All Related Articles

Italy Can Pay for a Flat Tax

4 min read

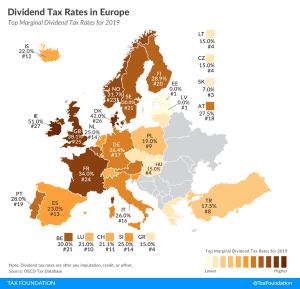

Dividend Tax Rates in Europe, 2019

2 min read

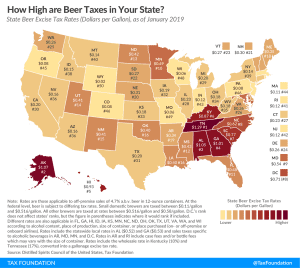

Beer Taxes by State, 2019

4 min read

Modernizing Utah’s Sales Tax: A Guide for Policymakers

By almost any measure, Utah is, and deserves to be, the envy of its peers. Utah leads the country in job growth, and the state’s economy has grown at twice the rate of the nation at large. Utah’s income tax reforms adopted in 2007 established a model for other states to follow. But today, some of these gains are being undone—not by conscious policy choices, but by their absence.

6 min read

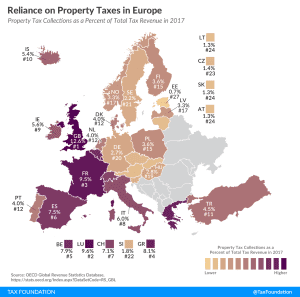

Reliance on Property Taxes in Europe

1 min read

Measuring Opportunity Zone Success

16 min read

Business in America

Who are the workers, consumers, and shareholders who interact with businesses in the U.S.? What forms do these businesses take? How do business taxes impact people’s lives? It is essential we answer these questions in order to design a business tax system that is simple, efficient, and enables economic progress.

5 min read

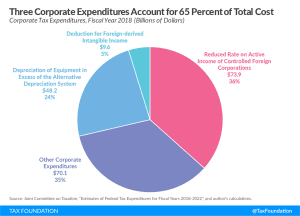

Not All Tax Expenditures Are Equal

The debate in Washington, D.C. often centers around tax expenditures, so-called corporate loopholes, in the tax code. But not all tax expenditures are created equal. Some represent neutral tax treatment and should be left alone, while others are distortionary and should be repealed. Understanding what a tax expenditure represents is essential for understanding how our tax code works for both businesses and individuals.

4 min read

What’s Going on With the Kiddie Tax?

2 min read

The U.S. Tax Burden on Labor, 2019

13 min read

Tax Burden on Labor in Europe, 2019

2 min read

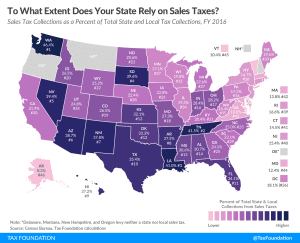

To What Extent Does Your State Rely on Sales Taxes?

Many states are seeing a significant narrowing of their bases as lawmakers continue to carve out exemptions, and as consumption patterns shift ever more towards relatively-untaxed services.

4 min read