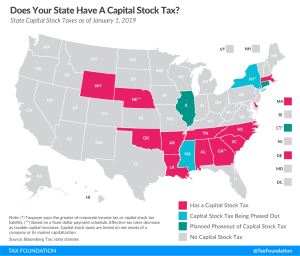

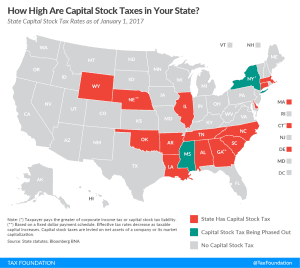

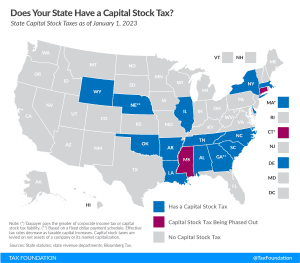

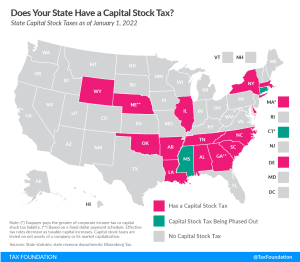

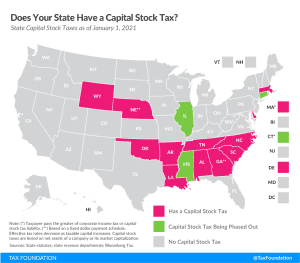

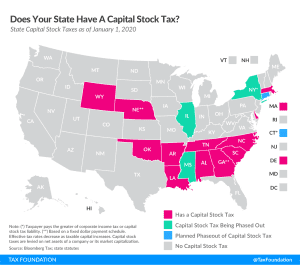

Does Your State Levy a Capital Stock Tax?

States can better position themselves for success by moving away from economically-damaging taxes like the capital stock tax.

4 min read

States can better position themselves for success by moving away from economically-damaging taxes like the capital stock tax.

4 min read

States can better position themselves for success by moving away from economically-damaging taxes like the capital stock tax.

3 min read

Capital stock taxes are imposed on a business’s net worth (or accumulated wealth). As such, the tax tends to penalize investment and requires businesses to pay regardless of whether they make a profit in a given year, or ever.

4 min read

As many businesses may need time to return to profitability after this crisis, states should prioritize reducing reliance on capital stock taxes, and shift toward more neutral forms of business taxation.

4 min read