USITC Report Highlights Trade-Offs of Using Tariffs

The assessment of the tariffs President-elect Donald Trump imposed in 2018 and 2019 is clear: the policies have had a negative effect on American’s welfare.

4 min read

The assessment of the tariffs President-elect Donald Trump imposed in 2018 and 2019 is clear: the policies have had a negative effect on American’s welfare.

4 min read

One prominent feature of President Biden’s agenda on the environment is to target U.S. fossil fuel producers and production with nearly $97 billion in tax increases over the next decade.

16 min read

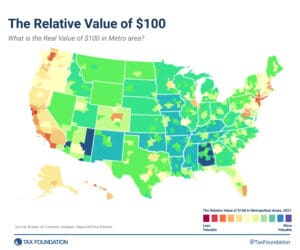

The differences in purchasing power can be large and they have significant implications for the relative impact of economic and tax policies across the United States.

3 min read

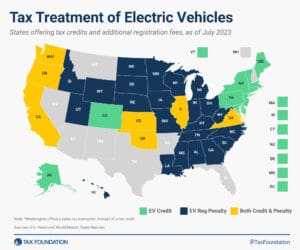

The state EV taxation landscape reflects the evolving transportation sector and the pressing need to address both fiscal gaps in road funding and environmental concerns.

4 min read

Step into the shadows of illicit trade where taxation, incentives, and criminal networks intersect to fuel the lucrative cigarette smuggling market.

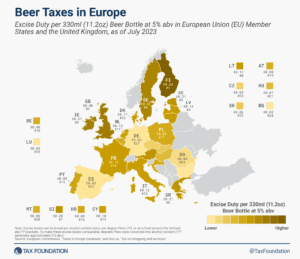

As Oktoberfest celebrations kick off around the world, let’s look at how much tax European Union (EU) countries add to the world’s favorite alcoholic beverage.

2 min read

Any move to repeal the cap or enhance the deduction would disproportionately benefit higher earners, making the tax code more regressive.

5 min read

Now is the time for lawmakers to focus on long-term fiscal sustainability, as further delay will only make an eventual fiscal reckoning that much harder and more painful. Congressional leaders should follow through on convening a fiscal commission to deal with the long-term budgetary challenges facing the country.

35 min read

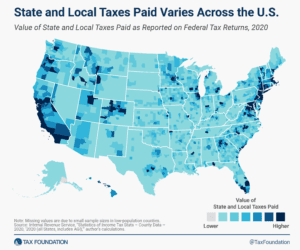

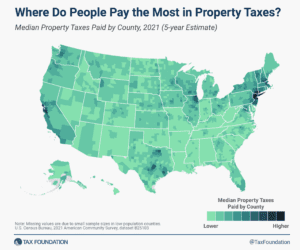

Property taxes are the primary tool for financing local governments and generate a significant share of state and local revenues.

6 min read

The Spanish election results are moving the country away from pro-growth tax reforms while launching the government’s tax agenda, and the agenda of the Spanish presidency of the Council of the European Union, into uncertainty.

7 min read

Policymakers at all levels of government should avoid the pitfalls of incentives. Instead, they should focus on creating a more efficient, neutral, and structurally sound tax code to the benefit of all types of business investment.

6 min read

Recharacterizing a rather simple repayment transaction as a tax rebate is concerning, not just for sound tax policy, but also for the future of public-private financing partnerships.

4 min read

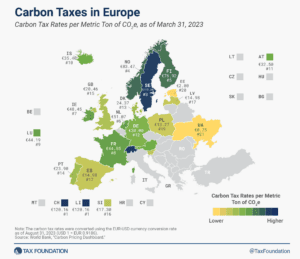

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems, and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax.

4 min read

What can Former President Trump’s previous tariff efforts—specifically the safeguards he authorized on imported washing machines in 2018—tell us about his most recent proposal for a 10 percent tariff on all imports?

6 min read

One year after its enactment, there are concerns about the Inflation Reduction Acts overall fiscal impact, the additional complexity it introduces to the tax system, and the sustainability of its initiatives.

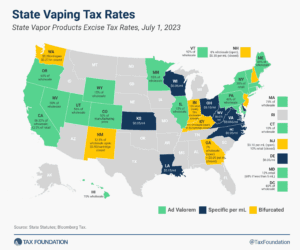

If the policy goal of taxing cigarettes is to encourage cessation, vapor taxation must be considered a part of that policy design.

3 min read

Former President Donald Trump’s proposed 10 percent tariff would raise taxes on American consumers by more than $300 billion a year—a tax increase rivaling the ones proposed by President Biden.

4 min read

The early evidence indicates that making a “good return greater” through Opportunity Zone tax incentives is an ineffective and poorly targeted way to raise the living standards of low-income residents.

6 min read

The potential for alternative tobacco products to save lives is clear and well established. The framework described in this paper uses a scientific approach to tax strategy that will both reduce harm and create a reliable revenue stream for public expenditures.

17 min read

For many Italian banks, there hasn’t been a significant “windfall” to tax. The profit margins of Italian banks have been lower compared to other industries for the past two decades.

5 min read