Key Findings

- In taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. year 2020, taxpayers claimed more than 159 million tax credits on their individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. returns worth a total of more than $277 billion. That was an increase of $35.3 billion from tax year 2019, largely due to an influx of pandemic relief administered through the tax code in 2020.

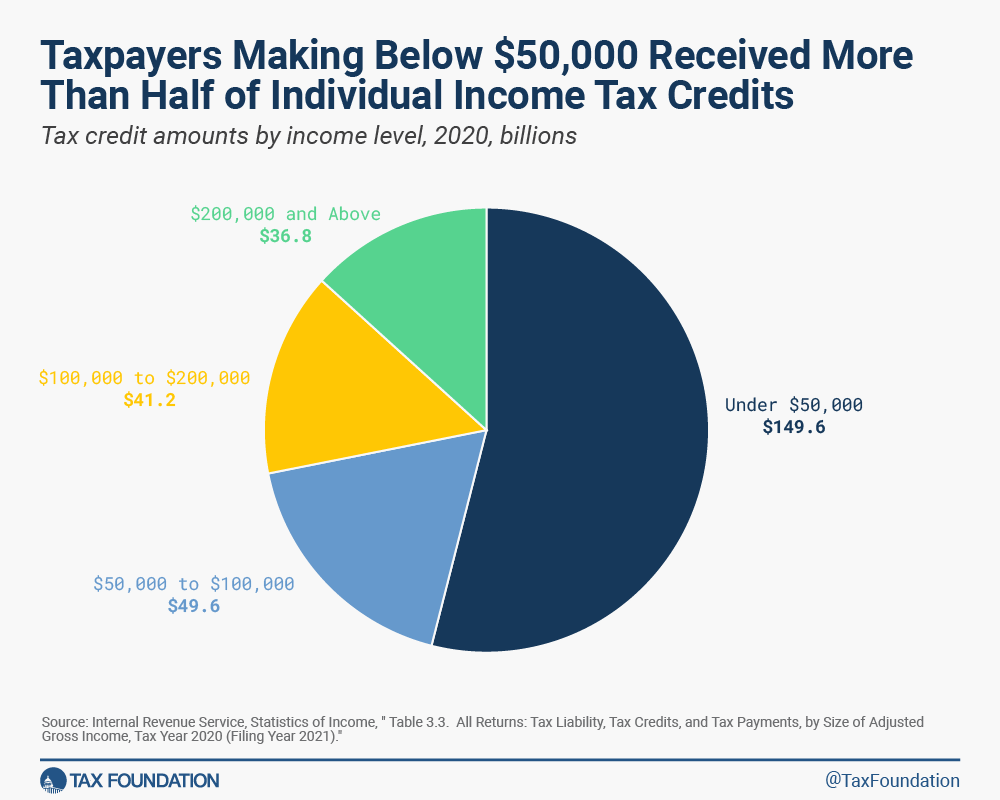

- Taxpayers with adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” below $50,000 claimed 54 percent ($149.6 billion) of tax credits by amount while taxpayers with adjusted gross income above $200,000 claimed 13 percent ($36.8 billion) in 2020.

- The largest tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. by number of claims and by amount was the Child and Dependent Tax Credit, claimed on 39.3 million tax returns for a total benefit of $84.4 billion.

