All Related Articles

Illustrating Senator Warren’s Taxes on Capital Income

Taken together, these proposed tax changes would significantly raise marginal and effective tax rates and increase the cost of capital, all of which would lead to a reduced level of output and less revenue than anticipated.

5 min read

2020 Tax Brackets

The IRS recently released the new 2020 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

5 min read

Welcome to the Index, Lithuania!

5 min read

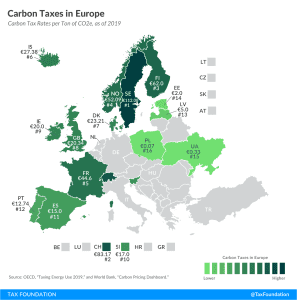

Carbon Taxes in Europe, 2019

3 min read

Proponents of Wealth Taxation Must Consider its Impact on Innovation

Instead of raising revenue from a narrow tax base through high tax rates, policymakers should identify options to raise revenue efficiently through broad-based taxes consistent with sound tax policy.

4 min read

Wireless Taxes and Fees Jump Sharply In 2019

Wireless taxes, fees, and surcharges make up over 20% of the average customer’s bill–the highest rate ever. Illinois has the highest wireless taxes in the country at over 30%, followed by Washington, Nebraska, New York, and Utah. How high are cell phone taxes in your state?

36 min read

Reviewing the Deadweight Loss Effects of High Tax Rates

Deadweight loss effects demonstrate why policymakers should pursue a more efficient tax code to achieve distributional objectives, rather than pursuing high tax rates that create disproportionately high economic costs.

4 min read