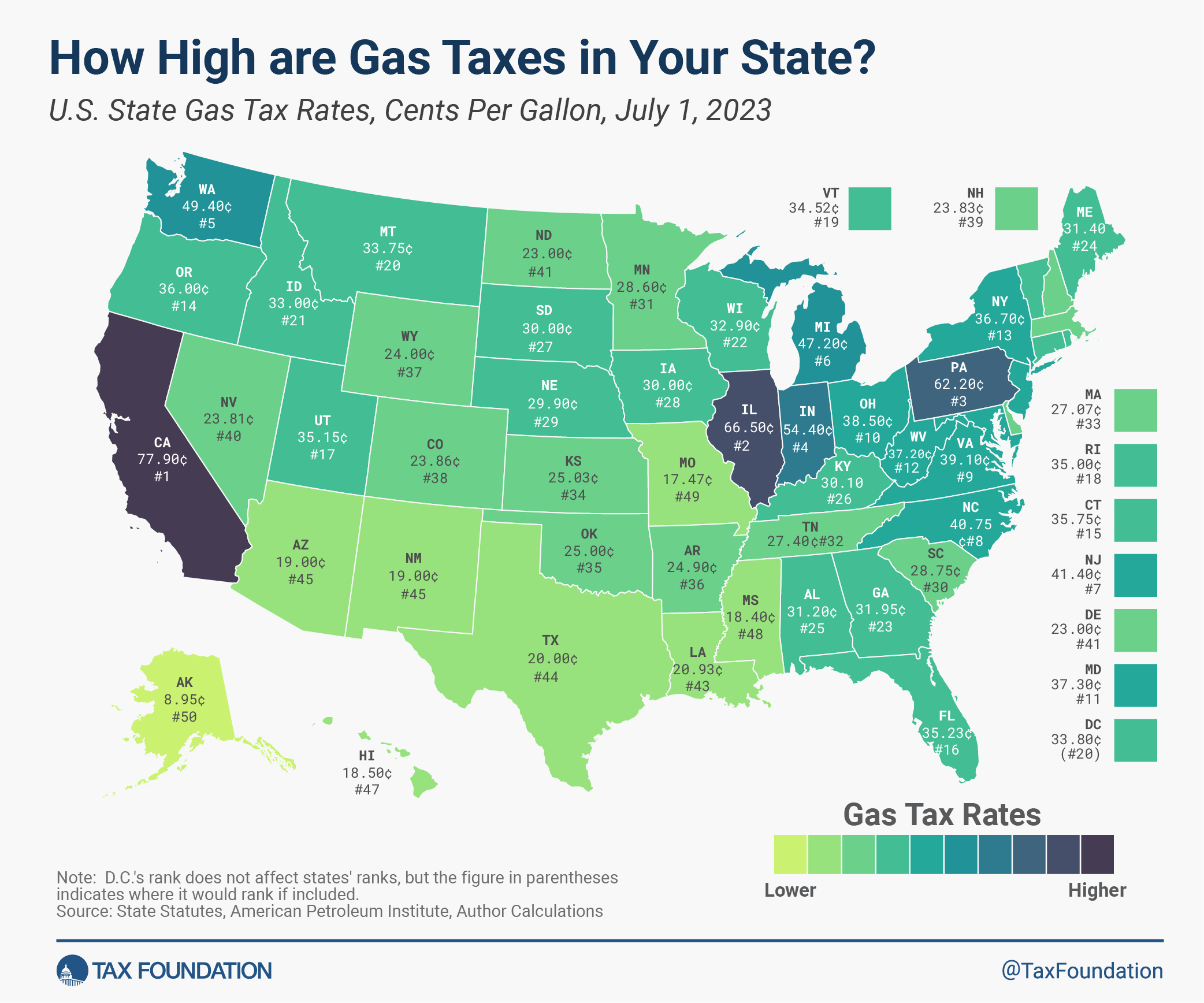

We add up all these different taxes and fees (not including carbon fees) to calculate a total tax rate on gas for each state. The map below shows that U.S. state tax rates vary widely.

California pumps out the highest state gas tax rate of 77.9 cents per gallon (cpg), followed by Illinois (66.5 cpg) and Pennsylvania (62.2 cpg). The lowest state gas tax rates can be found in Alaska at 9.0 cents per gallon, followed by Missouri (17.5 cpg) and Mississippi (18.4 cpg).

While few taxpayers cheer fuel taxes, these systems work well as “user fees.” This public finance concept is a fee imposed by the government with the primary purpose of covering the cost of provided services. In general, drivers benefit from the services that their gas tax dollars pay for, like road construction, maintenance, and repair. Because gas taxes connect drivers to the costs of road upkeep, they encourage efficient road use, which helps limit congestion and the wear and tear that comes from overuse.

However, many states have not indexed their rates for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. , leading the real value of gas tax revenue to fall behind infrastructure spending needs across the country. Gas taxes also face a narrowing base, as vehicle fuel economy has increased and electric vehicles make up an increasing percentage of vehicles on the road. One long-term solution would be to tax vehicle miles traveled (VMT) to ensure that those driving on the roads are paying for the roads. VMT pilot programs are ongoing in all 50 states.

How does your state compare?

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe