Businesses in America broadly fall into two categories: C corporations, which pay the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. , and pass throughs—such as partnerships, S corporationAn S corporation is a business entity which elects to pass business income and losses through to its shareholders. The shareholders are then responsible for paying individual income taxes on this income. Unlike subchapter C corporations, an S corporation (S corp) is not subject to the corporate income tax (CIT). s, LLCs, and sole proprietorships—which “pass” their income “through” to their owner’s income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. returns and pay the ordinary individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. . Understanding the composition and characteristics of American businesses provides important context for tax policy debates.

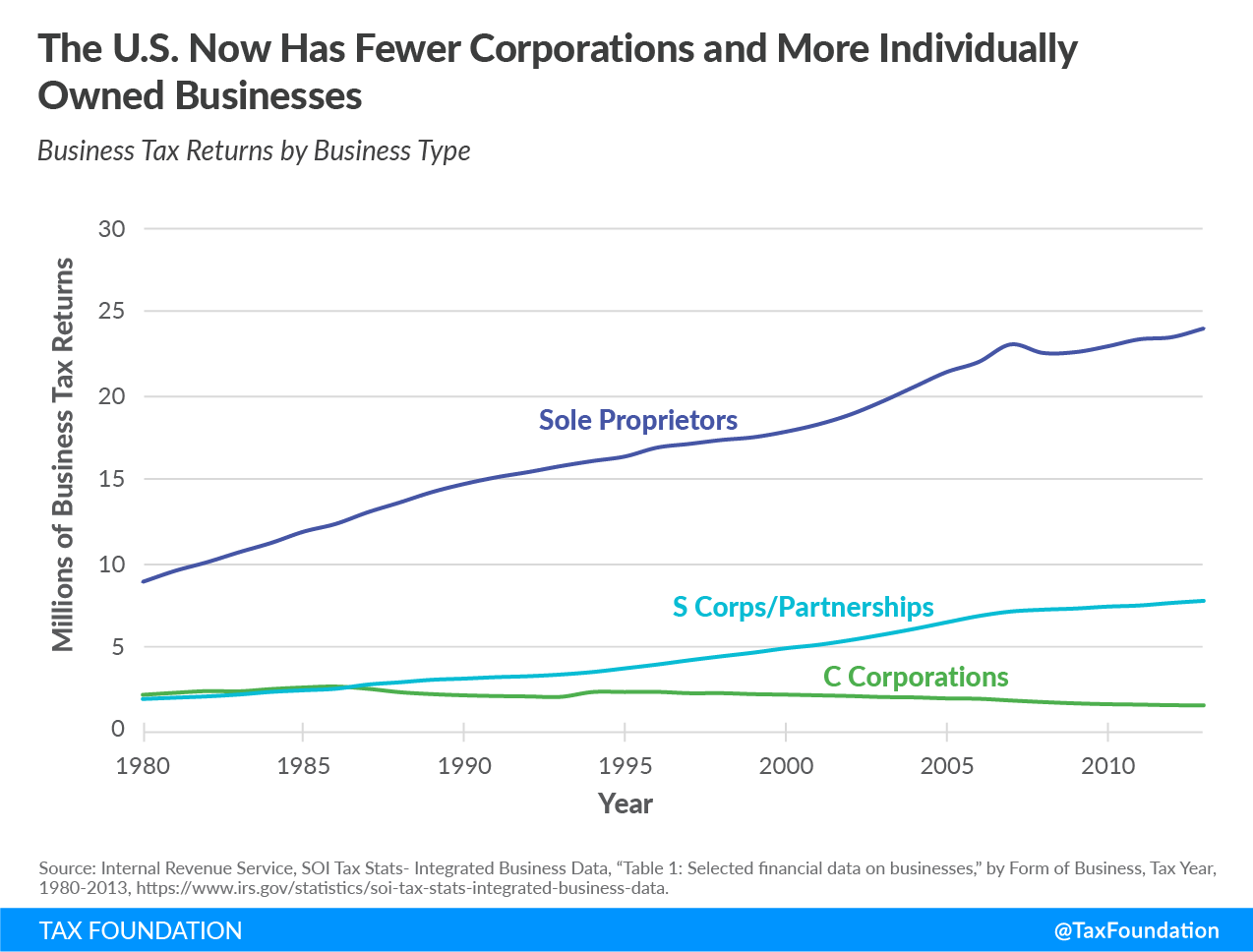

Pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. es are the dominant business type, and their number has steadily increased relative to C corporations over the past 30 years. In 1980, there were 2.1 million C corporations. There were 2.6 million C corporations by 1986, but the number dropped to 1.6 million by 2013. The number of sole proprietorships, however, increased from about 9 million in 1980 to more than 24 million in 2013, while the number of S corporations and partnerships combined increased from 2 million to almost 8 million. In total, there were just under 32 million pass-through businesses in 2013, almost 20 times the number of C corporations.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeOne explanation for this growth in pass-through businesses is that the U.S. tax code taxes C corporations more heavily than pass-through businesses. C corporations are taxed twice: once at the entity level by the corporate income tax and once at the shareholder level when profits are distributed as dividends or stockholders realize capital gains. Pass-through businesses, however, are taxed only once, under the individual income tax, meaning they are not subject to any business level tax. Following the 1986 federal tax reform, which dramatically cut individual income tax rates, pass throughs became much more attractive.

