All Related Articles

Are Sugar-Sweetened Beverage Taxes Regressive? Evidence from Household Retail Purchases

Soda taxes are proposed with the promise to improve public health outcomes, but they come with equity concerns because of their regressive nature.

23 min read

The Impact of the Tax Cuts and Jobs Act by Congressional District

A look at the data & methodology behind the Tax Foundation’s Mapping 2018 Tax Reform project which compares average 2018 tax cuts by congressional district.

3 min read

Taxing Patreon Contributions

4 min read

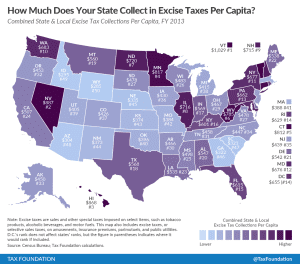

How Much Does Your State Collect in Excise Taxes?

Excise taxes make up a relatively small portion of state and local tax collections—about 11 percent—but per capita collections vary widely from state to state.

3 min read

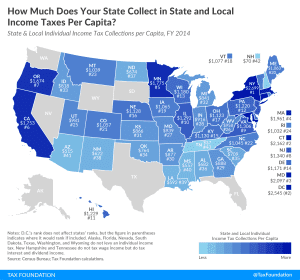

State and Local Individual Income Tax Collections Per Capita

On average, state and local governments collected $1,144 per person from individual income taxes, but collections varied widely from state to state.

2 min read

Highlights from the New JCT Tax Expenditure Report

How have federal tax expenditures changed since passage of the Tax Cuts and Jobs Act? We compare 2017 and 2018 Joint Committee on Taxation estimates.

8 min read

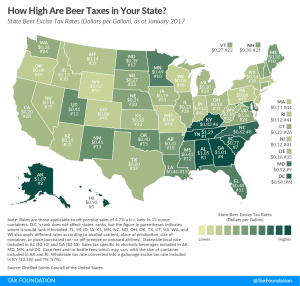

Beer Taxes by State, 2018

3 min read

Indiana Passes Conformity Bill in One-Day Special Session

Indiana recently passed tax conformity legislation linking the state’s individual and corporate tax code to the new federal law.

2 min read

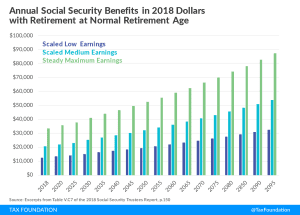

The Complicated Taxation of America’s Retirement Accounts

Changes to the way we tax long-term savings could remove the excess tax burden on saving and investment, helping individuals to better provide for their financial future.

15 min read