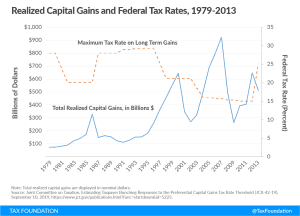

JCT Report Shows Capital Gains are Sensitive to Taxation

JCT’s report on capital gains elasticities reminds us that capital gains realizations, at least under a tax system that allows deferral, are sensitive to tax rates. Moving to mark-to-market taxation of all capital gains would remove this sensitivity by taxing capital gains annually.

4 min read