All Related Articles

Reliance on Consumption Taxes in Europe

2 min read

The Tax Gap Tops $500 Billion a Year

4 min read

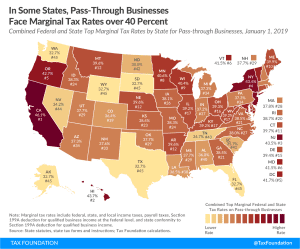

Marginal Tax Rates for Pass-through Businesses Vary by State

Pass-through businesses are now the dominant business form in the U.S., making up more than half of the private sector workforce in every state. Federal taxes on income set a minimum tax rate for pass throughs, but marginal rates for pass throughs vary based on how states tax individual income.

3 min read

Pass-Through Businesses Q&A

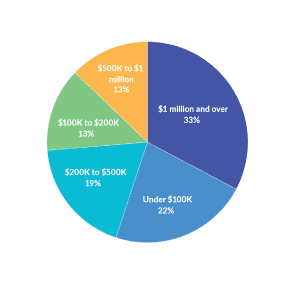

Pass-through businesses are the dominant business structure in America. Pass throughs file more tax returns and report more business income than C corporations. Pass-through businesses are not subject to the corporate income tax, but instead report their income on the individual income tax returns of owners. This blog will address some frequently asked questions about pass-through structure and taxation.

4 min read

New Details on the Austrian Tax Reform Plan

14 min read

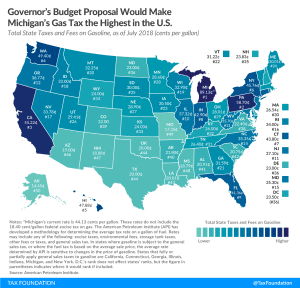

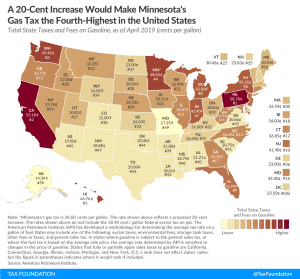

How High are Other Nations’ Gas Taxes?

3 min read

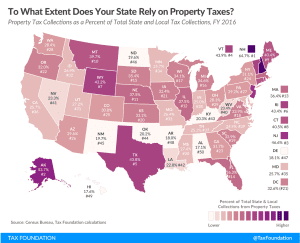

A Property Tax is a Wealth Tax, but…

Warren’s comparison between the property tax and her proposed wealth tax makes a good sales pitch. However, there are important differences between the taxes. By no means is the property tax in many jurisdictions perfect, but it is generally better structured than a wealth tax.

4 min read