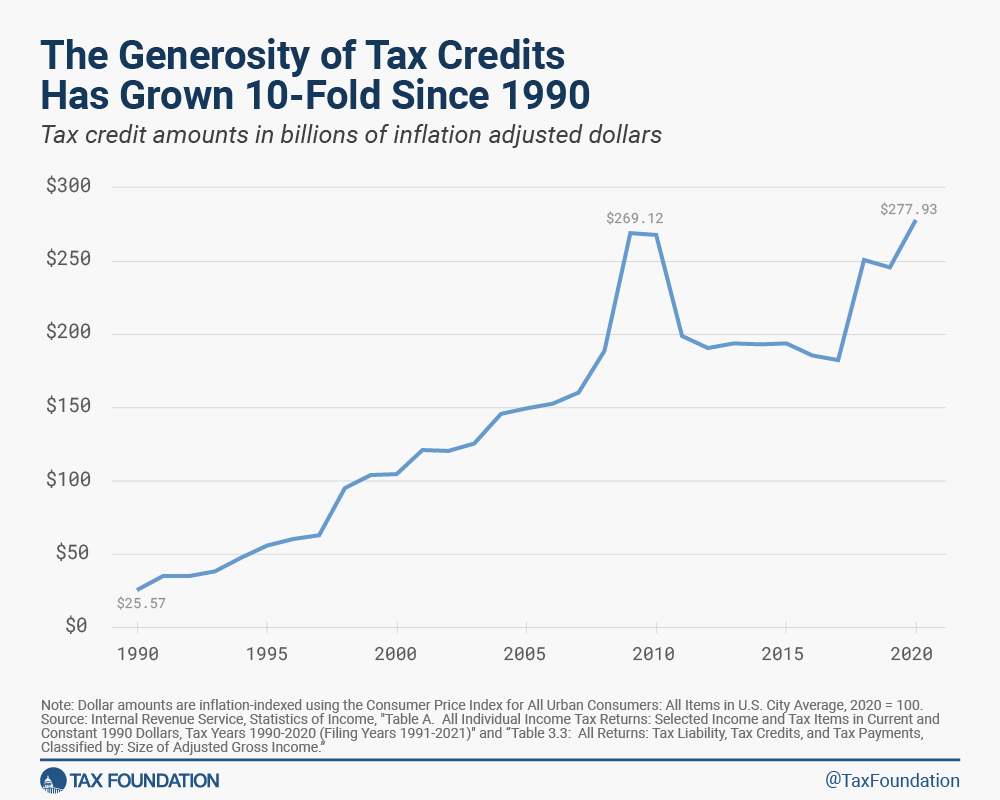

- From 1990 to 2020, the value of tax credits has increased nearly 10-fold after adjusting for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. , reflecting how lawmakers have increasingly relied on the tax code to administer social benefits.

Introduction

In tax year 2020, more than 164 million people filed tax returns with the Internal Revenue Service, and they reduced the taxes they owed with more than 159 million tax credit claims worth more than $277 billion.

