New Mexico’s Omnibus Tax Bill

Adopting the sound tax reforms still pending in Santa Fe is an opportunity for New Mexico to keep up with the pack or risk falling further behind.

7 min read

Adopting the sound tax reforms still pending in Santa Fe is an opportunity for New Mexico to keep up with the pack or risk falling further behind.

7 min read

Understanding how tax brackets work can inform decisions about performing extra work through a second job or overtime, or pursuing new streams of income.

As final negotiations occur between the House and Senate, legislators should avoid adopting new policies that would jeopardize Kentucky’s business tax competitiveness.

5 min read

The changes put forth in a new package of bills would represent significant pro-growth change for Oklahoma that would set the state up for success in an increasingly competitive tax landscape.

7 min read

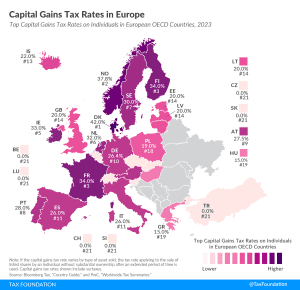

In many countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income. Denmark levies the highest top capital gains tax of all countries covered, at a rate of 42 percent. Norway levies the second-highest top capital gains tax at 37.8 percent. Finland and France follow, at 34 percent each.

4 min read

The proposed reforms would be welcome changes to the Commonwealth’s tax code, but the economic principles behind the reforms also have important implications for the Bay State’s income tax system writ large.

6 min read

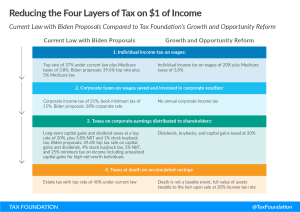

Tax reform should be about increasing fairness. And the way to get there is by reducing complexity and double taxation, not by doubling down on them.

6 min read

As Kansas legislators consider additional tax policy changes this legislative session, they should prioritize economic growth and a structurally sound tax code.

7 min read

President Biden’s new budget proposal outlines several major tax increases targeted at businesses and high-income individuals that would bring U.S. income tax rates far out of step with international norms.

7 min read

Focusing on the “threat” to European industry caused by the Inflation Reduction Act rather than internal tax system flaws puts the EU at risk of slower economic growth and possibly losing some of its important industrial base. It is also contrary to the EU’s geopolitical goals.

4 min read

Affordable housing is an issue that has had long-standing bipartisan interest in D.C. But the path to increase the supply of affordable housing, though often well-intentioned, has created a bureaucratic nightmare.

If the EU wants to strategically compete with economic powers like the United States or China, it needs principled, pro-growth tax policy that prioritizes efficient ways to raise revenue over geopolitical ambitions.

6 min read

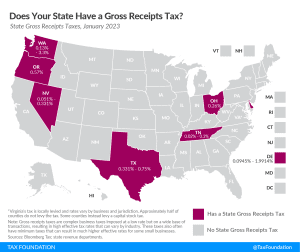

Gross receipts taxes impose costs on consumers, workers, and shareholders alike. Shifting from these economically damaging taxes can thus be a part of states’ plans for improving their tax codes in an increasingly competitive tax landscape.

4 min read

Crafting a hybrid bill for a low, flat rate on a broad base—with well-designed revenue triggers to responsibly reduce rates in the future—could be an ideal way forward for the North Dakota Senate.

7 min read

Adopting a distributed profits tax would greatly simplify U.S. business taxes, reduce marginal tax rates on investment, and renew our country’s commitment to pro-growth tax policy.

6 min read

In a day and age when businesses and individuals alike are increasingly mobile, West Virginians can be relieved that their state is getting off the sideline and into the action.

4 min read

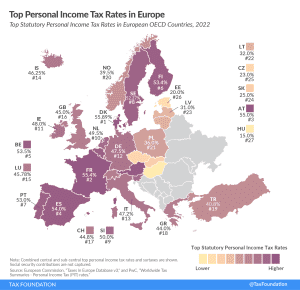

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

2 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

A growing number of cities, in red states like Arkansas and Texas, blue states like California and New Jersey, and purple states like Georgia and Nevada, have pursued streaming taxes in recent years.

7 min read

When it comes to providing economic relief to those in need, wartime energy security, and principled tax policy, the EU can do all three. But a windfall profits tax is not the policy to achieve these goals.

8 min read