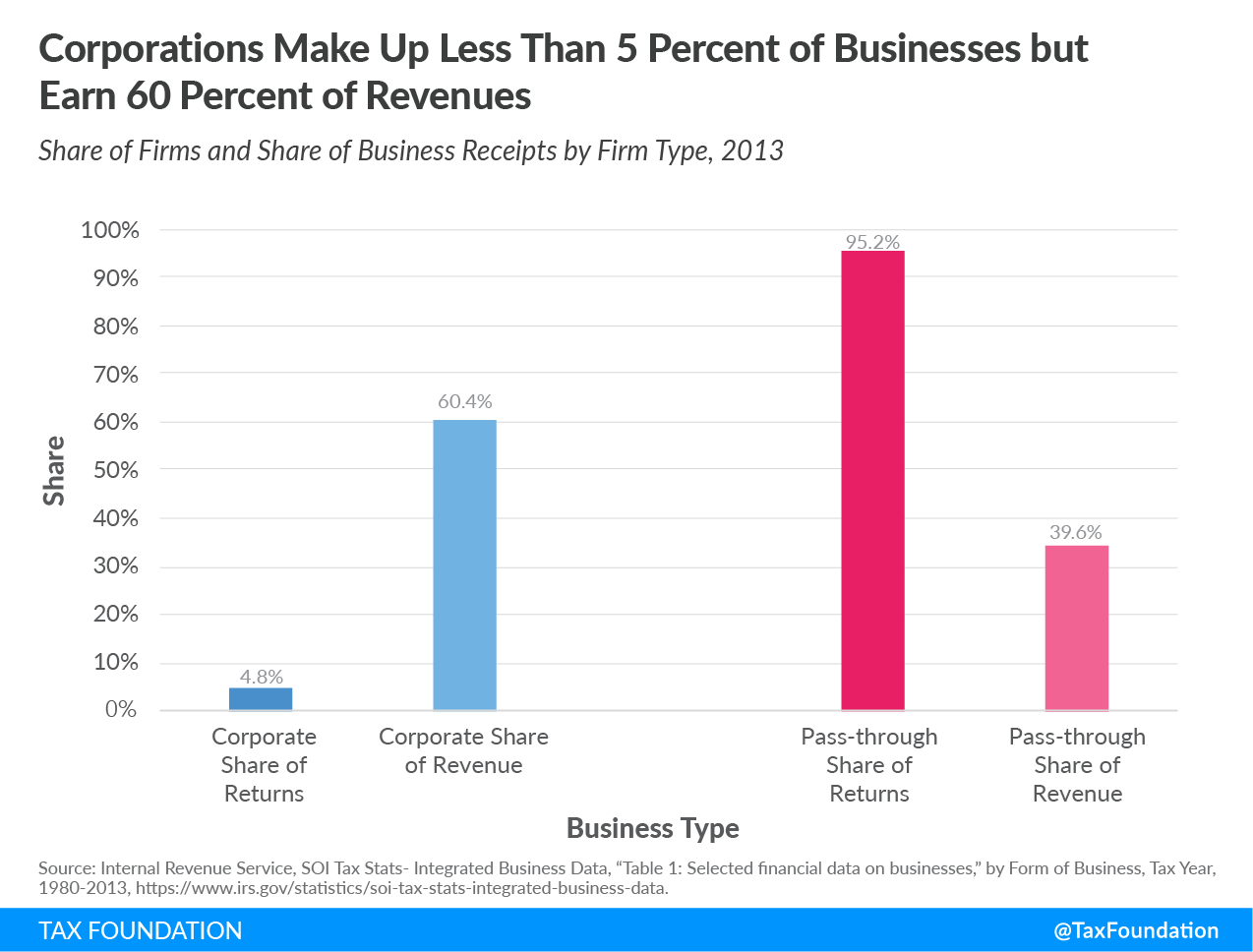

Despite this heavier tax burden, as well as being far fewer in number compared to pass-through businesses, corporations still generate more business revenue. In 2013, C corporations accounted for fewer than 5 percent of all business tax returns but generated more than 60 percent of all business revenue. Pass throughs accounted for more than 95 percent of all returns, but less than 40 percent of all business revenue.