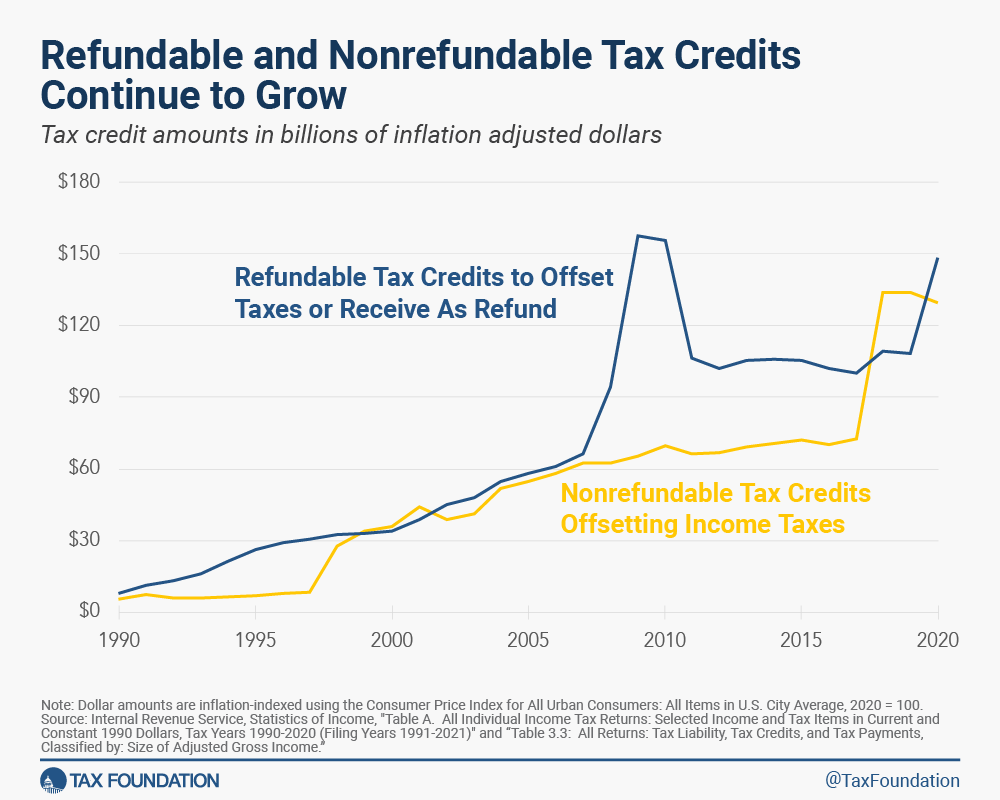

Tax credits can benefit taxpayers in two ways. A nonrefundable credit allows a taxpayer to reduce their income tax liability until it reaches zero. A refundable tax credit allows a taxpayer to reduce their income tax liability until it reaches zero, then reduce other taxes owed, and then receive any additional credit they are eligible for as a refund payment.

The number and generosity of individual income tax credits has steadily risen over the past several decades as lawmakers have expanded existing credits, established new credits, and increasingly relied on the tax code to provide relief during economic downturns.

Our report will examine the tax credits claimed in tax year 2020, the distribution of the largest tax credits, and notable trends in the availability and amount of tax credits over time.

Taxpayers Claimed More Than $277 Billion in Tax Credits in Tax Year 2020

The main type of income reported on individual income tax returns comes from wages and salaries, but people also report noncorporate business income, such as earnings from a partnership, on their tax returns. As such, both individual and business tax credits are available on the Form 1040.

Taxpayers filed more than 164 million individual income tax returns for tax year 2020 and claimed $277 billion worth of tax credits on their returns. That was a significant increase from $247 billion in credits claimed in 2019, largely due to the influx of pandemic relief administered through the tax code in 2020.

The largest credit by number of claims and aggregate dollar amount was the Child Tax Credit (CTC), followed by the temporary Recovery Rebate Credit which provided pandemic relief payments.

The Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC, the refundable portion of the CTC) also provided significant benefits to filers, as 26 million claimed the EITC for a total of $59 billion and 19 million claimed the ACTC for a total of nearly $34 billion.

Nearly 14 million tax returns claimed an education tax credit for a total of $13.5 billion. The Retirement Savings Contributions Credit and the Foreign Tax Credit were both claimed on 9 million tax returns, but for vastly different total amounts: $1.7 billion and $21.6 billion.

Table 1. Top Tax Credits in Tax Year 2020

| Number of claims (millions) | Dollar amount of claims (billions) | |

|---|---|---|

| Child Tax Credit and Other Dependent Tax Credit | 39.3 | $84.40 |

| Recovery Rebate Credit | 31.1 | $45.40 |

| Earned Income Tax Credit | 26.0 | $59.20 |

| Additional Child Tax Credit | 19.1 | $33.70 |

| Refundable and Nonrefundable Education Credits | 13.9 | $13.50 |

| Retirement Savings Contributions Credit | 9.4 | $1.70 |

| Foreign Tax Credit | 9.2 | $21.60 |

| Other Tax Credits | 11.8 | $18.20 |

| Total | 159.9 | $277.90 |

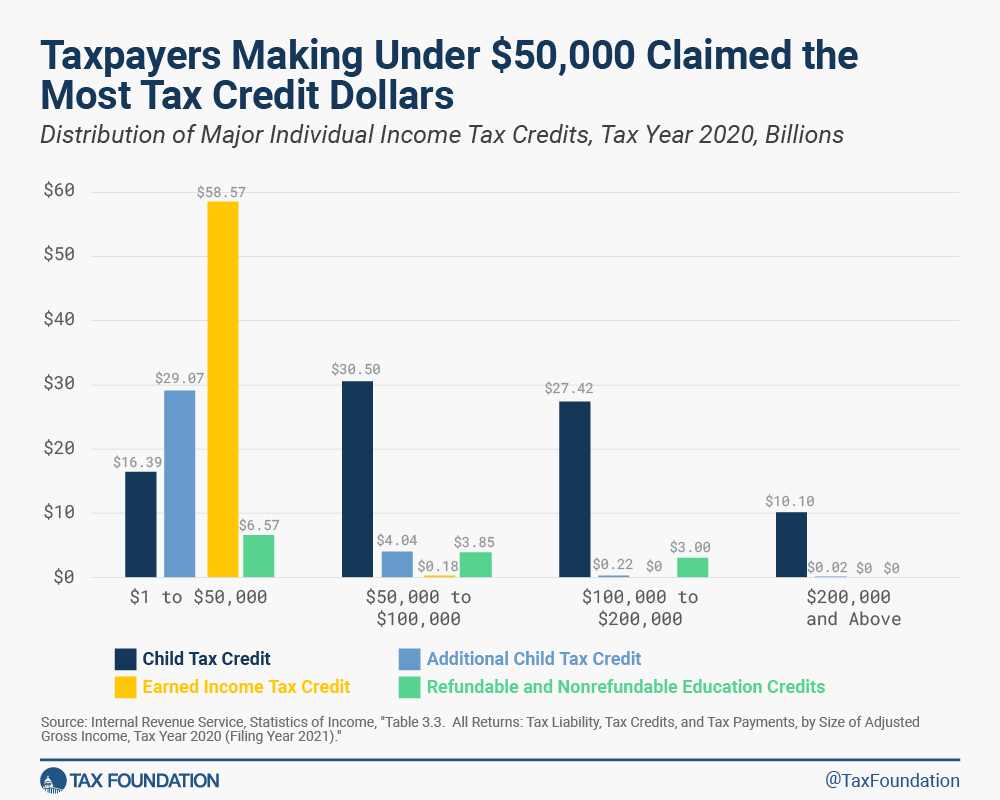

Taxpayers making between $1 and $50,000 claimed the largest amount of ACTC ($29 billion) and EITC ($59 billion), while taxpayers making between $50,000 and $100,000 claimed the most nonrefundable CTC ($30 billion) followed closely by taxpayers making between $100,000 and $200,000 ($27 billion). The highest income taxpayers claimed the smallest amount of CTC and received no benefit from the other three major credits.

Across all $277 billion of tax credits claimed on the Form 1040 in tax year 2020, a similar pattern holds. Taxpayers making under $50,000 received 54 percent of the tax credits claimed, while taxpayers making above $200,000 received 13 percent.

The Generosity of Tax Credits Has Grown 10-Fold Since 1990

In 1990, taxpayers filed 113.7 million tax returns and claimed $25.6 billion worth of tax credits (in 2020 dollars). By 2020, the number of tax returns filed grew by 45 percent to reach 164.4 million while the amount of tax credits claimed grew 10-fold to $277.9 billion.

The value of tax credits has risen in good economic times and bad, with the most prominent spikes occurring during downturns or major tax reform packages, as illustrated in the nearby chart. For instance, the increase from 2007 to 2009 occurred primarily due to Recovery Rebates in 2008 and the creation of the Making Work Pay Credit in 2009. Similarly, the 2017 tax reform’s expansion of the CTC caused a large step up in 2018, while pandemic relief programs in 2020 caused another marked increase in the total value of tax credits claimed through recovery rebates (the American Rescue Plan’s expansion of the CTC did not occur until 2021).

According to the IRS, before credits, the total amount of income tax due on taxpayer’s 2020 tax returns amounted to $1.83 trillion. Nonrefundable tax credits offset $129 billion of income taxes. Refundable credits offset more than $21 billion of income taxes due, nearly $11 billion in other taxes, and provided an additional $116 billion of net refunds. Together, nonrefundable and refundable tax credits amounted to more than $277 billion for tax year 2020.

From 1990 through 2020, nonrefundable tax credits have made up 40 percent of total tax credits on average, with refundable tax credits making up a larger 60 percent share on average. Nonrefundable tax credits amounted to more than refundable tax credits in only 5 of the years from 1990 through 2020: 1999, 2000, 2001, 2018, and 2019.

Table 2 provides brief descriptions and relevant dates for the 28 categories of tax credits found in IRS Statistics of Income Table A based on publications from the IRS, Congressional Research Service, or General Accountability Office.

