A new report from the Organisation for Economic Co-operation and Development (OECD) shows that the U.S. tax wedgeA tax wedge is the difference between total labor costs to the employer and the corresponding net take-home pay of the employee. It is also an economic term that refers to the economic inefficiency resulting from taxes. —the difference between total labor costs to the employer and the corresponding net take-home pay of the employee—declined from 2017 to 2018. That outcome, as detailed in Taxing Wages 2019, is primarily because of the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. cuts in the Tax Cuts and Jobs Act (TCJA).

The OECD calculates the tax wedge by taking “the sum of personal income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. , employee and employer social security contributions plus any payroll taxes, minus any benefits received by the employee, as a percentage” of labor costs. In other words, the average tax wedge measures the part of labor costs taken in tax and social security contributions net of cash benefits.

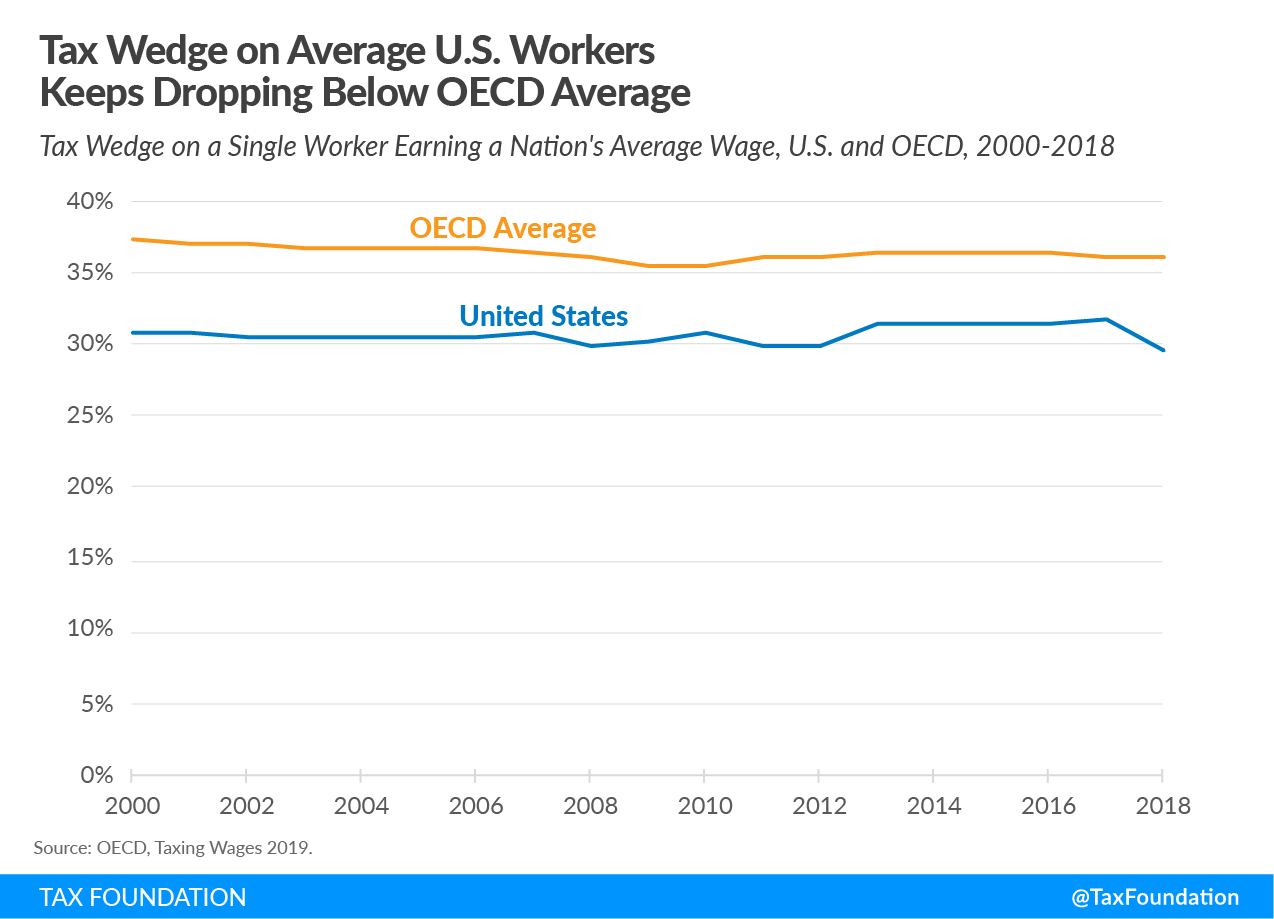

The following chart, using OECD data, shows that the U.S. tax wedge fell by 2.19 percentage points in 2018, from 31.8 in 2017 to 29.6 percent.

