What Is GDP and Why Should I Care About It?

GDP stands for gross domestic product and is calculated by measuring a country’s total consumption, government spending, investments, and net exports.

2 min read

GDP stands for gross domestic product and is calculated by measuring a country’s total consumption, government spending, investments, and net exports.

2 min read

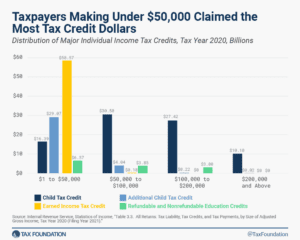

In tax year 2020, taxpayers claimed more than 159 million tax credits on their individual income tax returns worth a total of more than $277 billion. That was an increase of $35.3 billion from tax year 2019, largely due to an influx of pandemic relief administered through the tax code in 2020.

6 min read

Congress should reconsider key elements of the IRA, including the book minimum tax and the green energy credits, with an eye towards simplification and fiscal responsibility.

46 min read

As the TCJA expiration nears, lawmakers face difficult choices in reforming the CTC. While revenue, distributional and economic effects are important, lawmakers should also focus on simplifying the rules and reducing the administrative challenges.

9 min read

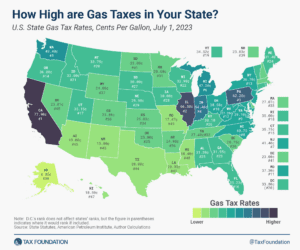

California pumps out the highest state gas tax rate of 77.9 cents per gallon (cpg), followed by Illinois (66.5 cpg) and Pennsylvania (62.2 cpg).

2 min read

A bill introduced in the Massachusetts House, (H. 74) would expand funding for community media programming by imposing a new tax on the gross revenues of digital streaming service providers. The sentiment is understandable, but the proposed solution leaves much to be desired.

6 min read

Taylor Swift’s Eras Tour highlights that taxes impact everyone, artists and fans alike.

3 min read

Discover why there are better and worse ways for governments to raise a dollar of revenue. That’s because no two taxes impact the economy the same.

Taxation plays a key role in driving illicit trade. People respond to incentives, and sizable price markups for legal cigarettes create incentives for tax avoidance.

4 min read

Starting on September 1st, federal student loan payments will resume after a three-and-a-half-year pause on payments and accrued interest following the onset of the COVID-19 pandemic.

6 min read

Montana Policymakers should pursue principled property tax reform that benefits all property owners without creating market distortions or unfairly shifting the tax burden.

5 min read

Our newly enhanced website will improve accessibility to the very data, research, and experts that make us the world’s leading independent tax policy organization.

3 min read

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

4 min read

Details and analysis of the latest House GOP tax plan, the American Families and Jobs Act. Learn more about the House Republican tax plan.

7 min read

In Greta Gerwig’s new Barbie movie, Barbie’s venture outside of Barbieland introduces her to new experiences. But what about Barbie and taxes?

3 min read

Explore IRS clean energy tax credits, including Direct Pay, the IRA and CHIPS Act tax provisions, and Section 1603 grant program. See more.

7 min read

The EU’s recent VAT reform is an example of a win for governments, consumers, and companies. Charting a new path toward a more successful tax system.

4 min read

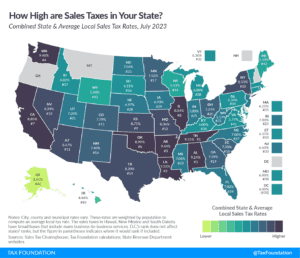

Compare the latest 2023 sales tax rates as of July 1st. Sales tax rate differentials can induce consumers to shop across borders or buy products online.

8 min read

Enhancing the European Union’s competitiveness is necessary, but the European Commission’s latest attempt is the wrong approach.

4 min read

It is hard to imagine the IRS Direct e-File Program operating seamlessly with the complexity of the current U.S. tax system. Instead, lawmakers should first address the more fundamental problem that causes taxpayer frustration: our highly complicated tax code.

4 min read