Table 2. Descriptions of Individual Income Tax Credits

| Name of Credit | Relevant dates | Description |

|---|---|---|

| Additional Child Tax Credit | Made refundable in 2001 | Refundable portion of the CTC of up to $1,400 (adjusted for inflation with a $2,000 limit) per eligible child. |

| Adoption Credit | Created in 1996, available beginning in 1997 | A nonrefundable credit to offset the cost of adoption related expenses for families who adopted or began the adoption process in 2020. The maximum credit is $14,300 for each eligible child under the age of 18 and begins to phase out when modified AGI exceeds $214,520. |

| Advance Earned Income Credit Payments | 1979-2010 | Beginning in 1979, workers could elect to receive the EITC in advance payments along with their paychecks. The advance payment option ended for tax years beginning after December 31, 2010. |

| Alternative Fuel Vehicle Refueling Property Credit | Created in 2005 | A nonrefundable credit for taxpayers who install “qualified vehicle refueling and charging property” in their home or place of business. The credit is equivalent to 30% of the expense of qualifying property and limited to a maximum of $30,000 per location for business property and $1,000 per location for non-business property. |

| Alternative Motor Vehicle Credit | Created in 2005 | A nonrefundable tax credit claimed on Form 8910 to offset the cost of purchasing a vehicle with at least four wheels that uses alternative energy sources. |

| American Opportunity Credit | Created in 2009 | The refundable portion of the AOTC is reported separately in the IRS data. |

| Child and Dependent Care Credit | Created in 1976 | Allows a nonrefundable tax credit for child or dependent care expenses incurred while working or looking for work. The maximum credit varies by income level and equals up to 35% of up to $3,000 in eligible expenses for one qualifying dependent or up to $6,000 in eligible expenses for more than one qualifying dependent. |

| Child and Other Dependent Tax Credit | Created in 1997, available beginning in 1998 | Allows a credit for “qualifying children” under the age of 17 claimed as a dependent on an individual's tax return. The credit allows up to $2,000 for each child to offset income taxes due. A nonrefundable credit of $500 is also available for dependents not eligible for the child tax credit. The credit phases out at 5% when AGI exceeds $200,000 for single filers and $400,000 for joint filers. See Additional Child Tax Credit for information on the refundable portion. |

| Credit for the Elderly or Disabled | Renamed from “Retirement Income Tax Credit” to “Credit for the Elderly” in 1976, added reference to disabled in 1983 | A nonrefundable credit of up to $1,125 for individuals 65 years of age or older or retired on permanent and total disability who meet certain income requirements. |

| Credit for Federal Tax on Gasoline and Special Fuels (Form 4136) | In 1956, Congress provided that Treasury refund taxes paid on gasoline used on farms for farming purposes and certain other non-highway purposes be refunded. | A refundable credit claimed on Form 4136 for taxpayers who paid federal excise tax on gasoline or special fuels for certain purposes. |

| Earned Income Credit | Created in 1975 | A refundable tax credit for taxpayers with earned income. Maximum amounts vary by number of qualifying children: $538 for no qualifying children, $3,584 for one, $5,920 for two, and $6,660 for three or more. Not available to taxpayers with investment income above $3,650. |

| Education Credits: American Opportunity Tax Credit (AOTC) and Lifetime Learning Credit (LLC) | AOTC created in 2009 | The AOTC allows eligible students to receive a maximum annual credit of $2,500 and a refund of 40% (up to $1,000) of any remaining amount of the credit if the credit reduces tax liability to zero. The credit can only be used for the first four years of postsecondary education and phases out for AGI between $80,000 to $90,000 for single filers and $160,000 to $180,000 for joint filers. |

| LLC created in 1997 | The LLC is a nonrefundable credit for qualified tuition and related expenses of eligible students enrolled in an educational institution and is worth up to $2,000. The credit phases out for AGI between $59,000 to $69,000 for single filers and $118,000 to $138,000 for joint filers. Only one education credit can be claimed per eligible student. | |

| First-Time Homebuyer Credit | 2008-2010 | A fully refundable credit of up to $8,000 for homes purchased from 2008 to 2010. Homebuyers who purchased homes in 2008 had to repay the credit over a period of up to 15 years. |

| Foreign Tax Credit | Created in 1918 | Can be claimed as a credit or itemized deduction intended to reduce U.S. taxable income or liability for individuals who paid or accrued foreign taxes in a foreign country or U.S. possession. Form 1116 must be completed if the credit is greater than $300 (or $600 for married taxpayers filing jointly). |

| General Business Credit | Varying dates | Limited to 100% for the first $25,000 of tax liability ($12,500 for married couples filing separately) and 25% of any excess tax liability over $25,000. Any excess amount of the business credit for the current year can be carried forward 20 years. |

| Taxpayers use the General Business Credit when they claim more than one of the following tax credits: investment credit; research credit; low-income housing credit; disabled access credit; renewable electricity, refined coal, and Indian coal production credit; Indian employment credit; orphan drug credit; new markets credit; small employer pension plan startup credit; employer-provided child care facilities and services credit; biodiesel and renewable diesel fuels credit; low-sulfur diesel fuel production credit; distilled spirits credit; nonconventional source fuel credit (carryforward only); energy-efficient home credit; energy-efficient appliance credit (carryforward only); alternative motor vehicle credit; alternative fuel vehicle refueling property credit; enhanced oil recovery credit; mine rescue team training credit; agricultural chemicals security credit (carryforward only); credit for employer differential wage payments; carbon dioxide sequestration credit; qualified plug-in electric drive motor vehicle credit; qualified plug-in electric vehicle credit (carryforward only); employee retention credit; new hire retention credit (carryforward only); credit from electing large partnerships (carryforward only); oil and gas production from marginal wells credit; and, certain business credits allowed against the Alternative Minimum Tax. | ||

| Health Coverage Tax Credit (Form 8885) (Formerly the Health Insurance Credit) | Created in 2002, sunset January 1, 2022 | A refundable credit to assist certain displaced workers and retirees to cover health insurance premiums. It expired on December 31, 2021. |

| Making Work Pay Credit | Available for 2009 and 2010 | A refundable tax credit of up to $400 for single filers and up to $800 for joint filers, provided in tax years 2009 and 2010. |

| Mortgage Interest Credit | Created in 1984 | Allows a nonrefundable credit for taxpayers who received a qualified Mortgage Credit Certificate (MCC) from a State or local government. |

| Net Premium Tax Credit | Created in 2013, available beginning in 2014 | A refundable credit that helps eligible individuals and families pay for health insurance premiums purchased through the Health Insurance Marketplace. |

| Prior-Year Minimum Tax Credit | Congress enacted the AMT in 1969 | A nonrefundable credit to offset alternative minimum tax (AMT) paid in 2019 or prior years. |

| Qualified Electric Vehicle Credit | Created in 2005 | A nonrefundable credit for taxpayers who are eligible for qualified electric vehicle passive activity credits for the current tax year, applied to previous years. |

| Qualified Plug-In Electric Vehicle Credit | Created in 2008 | A nonrefundable credit for any qualified, non-depreciable plug-in electric vehicle that was put into service during the tax year, worth up to $7,500. |

| Qualified Sick and Family Leave Credit | Created for the COVID-19 pandemic in 2020 | A refundable tax credit for eligible small and medium-sized businesses to reimburse the costs of providing qualified sick and family leave wages to employees for periods of leave during the COVID-19 pandemic. |

| Recovery Rebate Credit | 2008, 2020, 2021 | A refundable credit for individuals who did not receive or received less than the full amount of the Economic Impact Payments worth up to $1,200 for single filers or $2,400 for joint filers in the first round and $600 for single filers or $1,200 for joint filers in the second round. |

| Refundable Prior-Year Minimum Tax Credit (Form 8801) | 2007-2013 | A refundable credit for taxpayers with a credit carryforward from earlier years, no longer available after 2013. |

| Regulated Investment Company Credit (Form 2439) | Tax treatment of RICs most recently reformed with the Regulated Investment Company Modernization Act of 2010 | A refundable credit claimed on Form 2439 for taxes already paid on undistributed long-term capital gains. |

| Residential Energy Credit | First introduced in the 1970s, expired in 1985, reintroduced in 2005, currently set to expire in 2032 | Consists of the non-business energy property credit and the residential energy-efficient property credit. |

| The non-business energy property credit allows 10% of the costs paid or incurred in 2020 for qualified energy-efficient residential improvements and residential energy property limited to a $500 lifetime total. | ||

| The residential energy-efficient property credit is a credit of 26% for homeowners who invested in renewable energy for their home in the form of solar, wind, geothermal, fuel cells, or battery storage technology. | ||

| Retirement Savings Contributions Credit | Created in 2002 | Allows a maximum credit of $1,000 (or $2,000 if married filing jointly) for qualified retirement savings contributions if AGI is below $32,500 for single filers, $48,750 for head of household filers, or $65,000 for joint filers. |