All Related Articles

Top State Tax Ballot Initiatives to Watch in 2018

Explore our list of the top state tax ballot measures to watch for throughout the country.

11 min read

New IRS Data Reiterates Shortcomings of the Estate Tax

The estate tax’s narrow base and high rate limit its ability to generate revenue. The estate tax discourages economic growth by discouraging investment.

3 min read

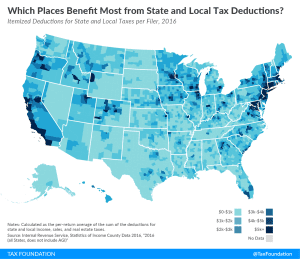

The Benefits of the State and Local Tax Deduction by County

Do taxpayers in your area rely heavily on state and local tax deductions? See how the Tax Cuts and Jobs Act tax plan may impact taxpayers in your county.

2 min read