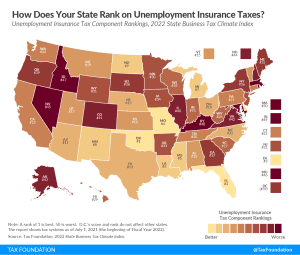

Ranking Unemployment Insurance Taxes on Our 2022 State Business Tax Climate Index

Ranking unemployment insurance tax codes on the 2022 State Business Tax Climate Index. Learn more about state unemployment insurance tax code and systems.

4 min read

Ranking unemployment insurance tax codes on the 2022 State Business Tax Climate Index. Learn more about state unemployment insurance tax code and systems.

4 min read

Among the many achievements in the illustrious career of former Sen. Orrin Hatch (R-UT) was his commitment to bipartisan tax reform.

3 min read

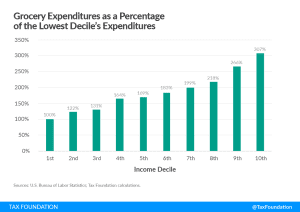

This legislative session, the sales tax on food has garnered a great deal of attention in Kansas, with policymakers on both sides of the aisle proposing the removal of groceries from the sales tax base.

7 min read

Tax reform has become a major focus for state legislatures this session, and Missouri lawmakers are tuned in to the action: after adjusting individual income tax triggers in 2021, the legislature is exploring further tax reform options.

6 min read

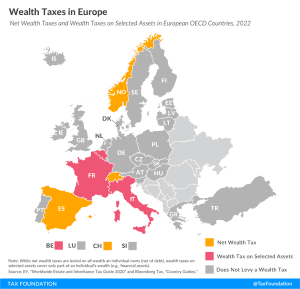

Only three European OECD countries levy a net wealth tax, namely Norway, Spain, and Switzerland.

3 min read

As the deadline for tax filing nears, the IRS faces scrutiny for its backlog of returns, inaccessible taxpayer service, and delays in issuing certain refunds.

5 min read

Learn where and when taxes originated and how they resemble taxes we have today. Understand how the American tax code developed from the beginning of the colonies. Learn about some of the weirder taxes throughout history, designed not just to raise revenue, but influence behavior too.

Total tax collections are currently running 25 percent higher than last year, and if that pattern holds, total federal tax collections will reach over $5 trillion in FY 2022—a new all-time high.

3 min read

In times of inflation, a review of the tax code shows that some provisions are automatically indexed, or adjusted, to match inflation, while others are not. And that creates unfair burdens for taxpayers. But it’s not always as simple as just “adjusting for inflation.”

4 min read

Exempting groceries from the sales tax base reduces economic efficiency without achieving its objective of enhancing tax progressivity.

19 min read

Lawmakers can be proud of the steps that they have taken toward a better tax code but should consider revisiting the design of the bill’s tax triggers in order to better accomplish their goal of responsible improvement.

6 min read

As part of President Biden’s proposed budget for fiscal year 2023, the White House has once again endorsed a major tax increase on accumulated wealth, adding up to a 61 percent tax on wealth of high-earning taxpayers.

4 min read

Before competing in the UEFA Champions League, football clubs in Europe also compete to lure the best players.

5 min read

Kentucky is making commendable progress toward a more modern and competitive tax code, but more work on comprehensive tax reform should be prioritized next session.

7 min read

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

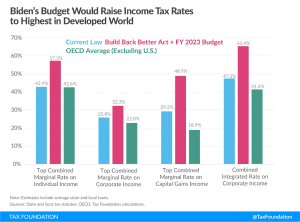

The FY 2023 budget proposes several new tax increases, which in combination with the Build Back Better Act, would give the U.S. the highest top tax rates on individual and corporate income in the developed world.

4 min read

In a letter to lawmakers, the 46th President said that his $5.8 trillion budget package would “[grow] our economy, while ensuring that the wealthiest Americans and the biggest corporations begin to pay their fair share.” We break down what the President is proposing for this upcoming fiscal year and what its impact would be on the U.S. economy in the face of record-high inflation.

Mississippi policymakers delivered the largest tax cut in state history, providing meaningful relief for taxpayers by cutting individual income tax rates.

7 min read

Lawmakers in Colorado, and in the several other states considering flavor bans, should think twice before following in the footsteps of Massachusetts. A statewide ban on flavored tobacco products is more than likely to costs millions of dollars, increase smuggling, and have a negligible effect on public health.

5 min read

The Biden administration should lift the Trump administration’s tariffs, as they have failed in their objective to bring better trading practices and instead brought about significant damage to U.S. businesses and workers.

6 min read