Do Consumption Taxes Do a Better Job of Taxing Criminals?

One of the arguments in favor of the FairTax is that it would do a better job of taxing the underground economy than the income tax it is intended to replace.

6 min read

One of the arguments in favor of the FairTax is that it would do a better job of taxing the underground economy than the income tax it is intended to replace.

6 min read

In our latest report, we consider several theoretical arguments for carbon taxes and the evidence from carbon taxes implemented around the world related to emissions, economic growth, distribution and revenue recycling options, other environmental taxes, green subsidies, and environmental regulations.

49 min read

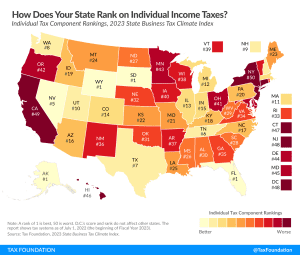

Individual income tax rates can influence location decision-making, especially in an era of enhanced mobility, where it is easier for individuals to move without jeopardizing their current job, or without limiting the scope of their search for a new one.

5 min read

When a country has a broad base with a simple and transparent tax code, small rate changes have little influence. Therefore, policymakers shouldn’t only focus on rate changes when it comes to increasing tax competitiveness.

4 min read

As policymakers in St. Paul finalize this year’s tax bill, they should avoid policies that incentivize the diversion or relocation of capital. Importantly, states do not institute tax policy in a vacuum. The evidence from states’ experiences and the academic literature supports the conclusion that tax competitiveness matters not just to businesses but to human flourishing.

15 min read

The Carbon Border Adjustment Mechanism (CBAM) is a key aspect of the EU’s broader Fit for 55 package which aims to cut 55 percent of net greenhouse gas (GHG) emissions in the EU by 2030. The growing number of competing climate policies between the EU and U.S., such as tax provisions in the Inflation Reduction Act, could present policymakers on both sides of the Atlantic an opportunity to work together.

5 min read

As predicted, the Inflation Reduction Act’s misguided price-setting policy is already discouraging drug development. Rather than double down on it, as President Biden proposes doing in his budget, lawmakers ought to restore incentives to invest in the United States.

5 min read

While some temporary policies can help in a crisis, policymakers should focus their efforts on sustainable policies that support growth and the resilience of businesses (and government coffers) over the long term.

6 min read

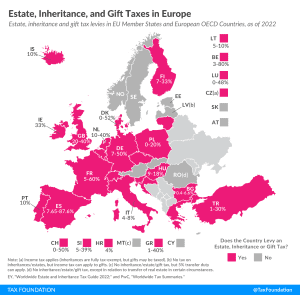

As tempting as inheritance, estate, and gift taxes might look—especially when the OECD notes them as a way to reduce wealth inequality—their limited capacity to collect revenue and their negative impact on entrepreneurial activity, saving, and work should make policymakers consider their repeal instead of boosting them.

3 min read

Our recent policy conference brought together academics and political leaders to present research on some of the most pressing issues in global tax policy and to discuss solutions that can unlock genuine global growth.

9 min read

Scandinavian countries are well known for their broad social safety net and their public funding of services such as universal health care, higher education, parental leave, and child and elderly care. So how do Scandinavian countries raise their tax revenues?

7 min read

Consistent principles ought to apply across the tax code. In the case of intangible drilling costs, companies should be able to claim full deductions for the costs they incur.

4 min read

Michiganders will pay a lower individual income tax rate next year thanks to high general fund revenues, but these savings may be short-lived following an opinion released by the state’s attorney general.

7 min read

Recreational marijuana taxation is one of the hottest policy issues in the U.S. Currently, 21 states have implemented legislation to legalize and tax recreational marijuana sales.

6 min read

While the IRS hopes to increase revenue collection and minimize additional burdens on taxpayers, uncertainty remains regarding its ability to deliver, particularly on the latter. Furthermore, some concerns about the original funding package are already surfacing, specifically around insufficient funding for taxpayer services.

6 min read

The Portuguese government has introduced plans to exempt “essential” food items from its value-added tax (VAT) in response to the recent inflation spike. While this may sound like a reasonable measure on the surface, it comes with numerous unintended consequences that compromise its effectiveness.

4 min read

Spain should follow the examples of Italy and the UK and enact tax reforms that have the potential to stimulate economic activity by supporting private investment while increasing its international tax competitiveness.

7 min read

Accelerating its current individual income tax triggers and setting up the corporate income tax for eventual elimination would increase Missouri’s attractiveness among states at a time when businesses are increasingly mobile and tax competition matters more than ever.

4 min read

When designed well, excise taxes discourage the consumption of products that create external harm and generate revenue for funding services that ameliorate social costs. The effectiveness of excise tax policy depends on the appropriate selection of the tax base and tax rate, as well as the efficient use of revenues.

83 min read

To recover from the pandemic and put the global economy on a trajectory for growth, policymakers need to aim for more generous and permanent capital allowances. This will spur real investment and can also contribute to more environmentally friendly production across the globe.

33 min read