All Related Articles

How High are Other Nations’ Gas Taxes?

3 min read

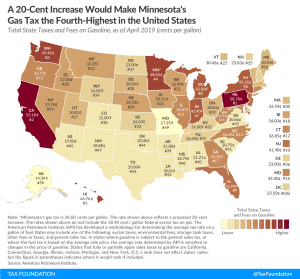

A Property Tax is a Wealth Tax, but…

Warren’s comparison between the property tax and her proposed wealth tax makes a good sales pitch. However, there are important differences between the taxes. By no means is the property tax in many jurisdictions perfect, but it is generally better structured than a wealth tax.

4 min read

Iowa Adopts a “Soft” Property Tax Cap

3 min read

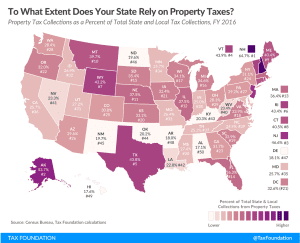

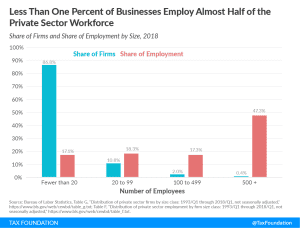

Firm Variation by Employment and Taxes

Less than one percent of businesses employ almost half of the private sector workforce. Large companies pay 89% of corporate income taxes in the United States.

2 min read

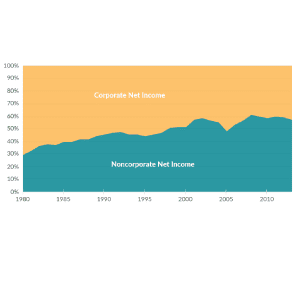

Corporate and Pass-through Business Income and Returns Since 1980

More business income is reported on individual tax returns than corporate returns. The U.S. now has fewer corporations and more individually owned businesses. Corporations make up less than 5 percent of businesses but earn 60 percent of revenues.

3 min read

Sources of Government Revenue in the OECD, 2019 Update

OECD countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less economic damage and distortionary effects than taxes on income.

10 min read