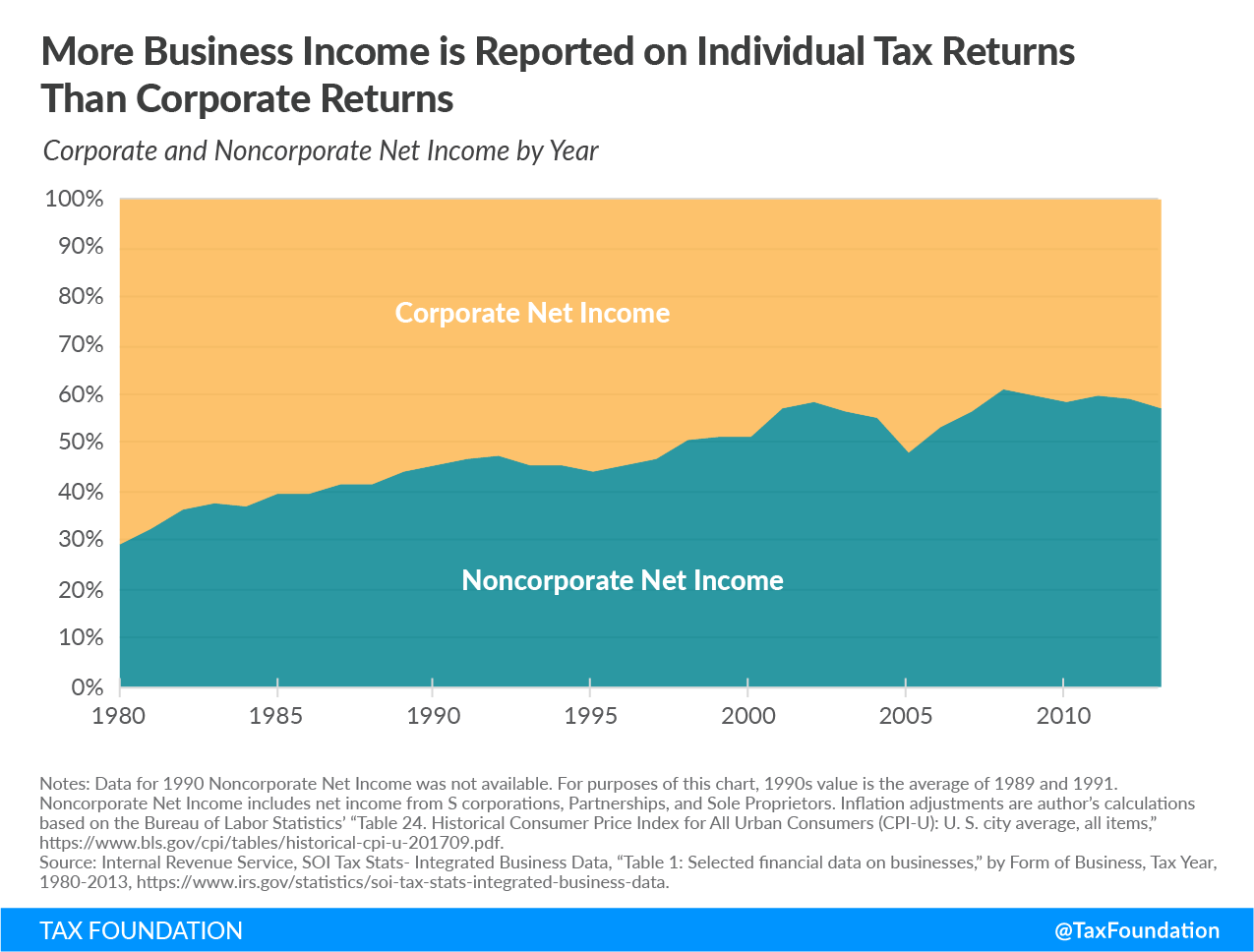

Though corporations earn the largest share of business revenues, pass-through businesses outpace corporations when it comes to net income. Noncorporate net income has outpaced corporate consistently since 1997, apart from a brief period in the mid-2000s when corporate net income spiked at the top of a business cycle. In 2013, pass-through businesses accounted for 57 percent of net business income, compared to 43 percent for C corporations.

Both pass-through businesses and C corporations provide important contributions to the American economy. While C corporations may be fewer in number than pass throughs, they generate larger amounts of revenue and net-income per entity. On the other hand, pass-through businesses make up almost three-fifths of net business income. Policymakers who wish to change business tax policy should note the differences between pass-through businesses and C corporations as both types of businesses are crucial to the future economic success of the United States.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeNote: This is part of our “Business in America” blog series

- The Lowered Corporate Income Tax Rate Makes the U.S. More Competitive Abroad

- Firm Variation by Employment and Taxes

- 2017 GDP and Employment by Industry

- Pass-Through Businesses Q&A

- State Corporate Income Taxes Increase Tax Burden on Corporate Profits

- Marginal Tax Rates for Pass-through Businesses Vary by State

- Taxes on Capital Income Are More Than Just the Corporate Income Tax

- Depreciation Requires Businesses to Pay Tax on Income That Doesn’t Exist

- Not All Tax Expenditures Are Equal