Key Takeaways

- The main purpose of taxes is to generate government revenue.

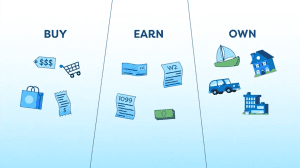

- There are three main types of taxes:

- Taxes on what you earn

- Taxes on what you buy

- Taxes on what you own

- Every type of tax impacts the economy, but some do more harm than others. There are two primary factors that can make a tax more harmful to the taxpayer and the overall economy:

- Can it be easily avoided?

- Does it discourage or limit economic growth?

- Taxes have a larger impact than you may realize. For example, higher business taxes can result in limited investment, fewer jobs, and a weaker economy overall.

- The least harmful and most effective taxes are those that raise the most revenue with the smallest negative impact on the economy.

- These taxes have less of an impact on people’s economic decisions, like the decision to work, save, or invest.

- Example: taxes on immovable property like houses or land.

- Every policy has trade-offs, but we should strive for those tax policies that are a win-win when it comes to raising revenue and protecting the economy.

Transcript

We may not like it, but we need taxes to raise revenue for all sorts of things that we depend on.

But not all taxes are created equal.

There are 3 main types of taxes: taxes on what you earn, what you buy, and what you own.

Every type of tax impacts the economy, but some do more harm than others.

There are two primary factors that can make a tax more harmful to the taxpayer and the overall economy.

One is if it can be easily avoided, which leads to less stable streams of revenue. The other is that it discourages or limits economic growth.

For example, when a business pays income taxes on their profits, it limits their ability to make investments.

Without these investments, there is less innovation and growth, and fewer jobs, so you and the economy suffer.

The least harmful and most effective taxes are those that raise the most revenue with the smallest negative impact on the economy.

A good example? Property taxes levied on immovable property like houses or land.

Because these types of property cannot be easily moved to avoid or lessen a tax burden, they generate consistent revenue.

Thus, they are also less harmful to economic growth because these taxes have less of an impact on people’s economic decisions, like the decision to work, save, or invest.

As with any policy, there are tradeoffs. When it comes to taxes, there are better and worse ways for the government to raise a dollar of revenue.

We should strive for those tax policies that are a win-win when it comes to raising revenue and protecting the economy.