Does the Optimal Tax System Exist?

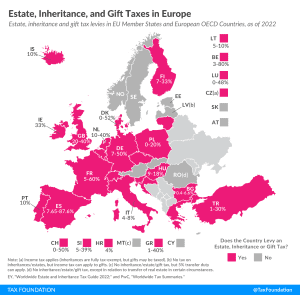

While research on optimal taxation often focuses on the pure economic implications, it rarely considers cultural and societal differences that can lead to very different outcomes when trying to implement an optimal tax system.

4 min read