Good Policy Leads to More Tax Cuts for West Virginia

Next year, West Virginians will see an income tax cut thanks to revenue triggers in a 2023 law. The Mountain State joins 14 other states that have cut income taxes this year.

4 min read

Next year, West Virginians will see an income tax cut thanks to revenue triggers in a 2023 law. The Mountain State joins 14 other states that have cut income taxes this year.

4 min read

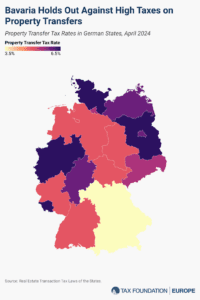

The real estate transaction tax is levied on the gross sales value of a property when it changes ownership, without deductions for investment or purchasing costs. This makes the tax particularly harmful to investment in buildings and structures.

3 min read

Gov. Pillen is searching for tax burden relief. But his plan, which reportedly involves a two-tiered sales tax and the state’s assumption of most school funding responsibility, would have profound implications that even those most convinced of the urgency of property tax relief may find unworkable and unpalatable.

12 min read

Governor Sarah Huckabee Sanders (R) recently called a brief special legislative session to enact the fourth round of reductions to the Natural State’s individual and corporate income taxes. Legislators also passed a modest property tax reform proposal.

4 min read

Many developed countries have repealed their wealth taxes in recent years for a variety of reasons. They raise little revenue, create high administrative costs, and induce an outflow of wealthy individuals and their money. Many policymakers have also recognized that high taxes on capital and wealth damage economic growth.

30 min read

Summer has arrived and states are beginning to implement policy changes that were enacted during the legislative session (or are being phased in over time).

13 min read

To stay competitive in an increasingly mobile post-pandemic world, states and localities must learn from the tax policy successes and failures of their neighbors and communities across the nation.

27 min read

With a robust surplus and plenty saved for a rainy day, Kansas can afford substantial tax relief, but not all tax relief is created equal.

7 min read

Get ready to hit the autobahn and explore the world of German taxes! We’ll navigate the complexities of Germany’s tax structure.

Two bills in Georgia will lower the flat individual income tax rate and align the corporate income tax rate with the individual income tax rate.

4 min read

With proposals to adopt the nation’s highest corporate income tax, second-highest individual income tax, and most aggressive treatment of foreign earnings, as well as to implement an unusually high tax on property transfers, Vermont lawmakers have no shortage of options for raising taxes dramatically.

7 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Focusing on competitiveness, neutrality, and efficient policies to raise revenue would go a long way in increasing economic growth and stabilizing public finances over the long term.

7 min read

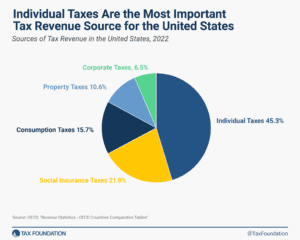

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

3 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

3 min read

The “Bring Chicago Home” ballot measure would make Chicago’s tax structure substantially less neutral by raising taxes on some property transfers while decreasing taxes on others.

7 min read

Portugal’s turnover tax on real property transfers places a serious drag on economic growth by making it harder for people to relocate for better jobs and living conditions while constraining investment into the development of housing and buildings.

5 min read

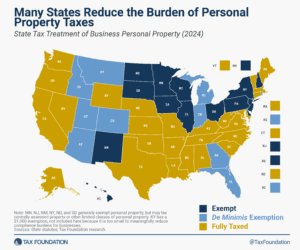

Does your state have a small business exemption for machinery and equipment?

3 min read

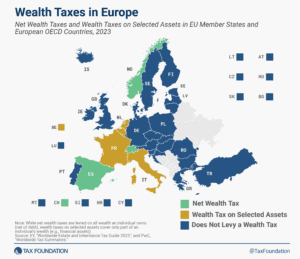

Only three European countries levy a net wealth tax—Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets.

4 min read