Taxing Life Insurance

As Congress attempts to prevent the expiration of major Tax Cuts and Jobs Act provisions, it needs to find ways to pay for them. Ideally, it should use the least economically harmful means possible.

3 min read

As Congress attempts to prevent the expiration of major Tax Cuts and Jobs Act provisions, it needs to find ways to pay for them. Ideally, it should use the least economically harmful means possible.

3 min read

The proposed changes to federal tax code conformity in Oregon are a good example of a change that could significantly reshape the state’s tax code in the future, despite being framed as temporary technical adjustments.

4 min read

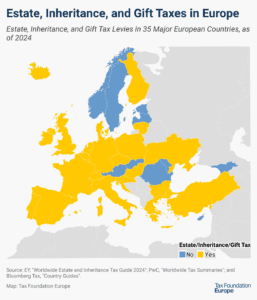

Twenty-four out of the 35 European countries covered in this map currently levy estate, inheritance, or gift taxes.

3 min read

Lawmakers are right to enact a single-rate individual income tax. However, lawmakers should consider the full effects of the reform, ensuring that relief is not financed by shifting the tax burden to lower-income individuals and families.

4 min read

Among the many other tax proposals being considered in Washington this year, policymakers have proposed separate bills that would impose a carbon tax on cigarettes and implement a state-wide flavor ban on tobacco products.

3 min read

Congressional Republicans are looking for ways to pay for extending the tax cuts scheduled to expire at the end of the year. Repealing the green energy tax subsidies expanded or introduced in the Inflation Reduction Act is an appealing option.

Do tariffs really level the playing field, or are they just bad economics? In this emergency episode, we fact-check the Trump administration’s claims that retaliatory tariffs make trade fairer.

What are the biggest tax stories shaping policy today—and what do they mean for you? In our 100th episode, we break down the five biggest tax stories, from the global tax deal to the looming expiration of the Tax Cuts and Jobs Act.

Many states regulate and tax legal marijuana sales and consumption, despite the ongoing federal prohibition. Explore the data here.

8 min read

The individual income tax has plenty of problems, but in some respects the tax has improved in recent decades. Unfortunately, several Trump administration proposals would move us in the wrong direction, including the president’s call to drop taxes on tips.

With a wealth tax, property tax increases, and this new payroll tax on the agenda, Washington lawmakers have reason to fear that many employers could be looking for the exits.

5 min read

The empirical evidence thus far on sugar-sweetened beverage taxes fails to support claims that these taxes will create substantial health benefits. At the same time, their structural limitations make them ill-suited for generating stable, equitable revenue.

54 min read

This legislative session, local taxes are a major topic of debate in Indiana. Although the state’s property tax system is already nationally competitive, dramatic increases in assessed values have created discontent in recent years.

8 min read

Surtaxes such as Germany’s solidarity surtax run counter to the principles of simplicity and transparency of the tax system because they impose an additional layer of tax on taxpayers and create a more complex tax structure that often obscures the actual tax burden.

4 min read

Montana’s 2025 legislative session has seen a flurry of property tax reform proposals, a response to the surge in property valuations in the state. Unfortunately, hasty decision-making can result in suboptimal policy outcomes.

6 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

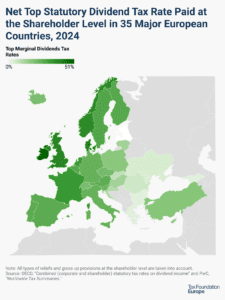

Many countries’ personal income tax systems tax various sources of individual income—including investment income such as dividends and capital gains.

4 min read

A North Carolina House bill titled “No Tax on Tips, Overtime, Bonus Pay,” is gaining bipartisan traction in the General Assembly, mirroring similar proposals nationwide, including those championed by President Trump.

4 min read

Whether we look at it as consumers of these goods, or as middle-class workers who transform them, low-cost goods have been the underpinning of American prosperity.

With such an important change to Iowa’s property tax system, it’s important that lawmakers get the details right.

33 min read