Behind the decrease in the U.S. tax wedge was the TCJA’s individual income tax cuts. According to the OECD, the 2.19 percentage-point decrease was overwhelmingly caused by a decline in the income tax, which fell by 2.14 percentage points; a decrease of the payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. accounted for the remaining .06 percentage points. The TCJA’s lowering of most individual income tax rates, along with several other changes, reduced tax bills for 80 percent of taxpayers in 2018. Lower taxes mean a higher net take-home pay, and therefore a smaller tax wedge.

Only one other OECD country, Estonia, saw a greater percentage-point decrease. The tax wedge increased in 22 countries and fell in 14, for a decrease in the OECD average from 36.2 to 36.1. Although the U.S. tax wedge has consistently been below the OECD average, it is now even further below.

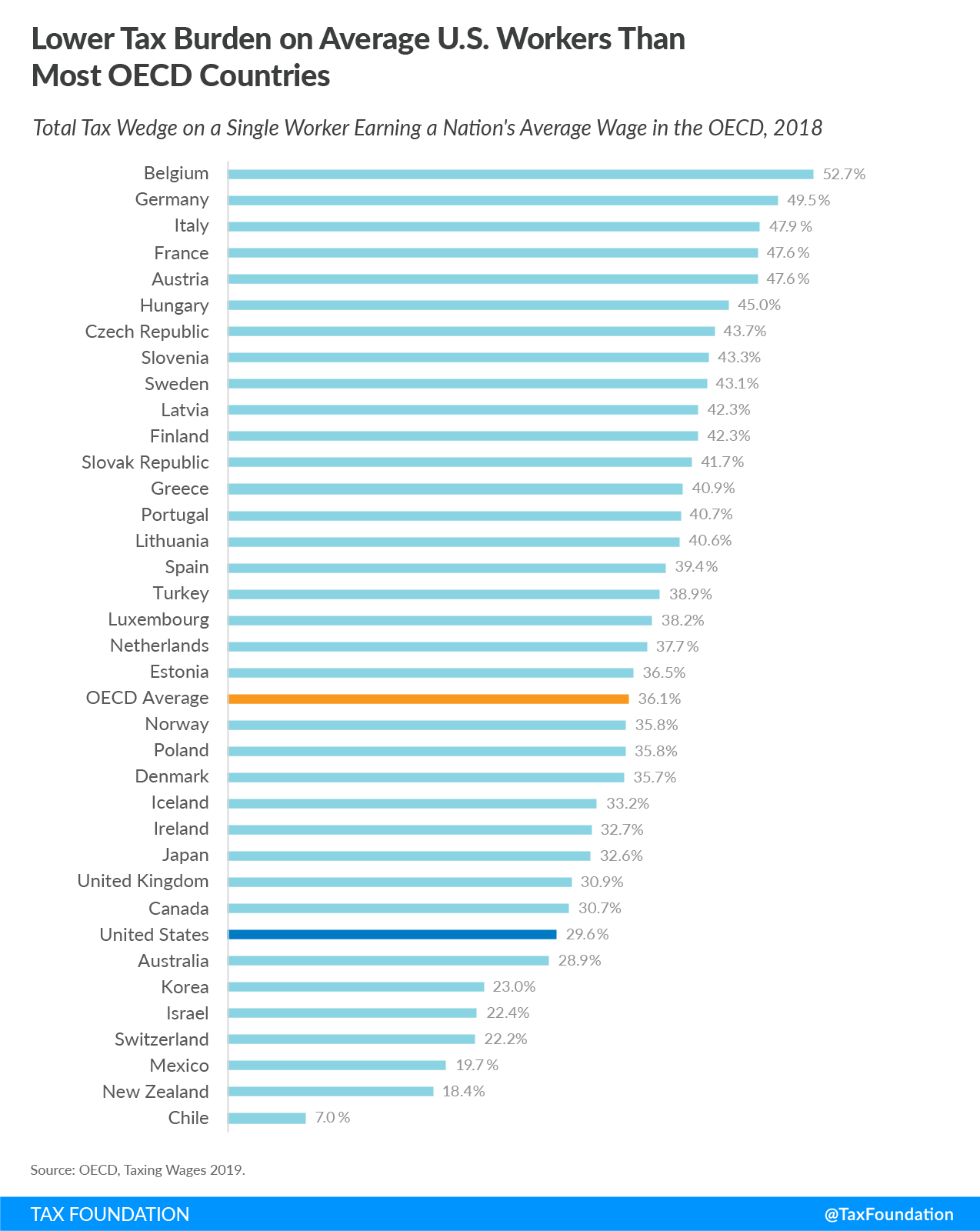

As the following chart illustrates, most OECD countries impose a higher tax burden on average wage earners than the U.S. does. Belgium has the largest tax wedge at 52.7 percent, followed by Germany (49.5 percent) and Italy (47.9 percent). Chile has the lowest at 7.0 percent, followed by New Zealand (18.4 percent) and Mexico (19.7 percent). In 2018, the U.S. had the 8th lowest tax wedge, versus 10th in 2017.

Recognizing the impact of policy changes can often be difficult. However, the OECD data shows one effect of the TCJA: lower individual income taxes have reduced the U.S. tax wedge temporarily, bringing it further below the OECD average.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe